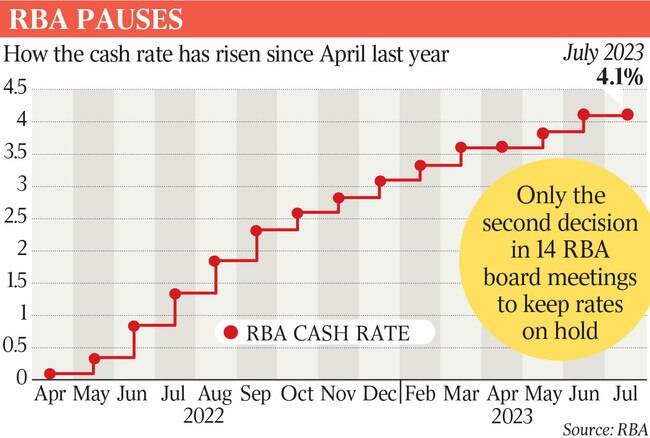

RBA holds at 4.1pc as Philip Lowe flags we are closer to an end to rate hikes

Governor Philip Lowe signals the most aggressive policy tightening in a generation is closer to an end, saying the need for further hikes would depend on ‘how the economy and inflation evolve’.

Reserve Bank governor Philip Lowe has kept rates steady and flagged that the most aggressive policy tightening in decades is moving closer to an end, saying further hikes would depend on “how the economy and inflation evolve” while conceding families were under a “painful squeeze”.

Tuesday’s decision will bring relief to millions of mortgaged households who have seen their interest bills soar after a dozen hikes in a little over a year, even as economists said it remained likely the RBA had more work to do.

In a statement accompanying the decision, Dr Lowe said “higher interest rates are working” to bring the economy back into balance, and that “inflation has passed its peak”.

“In light of this and the uncertainty surrounding the economic outlook, the board decided to hold interest rates steady this month. This will provide some time to assess the impact of the increase in interest rates to date and the economic outlook,” he said.

Following what could be his third-last board meeting ahead of the end of his term in September, Dr Lowe highlighted the fall in consumer price growth from 6.8 per cent to 5.6 per cent in May, and removed a reference from last month about “upside risks to the inflation outlook”.

But ominously he said “inflation is still too high and will remain so for some time yet”.

“The combination of higher interest rates and cost-of-living pressures is leading to a substantial slowing in household spending. While housing prices are rising again and some households have substantial savings buffers, others are experiencing a painful squeeze on their finances,” Dr Lowe said.

Finance Minister Katy Gallagher said the rate pause would provide “some much-needed relief” for households, and added the government’s economic strategy was “working alongside the Reserve Bank, not against it”.

“While this is welcome news, we understand many people remain under strain from rising mortgage payments and cost of living increases,” she said.

Days after revealing a bumper $19bn surplus for the financial year to May – multiples of the forecast $4.2bn surplus for the full financial year – Senator Gallagher said the government was prioritising budget repair over providing further cost-of-living relief. “We think it’s important to put back in place those fiscal buffers that you need for when the next time comes around that you need them. So getting the budget back in shape is a core priority for the government,” she said.

“But we don’t also sidestep the issue that we need to keep an eye on things that we can do to support cost of living.”

Economists had been split over whether the bank would pause at 4.1 per cent or hike to 4.35 per cent on Tuesday, and financial markets are continuing to price in further moves higher.

However, Dr Lowe said in his statement the RBA was not on a preset path, as it awaits evidence of the delayed impact of higher borrowing costs on spending and the economy more broadly.

“Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable time frame, but that will depend upon how the economy and inflation evolve,” he said, adding: “A significant source of uncertainty continues to be the outlook for household consumption.”

RBA Capital Markets chief economist Su-Lin Ong said Dr Lowe’s statement showed the RBA was “prepared to wait and see” before moving again.

Ms Ong said she anticipated one more rate increase, even though “the steady decision suggests that the bar to hike further is a little higher”.

Citi economist Josh Williamson said while Dr Lowe’s statement was more “dovish” than expected, he still anticipated two more rate rises in the coming two months. Rather than a fundamental shift, “we see today’s pause as giving the board more time to assess the state of the economy,” Mr Williamson said.

Economists have warned of a growing risk that monetary policymakers would tip the country into a recession, with an emerging consensus that an extended period of stagnant growth would be the price to pay for bringing inflation back under control.

Deloitte Access Economics partner Stephen Smith said the RBA board’s decision to hold rates – for only the second time in 14 meetings – was “welcome” and it “shows the RBA has realised the economy is on a knife’s edge and that it must pivot to achieve its goal of threading a ‘narrow path’ through the current economic conditions”.

“Monetary policy is a spent weapon. We must turn towards fiscal policy, investment and innovation to lift productivity, competition policy to improve efficiency and erode market power, and tax policy to boost prosperity,” Mr Smith said.

Dr Lowe in his statement acknowledged a slowing economy, but said labour market conditions “remain very tight”.

“At the aggregate level, wages growth is still consistent with the inflation target, provided that productivity growth picks up,” the RBA governor said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout