Renters now better off than home owners after interest rate hikes

Renters are better off than homeowners for the first time in a decade after successive RBA rate hikes.

Renters are better off than homeowners for the first time in a decade, new research shows, as successive Reserve Bank rate hikes send mortgage payments soaring.

Analysis by investment group Jarden found rising rents were being dwarfed by the impact of successive interest rate rises on housing affordability, with home loan repayments doubling from 24 per cent to 44 per cent as a portion of net income.

By comparison, rents as a portion of income have increased from 24 per cent in 2019 to 30 per cent today.

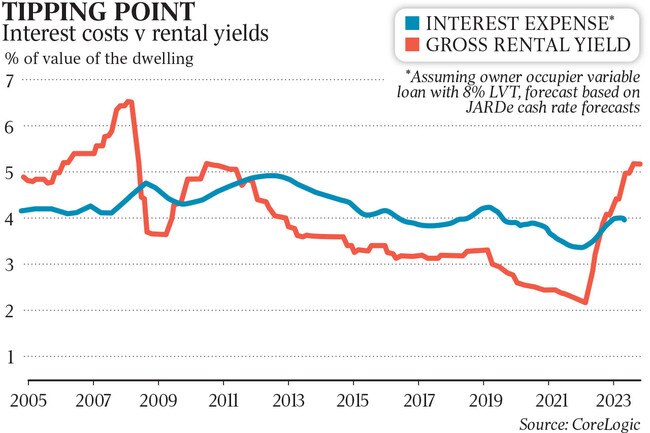

Jarden economist Carlos Cacho said renting in Australia has been more financially attractive than owning a home since December last year, marking a significant shift that had not occurred since prior to the 2009 global financial crisis.

He said mortgage holders who bought property in the past few years were being hit the hardest, with those aged 30-45 under the biggest strain.

“We’ve never seen affordability of mortgages be this bad and for new buyers who have bought in the past year, they are really struggling,” Mr Cacho said.

“Mortgage holders are feeling the pinch more than renters.

“Those aged 30 to 45 are under the biggest strain as these people have large mortgages and often have families, so have one and a half an income as they have often taken time off work for childcaring duties so this is the segment that is under the most pressure.”

The RBA’s monetary tightening to suppress inflation has seen mortgage interest charges rise by an annual 78.9 per cent in March, up from 61.3 per cent in the year to December.

National accounts released in June found the total mortgage interest bill had gone from $16bn to $28bn between March 2022 and March 2023.

According to consumer price index figures, rents have gone up by 6.3 per cent in the year to May.

Judobank economist Warren Hogan said mortgage stress was hitting young professionals aged between 30 to 45 whose repayments had increased by up to $6000 a month.

While older Australians with larger savings pools might be able to weather the pain, Mr Hogan said working professionals with large mortgages would be hit the worst, paying up to 70 per cent of their income in debt servicing.

“There is a real liquidity squeeze on these people who have great job prospects but (it) is just the magnitude of the debt which leaves them very vulnerable, and this may be people working in banking or with good jobs who invested in homes with the expectation that rates would stay low.

“I think this is the new feature of this cycle,” he said.

Rich Insights economist Chris Richardson said interest costs for mortgage holders were vastly higher than rent increases but renters were feeling the brunt of cost-of-living pressures more than homeowners, given they had smaller savings pools.

“While the renters are a bit more vulnerable, the fight against inflation is being felt by pretty much everyone. It’s hard to find any winners at this point. People who just have money in the bank are better off but pretty much everyone is worse off,” Mr Richardson said.

Centre for Independent Studies chief economist Peter Tulip said mortgage holders had seen a much bigger shock to their disposable income than renters, with repayments having more than doubled.

The former RBA researcher said homeowners who had bought property in the past year were suffering the most and “actually doing worse than renters, I’d say, because their mortgage payments would have doubled or tripled and they haven’t had the offsetting of capital against”.

“The standard mortgage rate is now at 6 per cent, so that’s $60,000 on $1m property,” Mr Tulip said. “A year ago, that was 3 per cent. So (repayments) on a $1m property (have increased) from $30k to $60k which is an enormous chunk of the average person’s income.”

Powerhousing Australia chief executive Nick Proud said the outlook for both renters and mortgage holders looked “increasingly bleak”.

“We know there is worse to come, with the RBA estimating that more than 800,000 fixed rate loans will switch to variable rates in 2023, or approximately $350bn in loans,” he said. “While there are 400,000 extra fixed rate loans about to be hit by a tsunami of costs this year and many more in 2024, renters have fared far worse in the past three years as the rising flood of rent increases have been flowing through annually to cripple Australian families.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout