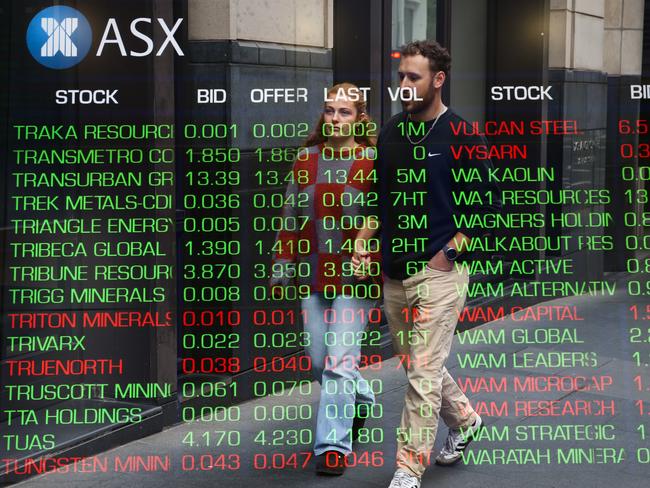

ASX 200 rises on banks; Arcadium top gainer

Rio Tinto’s takeover approach lifts Arcadium Lithium appeal. West African Resources drops on Burkina Faso mining concerns. Qantas may avoid second strike after proxy backing.

Rio Tinto’s takeover approach lifts Arcadium Lithium appeal. West African Resources drops on Burkina Faso mining concerns. Qantas may avoid second strike after proxy backing.

The ASX is poised for a cautious start to the week as traders fret about the prospect of a broad Middle East conflict.

Joseph Healy pulled himself together enough to co-pilot the $660m float of Judo Bank on the ASX, but the tragic death of his son in the lead up has spurred a new way of doing business for him | WATCH

Proxy group CGI Glass Lewis says the ASX didn’t take Bob Caisley or Phil Galvin seriously as outside candidates, noting the two former markets executives have ‘very relevant’ experience.

International conflicts are causing concern in investment circles, and closer to home some ASX big guns are under pressure.

US President Joe Biden triggers oil price jump. Mesoblast top gainer. Sinopec wants price review on APLNG deal. Platinum grants Regal access for higher offer. Ratings upgrade for Cochlear. Optimism underpinning latest Bendigo Bank, UBS forecasts.

Influential proxy group Ownership Matters says shareholders reject Perpetual’s remuneration report.

HMC Capital hopes to list a data centre real estate investment trust on the ASX by Christmas.

Property giants lift on ‘cheaper debt outlook’. Santos down despite oil price spike. Origin loses ground after abandoning hydrogen plans. Sell rating weighs on ‘overly ambitious’ Guzman y Gomez. IMF backs RBA’s tight stance.

In a strategic play to survive SPC, Original Juice and powdered milk business Nature One will combine to create a new food manufacturing company on the ASX.

A job cull is sweeping through one of Australia’s biggest insurance companies, even as the company rakes in big profits.

Oil, gold stocks jump on Middle East conflict escalation. Jobs to go in Country Road restructure. SiteMinder insider’s $85.4m selldown. Kennett to retire after juice company merger. CEO changes at Collins Foods, KMD. CBA shuffles top deck.

Sigma rockets on ACCC compromise to get $8.8bn merger with Chemist Warehouse across the line. Treasury Wine caves in to proxy demand on CEO bonus. Warmest August since 1910 sees retail sales lift 0.7 per cent.

August retail sales data due as house prices tick up. Qatar Airways to buy stake in Virgin. Star auditors raise red flags. US Fed chair strikes upbeat note on the US economy. Chinese stocks mark best day in 16 years.

Magnis Energy Technologies has failed to provide a date for lodging its annual accounts as questions linger over the company’s financial health.

Payments to Perpetual’s senior management are out of whack with industry norms, according to influential proxy group ISS.

BHP and Rio lead iron ore gains as billionaire-run Fortescue and MinRes also lift. Richard White’s WiseTech up after founder’s $46m selldown. Star hit with downgrades. Key Pacific Smiles shareholders reject Genesis bid. AUD above US69c.

Our sharemarket is tipped to build on last week’s record close as investor enthusiasm continues over the condition of the world’s major economies ahead of local retail and US jobs data.

The ASX 200 index closed flat after a choppy session at 8212.20 points as banking and healthcare falls offset strong gains among the miners.

The ASX says a former APRA chair and a business veteran are the best options for the market operator’s board vacancies despite two former executives seeking a seat at the table.

Original URL: https://www.theaustralian.com.au/topics/asx/page/16