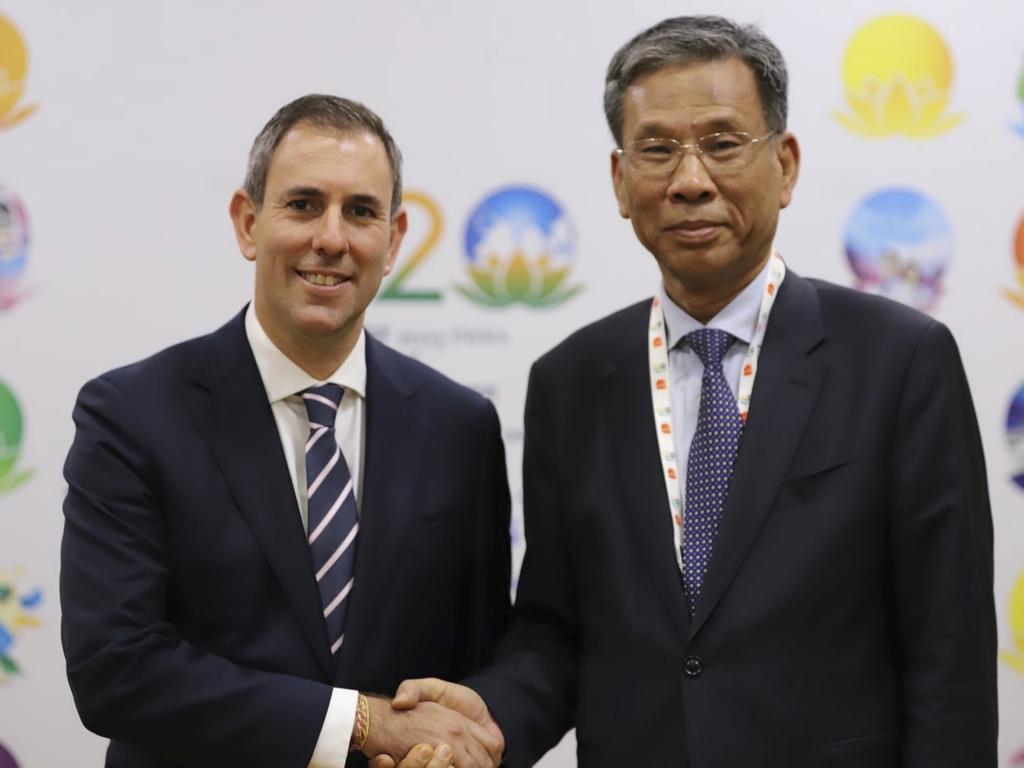

Jim Chalmers’ goal: well-paid jobs for everyone

The Treasurer says his aspiration to ‘create good, secure, well-paid jobs for everyone who wants one’.

Jim Chalmers has flagged he will pursue a nationally accepted definition of full employment, saying it will be the “first priority” of the upcoming jobs white paper.

As unions push for the federal government to tie the Reserve Bank to a zero unemployment target, the Treasurer said “our objective and our aspiration … is to create good, secure, well-paid jobs for everyone who wants one”.

Ahead of the release of Labor’s key employment blueprint, due in September, Dr Chalmers said “the first priority of that white paper will be to try and find some common ground about how this country understands full employment”.

The debate around full employment comes as the Reserve Bank attempts to slow the economy via the most aggressive series of rate hikes in a generation.

Dr Chalmers’ hand-picked replacement for RBA governor Philip Lowe – deputy governor Michele Bullock – has made it clear the central bank believes that the current 3.5 per cent jobless rate was too low to be consistent with returning inflation back to the top of the 2-3 per cent target by 2025.

Unions have heavily criticised the central bank for engineering a slowdown that they believe will unfairly and unnecessarily hurt workers, and say the RBA should be aiming to eliminate “involuntary” unemployment as part of its mandate.

Economists have heavily criticised the proposal, saying it would risk “blowing up” the economy by generating massive wages growth that would send inflation soaring and ultimately leave all Australians worse off.

Dr Chalmers on Friday said it was important to separate the RBA’s concept of the non-accelerating inflation rate of unemployment, or NAIRU, which sits at 4.5 per cent, “from our objective and our aspiration, which is to create good, secure, well-paid jobs for everyone who wants one”.

“That’s our objective,” he said. “That’s our reason for being and that’s what the unions and others have been getting at in their commentary.

“But we need to understand the difference between those two things.

“Whether it’s the Reserve Bank or the Treasury forecasts, they rely on a technical assumption that’s different from an objective or an aspiration.”

AMP Capital chief economist Shane Oliver said “the bottom line is that we don’t have community acceptance of what full employment is”.

“Most people think it would be zero unemployment, but it’s not practical or sensible to enshrine that into RBA policy, because it’s not achievable for them,” he said.

Mr Oliver said would always be a level of involuntary unemployment due to things like skills mismatches. people between jobs, and the impact on hiring from the economic cycle.

“The RBA’s job should be getting cyclical unemployment to zero, and the government should be charged with doing the rest to bring down structural unemployment as much as they can,” he said.

Institute of Public Affairs research fellow Saxon Davidson said an obvious first step towards achieving full employment was removing tax and red tape barriers that prevent the swelling number of older Australians from engaging in the workforce.

“Only 3 per cent of Australian pensioners work, compared to 25 per cent in New Zealand where such barriers do not exist,” he said.

Reforms introduced in December allowed limited additional capacity for pensioners and veterans to work before losing benefits, but he said the changes did not go far enough.

“Leading surveys show 20 per cent of all Australian pensioners would consider rejoining the workforce if tax and red tape barriers were removed, representing over 515,000 potential workers,” Mr Davidson said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout