Fortescue Ltd underperforms Friday, when compared to competitors

Here is the latest company close update for Fortescue Ltd, FMG.

Here is the latest company close update for Fortescue Ltd, FMG.

The failure of projects to materialise is a normal part of business risk. A key part of corporate decision-making is knowing when to cut your losses. This is a lesson government has yet to master.

Andrew Forrest’s Fortescue has bent the knee and agreed to pay back government funding directed towards the billionaire’s failed Gladstone hydrogen venture ‘where required’.

Billionaire Andrew Forrest’s miner has agreed to repay government funding directed towards his failed hydrogen company, adding ‘conversations are already underway’.

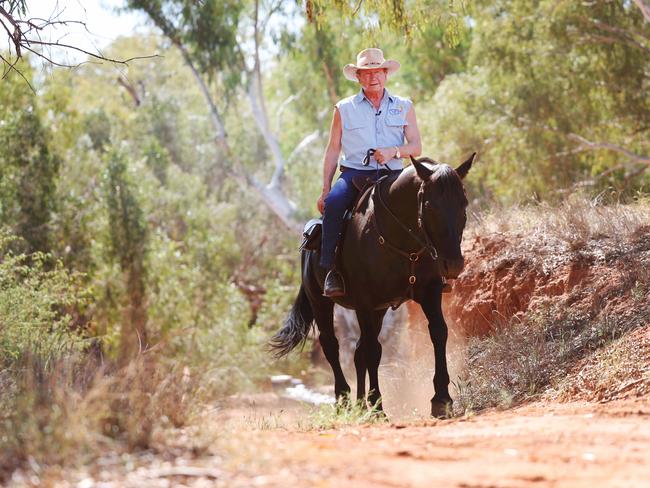

Whether the Fortescue executive chairman believes China’s propaganda or simply mouths it, Andrew Forrest’s upbeat take on Beijing’s ‘beautiful evolution’ is, in truth, the entry price into the court of Xi Jinping.

Labor has made it clear to Andrew Forrest’s Fortescue that it expects to get back the taxpayer funds directed to his failed hydrogen project, after the billionaire formally killed off much-hyped proposals in Queensland and Arizona.

BP quitting the renewables megaproject whose price tag eclipses SunCable deals an irreparable blow to a hydrogen industry struggling with high costs, regulatory hurdles and lack of customers for the clean energy source.

Andrew Forrest-led Fortescue takes another big step back on green hydrogen and flags $220m writedown on abandoned projects.

Scott Morrison and billionaire Andrew Forrest have engaged in a stunning war of words over China, with the former PM saying the Chinese Communist Party will be pleased with the Fortescue chairman’s attacks on his Liberal government’s handling of Beijing.

Macquarie quarterly profit falls, CFO flags exit. RBA governor cautions on speed of inflation fall. Bapcor sinks on profit warning, board exodus.

Pilbara Port Authority is discussing with BHP, Fortescue and Hancock Prospecting about funding a bypass channel to help safeguard the iron ore industry.

The ASX 200 index fell sharply from a record high as banks are hit by profit taking. Resources outperform. AMP hails super win in volatile market. South32 beats FY25 output guidance. Insignia’s $3.4bn offer yet to materialise as talks continue.

The ATSB says it wasn’t given ‘reportable factual details’ and it will now investigate an emergency at Port Hedland when the fully loaded iron ore carrier FMG Nicola broke down.

Even the green dreams of Fortescue’s Andrew Forrest couldn’t derail official meetings in Shanghai aimed at keeping the steelmakers buying.

Anthony Albanese and business leaders will be focusing on the main economic component of his China trip in Shanghai on Monday – the trading relationship.

Fortescue’s head of decarbonisation Christiaan Heyning is the latest high-profile departure from Andrew Forrest’s ‘green team’, as it ramps up spending on solar farms and battery-powered trucks.

Whistleblowers say seven tugs had to pull the fully loaded FMG Nicola to safety and prevent a grounding that could have blocked the most important shipping channel in Australia.

Beijing’s latest supply-side reforms provide some hope for Australian iron ore miners after a brutal financial year in which the materials sector significantly lagged the broader market.

Long-time Fortescue directors Mark Barnaba and Elizabeth Gaines have made a glittering start to the financial year via the Andrew Forrest-backed gold producer, Greatland Resources.

We’re still waiting for the latest figures but finally some financials show Fortescue spent about $730m on green energy ambitions on Andrew Forrest’s watch. And it looks to be accelerating.

Two senior executives have left their posts in the latest management shake-up at the resources giant, founded by Andrew Forrest.

BHP says Chinese blast furnaces have a long way to run, and unveiled a big breakthrough with Baowu. If BHP is right, the Pilbara golden goose will be just fine, countering Andrew Forrest’s claim the region risks becoming a wasteland.

The Andrew Forrest-led Fortescue is looking to sell cattle stations it acquired in 2022 at the height of its plans to build vast wind and solar farms.

Our big five resources stocks – BHP, Fortescue, Rio Tinto, Woodside and Santos – have disappointed investors recently, and now face fresh challenges.

Mark Hutchinson says Fortescue ‘gave it a good crack and we’re not done’. He will leave the iron ore miner turned green energy hopeful before Andrew Forrest’s hydrogen vision is ever realised.

Call it inevitable, call it what you will, but Fortescue Energy boss Mark Hutchinson has finally left the building, after the retreat from green hydrogen left him with next to nothing to do.

Two of Fortescue’s top executives will leave as part of an overhaul of the miner as it juggles iron ore growth with ambitions to build a major clean energy arm.

Fortescue’s troubled Iron Bridge magnetite operations are three years away from achieving production capacity, and the project is essential to billionaire Andrew Forrest’s plan to raise the iron content of its ore.

The gas has well and truly escaped from hydrogen-loving Fortescue which has shut a newly opened US plant after pocketing a lucrative financial incentive of almost $18m to set up there.

A green hydrogen project in the NT which counted Osaka Gas as one of its backers has been paused. It is the latest setback for true believers of the renewable energy source, after Andrew Forrest’s Fortescue cut 90 jobs this week.

Original URL: https://www.theaustralian.com.au/topics/fortescue-metals