Economy on a long road to recovery from deep recession

Commonwealth Bank chief Matt Comyn warns of significant economic challenges from the pandemic that are yet to be overcome.

Commonwealth Bank chief Matt Comyn has warned that significant economic challenges would still need to be overcome, despite Australia being spared the worst of the COVID-19 pandemic.

As the June quarter national accounts showed that the economy suffered the largest drop on record, Mr Comyn said it was important not to underestimate the “human story” behind the numbers.

“It is clear that the recovery will take slightly longer and be more uneven than we thought a couple of months ago, but there are some positive signs now emerging and I am confident the collective steps being taken will help us get back on track and the economy growing again,” Mr Comyn told The Australian.

Australian Bureau of Statistics figures released on Wednesday showed that the nation had slumped into the deepest recession since World War II, with the economy contracting by 7 per cent during the June quarter.

Mirvac chief executive Susan Lloyd-Hurwitz said the figures showing the depth of the recession came as no surprise.

“Now more than ever, government and industry need to work together and focus on viable projects that are shovel-ready for job creation and that can add value,” Ms Lloyd-Hurwitz said.

A technical recession was recorded because the ABS also confirmed that output had shrunk by 0.3 per cent in the March quarter.

The previous recession, which then-Labor treasurer Paul Keating termed “the recession we had to have”, was in 1991. The scale of the current downturn is much greater than in 1991, which barely troubled the scorers with GDP shrinkage of 1.3 per cent and 0.1 per cent.

Josh Frydenberg on Wednesday labelled the economic collapse a “pandemic-induced recession”.

Future Fund chairman Peter Costello, who was treasurer in the Howard government, said at the fund’s annual result on Wednesday that the national accounts were “backwards-looking”.

“The more important thing from now is how we pull the economy back into growth,” Mr Costello said. He said the recession was the result of factors beyond the government’s control.

State governments, however, mostly controlled the extent to which their economies were locked down and the pace at which they reopened.

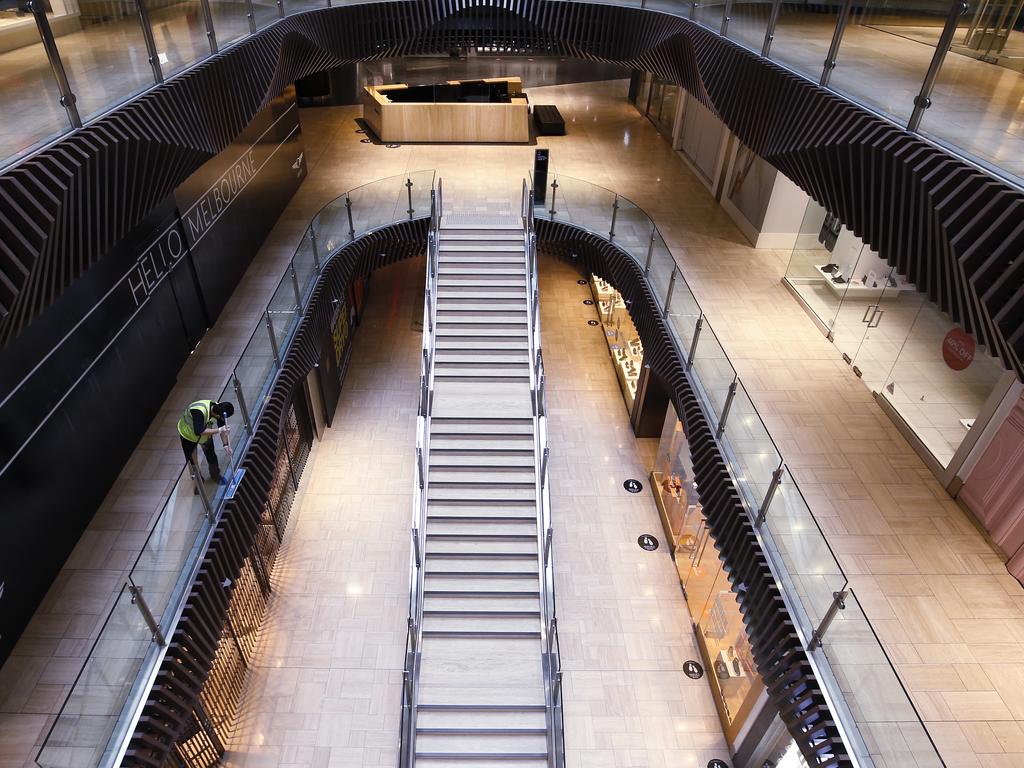

While Victoria remained under tight lockdown, Mr Costello said the state — which represents about 25 per cent of the national output — would be a constant drag on the national economy.

“And I think the government has responded well. There has been a lot of fiscal stimulus and monetary stimulus,” he said.

“The hard work is going to begin when this stimulus starts being withdrawn, which will have to happen at some point.”

Mr Comyn acknowledges the opportunity for the banking sector to help steer the recovery.

“I said at the beginning of the pandemic that this was a key moment for us in our history and an opportunity for banks like ours to support our nation,” Mr Comyn.

“It has been vitally important that our well-capitalised banks have been able to help absorb the immense financial shocks that the country has experienced as a consequence of the health and economic crises.”

In a remarkable turnaround, the entire banking industry has transformed itself from pariah facing the Hayne royal commission to a model corporate citizen, courtesy of about $275bn of temporary business and household loan deferrals.

The Treasurer said banks would play a critical role to help back lending for businesses and homeowners. “I’m confident the banks will seize this task and the flow of credit through the economy is going to be critical to the recovery,” Mr Frydenberg said.

Mr Comyn said it had been essential that the bank’s customers could rely on CBA “in their biggest time of need”.

“We have been able to respond through the collective efforts of government, regulators and the industry with tens of billions of dollars of support to keep people in work, businesses operating and families and individuals in their homes,” he said.

JLL chief executive Stephen Conry, who is also national president of the Property Council of Australia, called for an easing of restrictions on business activity to help get the nation out of recession. “The impact of recessionary economic times will be severe for many businesses and their people,” Mr Conry said. “Governments need to ease border restrictions and businesses need to get back to the office as soon as possible to nurture economic activity.”

Business Council of Australia CEO Jennifer Westacott said the decisions the nation’s made now — including around managing health and domestic borders — would determine the strength and speed of the recovery: “We’ll need to harness the spirit of co-operation we’ve achieved through this crisis to finally deal with some of our most difficult reform challenges — tax and regulation.”

Additional reporting: Eli Greenblat

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout