RBA under pressure on interest rates as jobless levels stay low

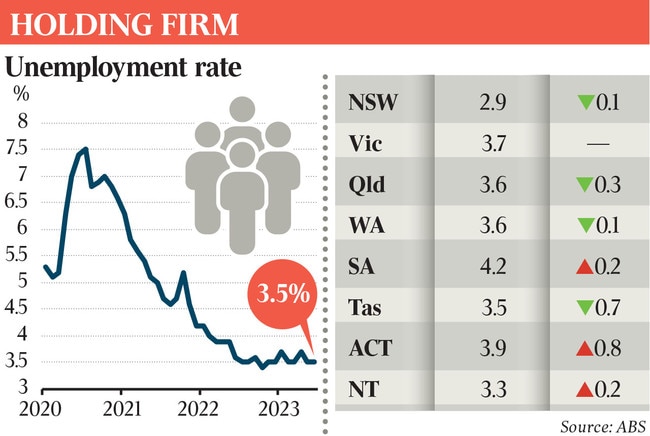

Australia’s unemployment rate held at 3.5 per cent in June, while in NSW the jobless measure dropped below 3 per cent for the first time on record.

The Reserve Bank is under pressure to hike rates again after a bumper month of jobs growth put Australia’s unemployment rate at 3.5 per cent and sent NSW’s jobless measure to its lowest on record.

Jim Chalmers greeted the latest evidence that soaring borrowing costs and a cost-of-living crunch were yet to meaningfully dent employment growth as “really welcome news” but the “red-hot” labour force report triggered renewed calls among economists that the RBA would need to do more to slow growth and bring inflation under control.

The economy created 32,600 jobs in June, according to the Australian Bureau of Statistics, helping to keep unemployment steady after the ABS revised the previous month’s jobless rate down from 3.6 per cent.

All the gains were in full-time employment, which jumped by 39,000 in the month, offset by 6720 fall in the number of people employed part-time, seasonally adjusted figures revealed.

The number of unemployed fell by 10,900 people in the month.

In NSW, unemployment fell below 3 per cent for the first time in records stretching back to 1978, and at 2.9 per cent was the lowest across the country.

The Treasurer said it was “pretty remarkable that unemployment still has a three in front of it”.

“It means we continue to face these global economic challenges from a position of relative strength,” Dr Chalmers said. “We’ve got a lot coming at us from around the world, but we’ve got a lot going for us here at home – low unemployment and a pick-up in wages growth.”

Economists are warning of an imminent growth slowdown as soaring borrowing costs and cost-of-living pressures hit household budgets, but the jobs figures revealed no immediate evidence of that.

ACTU assistant secretary Joseph Mitchell said “more people finding jobs is good news for working people”.

As unions call for the central bank and government to set a goal of zero unemployment, Mr Mitchell said “today’s number shouldn’t be seen as an opportunity for the RBA to raise interest rates in the coming months. Let’s not punish working families any further for a crisis they had no hand in.”

Capital Economics economist Abhijit Surya, however, said Australia’s labour market “continues full steam ahead” and “with the labour market running red-hot, we think the RBA has more work to do”.

EY senior economist Paula Gadsby agreed, saying “the ongoing tightness in the labour market and the risk that it translates into higher wages growth suggests there is still a case for tighter monetary policy”.

ABS head of labour statistics Bjorn Jarvis said “the rise in employment in June saw the employment-to-population ratio remain at a record high 64.5 per cent, reflecting a tight labour market in which employment has recently increased in line with population growth”.

There were more than a million more Australians employed than before the pandemic, Mr Jarvis said.

The underemployment rate – which measures those with jobs who are not able to find the additional hours they want – was also steady at 6.4 per cent and 2.3 percentage points lower than before the pandemic.

KPMG chief economist Brendan Rynne said next Wednesday’s June quarter inflation figures would be “crucial” in determining whether the RBA next month hiked from 4.1 per cent to 4.35 per cent. “The current state of the labour market continues to defy expectation … but we believe this tightness may begin to ease in the near term,” Dr Rynne said.

“The economy is slowing but the full impacts of tighter monetary policy will take some time to flow through. Mortgage stress and higher costs of living will increasingly bite and ease the pressure on the labour market.

“The forthcoming cash rate decision by the RBA will need to balance the risks of labour market tightness driving wage growth higher and feeding into inflation against the risk that further rate increases will push the economy into recession.”

The solid labour force report came as NAB’s quarterly business survey revealed a softening employment outlook, even as a large majority of employers complained they were still having trouble finding the right workers.

The report showed 83 per cent of respondents said a lack of suitable labour was holding their businesses back, down only slightly from 87 per cent in March. NAB chief economist Alan Oster said “while the rebound in population growth has helped somewhat, the labour market clearly remains very tight for the time being. Still, we expect this to gradually change as the economy slows more materially.”

The Australian revealed Telstra plans to lay off nearly 500 staff as part of a major cost-cutting exercise under its new chief executive.

The RBA in February predicted unemployment would reach 3.6 per cent in June and peak at 4 per cent by the end of the year, although private sector economists have since become more pessimistic about the outlook.

The August 1 board meeting will be RBA governor Philip Lowe’s second last before he is replaced by his deputy.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout