AMP hit by more departures

AMP Capital has been hit by a new round of departures in New Zealand, capping off a tumultuous week.

AMP Capital has been hit by a new round of departures in New Zealand, capping off a tumultuous week.

The rural homes of major food conglomerates are using the pandemic to their advantage; bringing in jobs and awareness to Australian small towns.

What was it that proved a key turning point in what transpired over the past six months at AMP?

AMP is expected be in IOOF’s sights if the latter succeeds in buying NAB’s wealth manager MLC.

AMP’s new chair Debra Hazelton has to emerge from the shadows, and the sooner the better.

Cbus has been critical of AMP’s leadership over its handling of the situation that has led to several staff exits.

Goldman Sachs joins the AMP investment banking team of advisers, as potential buyers continue to run the numbers on the wealth group.

For decades AMP management has had possibly the best view in Sydney. They should have been looking inside instead.

Parliament hears damning accusations by another former female AMP employee, alleging ‘consistent and systematic’ harassment’.

Shares bounced from daily lows but finished down 0.7pc under the drag of banks and ex-dividend trade in Telstra.

Several corporate and private equity buyers are thought to be keeping a watching brief or actively running the numbers on AMP.

What are some key changes predicted by Morgan Stanley in the next quarterly rebalance of S&P Dow Jones Indices?

Shares finished higher by 0.5pc after setting a five-month high, Afterpay surged 12pc and banks rose more than 4pc.

AMP chief Francesco de Ferrari has a supporter in former AMP chief investment officer Merv Peacock.

A strong lead from Wall Street saw the S&P/ASX200 burst out of the gates, almost reaching the key 6200 point mark before pulling back to close 0.5 per cent higher.

A spate of blunt phone calls and emails to the besieged David Murray-led AMP board late last week spelt the end for the group in its current form.

AMP is embarking on yet another journey to repair trust and fill key board and executive vacancies, after a tumultuous period marred by revelations of poor executive conduct.

AMP’s new chair Debra Hazelton smashed all sorts of glass ceilings in her time as a senior executive in the Japanese banking world.

Two household-name companies, Rio Tinto and AMP, two corporate governance nightmares, two different reactions.

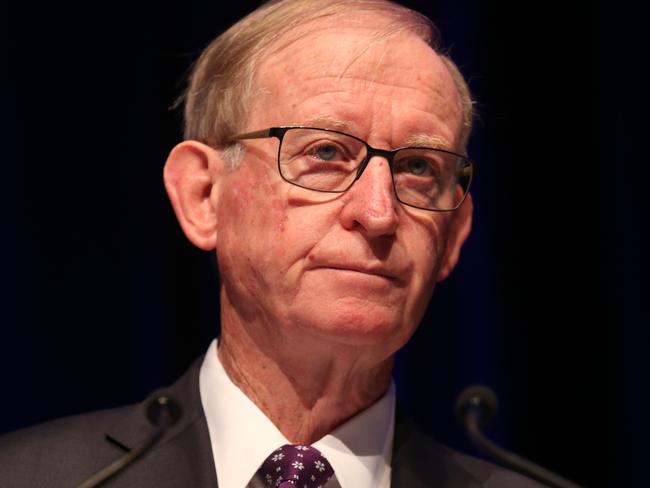

The chairman of embattled wealth group AMP has abruptly resigned due to the bungled CEO appointment at its wealth business.

David Murray has fallen on his sword to protect his appointed chief executive in a classic old school response to a governance nightmare.

Given the damage inflicted by the pandemic you’d expect investors to be cautious, if not downright bearish, not euphoric.

The AMP Capital Wholesale Office Fund has withdrawn its $300m-plus bond issue from the market.

‘As my mum would say, she is a credit to us,’ says pop singer-songwriter Megan Washington of former prime minister Julia Gillard.

AMP is now said to be restricting access to the investigation report by only allowing Ms Szlakowski to see it under supervision, and forbidding the taking of notes.

Gains evaporated on Friday as banks and CSL fell, sending the ASX to a 0.2pc weekly loss, while early earnings have been resilient despite the pandemic pessimism.

It’s natural to play safe in a crisis but boards need to keep focused on getting the mix right.

For decades AMP’s business has been persuading people that they’re getting financial advice when in fact they’re not.

The benchmark S&P/ASX200 Index closed within the narrow range it has been stuck in all week, not once piercing the key 6200 point mark.

Growing shareholder revolt over AMP’s handling of a now high-profile sexual harassment incident threatens to lead to an extraordinary meeting being called.

Original URL: https://www.theaustralian.com.au/topics/amp-limited/page/7