Banks, miners buoy ASX as Laybuy soars 45pc

The extension of Victoria’s lockdown weighed on Transurban, but did little to hamper recovery in the major banks, while the newest BNPL stock jumped 45pc.

- Laybuy jumps 60pc on ASX debut

- ANZ loan deferrals top 84,000

- Growth stocks to outperform: Citi

- Covid could shutter Viva’s Geelong refinery

That’s all from the Trading Day blog for Monday, September 7. The Australian sharemarket hit one-month lows early but support from the major miners and CSL helped the market to gains of 0.3pc by the close.

With US markets closed for the Labour Day holiday tonight trade will be more subdued, while Orora, Bega, IOOF, St Barbara, Ampol and ASX traded ex-dividend.

Glenda Korporaal 8.50pm: Exports to China down by 26pc

Australia’s goods exports to China fell by more than 26 per cent in August, taking total exports down by 7.5 per cent over the year to $US75.7bn ($103.9bn), according to figures from the Customs General Administration in Beijing.

The latest monthly figures from China show that imports from Australia were down by more than any other country in August. The figures, reported by Bloomberg and based on the latest Chinese customs data out on Monday, can vary from Australian Bureau of Statistics numbers.

Chinese imports from Australia in August were down by 26.2 per cent to $US8.81bn year on year in a month where total imports by China were down by 0.5 per cent.

The numbers from Beijing come after data from the ABS showed that Australian goods exports to China in July were down by 16 per cent in July on a year-on-year basis with a fall in exports of iron ore and coal.

This was a turnaround from four months of strong export sales to China from March to June.

China’s official figures show that its imports from Australia were only down by 7.2 per cent in July, which could reflect delays in timing between the two countries as well as exchange rate movements.

James Kirby 7.34pm: Infrastructure facing COVID-19 headwinds

A sell-off in Transurban may be a sign of things to come for the infrastructure sector, where tailwinds have suddenly turned into headwinds.

New restrictions on population movement, an immigration slowdown and a population decline are combining to challenge transport-based infrastructure investments that have long been a key part of defensive share portfolios.

The threat is particularly relevant to industry super funds, which have led the field with global commitments to roads, rail and airports in recent decades.

Transurban’s immediate problems relate to the extended lockdown in Victoria where it has key toll road assets — the stock fell by 3 per cent on Monday and at $13.14 remains well below the $16 level itwas at in February.

But more broadly Transurban and other listed stocks such as Sydney Airport and a wide range of unlisted funds are slowly facing the new reality that the existing traffic projections are simply not going to materialise in the year ahead.

Moreover, there are growing signs that some of the smart money is already moving out of what had been better than average investments, where the implicit price has always been illiquidity (it is very difficult to buy or sell tradeable parcels of many infrastructure investments).

Bridget Carter 6.38pm: Audit firms keep up graduates numbers

The Big Four consulting and audit firms will take in about 2500 graduates this financial year, despite three of them shedding more than 1100 staff via redundancies in response to the COVID-19 pandemic.

EY is the only firm not to make redundancies, but it will cut is graduate intake by 10-15 per cent.

PwC Australia will cut its graduate intake by 5 per cent, reversing an earlier forecast of a dramatic reduction of up to 50 per cent; KPMG expects no reduction; and Deloitte — the biggest hirer — plans a slight increase on this year’s numbers.

The healthy intakes suggest the firms have weathered the pandemic better than they expected when the lockdowns began in late March. But they are also so locked into a business model based on large intakes and high churn that they would find it hard to cut number drastically.

The graduates feed a model that relies on high intakes of high-achieving, entry-level graduates from commerce, economics, accounting as well as generalist fields each year to be trained, promoted or “winnowed” out depending on their abilities. The Big Four have an estimated 30,000 staff in Australia and New Zealand, including 2500 partners.

Despite the relatively stable intake for the 2021 financial year, the business models of the firms are likely to come under pressure from the top end as partners hang on in a recession.

Lachlan Moffet Gray 5.54pm: Final blow for small business

Victoria’s ultra-cautious road map to recovery could be the final hammer blow for many of the state’s small businesses which could force the federal government to extend another $20bn of stimulus efforts in its upcoming October budget, economists say.

AMP Capital chief economist Shane Oliver said Victoria’s easing of restrictions in effect extends the lockdown and could prove fatal for many small businesses unless there is another round of support programs from the government.

“We were working on the assumption that a more decisive opening would start occurring from the middle of September, while the real opening doesn’t occur until stage three, which is 28 October,” Dr Oliver told The Australian.

Bridget Carter 4.48pm: Syd Airport launches $265m bookbuild

DataRoom | Sydney Airport has launched a $265m retail shortfall bookbuild for its equity raising.

Investment bank UBS is calling for bids by 6pm for the 58.1 million securities accounting for the shortfall.

Bids will be accepted in a bookbuild from the offer price of $4.56, with bids starting at $4.60 and being accepted in 5c increments.

It comes after Sydney Airport tapped the market last month for $2bn by way of a renounceable entitlement offer for the airport to provide balance sheet strength amid COVID-19 disruptions.

4.12pm: Shares lift 0.3pc

The local market rounded out a rocky day firmly higher, as strength in heavyweight banks and miners offset weakness in energy and industrials.

Shares dived to one-month lows at the open, but recovered to gains of as much as 0.5pc in mid morning trade, before finishing the day up 19 points or 0.33pc to 5944.8.

BHP put on 2.4pc to $37.06, as Fortescue lifted by 2.1pc to $17.88 and Rio Tinto rose by 2.5 per cent to $97.94.

On the downside, Afterpay slipped by 2.4pc to $76.35, while Victoria’s road map out of coronavirus served a blow to Transurban, its shares falling by 2.8pc to $13.74.

Bridget Carter 3.44pm: Goldmans shuffles ranks

DataRoom | Goldman Sachs has promoted a number of staff within its ranks.

Josh Frank is assuming select client and subsector coverage responsibilities within the Consumer, Retail, Healthcare, Technology, Media and Telecommunications group in addition to his current role as a member of the mergers and acquisitions team.

Mr Frank will work closely with Adrian Lee, Will Broughton and Ben Bartholomaeus.

Matthew Zaidan and Stephanie Shannon will join the CRHTMT team where they will cover a broad range of clients across the three sub-sectors.

Meanwhile, Zac Haines will join the Financial and Strategic Investors Group at Goldman Sachs.

Mr Haines will work closely with Tim Freeman covering financial sponsor clients.

Samantha Bailey 3.29pm: Credit card balances fall to 14-year lows

The average credit card balance has fallen to a 14-year low with Australians having now wiped off about $5.5bn in credit card debt since the start of the COVID-19 outbreak, according to the latest Reserve Bank data.

The average credit card debt was at $2,768.13, while almost half a million accounts have been closed in four months.

“One of the few positives from the COVID-19 pandemic is that credit card debt is being kicked to the curb,” said Sally Tindall, research director for comparison site RateCity.

The RBA data revealed that card spending overall dropped in July, with Australians clocking $57.3bn in payments for the month, compared to $57.4bn in June.

About $23.7bn of that card spend was on credit or charge cards, down slightly from $23.9bn the prior month.

Jared Lynch 3.13pm: Extension a ‘devastating’ blow for small biz

Small business ombudsman Kate Carnell has slammed Daniel Andrews’ decision to extend Victoria’s hard lockdown until late October, labelling it a “devastating blow to thousands of small businesses”.

Ms Carnell said the lockdown extension would force many small and family businesses to shut and called the federal government to foot the bill for those closures.

Costs associated with closures include lease termination fees – not just on tenancies but also on equipment. Ms Carnell said it was not reasonable to expect small businesses to continue “to hang on and accumulate debt, given this ongoing forced closure is no fault of their own”.

“Under the Victorian Government’s road map, many small businesses will not be able to open for another eight weeks at least and that’s only on the condition that there are less than five (new COVID-19) cases per day as a statewide average,” she said.

“On that basis, small businesses that were thinking this lockdown would only last for another couple of weeks, now don’t know if they will ever be able to re-open.

“For those struggling small businesses that know they cannot remain viable under these imposed conditions, the Victorian Government needs to step up and help them make the sensible business decision to exit.”

Read more: PM puts Victoria on notice over funding plan

Bridget Carter 3.11pm: Jemena taps bond market for $350m

DataRoom | Australian energy infrastructure company Jemena is the latest to tap the bond market, making efforts to secure $350 million.

The company is understood to have already attracted bids worth about $1.2bn.

The eight-year bond has a 1.83 per cent yield and is priced 118 points above the Bank Bill Swap Rate.

The company is raising the funds for general purposes and given the specific amount, expectations are that the group is looking to use the funds for a refinancing.

Jemena owns Australian energy infrastructure assets, including gas pipelines and gas and electricity networks in Victoria, NSW, Queensland and the Northern Territory.

It is 60 per cent owned by China’s State Grid and 40 per cent by Singapore Power.

Bridget Carter 2.49pm: Perenti launches Aussie bond issue

DataRoom | Mining services provider Perenti Global has launched its Australian bond issue, and the amount it plans to raise is understood to be $200 million.

The company is believed to be hoping to secure as much of the funding in Australian dollars as possible, say sources.

The senior unsecured bond involves a 5.5 per cent fixed rate coupon over five years.

Earlier, the expectations were that it was hoping to gain about $500m from both the US and Australian bond market.

The $813m Perenti is a diversified global mining services group with businesses in surface mining, underground mining and mining support services.

PRN last traded down 5.2pc to $1.10.

2.40pm: Westpac could net $3bn in BT sale: Citi

A potential sale of Westpac’s BT wealth arm could net the major bank as much as $3bn, as opportunities for industry consolidation become more scarce, notes Citi.

After the sale of MLC to IOOF, announced last week, BT is now the second largest player in the wealth space, and could fetch similar multiples to Commonwealth’s sale of Colonial First State or ANZ’s offload of OnePath, notes analyst Brendan Sproules.

He adds that with fewer options on the table, any sale “could call for a bigger dowry”, especially if it were to sell the whole business as opposed to CBA’s 55pc sale of CFS to KKR.

“Applying a 2pc Price/FUA multiple to BT, we expect that the business could achieve a ~$3bn price tag. This would put it largely on par with CFS, although it is hard to argue that some kind of control premium shouldn’t be thrown in given CBA only managed to get 55pc of CFS away to KKR,” Mr Sproules writes.

“KKR’s – and other strategic buyers’ – options are now growing increasingly limited. Leaving its divestment process to the last of the major banks could serve WBC well as scale players drive up the value of what is left.”

He adds that Westpac is the broker’s top pick in the sector, rating it at a Buy with a target price of $17.60.

WBC last traded up 1.7pc to $17.35.

Read more: IOOF to lift its game after MLC buy

2.25pm: Chinese chip maker drops on US threat

Shares in Chinese semiconductor manufacturer SMIC have taken a battering after reports the Trump administration was weighing export restrictions in a crackdown against Chinese tech.

The Wall Street Journal overnight reported that Semiconductor Manufacturing International Corp, a supplier to Huawei and Qualcomm could face a string of export restrictions by the US.

The report noted that US agencies were in discussions to add the company to the Commerce Department’s “entity list”, which requires companies to go through a difficult layer of review before exporting any US tech to SMIC.

The Hong Kong-listed manufacturer is trading down 20pc in afternoon trade, to HK18.98.

1.45pm: Global reopening lifts Chinese exports

China has reported further growth in exports for August as key trading partners gradually opened up their economies, while imports pulled back.

The latest data shows exports, in US dollar terms, rose by 9.5 per cent year-on-year, well ahead of expectations of a 7.5pc lift.

Imports fell back further – by 2.1pc – adding to last month’s 1.4pc slip and worse than the marginal 0.2pc growth that had been expected.

That left a trade surplus of $US58.9bn for the month.

Drilling down on the data shows imports from Australia dropped by 26.2pc to $US8.81bn.

1.10pm: Pacific Equity Partners to buy Modern Star

DataRoom | Pacific Equity Partners is about to sign a deal to buy the Modern Star education business for about $600m from Navis Capital.

More to come

1.01pm: Shares fall under Woolies, Wesfarmers drag

Shares put on as much as 0.5pc midmorning, but are falling back into the red at lunch as retail names weigh on the index.

At 1pm, the ASX200 is off by 5.5 points or 0.1pc to 5920 – despite reaching highs of 5958.9 in the morning session.

Strength in the major miners and CSL is propping up the index, while drag from Woolies, Wesfarmers and Transurban is leading the market lower.

ASX debutant Laybuy is jumping by more than 50pc, while trade in its buy now, pay later rivals is mixed – Afterpay down by 2.6pc but Zip gaining 1.6pc.

Here’s the biggest movers at 1pm:

12.29pm: Jobs recovery stalled, worse ahead: ANZ

Any recovery in the jobs market stalled in August as Victoria entered its Stage Four lockdown and consumer sentiment took a hit.

The latest ANZ job ads data show a lift of just 1.6pc for August, following the 19.1pc jump in July – but still well off pre-pandemic levels. Compared to February, jobs ads are down by 27pc, and down 30pc year-on-year.

“With Victoria accounting for more than 26pc of the nation’s pre-pandemic employment, the Stage 4 restrictions in Melbourne and Stage 3 in regional Victoria have undoubtedly put the brakes on,” head of Australian economics Catherine Birch says.

“We expect outright falls in national employment in August and September. Q4 is also looking worrying, given the amount of fiscal support to workers, businesses and households scheduled to be withdrawn, particularly with Victoria only gradually emerging from lockdowns.”

The solid rebound in ANZ Australian Job Ads in June and July – which saw more than half the pandemic losses recovered – did not continue into August, with just a 1.6% m/m rise. Victorian restrictions have undoubtedly put the brakes on. #ausecon #employment @cfbirch pic.twitter.com/tLLJLTPv63

— ANZ_Research (@ANZ_Research) September 7, 2020

12.10pm: Laybuy jumps 60pc on ASX debut

The newest listed buy now, pay later player Laybuy has jumped as much as 60pc on its ASX debut, after raising $80m in its IPO.

The New Zealand-based provider, set to rival the likes of Afterpay and Zip, raised funds at $1.41 apiece but soared to heights of $2.25 on its debut, settling to $2.04 in the first ten minutes.

Funds raised in the offer have been slated for growth into the UK and Australia.

With 174.5 million shares on issue the group’s market capitalisation has jumped to $356m in early trade.

Read more: Laybuy readies to ride BNPL wave as IPO looms

ASX welcomes Laybuy Group Holdings. LBY is the 57th New Zealand-based company to list on ASX. We wish you all the best in this next phase of growth and every success for the future. https://t.co/DHBnFpPcGw

— ASX 🛠The heart of Australia's financial markets (@ASX) September 7, 2020

@LaybuySupport #ipowithasx #ListASX #invest pic.twitter.com/dQQP5dPhmC

11.57am: ANZ loan deferrals top 84,000

Figures released by big four bank ANZ show the lender has 84,000 home loans deferred in Australia at the end of July or 9 per cent of its lending book.

At the same time it has 22,000 businesses loans with deferred repayments. Most of these (19 per cent) are on commercial property and construction industries as well as accommodation cafes and restaurants (18 per cent). Retail (14 per cent) also makes up a big proportion of deferred loans.

The comments are made in an ESG presentation by ANZ.

The bank also says some 90 per cent of its staff are working from home.

ANZ last traded up 2.2pc to $18.20.

Read more: ANZ banker says businesses need to be realistic about long-term prospects

Perry Williams 11.45am: Viva lashes Victorian road map

Viva Energy has lashed the Victorian government for its pathway out of Stage 4 Covid restrictions, saying Premier Daniel Andrews appears to be targeting elimination of the virus which may be unachievable.

The Melbourne-based fuels supplier, which produces half of Victoria’s petrol supplies and operates 1290 Coles Express service stations across Australia, said it was worried about the ‘road map’ taken by the state government.

“I’m pretty disappointed that we’ve got ourselves into this situation and I’m disappointed that the pathway out is pretty long and I fear potentially unachievable,” Viva chief executive Scott Wyatt told The Australian. “I’m concerned that this has evolved into an elimination strategy and that too many businesses won’t survive this.”

Viva said on Monday it may be forced to shut down its Geelong refinery later this year and said the lengthy road map out of lockdown may be unrealistic and out of step with states like NSW.

Mr Wyatt described the state government’s goal of five cases per day by October 26 as “a very high bar” and said there had been poor communication between the Victorian government and Viva despite its integral role as a major fuels supplier.

“We supply 50 per cent of the state’s energy and liquid fields requirements so we’re an important component of the state’s energy security. We haven’t been engaged at all on the road map out of the current restrictions that we’re in. That makes it very difficult for us to contribute to supporting and supplying the state’s fuel requirements through the road map,” Mr Wyatt said.

“We’re left to basically form our own views based on the announcements we saw yesterday. And we’re having to find crude three months out, so that makes it very difficult to know what the right answer is and how to maintain base production and fuel supply.”

VEA last traded down 0.9pc to $1.59.

Read more: Steps out of lockdown ‘could be fast-tracked’

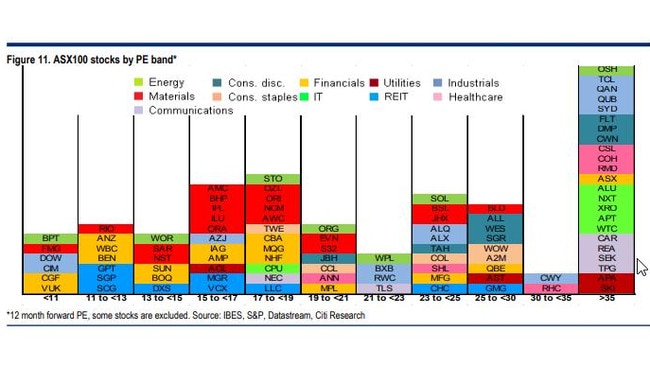

11.26am: Growth stocks to outperform: Citi

The end of August reporting season marks the end of a short, but sharp, downgrade cycle, with growth stocks set to continue to lead the market higher from here, says Citi.

In an equity strategy note led by Liz Dinh, the broker sets out expectations for healthcare, food and beverage, retailing and tech sectors to continue their outperformance, even as their valuation metrics blow out.

“There have been very few sectors with positive FY19-22e earnings revisions but have nevertheless rerated if they still show positive earnings growth,” Ms Dinh writes.

“Performance out of the reporting season is likely to see a continuation of patterns observed since 2018. The ‘stand-off’ between COVID and ongoing government stimulus have essentially put earnings and economic activity into ‘stasis’.

“Without a cyclical catalyst, companies with earnings growth are likely to benefit from continued out-sized allocations.”

She highlights a growing number of companies with PE multiples greater than 35x, especially across the healthcare, IT and communication services sectors.

11.10am: Upside risk for Fortescue dividends: Macq

Fortescue’s move to increase its port export capacity puts the iron ore miner near the top end of its dividend payout target, notes Macquarie.

The miner on Friday set out plans to steadily increase capacity at its Port Hedland facility to 210mtpa, a move which “de-risks” its FY21 forecasts, says Macquarie, and provides upside risk in the longer term.

“Buoyant spot prices continue to underpin strong upgrade momentum for FMG, with the recent move above $US130/t enhancing the upside risk to our case forecasts,” the broker writes.

“A spot price scenario generates 40pc and 100pc higher earnings for FMG for FY21 and FY22 compared to our base case. At spot prices, FMG’s free cash flow yields are an impressive 19pc for FY21e and FY22e.”

FMG shares last up 2.9pc to $18.03.

10.56am: Iron ore miners pull ASX to flat

Strength in mining heavyweights has helped the ASX to trim most of its early losses, even after continued selling on Wall Street on Friday.

BHP is higher by 1.9pc, Fortescue by 2.3pc and Rio Tinto by 1.9pc – to add a combined 13 points to the ASX200.

The benchmark touched a one-month low of 5869.9 but was last trading flat at 5922.9.

A jump in CSL is also adding to the positivity – its shares up by 0.4pc to $280.04.

10.11am: Shares fall 0.6pc

Heavyweight support from BHP and CSL is helping to trim the market’s early weakness, as the benchmark falls by 0.6 per cent.

At the open, the ASX200 is off by 37 points or 0.62 per cent to 5888.7 – albeit a slightly smaller drop than had been projected by US futures.

All sectors bar materials are trading in the red, led by a 1.7pc drop in energy as Viva takes a 3.6pc hit on its warning of the future of its Geelong refinery.

The extension of Victoria’s lockdown is weighing on stocks with heavy Melbourne exposure – Crown is off by 1.6pc as Transurban slips by 1.3pc and Premier is down by 1.8pc.

9.21am: ASX to test monthly low

The local market is headed for further pain to start the week, following the $60bn tech wipe-out on Friday, with the extension of Victoria’s lockdown set to add to negative momentum.

Futures relative to fair value suggest an early 0.8pc drop to take the index to 5878, a near five-week low.

US macro data released on Friday was slightly better than expected, but that didn’t stop the drop on Wall Street, with the S&P500 falling 0.8pc and Nasdaq down by 1.3pc.

Non-farm payrolls rose 1371k, in line with expectations but the unemployment rate tumbled to 8.4pc versus 10.2pc in July, much lower than the 9.8pc that had been expected.

On the commodities front, iron ore futures gave up some its recent gains as inventories rose, while gold struggled amid weaker investor demand as risk appetite rose and the US dollar strengthened.

News over the weekend from the WSJ that the Trump administration was considering whether to place export restrictions on China’s top chip maker could flare up tensions this week, putting more pressure on the stressed tech sector.

9.06am: Mirvac execs exit in management overhaul

Mirvac has this morning unveiled a shake up of its operating structure, as it detailed the departure of its chief financial officer and head of retail.

A search for a replacement CFO has commenced, and incumbent Shane Gannon will stay on until his replacement is found, while retail head Susan MacDonald will leave at the end of the year.

Chief executive Susan Lloyd-Hurwitz said the property group was combining its office, industrial, retail and build-to-rent business units into one, led by Campbell Hanan, head of commercial property, while residential development, design and group construction will be led by Stuart Penklis, head of residential.

Chief investment officer Brett Draffen will have his role expanded to include oversight of the group commercial and mixed-use developments.

“We are unlocking synergies in our commercial portfolio while also significantly enhancing our mixed-use asset creation capabilities. These changes will allow our teams to operate more efficiently and focus their efforts on creating further value for our customers, our securityholders and our communities,” Ms Lloyd-Hurwitz said.

Perry Williams 9.01am: Covid could shutter Viva’s Geelong refinery

Fuels retailer Viva Energy has warned its troubled Geelong refinery in Victoria faces closure with COVID-19 economic pressures including Victoria’s lockdowns threatening the future of the facility.

Viva said the longer-term outlook for the refinery remains “very challenging” given the big fall in global demand for oil products and economic jitters from the pandemic.

Earnings for Viva’s refining business plummeted to a $49m first half loss in August from a $18.4m profit a year earlier amid margin pressure after crude premiums increased from the move to low sulphur marine fuels and global demand for oil cratered due to the pandemic.

“Given the materiality of these issues, the company is assessing other options to address operating losses, including the possibility of moving to a full shutdown of the facility,” Viva said in a statement on Monday.

“Unfortunately, the impacts of COVID-19 and the restrictions on mobility and the economy are putting extreme pressures on the refining business that we have not experienced before and are not sustainable over the longer term,” chief executive Scott Wyatt said. “We are closely monitoring the evolving situation and will continue to keep our employees, investors and stakeholders updated.”

Viva has been in talks with the Morrison government over possible support for refiners including the creation of a strategic fuel reserve as concern grows over safeguarding a key strand of domestic manufacturing. It said on Monday it continues to closely work with the Commonwealth on the viability of the sector and was encouraged by the review underway.

VEA last traded at $1.60.

Read more: Geelong refinery facing closure: Viva

Samantha Bailey 8.53am: Magellan FUM passes $100bn

Magellan has grown its funds under management to $100.87bn as of August 31, compared to $98.53bn a month prior.

The Hamish Douglass-led fund manager said it had experienced net inflows of $566m in August, comprised of $208m in net retail inflows and $358m in institutional inflows.

Magellan experienced net inflows of $769m in the month prior.

7.00am: CSL signs Covid vaccine deals

CSL says it has signed a heads of agreement with the Australian government for the supply of 51 million doses of the University of Queensland’s COVID-19 vaccine candidate.

It has also signed an agreement with AstraZeneca to manufacture the Oxford University candidate should clinical trials of both prove successful.

CSL says the total number of vaccines ordered by the government is based on a two dose per person regime. Once trials are successfully completed, CSL expects the first tranche of doses to be available by mid-2021.

CSL CEO Paul Perreault said, “The social and economic impact of the COVID-19 pandemic has brought a high level of urgency to the task of developing a vaccine against the SARS-CoV-2 virus, and to manufacture a successful vaccine at high quality and in sufficient quantities.

“CSL has been working at pace to respond to the pandemic and has invested significant resources in the rapid development and large-scale manufacture of (University of Queensland’s) UQ-CSL V451, along with a number of other therapeutic programs.

“Together with partners including the University of Queensland and Coalition for Epidemic Preparedness (CEPI), our development and manufacturing teams have been working extremely hard to advance this program to ensure the availability of a safe and effective vaccine should clinical studies prove successful,” he said.

6.50am: Bank loan assessments start

Banks will soon start loan assessments as six-month payment deferrals implemented because of the pandemic come to an end.

The Australian Banking Association says banks have begun to contact customers for their six-month assessment and to discuss the next stage of support and assistance.

Of the more than 900,000 loans which have been deferred across the pandemic, at least 450,000 loan deferral customers will be assessed in coming weeks as they approach the end of their deferral in September and October, the ABA says.

These include 105,000 business loan deferrals to small and medium businesses, of which 65,000 will be assessed by the end of September, and 40,000 by the end of October. 260,000 mortgages are also due to be assessed, 80,000 by end of September and 180,000 by end of October.

The ABA says those who can resume repayments at the end of their deferral will be required to do so. Those still in difficulty will work with their bank to restructure or vary their loan, including converting to interest-only payments for a period of time, or extending the term of the loan

The ABA says in some cases, a further four-month deferral may be granted, but this will not be automatic. Customers who can’t pay their loan over the longer term will be offered tailored assistance that addresses their needs.

6.00am: ASX tipped to open lower

Australian stocks are set to start the week lower, adding to the losses suffered on Friday, when investors wiped almost $60bn off the sharemarket on its worst day in four months, and the Aussie dollar hit a six-day low.

Monday’s cautious open follows further falls on Wall Street on Friday, amid volatility and a continuing tech sell-off.

Shortly before 6am (AEST), the SPI futures index was down 36 points, or about 0.6 per cent.

The Australian dollar was higher at US72.82, after losing ground late last week.

The local sharemarket is set to remain cautious as it digests Victoria’s road map for an economic reopening, with global markets also guarded while the US remains closed on Monday for a Labour Day holiday.

While intraday rebounds in key barometers of risk appetite such as the S&P 500, the Nasdaq 100, the Australian dollar and copper over the weekend will go some way toward calming nervousness about last week’s sell-off, the S&P/ASX 200 share index may test its August low at 5860.7 after futures fell 0.6 per cent.

Domestic economic jitters may grow after Victoria’s government extended most conditions of its stage four lockdown by two weeks and outlined plans for a slow easing of harsh restrictions on movement contingent on meeting low targets for average daily cases of coronavirus.

5.30am: Aramco lowers its price for crude

Saudi Arabian Oil Co. on Saturday lowered the price at which it will sell crude oil to Asia and the US in October.

The state-run Arabian oil company, known as Saudi Aramco, lowered the price for its Arab light crude oil – which it will sell in Asia in September – by $US1.40 cents a barrel, giving it a $US0.50 cents-a-barrel discount to the Oman/Dubai average.

That marked the second-straight month in which Aramco cut its light crude price to Asia.

The company reduced the price for medium and heavy grades of crude-oil to the Far East by $US1.20 and $US0.90 cents a barrel respectively. Aramco also lowered both its extra and its super light crudes by $US1.50 cents a barrel to give super light crude a premium of $US0.55 cents and extra light crude an $US0.80 a barrel discount versus the Oman/Dubai average.

The oil giant’s price cuts for October came as oil prices remained in the narrow price range in which they have spent much of the past few months, amid a patchy economic recovery from the worst effects of the coronavirus in several of the world’s largest crude consumers.

AFP

5.25am: Suez boss slates Veolia stake bid

The head of French water and waste giant Suez said a bid by rival Veolia for an almost 30 per cent stake was “irrational” and would be “destructive for France”.

Veolia put in a bid last week for the 29.9 per cent of the group held by French energy firm Engie ahead of a takeover bid.

But Suez director general Bertrand Camus blasted the idea as an “opportunist financial operation … which undervalues Suez assets”.

The attempt was “an attempt at serious destabilisation of one of our country’s leading companies”, Camus said in an interview with Le Figaro daily.

He added in a tweet that “SUEZ does not need to get married: we are already the world leader in #water distribution, with 145 (million) households supplied.” Suez said last week the approach was unsolicited and Camus insisted the company was “headed back to growth” despite conceding the coronavirus had hit its share price.

Veolia said last week it wants to build a “world champion in ecological transformation” in explaining its offer, worth an estimated 2.9 billion euros ($3.5 billion) as it eyed an “historic opportunity.” The offer would leave Engie with a holding of just over two per cent in Suez that it could sell later when Veolia makes a planned public offer for the remaining shares.

To overcome potential competition issues, Veolia said it would sell Suez’s French water, engineering and research activities to Meridiam, a French infrastructure management company.

AFP

5.20am: Wall Street recap

US stocks ended lower again Friday, with tech shares tumbling in a continued sell-off ahead of the holiday weekend, shrugging off data showing US unemployment falling more than expected in August.

At the closing bell, Dow Jones Industrial Average shed 0.6 per cent to finish the week at 28,133.31, while the broadbased S&P 500 dropped 0.8 per cent to 3,426.96, both recouping from the day’s low point.

The tech-rich Nasdaq Composite Index fell 1.3 per cent to end at 11,313.13, adding to the losses from Thursday’s 5.0 per cent rout. Markets are closed Monday for Labour Day.

After a strong summer that saw US indices enjoy their best August in decades, equities tumbled on Thursday with high-flying tech shares leading the market lower as investors cashed in on the big gains.

Amazon and Facebook were among the major losers in the session, dropping close to three per cent, although Apple recovered enough to close flat.

Microsoft dropped 1.4 per cent even after news just before the close that the Pentagon confirmed a $10 billion contract for the JEDI cloud computing program, despite a lawsuit from Amazon alleging bias given President Donald Trump’s frequent attacks on the company and founder Jeff Bezos.

Shares got little help from the key US employment report which showed the jobless rate fell to 8.4 per cent, the first reading below 10 per cent since the coronavirus pandemic struck, but the economy added 1.4 million jobs last month indicating a continued but slowing recovery.

Some analysts have described the stock market as divorced from economic fundamentals, with unemployment still at historically high levels even with Friday’s better-than-expected data.

“The market was very extended coming into this and it was overdue for a pullback. It’s normal and healthy,” Adam Sarhan of 50 Park Investments told AFP.

“We’re going see some more pullbacks (and) a steeper pullback is warranted. Stocks got ahead of themselves.” The relatively better performance of financial shares Friday was evidence of a rotation in the market, Peter Cardillo of Spartan Capital Securities said.

“Today is the Friday before a long weekend,” Cardillo said. “People are selling and ignoring the macro news.”

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout