APRA sends banks back to the drawing board on dividends

Rethink necessary on moves to stop billions in dividends going out to the big banks’ army of shareholders.

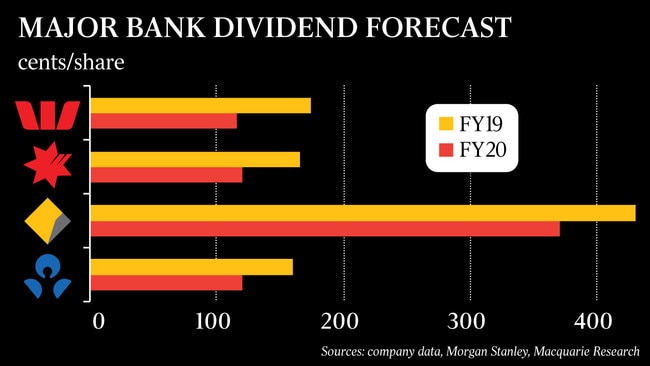

Westpac, National Australia Bank and ANZ face shelving $7bn worth of dividends that were destined for shareholders in May after the prudential regulator intervened to protect depositors and the financial system.

Macquarie Group is also poised to slash its generous cash bonuses for its senior executives after the directive from the Australian Prudential Regulation Authority, which on Tuesday night warned banks and insurers to rein in plans for dividend payments as the economy and financial system creaks under the strain of the coronavirus pandemic.

With an expectation that Australia’s biggest lenders, insurers and life insurance companies will make “prudent reductions in dividends” if they do decide to go through with any distributions, institutional and retail shareholders are set to miss out on potentially tens of billions in expected profit payouts.

The major banks shell out about 80 to 90 per cent of profits to shareholders each year, and the twice yearly payments by Westpac amount to about $3.5bn each half. NAB sends shareholders about $1.5bn each six months, while ANZ distributes about $2.2bn twice a year.

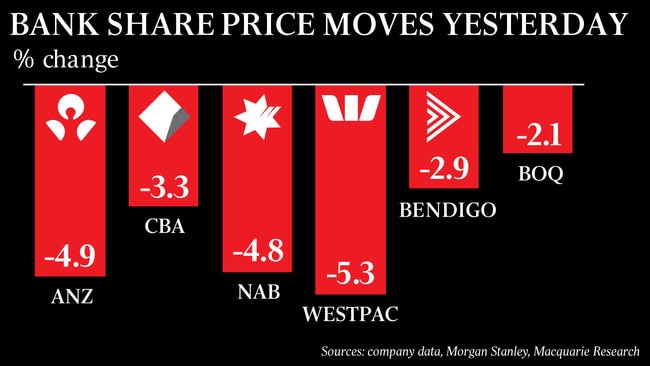

Shares in those three lenders sunk about 5 per cent each on Wednesday, more than the 3.3 per cent fall registered by Commonwealth Bank stock.

APRA’s intervention was too late for some lenders, such as Commonwealth Bank, Suncorp and Bendigo and Adelaide Bank, which sent out nearly $4bn in collective interim dividend cheques last week, but a number of self-funded retirees and other households are set to face a drop in a key source of income.

APRA chairman Wayne Byres said the watchdog’s primary role was “protecting the safety of bank deposits” and the ability of insurance companies to continue to pay claims.

“By asking banks and insurers to consider delaying any decision on dividends for a few months in light of the current economic uncertainty, or consider alternatives such as dividend reinvestment plans, APRA has sought to protect the capital strength of banks and insurers while minimising the long-term impact on Australians who rely on dividends as a key income source,” Mr Byres said.

Mr Byres said the regulator “recognises the important role dividends play in the incomes of many Australians”.

“However, as Australia’s financial safety regulator, APRA is responsible for protecting the safety of bank deposits and ensuring insurers have the means to pay claims from policyholders,” he told The Australian.

“This approach is designed to underpin financial system stability, which ultimately benefits all Australians.”

Pause on dividends

While the Bank of England enforced a pause on dividends in recent weeks, the move was followed by the European Central Bank and then the Reserve Bank of New Zealand, which forced the Kiwi arms of the big four Australian banks to refrain from shipping back profits across the ditch to the parent entities locally.

In APRA’s 2017 stress test of the lenders, the sector experienced a 2.8 percentage point fall in capital ratios over three years under a scenario that involved the economy shrinking by 4 per cent, unemployment rising to 11 per cent and house prices sliding 35 per cent. Under the scenario, dividend payments were curtailed.

‘APRA has sought to protect the capital strength of banks and insurers while minimising the long-term impact on Australians who rely on dividends.’

Citi analyst Brendan Sproules said the regulator “had a major rethink” over the last week, after it publicly advised the market last Tuesday the decision on dividends and executive pay was “for the time being….matters for boards”.

After that, APRA on Friday spoke to other financial regulators, including the Reserve Bank and the Australian Securities and Investments Commission, for a meeting of the Council of Financial Regulators, where the topic of dividends were discussed.

“Just last week, bank dividends were a matter for bank boards but now APRA instructs banks to defer or ‘materially reduce’ dividends,” Mr Sproules said.

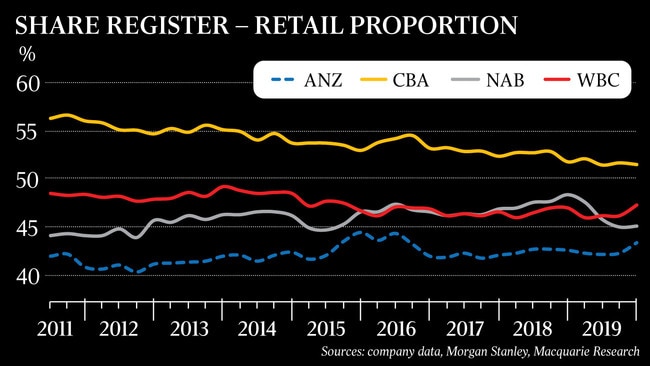

“Dividend volatility in coming months created by this approach from APRA will unsettle many investors, particularly retail,” he said.

Bank of Queensland was the first lender to announce the deferral of its dividend as it opened its books for an interim profit announcement on Wednesday.

“BOQ understands the impact of this decision on shareholders, however also acknowledges this guidance as a prudent step for the industry,” BOQ chairman Patrick Allaway said.

Alex Dunnin, head of research at superannuation consultancy Rainmaker, said the curtailing of dividends could impact SMSF investors.

“Some very significantly,” Mr Dunnin said.

“The sector holds 43 per cent of its assets as shares. If dividends are reduced it could severely expose investors who heavily rely on franked dividends for their retirement income,” he said.

“Super funds, including SMSFs, have been put on notice by the government not to expect any assistance. The irony of this move is that it exposes investors of listed portfolios to the same criticisms now being hurled at unlisted assets. This just shows how nuanced these debates are and how we should be wary of simplistic solutions.”

Shareholders in the major banks and regional lenders now face a prolonged period of uncertainty after the prudential regulator urged banks and insurers to think twice before shelling out profits to shareholders during the COVID-19 pandemic.

Stress test themselves

Banks and insurers will need to stress test themselves against any dividend payment scenario, and will need to talk to APRA before any final decision is made.

Westpac, NAB, Macquarie Group and ANZ are due to reveal the state of their accounts in early May, at which point investors would usually find out the banks’ planned dividend payments.

Westpac on Wednesday said the regulator had noted that even where dividends were being considered, they “should nevertheless be at a materially reduced level”, and that it expected to clarify its dividend payment in early May.

“No decision has yet been made by the Westpac board,” Westpac said.

NAB said its board would “take APRA’s guidance into account” when it considers its interim dividend payment in early May, while Macquarie Group said it would “work through the details” of APRA’s recommendations.

“Macquarie also acknowledges APRA’s guidance in relation to executive cash bonuses,” said the so-called Millionaires’ Factory.

“Macquarie recognises its role in supporting Australian households, businesses and the broader economy during this period of significant disruption.”

APRA said banks that continue to pay dividends should implement dividend reinvestment plans, but UBS analyst Jonathan Mott said the move would be “highly dilutive” for shareholders and said ANZ, NAB and Westpac would rather cut their dividends to zero.

“Dividend reinvestment plans are highly dilutive when banks are trading below book value, which ANZ, NAB and Westpac currently are. The strategy of overpaying dividends and offsetting this by DRPs does not work when you trade sub-book value,” Mr Mott said.

Macquarie Wealth Management analyst Victor German said banks would “reduce or entirely suspend” upcoming dividends because under a “stressed” scenario where bad debts rose to $25 billion the lenders lost their capacity to pay dividends.

Increased strain for retail shareholders

“The potential full removal of the dividend is likely to result in increased strain for retail shareholders. A possibly diminished appetite from this group to investors, as well as yield-focused funds and yield ETFs, is prone to impact banks’ share prices further,” Mr German said.

Morgans analyst Azib Khan said dividends were now in the Intensive Care Unit.

“While dividend suspension is now our base case for each bank’s next dividend, it is possible some banks may declare an ordinary dividend with a significantly reduced dividend payout ratio,” Mr Khan said.

“Also, while bank boards which decide to not declare the next dividend may describe the decision to be a deferral until the outlook is clearer, we are not building deferred dividends into our forecasts at this point in time given the highly uncertain outlook.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout