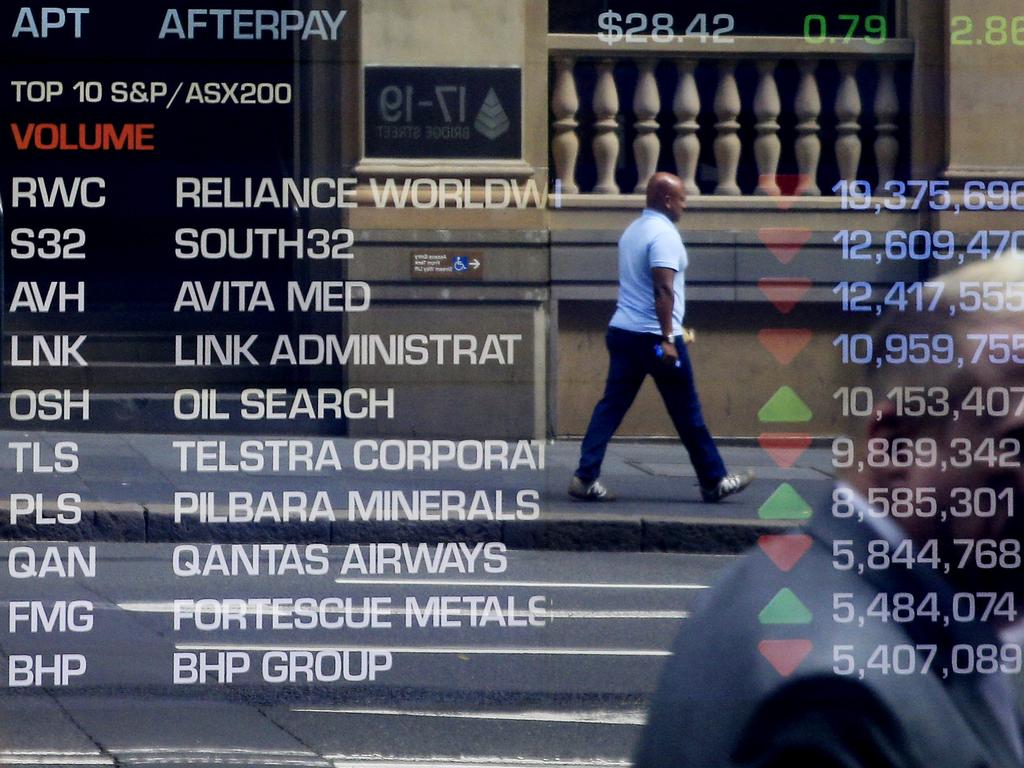

BHP, CSL drag as ASX sell-off extends to 3.1pc

Share losses accelerated at the close, to mark the benchmark’s worst day since May 1, with more weakness to come in the US overnight.

- ‘Frothy’ tech stocks bear brunt of selling

- CBA defends payout as duty to retail holders

- Positive momentum couldn’t last forever: JPM

- Coles, Fortescue to join top 20 stocks

That’s all from the Trading Day blog for Friday, September 4. Tech names led the local market drop, just as they did on Wall Street, sending the ASX down by 3.1pc – its worst session in four months.

Locally, Virgin’s creditors’ meeting has sealed the airline’s sale, while ANZ’s Shayne Elliott and CBA’s Matt Comyn faced a parliamentary economics committee hearing.

8.54pm: Investors wipe almost $60bn off ASX

Investors wiped almost $60bn off the Australian sharemarket after Wall Street dropped from record highs, amid sharp falls in the technology giants that have led the fastest US bull market on record.

In cautious trading before the release of non-farm payrolls data and a long weekend in the US, the Australian sharemarket had its worst day in four months and the Aussie dollar hit a six-day low.

However, there was some reprieve after US futures turned positive on Friday night and markets in London and Europe opened cautiously higher.

The benchmark S&P/ASX 200 share index fell 187.1 points, or 3.1 per cent, to 5925.5 points. It was the lowest daily close for the sharemarket in just over two months.

WiseTech dived 7.3 per cent, Appen tumbled 7.1 per cent, Next DC lost 6.8 per cent and Afterpay fell 6.7 per cent on Friday. The losses came after the Nasdaq 100 index fell 5.2 per cent — its biggest fall since June — with Apple down 8 per cent, Tesla down 9 per cent, Nvidia down 9.3 per cent and Microsoft down 6.2 per cent.

While technology was by far the weakest sector in the local market, the healthcare and consumer staples sectors also underperformed, with CSL down 4.1 per cent and Woolworths losing 3.9 per cent.

BHP dived 3.8 per cent and Wesfarmers fell 3.7 per cent, while three of the major banks and Macquarie lost about 3 per cent after the S&P 500 Index fell 3.5 per cent, in its biggest fall since June.

At the same time, the VIX volatility index jumped seven percentage points to a two-month high of 33.6 per cent.

David Swan 7.57pm: Apple leads tech falls

Global and local tech stocks slid across the board this week, with Apple alone losing nearly $US180bn ($247bn) in one day, and Australia’s “buy now, pay later” market darlings facing a new challenge in the form of competition from payments giant PayPal.

The tech-heavy Nasdaq — home to Australian software maker Atlassian — fell 5 per cent on Thursday, in its biggest one-day fall since June 11. Big Tech led the way, with Facebook falling 3.8 per cent, while Tesla fell 9 per cent, days after it completed a five-for-one stock split. Atlassian fell 5 per cent, and lost another 2 per cent after hours, wiping about $US2bn from its valuation.

That’s nothing compared to Apple, which completed a four-for-one stock split last month. The iPhone maker lost $US179.92bn of its market capitalisation, marking the biggest single-day drop for a US-listed company on record.

The mass sell-off marked a pullback for technology stocks, which had largely buoyed the market since the coronavirus pandemic hit in March.

It was also a tough week for Australia’s BNPL stocks, which bore the brunt of an announcement from California-based heavyweight PayPal that it, too, was entering the red-hot market.

PayPal announced a Pay-in-4 functionality in the US market, which will allow customers to split purchases of between $30 and $600 into four repayments over six weeks. Like Afterpay, customers won’t be hit with interest charges, but may have to pay a late fee.

Alan Kohler 7.25pm: We need compo, not more stimulus

Naturally enough all the headlines after the June quarter national accounts went something like: “Australia now in its first recession in 29 years!”

I was even asked to go on BBC TV that night because they thought it must be really bad news for the world if even the Lucky Country is in recession.

I had to explain that we’re talking about data from two months ago, Australian statisticians being the slowest/most painstaking in the world, so the word “now” may or may not apply, and anyway the idea that Australia has not had a recession since 1991 is just a quirk of definition: the only reason there haven’t been two consecutive quarters of negative real GDP in 29 years is population growth. Per capita recessions … we’ve had a few, but then again, too few to mention apparently.

should we even call it a recession?

Ticky Fullerton 7.06pm: 5G a whole new ball game

Rob Le Busque is a Queenslander who barracks for Hawthorn. He also runs the Asia-Pacific region for Verizon, the US technology, communications and entertainment giant that sits at number 20 on the Forbes 500 list.

Verizon was the first mover in the US on 5G, the highly anticipated fifth generation of wireless networks, and has longstanding relationships in Australia at the government and business level. This is big business.

During an interview with Le Busque for The Alliance on Sky News, 5G and cyber dominated the conversation.

Jared Lynch 6.35pm: Drought in agri workers hits

The rains have come and dams are full, but agribusiness landlord Vitalharvest is now facing a drought of a different kind as COVID-19-enforced travel bans dry up the supply of backpacker workers.

Vitalharvest managing director David Schwartz said travel bans had led to labour shortages across farms, with the number of backpacker workers down about 100,000.

As unemployment is forecast to soar to 9.25 per cent by Christmas, Mr Schwartz urged people to consider a treechange, saying the fall in backpackers meant there was plenty of work around.

“Labour has been the biggest issue through COVID. A lot of the work is done by backpackers and there are normally about 170,000 backpackers around and currently there are about 70,000, so getting workers is going to be an issue,” Mr Schwartz said.

“We hope that some of the local people will come and assist us on the farms. There are also going to be a lot of people unemployed and I would be encouraging them to go out and talk to people like Costa Group.

“I don’t think it’s an insurmountable problem.”

The company leases 100 per cent of its assets to listed fruit and vegetable grower and wholesaler Costa Group. Mr Schwartz said during the peak harvest at the group’s berry farm at Corindi on the NSW north coast, the company employed about 1600 workers.

“These are backpackers,” he said. “They go up and find accommodation and work and they do earn good money and I’m sure there are going to be jobs around.”

The labour shortage comes as Costa Group said it had recovered from extreme weather, which had wiped about $15m off its half-year earnings.

4.35pm: WAAAX names hardest hit in selldown

High growth WAAAX names were the hardest hit in Friday’s session, trimming their recent record rallies to follow the big tech names lower.

WiseTech’s weakness was exacerbated by the stock’s ex-dividend trade – dragging it to the top of the worst performers list with a 7.3 per cent decline to $27.53.

Afterpay lost 6.7 per cent to $78.20, Xero fell 5.7 per cent to $94.78 and Appen dropped 7.1 per cent to $32.43 – though do keep in mind all three stocks hit record highs earlier in the week.

Altium rounds out the WAAAX names with a 6.2pc drop to $34.05.

Here’s the biggest movers at the close:

Read more: ‘Frothy’ tech names bear brunt of sell-off

4.12pm: Stock drop worst since May

Heavy selling on the ASX has wiped $58bn off the market’s valuation, as tech stocks dived on offshore jitters.

The benchmark ASX200 fell to lows of 5918.8 in the afternoon session, and settled to a loss of 187 points or 3.06 per cent to 5925.5 at the close, marking the benchmark’s worst day since May 1.

Heavyweights CSL and BHP accounted for much of the weakness, finishing down 4.1pc and 3.8pc respectively, while the major banks lost between 2.1pc and 3.1pc.

Woolies fell 3.1pc, Wesfarmers lost 3.7pc and Macquarie fell 3.1pc.

4.08pm: ‘Frothy’ tech stocks bear brunt of selling

Today’s heavy selling has been seen by many in the market as an inevitable pullback, with many of the “frothy” tech names hardest hit, so says IG Markets’ Kyle Rodda.

He notes the backdrop of the COVID-19 crisis has cushioned the market panic somewhat, with traders noting the reversal “had to happen eventually”.

“That’s likely to be true, given commentary in recent months has focused on unjustifiably high valuations, narrow breadth, and the irrational exuberance of retail participants in the market,” he points out.

“It does speak though of the enormous moral hazard that’s emerged in this market. Stock markets won’t go down too long when the like of the Fed don’t allow it to occur.”

Looking ahead to US macro data released tonight, he cautions that jitters may accentuate a reaction in either direction, with “a nervous market much more likely to jump at shadows that may have been ignored in the recent past”.

Lachlan Moffet Gray 3.50pm: CBA loan deferrals peaked at 154,000

Commonwealth Bank’s total loans in deferral peaked at 154,000 at the height of the first lockdown before falling and then slightly increasing as lockdown 2.0 blanketed Victoria.

Chief Matt Comyn tells the House Standing Committee on Economics the peak was in April or May, reduced by about 20,000, but would finish August at “about 130,000 to 134,000.

Mr Comyn adds that “approximately 25 per cent of our customers” continued to make “some form” of payment towards their mortgages in deferral.

“Some of our customers, they haven’t been as severely impacted as they otherwise might have been,” he says, adding that some customers able to service their deferred mortgage have elected to keep them in deferral for the flexibility it provides.

With some deferred loans reverting to normal repayment terms in October and November, Mr Comyn says CBA is working with customers who will find it difficult to resume service of their debts.

“There are a number of options we are offering to customers as they are coming out of the six month payment deferrals,” he said.

“One of those options would be, if it was suitable for a customer, to move from principal and interest to interest only.”

Lachlan Moffet Gray 3.26pm: Federal support masking tourism stress: CBA

Tourism operators will begin to suffer if state border closures remain in place while income support measures are wound back, Commonwealth Bank chief Matt Comyn warns the Economics Committee.

Asked whether he has seen evidence of tourism-reliant businesses struggling, Mr Comyn says:

“At the moment, the substantial federal income support is probably masking some of the underlying stress, and so I think it will become perhaps more evident if the borders remain closed as income support reduces.

“There’s no question that the Queensland economy has a higher proportion of reliance on tourism … There has to be some segment of the business community there that is suffering from the ongoing border closures and the lack of clarity about when those borders may reopen.”

Lachlan Moffet Gray 3.06pm: Economy performing better than feared: Comyn

CBA chief Matt Comyn describes the economy as performing better than the bank expected when it set aside $1.5bn in capital to cover losses in May.

Speaking to the House Standing Committee on Economics, Mr Comyn says only Victoria is languishing in line with initial expectations.

“Since that time, we would say that with the exception of Victoria, most of the states and territories are performing better than we expected at that time,” he said.

Mr Comyn notes that the bank’s most pessimistic economic modelling focused on a blowout in the unemployment rate.

“If you think about even the way we distinguish between our central scenario … versus a more severe, prolonged downturn, the difference between those two scenarios is mostly a higher unemployment rate for a lot longer,” he says. “There is also an associated fall in house prices.”

Like ANZ, Mr Comyn says CBA’s credit card and personal loan balances have reduced over the course of the pandemic.

“Particularly in our June quarter … we saw an approximately a $2bn reduction, or a 20 per cent, just under 20 per cent reduction in credit cards, and I think it was a 16 to 17 per cent reduction in personal lending.”

Read more: Aussies ‘remarkably prudent’ amid pandemic: ANZ

2.56pm: Laybuy to add to BNPL competition

The latest entrant in the buy now, pay later space, Laybuy, is set to join the boards on Monday after raising $80m in its IPO.

The New Zealand group, which is owned by its founders, was today admitted to the ASX, and will commence trade from midday on Monday.

Shares in the IPO were offered at $1.41 apiece, with proceeds slated to grow its receivable book and increase sales and marketing to push into new markets.

Laybuy describes itself as a market leader in the sector in New Zealand, with growing presence in Australia and the UK.

Similar to its listed rivals Zip and Afterpay, the service offers customers an option to split purchase into as many as six weekly, interest free instalments, with transactions up to $1,500, depending on their credit score.

Read more: Book closed on Laybuy IPO

2.29pm: Shares head for worst close in 2 months

There’s no appetite to buy Australian shares before US non-farm payrolls data and the Labour Day long weekend in the US.

Thin trading could magnify any additional sell-off if US jobs disappoint and “Robinhood” traders can’t meet margin calls.

The S&P/ASX 200 fell as much as 3.2pc to a 3-day low of 5918.8.

A fall of more than 3.05pc would be the worst since a 5pc fall on May 1.

A daily close below 5826.09 would be the lowest daily close in 2 months.

Lachlan Moffet Gray 2.14pm: CBA defends payout as duty to retail holders

CBA chief Matt Comyn defends the bank’s move to dish out a dividend near the top of APRA’s statutory limit, saying it was justified due to the bank’s strong capital position and large base of retail shareholders.

In July APRA advised banks to limit dividend payouts to half of their earnings, a limit CBA came close to with the authorisation of a 98 cent per share final dividend.

Mr Comyn tells the Economics Committee the bank had the capital position to justify the payout, and also had a duty to support its retail shareholders.

“As you would appreciate, we also have to think through the requirements of our retail shareholders in particular,” Mr Comyn says. “We were in the financial position to make the dividend distribution to 890,000 households and families who own our shares directly.”

On the topic of home loan applications, deputy CEO David Cohen said early access of super withdrawals did not factor into home loan application eligibility.

Read more: CBA declares lowest dividend since 2006

Lachlan Moffet Gray 1.54pm: Investors should consider selling: CBA

Commonwealth Bank CEO Matt Comyn says that certain housing investors should examine the possibility of selling their investment property if they are having trouble servicing their loan.

Although just 28 per cent of all deferred loans are investor loans, Mr Comyn says that the bank will prioritise keeping struggling owner-occupiers in their homes, with a relatively robust housing market meaning many investors will still have positive equity, despite recent price declines.

“It would be sensible for some customers to be contemplating about whether now was the right time to reduce some of that outstanding debt,” he tells the Economics Committee.

While its hard to say what the impact of the pandemic would be on property investors, he notes demand for investment loans is falling, with investing lending at its lowest since 2004.

“We’re seeing some very divergent outcomes and results in different parts of the housing market both regionally and across dwellings … There’s pressure on rental yields, which eventually will flow through into prices.”

Unlike Mr Elliott, Mr Comyn said the lockdown in Victoria had produced a noticeable increase in SME and mortgage loan deferrals.

“We’ve certainly seen an increase in both requests for assistance and repayment deferrals since the lockdown began in Victoria,” he says, adding that in terms of spending there has been “a reduction, a clear difference in terms of underlying consumer expenditure in Victoria versus many other states”.

“We’ve also seen, I think as a by-product, a flowthrough in other states in terms of consumer and business confidence.”

Read more: Worse to come in home price downturn, warns CoreLogic

Lachlan Moffet Gray 1.41pm: Apartments to bear brunt of price drop: Comyn

Its now Commonwealth Bank chief Matt Comyn’s turn to front the House Standing Committee on Economics.

He starts by noting that the bank has received over one million requests for support throughout the pandemic and has deferred more than 250,000 loans worth $60bn.

Around 154,000 of these loans were mortgages, 86,000 loans to small and medium businesses and 21,000, personal loans.

Mr Comyn says the bank concurred with the RBA’s estimates of the Australian economy, forecasting a 4pc GDP contraction over 2020 and a 1.75pc rebound next year, with unemployment peaking between 9 and 10pc in the December quarter.

The biggest challenge, according to Mr Comyn, was now “how effectively can we move from the substantial and very effective income support that’s been in place to one of fiscal stimulus generating aggregate demand”.

Mr Comyn says the bank is predicting a blanket property decline of 10pc -12pc but said the impact will fall mostly on apartments, and that the market was looking more “robust” than initially anticipated.

Like ANZ’s CEO Shayne Elliott, who spoke in front of the committee earlier today, Mr Comyn notes that some customers will invariably default on their loans, but the exact number was likely to be manageable.

“We would expect and hope that a majority of customers would be able to recommence repayments, but obviously not everyone will be able to do so,” he says.

Read more: Stop digging and get out, says banker

1.34pm: Shares extend losses to 3.1pc

Australia’s share market is easily the weakest in the Asia-Pacific region today.

The S&P/ASX 200 fell as much as 3.1pc to a 3-day low of 5925 points in early afternoon trading.

At its low, the index was on track for its worst day since a 5pc fall on May 1.

In Asia, the Hang Seng is off by 1.8pc, as the Shanghai Composite drops 1.4pc and Japan’s Nikkei shed 1.1pc.

Tech stocks continue to lead broadbased falls with Appen and WiseTech down more than 7 per cent although Afterpay recovered slightly to be down 5pc.

Heavyweight stocks are doing most of the damage, with CSL down 3.9pc, BHP down 3.7pc, Wesfarmers down 3.5pc and Woolworths down 3.7pc.

Major banks are actually outperforming for a change, suggesting a tilt to value, with CBA down 2pc and the others down about 2.8pc.

1.01pm: Appen, WiseTech lead tech drag

Shares are trading near daily lows at lunch as Appen and WiseTech lead the tech tumble.

At 1pm, the benchmark ASX200 is off by 167 points or 2.73 per cent to 5945.7.

While there are a few more bright spots emerging, any gains are relatively meagre, while the worst performers pull lower.

Appen is lower by 7 per cent to $32.44 while Xero takes a 4.4 per cent hit to $96 and WiseTech trades down 7 per cent to $27.62.

Keep in mind that the tech sector had recently been hitting record highs – Xero hitting $103 yesterday and Appen hitting $43.60 just last week.

Here’s the biggest movers at 1pm:

12.50pm: WAM Capital pounces on Concentrated Leaders

The Geoff Wilson-led WAM Capital has made an off-market takeover bid for the listed Concentrated Leaders Fund, and used the opportunity to take a swipe at the fund’s management.

WAM’s offer is for 2 shares for every 3.7 CLF shares held, what it said represents a premium of 15.2pc to the stock’s current trading price.

The fund called out CLF’s “poor corporate governance and capital management” saying the appointment of its manager occurred without shareholder approval and was evidence the board had “treated CLF shareholders unfairly”, along with a move to declare a special dividend.

“We consider that these actions by the CLF Board represent a pattern of poor decision-making on behalf of CLF shareholders,” WAM says.

“Despite the persistent share price discount to pre-tax NTA of CLF, the CLF board of directors has employed inconsistent and ineffective capital management initiatives and have not provided shareholders with the opportunity to exit their positions at or above the announced pre-tax NTA.”

David Swan 12.34pm: GetSwift plots move to Canadian exchange

Embattled Australian logistics software maker GetSwift says it will de-list from the ASX, with the company set to leave Australia and redomicile in Canada.

The $140m tech company, which is facing an ongoing class action suit in Australia, has entered into an implementation deed with GetSwift Technologies Limited, otherwise known as Holdco, located in British Columbia, Canada.

The company said US and Canadian customers made up the majority of its new customers and shareholders throughout the last financial year and that the move would better position GetSwift to take on its global ambitions.

The company intends to list on Canada’s NEO exchange, with Holdco to acquire GetSwift and its subsidiaries. GetSwift shareholders will receive one Holdco share for every seven GetSwift shares they hold.

“We have made no secret of the fact that our customers and shareholders across North America have supported our focus on the region with increased business and continued investor support,” CEO Bane Hunter said. “Our focus on the world’s leading markets as we continue seeking growth in all regions is simply good business.”

The company’s class action, which stems from alleged breaches of continuous disclosure obligations, is ongoing.

Read more: GetSwift in dock over its ASX announcements

Lachlan Moffet Gray 12.29pm: Elliott pushes for insolvency relief extension

Temporary changes to insolvency laws allowing businesses to trade while insolvent should be extended in line with mortgage deferral rules and JobKeeper into next year, ANZ CEO Shayne Elliott has told the House Standing Committee on Economics.

From March 25, businesses have been able to continue to operate while illiquid but the rules allowing this are due to expire on September 25 – but Mr Elliott says the scheme should be extended.

“We think those changes are appropriate and we think there’s a logical reason to see those changes maintained for a further period of time that is more aligned for a further extension of deferrals,” he said.

Mr Elliott said that ANZ is already preparing to deal with an increase of customer insolvencies to hit in the middle of next year, after all major government support measures are due to expire.

“We do believe, sadly, there will be a pick-up in insolvencies in the middle of next year,” he said.

“What we’re doing, is making sure we are resourced appropriately to deal with that.”

Read more: Stop digging and get out, says banker

12.24pm: Malaysia drops Goldmans criminal charges

Malaysia has dropped criminal charges against units of Goldman Sachs Group, a move that follows a $US3.9bn settlement over the US bank’s role in the alleged theft of billions of dollars from a government investment fund.

A Malaysian court on Friday dismissed charges against the three of the US bank’s subsidiaries. Judge Mohamed Zaini Mazlan gave orders for a discharge amounting to acquittal on four charges each against Goldman Sachs (Asia) LLC, Goldman Sachs International and Goldman Sachs (Singapore) Pte.

Goldman Sachs was the main banker for 1Malaysia Development Bhd, or IMDB. The bank raised billions of dollars for the Malaysian fund, much of which was allegedly stolen by people who worked for the fund, government officials and two senior Goldman bankers.

In July, Goldman agreed to pay Malaysia $US2.5bn and guaranteed the recovery of $US1.4bn in assets allegedly stolen from the fund, as part of efforts by the Wall Street bank to move on from one of the worst scandals in its history. As part of the deal, Malaysia agreed to drop criminal charges against the bank related to the fundraising.

Dow Jones Newswires

12.20pm: ASX drop worst since June

In a nutshell, the Australian sharemarket looks worse after failing to bounce at all this morning.

The S&P/ASX 200 extended its fall to a two-day low of 5944.2 at midday.

Perhaps a clean-out of the Robinhood-type traders will magnify a short-term pullback that might help the longer-term outlook.

The index was last down 2.7pc at 5446.7, on track for its worst day since a 3.1pc fall on June 11.

US futures have bounced off their worst levels today, but the ASX200 looks like it could test Tuesday’s low at 5908.9.

Lachlan Moffet Gray 11.59am: Demand for relief will become lopsided: ANZ

The demand for relief measures from banks across different states and territories will become lopsided once government support benefits begin to wind back, ANZ CEO Shayne Elliott tells the House Standing Committee on Economics.

Mr Elliott says the demand for loan deferrals and other assistance measures across the country is “remarkably similar”.

“There are some differences but they are pretty difficult to see, to be perfectly honest,” Mr Elliott says, noting government stimulus has been handed out equally across the country.

“Real differences will emerge once these support packages start to be targeted or removed.”

Australian retail and commercial banking group executive Mark Hand notes that SME lending has been strong to industries benefiting from the unique economic landscape of the pandemic including health industries and home and office goods.

11.43am: July retail sales lift 3.2pc

Australia’s July retail sales growth has been revised lower to 3.2pc, near Bloomberg’s consensus estimate of 3.3pc, with all states except VIC recording strong gains.

The latest drop is an update on the preliminary result of 3.3pc released in late August, and follows a 2.7pc lift in June.

Clothing, footwear and personal accessory retailing, and cafes, restaurants, and takeaway food services sales rose in all states but Victoria, where the reintroduction of Stage 3 stay-at-home restrictions in July partially offset these rises, the ABS said.

Preliminary August data, taking into account the full effect of Stage 4 lockdowns, will be released on the week beginning September 21.

11.36am: Four stocks bucking ASX weakness

Amid the sea of red in morning trade there are a few rays of optimism, with just four stocks managing to buck the broader momentum.

The market has extended its losses to 2.6pc as tech names pull lower, but unlikely gainer Corporate Travel is adding 0.3pc, while Genworth Mortgage is up 0.3pc, News Corp by 0.1pc and SkyCity outperforming with a 2pc jump.

Lachlan Moffet Gray 11.32am: ANZ rules out V-shaped recovery

ANZ CEO Shayne Elliott says the bank has never believed in the “V shape” economic recovery due to the level of Australia’s economic exposure to the rest of the world.

“We’ve never bought the v shape recovery argument … and that is because Australia is an open, liberal democracy reasonably dependent on the free flow of goods and people,” Mr Elliott told the House Standing Committee on Economics.

Until immigration and global trade flows resume, Australia’s recovery will be more of a “grind,” Mr Elliott said, with GDP expected to recover in a “real” sense by 2022.

Mr Elliott also said that from an economic point of view, activity will be lowest “between now and the end of the year” but the impacts will be felt by the banks “more like the middle of next year.”

Eli Greenblat 11.27am: DJs, Country Road staff underpaid almost $4m

South Africa’s Woolworths Holdings, which owns up-market department store David Jones as well as the Country Road Group, is the latest corporate to admit to underpaid staff wages of almost $4m after discovering issues with its rostering and payroll systems.

It potentially affects more than 7000 staff over the last six years and it joins other companies like Woolworths supermarkets, Target and Super Retail Group to uncover tens of millions of dollars in lost wages.

Australia’s Woolworths, no link to the South African company that owns David Jones with the same name, still holds the record for the biggest lost wages bill which together with back interest and other costs is almost $500m.

The company said that following a review, it has identified underpayments affecting some team members within its David Jones and Country Road Group businesses.

“Woolworths Holdings apologises unreservedly to all team members impacted by this issue, and is committed to making full back-payments plus interest to all team members by mid-October.

“Payment errors were identified as a result of system changes in late 2019. Following identification of these issues, Woolworths Holdings undertook a comprehensive audit of all payment processes across David Jones and the CRG brands.”

Robyn Ironside 11.20am: Virgin creditors meeting underway

The crucial second creditors meeting is underway to decide on how the sale of Virgin Australia should proceed to US private equity firm Bain Capital.

Creditors, including 9000 employees, will vote on Bain’s deed of company arrangement (DOCA) which would allow the airline to be sold as a going concern, and ensure a much quicker end to administration.

If the DOCA is not supported, the administrator Deloitte will adjourn the meeting and make preparations for an asset sale arrangement, which would take considerably longer and run the risk of Virgin Australia being liquidated.

The airline went into administration on April 21 with debts of $6.8bn.

The majority of creditors are expected to vote in favour of the DOCA, with the possible exception of bondholders who had wanted to present an alternative proposal at the meeting but failed to get Federal Court orders to do so.

Read more: Bain set to land Virgin as unions approve deal

Lachlan Moffet Gray 11.18am: Covid recession no different to past recession: ANZ

The recession spurred by the COVID-19 pandemic is not vastly different to past economic recessions from a bank’s perspective, ANZ chief Shayne Elliott says.

“We have a bunch of customers, through no fault of their own in most cases, have lost income, and we need to work that through with them,” he says in response to questions from the House Standing Committee on Economics.

“One of the big differences this time is that the economic effects are far less discriminating. This virus has impacted, with some exceptions, right across the country, right across segments, right across socio-economic levels,” he said.

“Our view at the moment is that Australia still has good prospects as an economy. There is no reason to believe that unemployment won’t reduce again.”

Mr Elliott said the bank was watching the investor property market closely.

“History, up until now, history would tell you that investor loans were slightly less risky than owner-occupier,” he said.

“The reason is that mostly people who have an investment property have multiple sources of income.

“They’ve got a job, and they’ve got rent … what will be interesting through this period is how much rent falls, and if people liquidate their investment properties.”

Australian retail and commercial group executive Mark Hand added: “investors are less represented in our deferred population that our mortgage book.”

Read more: Why Australia’s 2020 recession is one like no other

Lachlan Moffet Gray 10.56am: Don’t dig deeper debt hole: ANZ

ANZ Australian retail and commercial group executive Mark Hand has told the House Standing Committee on Economics that although business insolvencies have not yet increased, he stands by earlier comments implying that some small businesses would benefit from winding up and walking away from some equity.

Mr Hand said that the COVID-19 pandemic had caused a number of permanent shifts in consumer behaviour such as decreased cash usage and increased online shopping, which may impact some businesses negatively.

“These changes in customer behaviour that impact us are impacting a lot of other industries,” Mr Hand said.

“They believe they can trade out this. My message is that they should have a realistic view of what changed, and what that means for them.

“Our concern is that it is very easy for a customer to continue to dig a deeper and deeper hole because they believe things will return to normal.”

Mr Hand said the anticipated rate of insolvencies cannot yet be estimated.

“In terms of spikes in insolvencies, it is too early to tell. We have not yet seen a spike in flows … that is out of the normal.”

10.48am: BHP drags despite iron ore jump

Iron ore prices topped $US130 per tonne overnight, but BHP shares are among the worst drags on the market in today’s trade.

The heavyweight miner is trading down by 3.4pc to $36.34 to take 13 points off the market, second behind only CSL’s 14 points as the market’s biggest drags.

Strong demand from China’s steel mills was behind the jump in the commodity, along with shortage of mid-grade ores at Chinese ports, according to Commonwealth Bank’s Vivek Dhar.

Meanwhile Fortescue is off by 1.5pc to $17.87 and Rio is down by 2.5pc to $95.90.

10.41am: Afterpay the biggest tech hit for ASX

Tech names are driving the local market drop – following the big tech weakness on the Nasdaq overnight.

In the first hour, the sector has trimmed losses somewhat, but is still down 4.4pc.

Afterpay is the biggest drag – shedding 5 per cent to $79.64 and wiping 3.2 points from the index.

Other big name falls are Appen, off by 6.8pc, while Xero takes a 4.8pc hit and WiseTech by 7.2pc, adding to weakness after founder Richard White announced his intention to sell down his holdings yesterday.

In the much-hyped buy now, pay later sector losses are similarly broad – Zip is lower by 4.2pc as Splitit sheds 4.9pc and Sezzle loses 4.7pc.

Lachlan Moffet Gray 10.36am: ANZ swamped with 4x daily loan applications

As questioning at the Parliamentary Economics Committee continues, ANZ CEO Shayne Elliott defends lengthening home loan approval times at ANZ, saying the bank was working hard to bring application times down amid a flood of customers seeking to refinance their mortgage.

Asked why ANZ’s home loan approval length has extended from a few days to around eight weeks, Mr Elliott said the bank had already reduced the application time frame.

“In fact, we have a plan, work in progress, to get those approval times down to a handful of days and we have made significant progress,” he said.

He added “the vast bulk of those applications are for people refinancing,” with a fixed-rate loan of 2.19 per cent introduced at the start of the COVID-19 pandemic resulting in ANZ being “literally swamped with volumes we’ve never seen before, up to three times, four times our daily application rates”.

Australian retail and commercial banking head Mark Hand said the average application time was now 10 days.

Lachlan Moffet Gray 10.24am: Default rates will increase, still manageable: ANZ

Housing prices will most likely fall by 10 per cent, ANZ CEO Shayne Elliott has told the House Standing Committee on Economics, with rental investment properties to come under pressure and mortgage default rates to increase.

Noting that “there’s a danger of looking at average,” Mr Elliott said the bank is anticipating a property price decrease of “around 10 per cent from peak to trough,” with significant pressure to be applied to rental income properties.

“The simple reason is sadly, the most impacted members of our community … have been those that are employed in retail, tourism, hospitality, etc, and those generally tend to be lower income, they tend to be younger people, they tend to be more female – and that tends to be a renter population more than it tends to be a homeowner population,” he said.

“Therefore there will be a reduction in the value of those investments.”

Mr Elliott said that default rates will increase but remain manageable.

“The reality is we don’t know. Prior to COVID-19, what we did know was that in Australia about 1 per cent of all people with a home loan were struggling with their repayments.”

Mr Elliott said that about 15,000 of the some 84,000 customers with a mortgage deferral are signalling that they are uncertain about the future capacity to resume payments, meaning the number of delinquencies “will probably be in the thousands”.

“We have the capacity to help those people,” he said, adding that the second lockdown in Victoria did not have a material impact on deferral requests.

“Despite the most recent lockdown, we haven’t really seen a surge in people applying for deferrals or stress payments,” he said.

Read more: Economy on long road to recovery from deep recession

Nick Evans 10.20am: Jupiter to spin off iron ore projects

Jupiter Mines has confirmed it will spin off its WA iron ore projects into a new ASX-listed vehicle, looking to take advantage of the iron ore price to win some value for the long-stalled projects.

The company’s core asset is the Tshipi manganese mine in South Africa, but the company once harboured ambitions to build an integrated business producing steelmaking materials, including manganese, iron ore and coking coal.

Central to those ambitions was the Mt Ida magnetite project north of Kalgoorlie in WA’s Central Yilgarn district, planned to produce 10 million tonnes of concentrate a year at a capital cost of about $1.6bn. The project also included a small direct shipping ore component worth about 6 million tonnes of ore grading 60 per cent iron.

Those ambitions came to an end as iron ore prices crashed in 2012, and Jupiter put work on its WA iron ore projects on hold, citing the “depressed iron ore price and strong exchange rate environment”.

The strong iron ore price has led to a reassessment of that decision, with Jupiter confirming on Friday it plans to float the assets in a separate company, which would fast-track the development of a small direct-shipping mine as it looks to find a backer for the magnetite operation.

Jupiter shares last traded at 27c.

10.11am: Tech leads 2.4pc market drop

Local tech names are leading the local market’s 2.4pc sell-off, just as they did on Wall Street, with the sector down by more than 5pc early.

At the open, the ASX200 is lower by 148 points or 2.44 per cent to 5963.7 – a two-day low.

Falls in US index futures and the Australian dollar magnified a rush for the exit after the Tech sector led a sell-off on Wall Street.

Afterpay is lower by 6.5pc, Kogan by 8.2pc, Zip by 5.8pc and Appen by 6.2pc.

The major banks are winding back too – Commonwealth by 1.3pc, Westpac and ANZ by 1.9pc and NAB lower by 1.7pc.

CSL is down 2.8pc, BHP is down 3.2pc and Fortescue and Rio Tinto are down about 2pc.

Gold miners are outperforming with Regis Resources up 1.3pc and Evolution up 0.7pc.

Changes to the S&P/ASX 200 index announced by S&P saw drops in McMillan Shakespeare, New Hope and OHH!Media and a jump in Westgold Resources.

Lachlan Moffet Gray 10.05am: Aussies ‘remarkably prudent’ amid pandemic: ANZ

ANZ CEO Shayne Elliott says that contrary to trends in the US and our own country’s past, Australians have behaved “remarkably prudently” throughout the COVID-19 crisis, increasing savings and paying down debts.

Taking questions from Committee chair Tim Wilson, Mr Elliott said:

“What’s been very interesting as opposed to other parts of the world … Australians are behaving remarkably prudently, which is a good thing. We’ve also seen a significant increase in people paying down their credit card debt.”

Mr Elliott said the total credit card balance for the bank has decreased from $7bn-$7.5bn prior to COVID, down to around $5.5bn.

Answerings questions on banking culture following controversies at AMP, Mr Elliott said that he was not aware the bank had any NDAs pertaining to staff conduct.

“I’m not aware that we have any … it’s not a normal process for us,” he said.

Mr Elliott also asserted that the bank has not “shied away” from lending to SMEs, “continuing to approve (loans) at about the same rate.”

Australian retail and commercial banking group executive Mark Hand said the SME loan balance sheet grew “around about 2 per cent on the previous six months,” equal to an amount of about $1.2bn.

Read more: ANZ issues dividend despite COVID-19 challenges

9.54am: Positive momentum couldn’t last forever: JPM

Profit taking in high-flying US tech stocks before the US presidential election could fuel a correction in the US share market after strong gains since March, according to Kerry Craig, global market strategist at JP Morgan Asset Management.

After the US market posted its biggest drop since June overnight, he cautions that market corrections are to be expected, with driving factors such as central bank easing and record earnings beats not able to last forever.

“When it comes to the tech sector and the other online giants that have gained so much in the last few months, there could be profit taking as we head towards the US presidential election in November,” he notes.

“Negative headlines on potential regulatory and tax changes are likely to add to investor unease in a market with elevated valuations.”

But Mr Craig argues that this is unlikely to be a repeat of the tech wreck of the late 1990s, given how much the market and sector have changed. The Fed isn’t tightening this time either.

“While tech sector valuations are elevated, we are also mindful of the earnings and revenue potential in the coming years from areas like cloud computing and artificial intelligence, as well as how many of these companies will benefit from the shifts in corporate attitudes towards physical workplaces,” he says.

News that a vaccine could be available to frontline health workers sooner than expected may be a reason to expect a rotation towards more cyclical sectors of the US market, but “the second wave in Europe reminds us that the battle is far from over and until a vaccine is widely available, economies will likely remain constrained by measures aimed at slowing the spread of the virus,” Mr Craig cautions.

“Governments’ willingness to continue to support household incomes and businesses until a vaccine is readily available or until the virus is brought under control by other means will be key to the outlook from here.”

Lachlan Moffet Gray 9.51am: Economic outlook loss “less bad”: ANZ chief

ANZ CEO Shayne Elliott has told the House Standing Committee on economics that although there are “emerging bright spots” in the economy, he believes that unemployment will reach “high single digits” in the next 12 months.

“There are emerging bright spots around the country like agriculture and resources,” Mr Elliott said. “We’ve also seen how quickly business can adapt, particularly when supported by effective policy.”

Mr Elliott said that the rate of economic recovery will be dependent on the extent to which the state governments and Commonwealth “be responsive and act with speed” but the outlook was more optimistic than it was earlier in the year.

“Having said all that, while there is still much concern about the future state of the economy over the next 12 months, it is looking less bad than it did in March when we reported our half-year results,” Mr Elliott said, adding that at that time the bank was predicting peak unemployment of 13 per cent.

Lachlan Moffet Gray 9.44am: Economics Committee probes bank COVID-19 support

Representatives from ANZ bank are the first to appear in front of the House Standing Committee on Economics this morning, with chair Tim Wilson in his opening statement declaring the session an important opportunity for MPs to scrutinise COVID-19 relief measures provided by the banks and identify potential areas for reform.

“It is crucial that financial institutions are held accountable, and they are treating consumers fairly during what is a very difficult time for Australians and their families,” Mr Wilson said.

ANZ CEO Shayne Elliott said the bank has been assisting its customers through deferring payment on $9.5bn of business loans and $31bn of mortgages, although some customers will need further assistance once the loan deferral scheme ends early next year.

Mr Elliott said that despite the high rate of deferrals, “we’ve also seen some customers make some kind of repayment” but also said “some will need further help”.

“It’s because people’s situations differ, we need to work on solutions that are fair and appropriate for them,” Mr Elliott said, highlighting measures such as interest only payments, further deferrals or loan extensions.

However, the CEO said that the bank may have to wind up debts in some cases.

Representatives from Commonwealth Bank will appear this afternoon and representatives from Westpac and NAB will appear next Friday.

Read more: Australia’s looming default cliff

9.39am: Futures point to 1.8pc early drop

Australian shares are shaping up to be pummelled Friday after big falls on Wall Street and a sharp rise in volatility overnight.

Overnight futures relative to fair value suggest the S&P/ASX 200 will open down 1.8pc at 6000 however a bigger fall is likely as the market anticipates further falls on Wall Street, with Dow futures down 0.7pc, S&P 500 futures down 0.9pc, and Nasdaq futures down 1.6pc in early Asian trading.

The big concern last night was the VIX spike to 35.94pc, as it will tend to force risk parity investors to reduce their exposure to risk assets. While it was also elevated above 20pc in the latter stages of the Tech Bubble, the VIX index stayed below 30pc in that period.

Last night saw a rush for the exits in growth stocks, exacerbated by algorithmic trading, driving Apple down 8pc.

Economic data were okay but Chicago Fed’s Evans said economic recovery will “critically depend on receiving substantial additional support from fiscal policy”. “Forward guidance for the rate path and asset purchases could be beneficial in the not-too-distant future”, hinting that the Fed may move later this month.

Treasury secretary Mnuchin and House speaker Pelosi agreed to a stopgap funding bill to avoid a government shutdown. But Senate Majority leader Mitch McConnell cast doubt on whether Congress can agree on more stimulus in the next few weeks.

A falling Australian dollar could also compound the expected sell-off in Australian shares today. AUD/USD has dropped to a 5-day low of 0.7257 this morning, below key support at 0.7276 after a 35pc rise since March.

Thus the S&P/ASX 200 could well test chart support from Tuesday’s low at 5908.9, marking an intraday fall of 3.4pc.

If Wall Street does fall and stay down tonight, the S&P/ASX 200 may test its 100-day moving average at 5830.50 next week.

9.29am: 5G Networks to raise $30m

Business-focused telco provider 5G Networks has this morning launched a $30m institutional placement to fund acquisitions and pay down debt.

The group said this morning it was offering shares at $1.85 apiece, a 13pc discount to its last trading price of $2.13.

Proceeds of the raise are slated to buy out Webcentral Group, formerly Melbourne IT, which 5G already has a 10.2pc strategic interest in, along with refinancing of the targets outstanding debt.

But it said, if that were not to eventuate, it was looking at “a range of other potential acquisitions” and the funds would be put towards “unique growth opportunities during and post COVID-19”.

Alongside the placement, managing director Joe Demase has agreed to sell 3 million shares, representing 16pc of his shareholding, to be offered at the same price as the placement, to reduce his stake to 15pc of expanded capital of the company.

Wilsons Corporate are the lead managers for the placement.

9.12am: Fortescue lifts WA licenced throughput

Fortescue says its received approval to increase the throughput of its Port Hedland facility by 35 million tonnes per year, what it says will help it achieve its shipment guidance.

The WA government has given the miner the all clear to gradually build its throughput from 175 million tonnes per annum to 210mtpa, including allowances for its first magnetite product.

Fortescue said the revised licence allowed it to use the capacity of its existing infrastructure and supports its guidance of FY21 shipments between 175mt and 180mt.

“The increase in the licensed capacity of Fortescue’s Herb Elliott Port from 175mtpa to 210mtpa is in line with our strategy to deliver growth through investment, including the $US2.6bn investment in the Iron Bridge project,” chief Elizabeth Gaines said.

“This significant project will deliver 22mtpa of high-grade magnetite product, enhancing the range of products available to our customers through our flexible integrated operations and marketing strategy.”

9.04am: What’s on the broker radar?

- Sonic Healthcare raised to Neutral – UBS

- Stockland cut to Underweight – JP Morgan

- Transurban raised to Buy – UBS

- United Malt cut to Hold – Morningstar

8.55am: Coles, Fortescue to join top 20 stocks

The highly anticipated S&P quarterly rebalancing has been released which updates which companies are in and out of the key ASX indices.

With the rise of passive investing, the changes are even more significant, set to impact how billions of dollars of funds are allocated.

The update also show changing trends across ASX listed companies.

In the top 20 companies, Coles and Fortescue are stepping up to the lucrative top spots, replacing Scentre and Suncorp.

S&P ASX200 additions are: Auckland International Airport, AUB Group, Ramelius Resources, Westgold Resources and Zip Co.

They replace McMillan Shakespeare, New Hope, oOh!Media, Orocobre and Southern Cross.

In the broader ASX 300, Alkane Resources, Capricorn Metals, Dicker Data, De Grey Mining, Event Hospitality and Entertainment, Reece and Temple & Webster are joining the fold.

Meanwhile FAR, Ive Group, Japara Healthcare, Myer Holdings, Regis Healthcare, SG Fleet Group are being booted out.

The #ASX 200 will have several new names added on 21 September following a quarterly re-balancing. $Z1P $AIA $AUB $RMS $WGX will be added while $MMS $NHC $OML $ORE $SXL will be removed #ausbiz pic.twitter.com/3wXrSX5GJ7

— CommSec (@CommSec) September 3, 2020

8.48am: Dive in US futures bad news for ASX

US stock index futures are getting hammered after the overnight sell-off.

S&P 500 futures are down 0.5pc, Nasdaq futures are down 1pc and Dow futures are down 0.4pc.

This looks like an ugly day for Asia as everyone rushes for the exits.

8.35am: $A set to fall further

AUD/USD continues to pressure chart support level from the August 19 peak at 0.7276.

The lack of any significant rebound off the overnight low of 0.7265 suggests it will fall further in the short term.

The market may be a bit too long after a 35pc bounce off the March low, with strategists having boosted their medium-term targets recently.

“Early in the week we noted that the move up in the A$ above 74c was looking a bit stretched and was not fully justified by our short term fair value model,” says NAB’s Rodrigo Catril.

If it continues to fall sharply today, the 50-day moving average at 0.7120 and August 20th low at 0.7136 could be tested.

7.14am: Juul to slash workforce

E-cigarette maker Juul Labs is planning to lay off more than half its employees, according to people familiar with the matter, and is considering halting its sales across Europe and Asia. That could mean pulling out of as many as 11 countries and shrinking the start-up’s footprint to its core markets, the US, Canada and the U.K.

Juul cut about one-third of its 3000 workers earlier this year and already has halted sales of its vaporisers in several countries. The once fast-growing company has been scaling back its operations to combat a sharp drop in sales. It currently has about 2200 employees. The company is aiming to shrink its workforce of 2200 to about 1000, the people familiar with the matter said. Juul Chief Executive K.C. Crosthwaite told employees in an email Wednesday that the company was planning significant cuts.

“No final decisions have been made and we will continue to go through our evaluation process,” a Juul spokesman said Thursday.

Widely blamed by parents and government officials for a surge in teen vaping in the U.S., Juul has faced regulatory crackdowns and investigations into its marketing practices over past two years. Now its sales are falling as Reynolds American Inc.’s Vuse e-cigarette brand gains market share and some vapers switch back to traditional cigarettes.

Dow Jones

7.08am: Apple delays privacy change

Apple said it would delay until early next year a privacy change that would invite iPhone users to keep their devices cloaked from apps that want to track them.

Critics of the change, which had been set to go into effect this fall, say it would hurt app makers by making it harder to sell personalised ads. Facebook, which has a business that facilitates such ad sales on mobile devices, spoke out last week against Apple’s proposed policy, as did some online publishers.

“We want to give developers the time they need to make the necessary changes,” an Apple spokesman said.

When the new privacy prompt is introduced next year, iPhone users will be asked on an app-by-app basis if they consent to having their behaviour tracked.

Apple announced the feature during its annual developers’ conference in June, with the intention to include it in the new iPhone operating system to be released this month.

The announced feature had sent the digital-advertising and app-publishing industries scrambling to prepare for the change, devising new methods to target users with ads.

Dow Jones

6.50am: Vanguard has first trillion-dollar fund

Investors saw no shortage of record-breaking stock news this past August: The S&P 500 hit an all-time high just five months after the coronavirus sell-off, and tech giant Apple became the first US company with a $US2 trillion market cap.

Today’s milestone is in the fund world: The Vanguard Total Stock Market Index fund has become the first fund, ever, with more than $US1 trillion in assets under management.

“It’s been a decade of index funds,” says Jeff DeMaso, research director at Adviser Investments, an independent advisory firm that has an expertise in Vanguard funds. “The fact that we got a trillion-dollar index fund is just a prime example of that.”

The $US1 trillion in the Vanguard Total Stock Market Index funds represents about 17 per cent of Vanguard’s more than $US6 trillion in total assets, DeMaso says.

Dow Jones

6.25am: ASX to open sharply lower

Australian stocks are tipped to plunge at the open after Wall Street gave back some of the gains from a torrid August as investors took profits, amid worries about bubble-like valuations.

Around 6am the SPI futures index was down 120 points, or 2.0 per cent.

On Thursday, Australian stocks ended 0.8 per cent higher.

The Australian dollar was lower at US72.72.

Spot iron ore was 2.1 per cent higher at $US130.8.

6.20am: Tech stocks lead US sell-off

US stocks fell sharply in their worst showing since June, driven by a broad decline in many of the technology firms that have led the market higher in recent months.

The Dow Jones Industrial Average fell 811 points, or 2.8 per cent, to 28,290 as of the 4pm close of trading in New York, suggesting that investors may be taking a breather following a rally that sent the Dow industrials above 29000 for the first time since February a day earlier.

The S&P 500 lost 3.5 per cent to 3455, while the tech-heavy Nasdaq Composite slid 5 per cent to 11458, its biggest one-day percentage decline since June 11.

Big technology companies, including Facebook and Apple, were leading the declines, contributing to the pressure on Nasdaq. Facebook fell more than 4 per cent and Apple lost nearly 7 per cent, a drop mitigated by its stock split in August. Amazon.com, meanwhile, lost 5.4 per cent.

Big technology firms have been among the leaders in the broad market rebound. Overall, stocks have soared since March despite the worst economic slump in decades and the novel coronavirus’s continued hold even in some countries that had previously showed success in quashing it, confounding investors.

The decline on Thursday indicates the rally may not continue unabated, investors said.

Holly MacDonald, investment chief of New York-headquartered multi-family office Bessemer Trust, said the sell-off represented something of a return to more normal conditions and wasn’t entirely unexpected given the August gains. She also said she expected a pick-up in volatility going into the fall.

“As the market continues to digest the news related to COVID-19, the vaccine, the election, there are going to be sessions where you don’t see that degree of strength,” Ms MacDonald said.

On the economic front, fresh data showed that, seasonally adjusted, 881,000 Americans applied for unemployment benefits for the first time through the week ended August 29. Unemployment claims have continued to edge lower but remain near historic highs, signalling lay-offs continue as the coronavirus hampers the economic recovery.

The uptick in market volatility could be due to a large number of call options, which confers the right to buy shares, on technology stocks such as Apple and Tesla, according to Saxo Bank. Market makers have been forced to take the other side of such trades, buying the underlying stocks to hedge their positions.

US stock options trading has been driven by Robinhood traders, said Peter Garnry, head of equity strategy at Saxo Bank. If shares in a stock fall enough, market makers will unwind their shares, causing a sharp sell-off.

“Over the past few months we’ve had really quite a strong recovery, and that has started to stall,” said Andrew Hunter, senior U.S. economist at Capital Economics.

Renewed tensions between Beijing and Washington also remain a risk for markets. The Trump administration signalled plans to impose new restrictions on Chinese diplomats in the U.S., citing Beijing’s use of similar measures on American envoys. The Chinese embassy in Washington responded by accusing the U.S. of violating international conventions, characterising the fresh restrictions as unjustified and urging the country to reconsider.

Overseas, the pan-continental Stoxx Europe 600 climbed 0.7 per cent. Markets in Asia ended the day on a mixed note, with the Shanghai Composite closing down 0.6 per cent while South Korea’s Kospi added 1.3 per cent.

In commodities, Brent crude oil fell 1.9 per cent to $US43.56 a barrel and US crude futures declined 2 per cent to $US40.66 a barrel. The move follows five straight weeks of gains for crude, likely prompting some profit-taking, according to Commerzbank.

Dow Jones Newswires

5.50am: Hedge fund founder arrested

A hedge-fund manager was charged with fraud for trying to suppress bidding for a prized piece of bankrupt retailer Neiman Marcus Group.

Dan Kamensky, the founder of Marble Ridge Capital LP, was arrested and charged by New York prosecutors with securities fraud, wire fraud, extortion and obstruction of justice in connection with his efforts to acquire shares in Neiman’s MyTheresa e-commerce business.

Mr Kamensky previously admitted to Justice Department bankruptcy watchdogs that he had used his pull with investment bank Jefferies LLC, where he was a client, to try to scrap a competing offer for the MyTheresa shares so he could buy them himself for less.

The Securities and Exchange Commission also sued Mr. Kamensky and Marble Ridge on Thursday over his attempt to suppress competition for MyTheresa shares.

If convicted of all charges, Mr. Kamensky faces up to 50 years in prison.

Dow Jones

5.47am: How Tesla director made $US5m

Tesla disclosed that board member Kathleen Wilson-Thompson exercised an option to buy 12,500 shares at $US44.95, then immediately sold those shares at more than 10 times the price to pocket more than $US5 million.

The option was exercised on August 31 as part of a trading plan adopted on June 16. On the same day, Wilson-Thompson sold 12,500 shares at a weighted average price of $US451.48, based on a MarketWatch calculation of trades detailed in a Form 4 filing with the Securities and Exchange Commission. That produced a gain of $US5.08 million.

Based on the stock’s intraday activity on Aug. 31, the stock sales were completed within the first hour after the open, as the stock traded higher from there to close at a record $US498.32. The stock, which is down 8.4 per cent in afternoon trading Thursday amid a 3-day losing streak, is now 9.2 per cent below where she sold her shares.

Wilson-Thompson, a Tesla board member since December 2018, has been Walgreens Boots Alliance’s global chief human resources officer since December 2014. In 2019, she received total compensation from Tesla of $US7.36 million, including a cash payment of $US27,005 and $US7.33 million in option awards.

Dow Jones Newswires

5.30am: Markets slump as Wall Street fades

Major European stock markets were lower at the close as a record-breaking rally on Wall Street ran out of steam, analysts noted.

In Paris, the CAC-40 index followed peers into the red with a fall of 0.4 per cent despite support from the French government’s 100-billion-euro ($US120-billion) spending plan to bolster the economy.

Frankfurt gave up 1.4 per cent and London was off by 1.5 per cent as traders clocked out for the day.

In New York, the Dow Jones index was 1.7-per cent lower in midday trading. “Wall Street’s rally is running out of steam amid worries the labour market recovery has stalled,” Oanda senior market analyst Edward Moya concluded.

But Briefing.com analyst Patrick O’Hare said the pullback was not the result of fears for the economy, but an inevitable reconsideration about excessive valuations following the US surge in recent weeks.

“Let’s not kid ourselves with the idea that worries about COVID-19, the election, diplomatic tension with China, or the fiscal cliff are the basis for this morning’s weakness,” O’Hare wrote in a note.

“The basis for this morning’s weakness is the realisation that things are getting carried away in terms of trend exuberance and that some profit taking is in order.”

Asian equities were mixed earlier in the day despite an exceptional session on Wall Street Wednesday, with new vaccine hopes offsetting concern over the US labour market and tensions between Washington and Beijing.

Oil prices continued to slump as a bleak US labour market outlook suggested that stronger demand for crude oil would stall, Moya said.

Traders will now focus on the release Friday of government jobs data that serve as a guide to the state of the world’s top economy.

AFP

5.28am: Virus deals 15pc hit to Greece

The coronavirus dealt a huge single-quarter blow to Greece’s economy, official data showed, though Athens hopes that recent months will show a tourism-driven rebound.

“The COVID-19 pandemic and the restriction measures that were put into place” sent gross domestic product (GDP) plunging by 15.2 per cent in the second quarter compared with the same period a year earlier, the state statistics agency said.

Exports collapsed by almost one-third and consumption also dropped sharply. Greece reopened its borders from July 1 to limit the harm to its vital tourism sector, but then saw coronavirus cases surge in August.

More than half the country’s 10,500 cases were recorded last month and officials have blamed the spike in infections on flouting of social distancing rules in restaurants, bars and public gatherings.

But even with a general lockdown ruled out, the number of visitors has not lived up to expectations.

AFP

5.27am: US trade gap surges

US imports jumped nearly 11 per cent in July, driving the trade gap up to $US63.6 billion in the month, the Commerce Department reported, far more than economists had expected.

Although American exports also rose in July, it was far less than imports, contributing to the $US10.1 billion jump in the overall deficit — nearly 19 per cent higher than June, according to the report.

Though trade has picked up pace it “remained below pre-pandemic levels, reflecting the ongoing impact of COVID-19, as many businesses continued to operate at limited capacity or ceased operations completely, and the movement of travellers across borders remained restricted,” the Commerce Department said in the report.

However the report said it could not quantify or separate the impact of the pandemic on the trade data.

AFP

5.25am: New US jobless claims drop

The United States saw 881,000 new jobless filings in the week ended August 29, the Labor Department said, the second time the metric has dropped below one million since the start of the coronavirus pandemic.

The seasonally adjusted data was better than expected, and also saw the insured unemployment rate drop 0.8 points to 9.1 per cent in the week ended August 22.

But the Labor Department also reported an additional 759,482 people, not seasonally adjusted, made new claims last week under a special program for professions not normally eligible for benefits, an increase of 151,674 from the week prior.

Unemployment filings surged in March as businesses shut down to stop the transmission of COVID-19, and have declined since reaching that peak.

AFP

5.22am: Sanofi, GSK to start clinical vaccine tests

French pharmaceutical giant Sanofi said it would start human trials of the potential coronavirus vaccine it is developing with British peer GSK, following promising preliminary tests.

The launch of phase 1 and 2 trials represent an “important stage and another step towards the development of a potential vaccine to help us beat COVID-19,” said Sanofi Pasteur executive vice president Thomas Triomphe.

The vaccine combines leading technology from both Sanofi and GlaxoSmithKline. A protein-based vaccine owned by Sanofi and used to treat influenza was paired with a GSK-developed add-on, known as an adjuvant, that boosts the recipient’s immune response.

AFP

5.20am: US job cuts skyrocket

US job cuts so far this year surged 231 per cent compared to the same period of 2019 as the coronavirus wreaked havoc on the once-healthy economy, according to a new report.

Though the pace of announced lay-offs is slowing, the number of job cuts announced by US-based employers through August already surpassed the previous full-year record set in 2001, according to outplacement and coaching firm Challenger, Gray & Christmas.

The data are the latest indication of the awful employment situation facing many American workers as the country weathers the world’s worst coronavirus outbreak.

All told, employers have announced nearly two million cuts this year, and COVID-19 was cited as the reason for more than half.

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout