Giant IOOF to lift its game after MLC buy

IOOF will have an obligation to create a better wealth industry when it becomes the nation’s largest wealth manager.

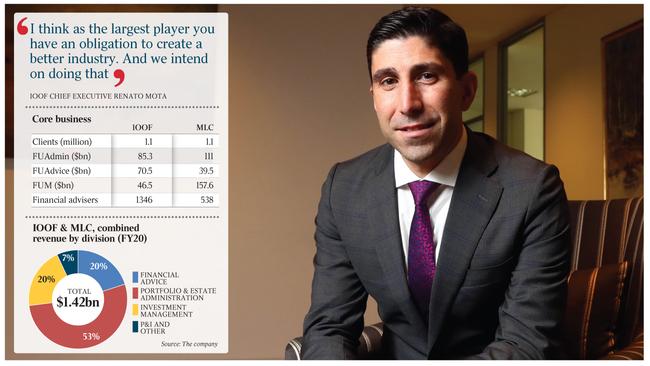

IOOF will have an obligation to create a better wealth industry when it becomes the nation’s largest wealth manager through its acquisition of NAB’s MLC business, according to chief executive Renato Mota.

IOOF on Monday announced it had struck a deal with NAB to acquire the wealth division for $1.44bn in a move that will see its adviser numbers swell to just shy of 1900 and its funds under management jump to more than $500bn.

Hailing it a transformational deal for both the industry and IOOF, Mr Mota said the scale of the transaction was not lost on him.

“It’s an opportunity we’re quite humbled by, actually. We’re also conscious that we are undertaking a very large transaction here. There are a series of large commitments that we will be making for the next three years and we’re going to make sure that we deliver on that,” Mr Mota told The Australian.

“It’s both a challenge and an opportunity, but I think as the largest player you have an obligation to create a better industry. And we intend on doing that through advocacy, through challenging ourselves to better client outcomes, building better, more affordable solutions, and hopefully contributing to the narrative.”

IOOF beat out a handful of players in the MLC auction, including private equity firms KKR, Platinum Equity and JC Flowers.

The deal comes two years after NAB flagged its intention to offload its wealth business and hastens the major banks’ retreat from the wealth management sector following years of scandals.

It also comes about three months after Commonwealth Bank agreed to sell 55 per cent of Colonial First State to KKR & Co for $1.7bn. Westpac last year sold part of its financial planning unit, while ANZ earlier this year completed divestments of its adviser dealer group and pensions and investments business to IOOF.

Mr Mota, who was involved in NAB’s acquisition of MLC from Lendlease 20 years ago — for which it paid $4.5bn — suggested the nation’s major lenders had struggled with their wealth divisions because banking and wealth management were so different.

“I recall back in 2000 when we bought (MLC), I thought it was a fantastic asset then and I’ve got the same feeling now.

“To me, the key lesson is the power of focus. And this is not a criticism of banks, but the reality is that banks are credit institutions, and wealth management is a very, very different business. And I think that focus can add considerably to the value of these businesses and how they contribute to consumers.”

Alongside the acquisition announcement, IOOF also handed down its full-year results on Monday, posting an underlying net profit after tax of $128.8m, down 35 per cent on the year prior, as revenue jumped 10 per cent to $1.17bn.

The acquisition, which is expected to be completed by June 30 next year and is subject to a number of conditions including regulatory approvals from APRA and the ACCC, will see IOOF become the largest retail wealth manager in the country, with $510bn in funds under management, advice and administration and also the largest advice business by number of advisers. The combined adviser number would sit at 1884 when the transaction is completed, IOOF said.

It will also become the nation’s second largest superannuation provider, with $173bn in funds under administration.

Mr Mota expects the largest super fund will clock half a trillion dollars in funds under management within the next five years, with a handful of others boasting funds of $200bn to $300bn each.

“This deal ensures that IOOF is in that five or six pack and in fact that we are the advice-led player in that pack,” he said.

Morningstar analyst Shaun Ler said the acquisition made sense from a strategic point of view.

Among the positives would be a reduced cost to customers, he noted, “bearing in mind that IOOF and MLC products tend to be historically at the more expensive end of the market. Especially IOOF.

“Now, when you combine (IOOF with) ANZ’s P&I and MLC, there’s really room to become the lowest-cost producer, to reduce the cost to customers,” he told The Australian.

This would allow IOOF to begin clawing back some of the market share the major adviser groups had lost in recent years, he said.

The $1.44bn price tag was “not unreasonable” if IOOF could realise its expected synergies, which at $150m per year pre-tax were quite conservative, Mr Ler said.

The acquisition will be mostly funded via a $1.04bn capital raising at $3.50 a share, with the balance coming from a syndicated debt facility, a $200m subordinated loan note issued to NAB and $40m of IOOF’s own cash.

Once-in-a-generation opportunity

At $3.50 a share, the raising represents a 22.5 per cent discount to its dividend-adjusted last closing price of $4.515 and a 13.6 per cent discount to the dividend-adjusted theoretical ex-rights price of $4.05.

The opportunity to acquire MLC was “compelling” and a once-in-a-generation opportunity to create the leading wealth manager of the future, Mr Mota said.

“MLC is a natural fit with IOOF and presents a unique opportunity to create value from synergies for the benefit of clients, members and shareholders,” he said.

“As the financial services industry reshapes, a much bigger and better IOOF will position it at the forefront of the industry transformation. In this new era, and in response to changing societal and technological needs, the new IOOF will have the ability to offer unmatched choice and accessibility of quality financial advisory and wealth management services to all Australians.”

Commenting on the ANZ P&I integration, Mr Mota said it had gone as planned.

“There have been no surprises. It’s been exactly as we thought it would be,” he said as he told investors IOOF took a de-risked approach to the MLC acquisition.

It will acquire the Godfrey Pembroke and MLC brands but will not acquire the Meritum, Apogee or Garvan brands.

NAB will retain the AFSL holders that operate MLC’s advice business while MLC self-employed advisers will transfer to IOOF AFSLs at completion. IOOF will not assume any conduct or remediation liabilities for MLC’s advice business that occur before the completion of the transaction.

Other MLC conduct or remediation liabilities, including for the platform business, would be retained by IOOF, it said.

The wealth manager said it would manage this exposure through a combination of provisions, indemnities and warranties, including indemnities for fines and penalties, regulatory investigations and litigation matters (including for two class actions and one ASIC proceeding).

NAB facing steep remediation bill

Shaw & Partners analyst Brett Le Mesurier said NAB had done well to sell it for $1.44bn but that the lender may end up getting less than that in the end.

“They may end up getting $1bn by the time they’ve paid for the warranties for client remediation,” he cautioned.

Alongside the other major lenders, NAB is facing a steep remediation bill to compensate aggrieved customers caught up in the numerous scandals that have plagued the industry.

Commenting on the sale, NAB chief executive Ross McEwan said it would allow the bank to prioritise investment and focus on its strategy of delivering more streamlined products and processes for customers.

“We recognise the specialised nature of wealth management and the opportunity for the MLC business as part of IOOF,” Mr McEwan said.

“Consolidation has the potential to deliver significant benefits for clients and members, including scale and reducing costs, complexity and risks. The combined business is expected to be a highly competitive, advice-led retail wealth manager.”

Speaking to investors after the announcement, Mr Mota said the deal was not about building scale for scale’s sake.

“It’s about creating scale, and driving simplification to deliver better outcomes to clients and shareholders. That’s the primary driver here,” he said.

The entitlement offer is expected to raise $588m, while the placement will raise $452m.

The raising will see 297 million new shares issued, representing 85 per cent of IOOF’s existing capital.

Eligible retail shareholders will also be able to acquire additional new shares under the non-underwritten share purchase plan to minimise the dilution impact from the placement.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout