After analysing hundreds of transcripts of corporate conference calls from the recently concluded June-half earnings period, Macquarie Equities found these unsettling words had the biggest increase in mentions as the “language related to the pandemic dominated the conversation”.

Apart from surging global markets, including a massive 7 per cent rise in the S&P 500 and a 9.6 per cent rise in the Nasdaq 100 index last month, the Australian market was supported by a significant lessening of earnings uncertainty through the reporting period, although at least part of that improvement in confidence came from the stunning rebound in financial risk assets since March that followed the advent of unprecedented fiscal and monetary stimulus in response to the pandemic.

“As one might deduce from the above, the overall sentiment in the calls was also subdued relative to the last five years,” says Macquarie’s Australian equity strategist, Matthew Brooks.

But while the language of management reflected the pandemic, his measure of overall sentiment did not drop to the levels experienced through the global financial crisis as “the V-shaped recovery in markets has given investors and business reason for optimism”.

More importantly, while the overall sentiment of the earnings calls was dominated by the effects of the pandemic and associated lockdowns of economic activity globally, Macquarie’s analysis of the Q&A sessions from those calls suggests an improvement in the sentiment of both corporate management and the sell-side analysts after their sentiment hit multi-year lows in February.

“As we drilled deeper into the data we saw the optimism come through in other ways,” Mr Brooks said. “Our previous research suggests that analysing the sentiment of the Q&A section of earnings calls is often more informative than the carefully prepared management discussion.

“Both the analyst questions as well as the answers from management have shown an improvement in sentiment since the February lows.”

Macquarie’s gauge of sentiment for analyst questions bounced off a five-year low last month.

Similarly, its measure of management’s answers to those questions bounced off a seven-year low.

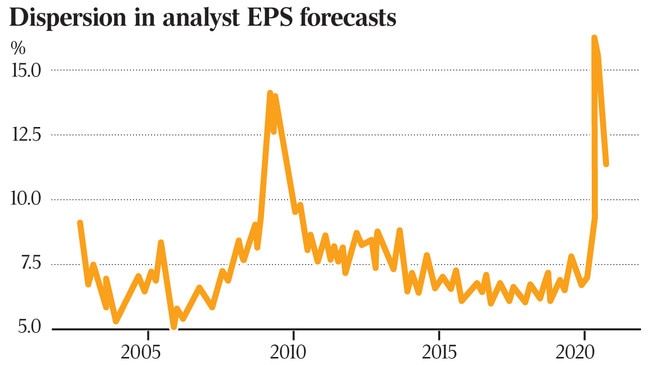

Importantly, these nuances have helped reduce the extreme uncertainty about the outlook for corporate earnings that triggered the fastest-ever bear market in equities in March this year.

In fact, a proxy for uncertainty about corporate earnings, based on the standard deviation of consensus earnings per share forecasts for the year ahead, hit a record high of around 16 per cent in March, exceeding the period high of around 14 per cent during the global financial crisis.

“The global economic selldown of 2020 meant there was significant anticipation heading into the August reporting season, but this was also met with a level of cynicism that many firms will still be unable to provide clarity on how the slowdown has fully impacted their business,” Mr Brooks said.

He notes that the share prices of 60 per cent of companies beat the index on the day of their reports, with improvements in earnings certainty being a key driver of returns. This was despite the actual EPS surprises being underwhelming.

“While the absolute levels of earnings uncertainty remained elevated, as reporting season unfolded and volatility continued to reside, we have seen the dispersion lower significantly,” he added.

“This tells us that there is some clarity emerging for stocks.”

That being the case, there are two obvious questions for investors to consider.

Firstly, given that earnings uncertainty remains relatively high, is it more likely to fall or rise?

Secondly, would an additional retreat in earnings uncertainty, or improvement in certainty, fuel a further expansion of the near record-high price to earnings multiple of the S&P/ASX 200 index?

The increasing prospect of a slow return to normality in Victoria and the invention of effective treatments and vaccines against coronavirus would surely reduce the main source of uncertainty and there is a lot of work under way.

US political uncertainty might get worse before it gets better but it should be resolved one way or another after the November election, and either side will try to boost spending once elected.

Mr Brooks also notes that the share prices of stocks that have experienced a revision of the consensus estimate for their future earnings, and a change in earnings certainty in the same direction as the surprise, are more likely to keep drifting in the direction they moved after their results.

“With many investors coming into the reporting season having elevated levels of uncertainty, the positive skew in returns is an indication that pricing expectations were typically too pessimistic.”

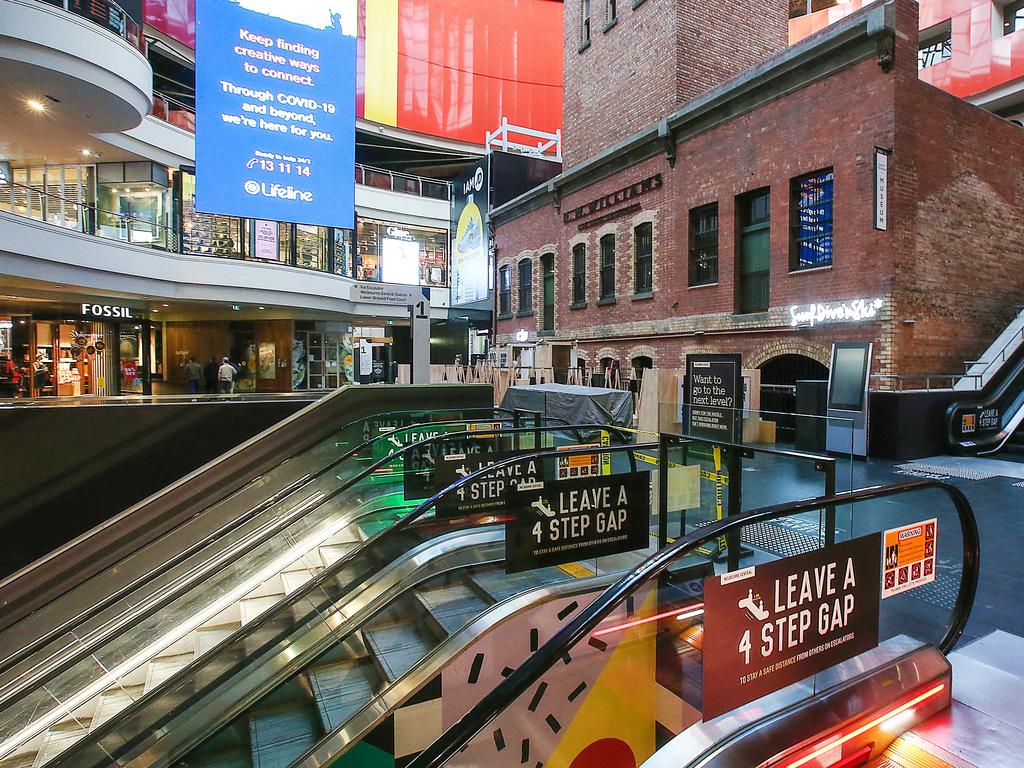

Pandemic, COVID-19, restrictions, uncertainty, lockdown — these words were thrust into the lexicon of CEOs and analysts during the August reporting season, yet the sharemarket was unfazed.