Burn political capital and take policy risks, Paul Keating urges Anthony Albanese’s Labor

Paul Keating has urged Labor to take policy risks and burn political capital, because voters will reward politicians who pursue bold reform in the national interest.

Paul Keating has urged Anthony Albanese’s government to be brave and courageous, take policy risks and burn political capital – and not worry about polls or agonise about re-election – because voters will reward politicians who pursue bold reform in the national interest.

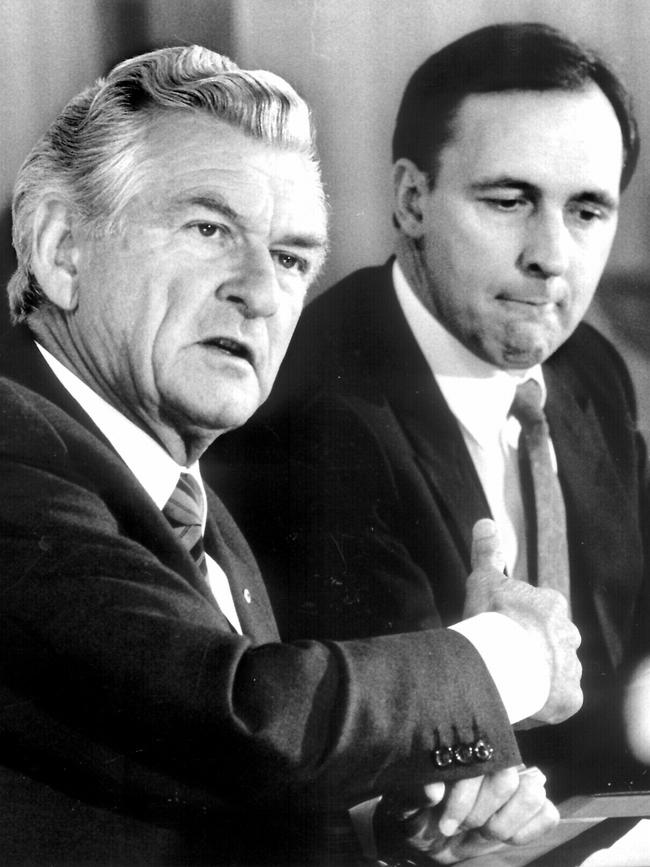

In an interview to mark the 40th anniversary of the float of the Australian dollar – announced by Mr Keating and Reserve Bank governor Bob Johnston on December 9, 1983 – the former treasurer recalled it was like riding a 60-foot wave, out on the edge of a surfboard and not knowing whether you would make it safely to shore.

“It’s like riding one of those big waves at Waimea Bay,” Mr Keating, 79, told The Weekend Australian.

“You’re on your surfboard, but you don’t quite know how it’s going to finish. And the good thing about Bob Johnston is that, like me, he was a policy gambler. He would ride the wild surf. And that’s what I loved about him. I was determined never to be a mouse. I never wasted a day and I never took bum decisions, ever. I always went for the highest-quality decisions and rapidly, deciding quickly.

“See, one of the great costs in public administration is the wasted bureaucratic effort on people ruminating and re-examining things, sending things off to committees. You’ve got to be brave in these jobs, you know, because the worst that can happen to you is you lose the job.”

“I’m hoping the current Labor government can see the value of the Waimea wave, you know, riding on the front of the board … the crowd know when you are giving them value, even if they don’t understand all the issues, even if they don’t agree with all the issues, they know you’re giving them value. And I used to always say to Bob (Hawke), we’ve got to burn the political capital.”

Floating the dollar, rather than having officials continue to set the value, and abolishing most exchange controls on investing, lending and borrowing overseas, was the most significant post-war economic reform, John Howard told The Weekend Australian this week, a decision he supported at the time. It opened up Australia to global financial markets, turbocharged business competitiveness and efficiency, boosted productivity, and acted as an economic shock absorber. It made the economy more flexible and resilient. It also meant that foreign speculators, who made windfall gains by betting on devaluations, would not be “speculating against themselves rather than against the government” the then treasurer said at the time.

“The exchange rate was the killer of competitiveness,” Mr Keating said. “The exchange rate management system was really sitting there as a sort of a de facto wages policy to keep downward pressure on local prices through imports. I shared the desire with Johnston to break out of this deregulatory system.

“The exchange rate is the most important price in the economy. In 2006-07, when the terms of trade had blown the roof off the place, and the income would have threatened the inflation rate and the wages system, the exchange rate moved up to take that surge off. It nominates, by its virtue, which businesses are viable and which businesses are not. So we are not putting national savings into immature or uncertain investments.”

The editorial of The Weekend Australian said at the time: “In one fell swoop, the government has turned the foreign exchange speculators against themselves, opened up our financial system to the world and laid the framework for Australia to share in a potentially thriving international capital market. The nation has now come of age.”

Mr Keating agreed with the editorial. “It was the country’s coming of age,” he reflected. “There’s no doubt about that. What the float meant was that Australia had faith in itself and was not a derivative economy run bureaucratically in deference to the rest of the developed world.”

The decision to float was taken against Treasury advice and announced by Mr Keating with the Reserve Bank governor alongside him at a press conference. Mr Keating said he took political responsibility for the decision and if it had failed, with the dollar appreciating significantly, he would have been removed as treasurer.

“If it had failed, I would’ve just been dismissed,” he thought. “Bob would have remained prime minister, but he probably would’ve brought in Ralph Willis to do the job, who he wanted in the first place.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout