The Australian Securities & Investments Commission case against GetSwift got under way in the Federal Court on Monday. ASIC alleges GetSwift breached its ASX continuous disclosure obligations by making a series of misleading announcements about partnerships with 13 clients including the Fruit Box Group in 2017.

The agreements with clients were for the use of the company’s software-as-a-service platform. Some were allegedly just trial agreements.

ASIC’s barrister, John Halley SC, alleged the announcements were part of a deliberate approach to “boost” the share price.

The court was told that GetSwift chief executive Bane Hunter had sent an internal email explaining that the Fruit Box announcement was to “excite investor interest and build the share price”.

“That means that I have driven the market value of the company up by more than $36m in three months. We are now worth more than $63m and heading towards $200m in very short order. These results are not accidental,” Hunter advised.

Over the year the series of announcements saw its share price up over 2000 per cent after being floated at 20c a share in 2016 and seeing the shares briefly hit $4.30 in December 2017 following the contract announcements.

The corporate watchdog advised Justice Michael Lee that GetSwift’s prospectus stated it would only announce customer agreements when the financial benefit of the deal was “secure, quantifiable and measurable”.

Hunter, GetSwift co-founder and former AFL player Joel MacDonald, who have been based in New York, and former director Brett Eagle are fighting ASIC’s allegations.

ASIC is seeking declarations that Hunter and Macdonald be prohibited from managing a corporation.

A shareholder class action over the matter has been scheduled to start in September for a 19-day hearing.

Dealers digging in

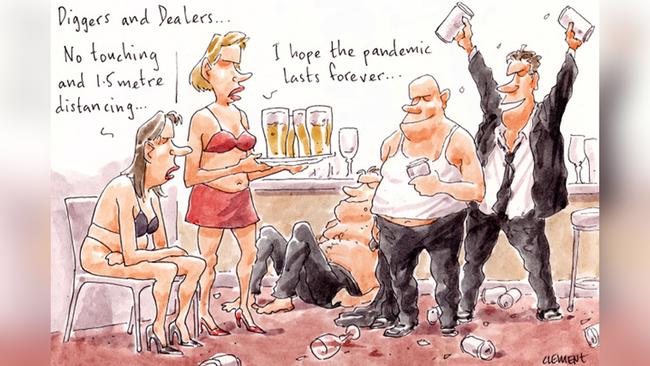

The UK-based Professor Ian Goldin, who has been regularly lecturing world leaders at the Davos World Economic Forum, remains pencilled in as the 2020 keynote speaker at the delayed Diggers & Dealers mining forum in Kalgoorlie.

The organisers hope to hold their annual event in October despite the nation’s tightest pandemic travel and tourism restrictions applying in Western Australia.

Initially scheduled for August, Diggers has been a popular annual industry conference since 1992, despite some mining companies being increasingly uncomfortable about sending their key executives.

Not so much this year’s COVID-19 risks, but because of the town’s reputation for scantily clad waitresses in the hotels. The local paper reported last year the proposed ban on skimpy barmaids at Kalgoorlie’s infamous Palace Hotel lasted just one night, such was the desired temptation.

Officially it is about industry professionals networking, visiting regional mine sites, raising finance, and investing in projects.

The Diggers & Dealers entity was sold in 2017 to the Georgette family by the Stokes family.

Forum chairman Jim Walker, the former chair of Macmahon Holdings, advised there were already 53 confirmed companies keen to make presentations, which would ensure an influx of people to Kalgoorlie-Boulder.

WesTrac and The Perth Mint have sponsored the gala dinner and awards respectively for 21 years.

The GJ Stokes Memorial Award, named after late Diggers & Dealers founder Geoffrey Stokes, went to Perth miner Mark Creasy last year, with prior winners including the inaugural recipient Sir Avi Parbo, Trevor Sykes, Jim Askew, Sir Charles Court and Andrew “Twiggy” Forrest, who won the award in 2013.

Perth billionaire Gina Rinehart is yet to secure the award, but her Roy Hill won the Digger award last year. She also picked up the Dealer of the Year Award in 2006, when her Hancock Prospecting struck a last-minute $US1bn deal with Rio Tinto.

Goldin, the Oxford University professor of globalisation and development, was the vice-president of the World Bank and has given lectures at Davos for the past two decades.

He has published 21 books, including The Butterfly Defect: How Globalisation Creates Systemic Risks, and What to Do About it; and Exceptional People: How Migration Shaped our World and Will Define our Future.

The isolated event has always been about to get big drawcard speakers including in 2008, when they got billionaire mining magnate Robert Friedland.

Margin Call reckons they should try to get Bobby Axelrod or Mike Prince from the Showtime series Billions this year. They both could offer their insights into tin being mined, safely and ethically, in Australia, against the prospect of cheaper tin sourced from the war lord-controlled mines of the Congo.

Afterpay changes

There has been a change in Afterpay’s marketing ranks, the buy-now, pay-later fintech with the slogan Love the Way You Pay.

Afterpay has appointed Andrew Balint, former CMO of ride-share Ola, to the role of VP of marketing across Australia and New Zealand.

Balint had been at the Indian-founded Ola since 2018, having left the Australian fractional property investment firm BrickX.

They’re certainly big shoes to fill, left behind by their former chief marketing officer Vicki Aristidopoulos.

According to Aristidopoulos’s LinkedIn, she was the pioneering CMO responsible from Sydney for the ground-up build of marketing at the buy-now, pay-later ASX giant.

The marketing push is now worldwide, with Afterpay opting to appoint its first global marketing chief out of its San Francisco office when it appointed former Airbnb global marketing director Geoff Seeley.

Afterpay’s share price has been one of the biggest success stories globally during COVID-19. It hit late March lows of around $8, but is now trading at around $51, down a tad on its record high $54.52 earlier this month.

Meanwhile Aristidopoulos has just joined Wilsons Financial Services.

Keeping a tight rein

The Australian Taxation Office was the biggest of the eight creditors who virtually attended the recent creditors meeting of Munce Racing, the company headed by horse trainer Chris Munce.

The ATO is owed $415,000 after the training operations company fell into administration in April.

Bloodstock auctioneers William Inglis & Sons are owed $37,000, along with spelling and agistment firms.

The 23-minute Skype meeting considered entering into a deed of company agreement.

Munce continues to train and race after getting the green light from the Queensland Racing Integrity Commission.

However, he didn’t fare well at the weekend as the filly Papaya was euthanised after breaking down.

Learning the Lingo

With thousands of jobs cut amid the worst oil crash in a generation, taking on a new CEO role in the beleaguered industry isn’t for the faint-hearted.

For $16m junior Armour Energy, securing the services of Brad Lingo as its next boss was a coup of sorts.

Lingo made his name as CEO of the $800m DrillSearch Energy for six years until 2015, before it was bought out by Beach Energy.

But if you were wondering what Lingo did next, Armour’s ASX announcement to shareholder on Monday was coy.

It quoted the oil man’s extensive CV dating back to 1993, including stints at CBA, Tenneco Energy, Epic Energy and Drillsearch.

And that’s where the disclosure ended. Lingo’s next move was entirely left out of the announcement.

His four-year role from 2015 to 2019 as chief executive of Elk Petroleum did not rate a mention. The US-focused oil company subsequently plunged into administration and chapter 11 later that year.

Armour may have taken its inspiration from another energy junior called Pilot Energy.

Lingo was appointed chairman at Pilot on May 13 but the minnow also failed to mention Lingo’s CEO stint at Elk in its announcement.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout