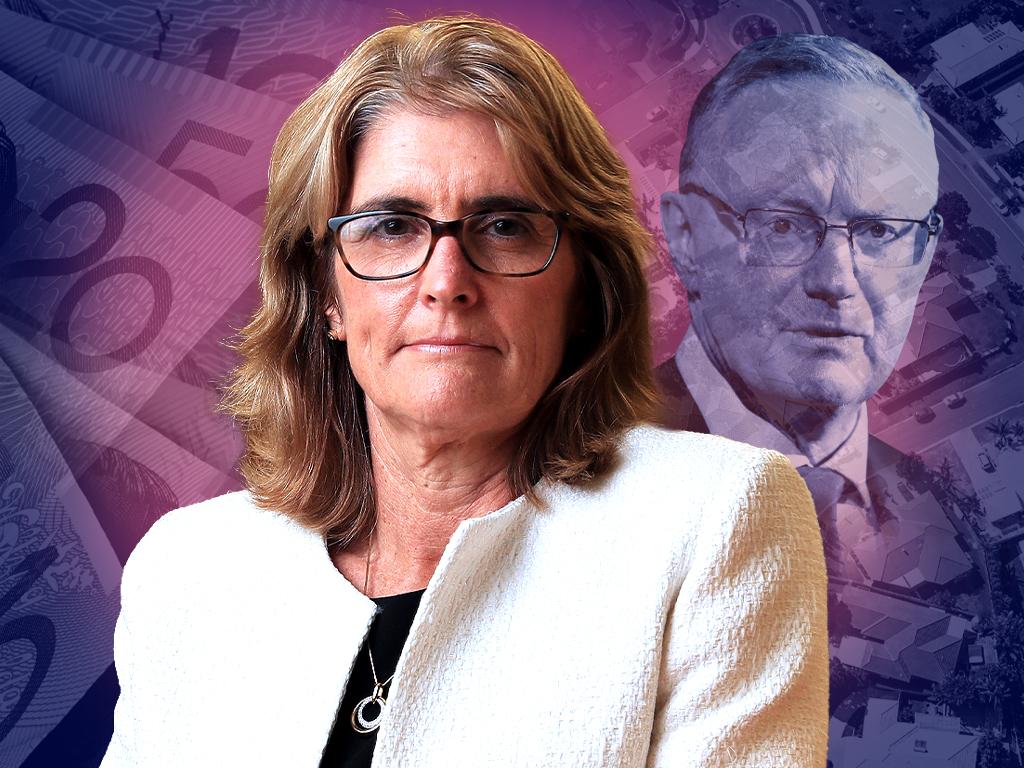

‘An outstanding economist and respected leader’: Michele Bullock’s appointment hailed across the board

The Albanese government’s historic appointment of Michele Bullock as RBA governor has won immediate and broad acclaim for choosing the most capable person for the job.

For a titan of the financial system and economic policy, Michele Bullock has kept her ego in check and brought humanity to the fore on the long and winding road to the top.

Power players in finance are commonly seen as forthright, smart, hard working, and some, even media shy. People who know Bullock in this rarefied realm concur with those descriptors, then add a few surprising ones: kind, thoughtful and humble.

In September, Bullock will become the first female, and ninth overall, Reserve Bank of Australia governor – a historic appointment for which the Albanese government has won immediate and broad acclaim for choosing the most capable person for the job, although trade unions clearly have a beef with her recent comments on full employment.

Still, within the engine room of government, she is viewed as the person who best knows the terrain, carries the least political and policy baggage, and is open and motivated to bed down the many changes the far-reaching RBA review has stipulated.

On Friday, Jim Chalmers said Bullock “is the person best-placed to take the Reserve Bank into the future”.

“Michele is an outstanding economist, but also an accomplished and respected leader,” the Treasurer said.

“Her appointment best combines experience and expertise with a fresh leadership perspective at the Reserve Bank as well.”

Some aspects of this new era for the nation’s financial ecosystems may prove less comfortable for the governor-designate: the inevitable and brutal politics, which killed Philip Lowe’s chances of a term extension, and the requirement to be the explainer in chief of the central bank’s every move and custodian of price stability.

Lowe said on Friday “the Treasurer has made a first-rate appointment” and wished Bullock all the best. “I congratulate Michele on being appointed governor,” he said in a statement.

“The Reserve Bank is in very good hands as it deals with the current inflation challenge and implementing the recommendations of the review of the RBA.”

Former RBA governor Ian Macfarlane, who was Bullock’s boss when she was working in the economic group in the early part of her 38-year career, told The Weekend Australian he was “overjoyed that Michele got the nod”.

“Michele is sensible and down to earth and that’s exactly what you need in a leader,” says Macfarlane, who led the central bank from 1996 to 2006.

“More to the point, she is a fine person, admired and respected. Even when she was a young person, people at the bank turned to her for ‘big-sister advice’ on all sorts of things.”

Gianni La Cava worked at the RBA for almost two decades and remembers working from home during the Covid-19 pandemic and getting a telephone call from Bullock when she was assistant governor with responsibility for the financial system.

“The first thing she did was ask ‘How are you? Are you OK?’ She cared about a middle manager and his physical and mental health and that meant a lot to me,” says La Cava, who once headed the RBA’s household and business conditions team and is now research director of the e61 Institute.

“Michele really knows her stuff and quickly gets to the crux of the matter. From my own experience, she was a leader who was open to innovation and encouraged me in meetings in front of everyone else to try new things and then backed me.”

From Armidale in the NSW northern tablelands, the high school dux opted to study economics locally at the University of New England, rather than take up an offer to study medicine at the University of Sydney.

Macfarlane, who ran the RBA’s economic research department before his own stellar rise, rates Bullock’s technical skills very highly.

“She has a strong economics background and because we thought so highly of her abilities we sent her to the London School of Economics to do a Masters,” he said.

“Her good character and talent will be very helpful as she navigates the changes foisted on the bank by the RBA review and accepted without challenge by the Albanese government.

“It’s a very difficult job that’s become even more difficult,” he said, nominating what he sees as the looming upheaval of the new monetary policy board of outside experts that will set interest rates.

RBA insiders describe Bullock as direct, but not blunt, and a very good manager of people, interacting with staff at all levels of the central bank. Business groups welcomed her appointment, with Innes Willox of national employer body Ai Group praising her “strong track record of consulting closely across the economy”.

Bullock was an assistant governor for a dozen years, overseeing currency, business services and the financial system, but cut her management teeth in the payments system – obscure to the public, yet fundamental for the plumbing of commerce in this country.

Some say not having had carriage of economic issues or experience of financial markets, as Lowe once did, are weak points. Her promotion to deputy governor in April last year and the board, however, has given her more exposure and responsibility for all aspects of the bank’s work.

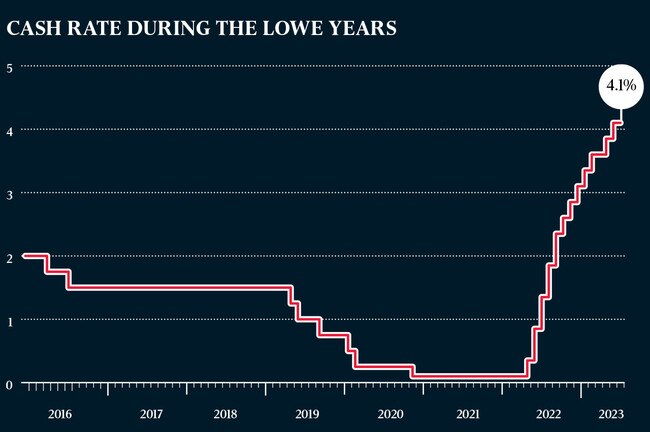

Bullock may be fortunate in a sense that she will be leading the RBA when interest rates are falling rather than rising, although she attracted the ire of organised labour after a recent speech in Newcastle inelegantly presented the textbook trade-off between inflation and employment, and how high interest rates would lead to a rise in unemployment.

In her only public comments, Bullock said she was “deeply honoured to have been appointed to this important position”.

“It is a challenging time to be coming into this role, but I will be supported by a strong executive team and boards,” she said.

“I am committed to ensuring that the Reserve Bank delivers on its policy and operational objectives for the benefit of the Australian people.”

The institutional makeover will be her biggest test; in her favour is a team that appears willing to embrace change, according to several RBA staff members, and her own mastery of the soft skills to ease the disruptions and cope with the starts and stops of non-linear progress.

The wilder world – of partisan politics, global uncertainty, public opprobrium and financial distress – is another matter, but the RBA and Bullock won’t be the only players caught in the rumble.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout