China’s new stimulus ‘very good’ for Australia as shares in mining giants soar: Jim Chalmers

The Treasurer welcomed Beijing’s new plan to jump start its sluggish economy while indicating Australia would not be following America’s lead on a new ban on Chinese EVs.

Jim Chalmers has called Beijing’s new economic stimulus package a “very, very good” development for Australia, an assessment shared by investors who sent stock in China-exposed Australian businesses soaring on Friday.

The Australian Treasurer also indicated the Albanese government was in no hurry to follow America’s new ban on Chinese EV software, declaring “we will take our own advice” on the burgeoning security concern.

In a welcome coincidence for the Australian Treasurer, China’s leader Xi Jinping on Thursday chaired a meeting of the powerful 25 member politburo to workshop a sweeping raft of measures to support the sluggish Chinese economy.

Officials pledged action to make the real estate market “stop declining” along with announcing a $165 billion war chest to boost China’s stock market, however many details of the stimulus package remained vague.

Speaking at a press conference in Beijing on Friday, the Treasurer said he wanted to make it “really clear” that his top level assessment was that the new stimulus in our biggest trading partner was a “very, very good development for Australia”.

“We welcome efforts to boost growth in the Chinese economy. We are very pleased to see these additional steps being signalled by the Chinese government,” Dr Chalmers said.

“We are very pleased to see the Chinese authorities announce, or signal, the sorts of steps that we have been hearing about this week publicly and also in our private discussions with our counterparts.

“This can only be a good thing for Australia, subject to those details, because we know that weakness in the Chinese economy does flow through to our own economic conditions.”

The early assessment of investors was enthusiastic, with shares in Australia’s three biggest iron ore miners BHP, Rio Tinto and Fortescue each closed up more than 3 per cent on Friday. Meanwhile, Chinese equities were on track for their best week since 2008.

The new measures from Beijing were announced after the Treasurer had shared in a piece published in The Australian details of his department’s concerns about the impact of a slowing Chinese economy, with a drop of one percentage point in China’s GDP growth projected cost about $6n in lost output in Australia.

Before flying out of Beijing late on Friday, Dr Chalmers met with the chair of the China Securities Commission, Wu Qing.

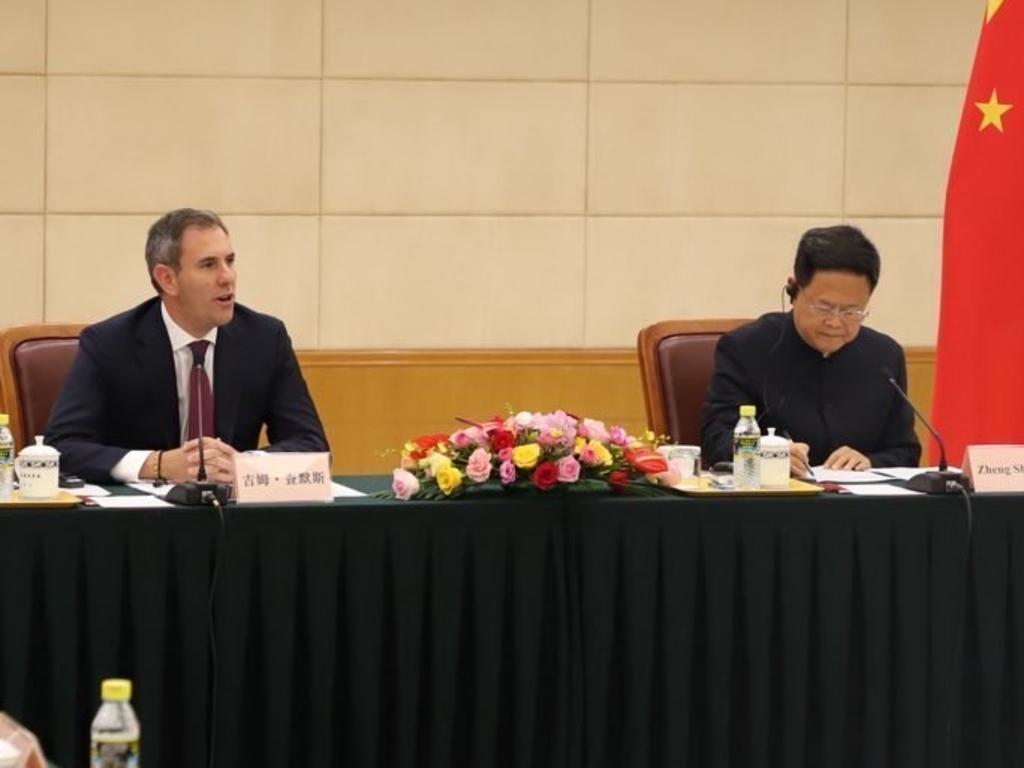

On Thursday, Dr Chalmers and his team of senior Australian officials spent over three hours with their Chinese counterparts on Thursday at the Australia-China Strategic Economic Dialogue, the first time the event had been held since 2017.

While much of the agenda was taken up by bureaucratic pleasantries, it did also give rare access to senior officials within the Chinese government who are currently wrestling with a host of economic challenges as they struggle to reach their annual growth target of “about 5 per cent”.

“There couldn’t have been a more important time to be engaging with Chinese counterparts than right now,” the Treasurer said.

As flagged in The Australian, the Chinese delegation led by NDRC chair Zheng Shangjie brought up Australia’s foreign investment screening regime during Thursday’s meeting.

Dr Chalmers said he had welcomed the opportunity to explain Australia’s “sensible, considered, common sense” approach to foreign investment, which “doesn’t single any one country out”.

He reiterated that Canberra approached each proposal “on a case-by-case basis” and tried to “provide as much information and clarity and certainty about the sorts of things that we consider”.

But the Treasurer added that he had made it “very clear” that Australia takes a “harder look where it applies to critical infrastructure, critical data, critical minerals”.

The Treasurer also indicated Canberra was in no hurry to follow a new American ban on Chinese software in EVs.

“ We will continue to discuss with American counterparts the steps that they’ve announced and the steps that they’re taking when it comes to EVs, but we will take our own advice,” he said.

There was no progress on Beijing’s ongoing black-listing of Australian live lobster, which the Treasurer said continued to be bogged down in “technical issues”.

Hours before the Treasurer arrived in Beijing, China’s military blasted an intercontinental ballistic missile for the first time in more than four decades.

That came a week after China’s national broadcaster released footage of an RAAF plane being harassed by a PLA fighter jet.

Dr Chalmers said he had raised Australia’s concerns about threatening Chinese military behaviour, including the missile test.

“I was able to reiterate in the meetings yesterday afternoon our expectations of safe and professional conduct of all militaries operating in our region,” the Treasurer said.

On Wednesday, an Australian navy vessel sailed with counterparts from Japan and New Zealand through the Taiwan Strait on their way to the South China Sea.

Chinese media reported that the PLA had tracked the joint operation, while China’s foreign ministry said it was “vigilant against any acts that might jeopardise China’s sovereignty and security”.

A report on the transit in China’s pugnacious Global Times said that exercises by countries outside of the region were “stirring up troubles and sabotaging freedom of navigation”.

The Treasurer said his Chinese counterparts had not brought up the joint exercise in his meetings on Thursday and said the joint operation was “routine”.

“Australia, like other countries in our region and around the world, has a lot at stake when it comes to a stable, secure, peaceful and prosperous region,” Dr Chalmers said.

“It’s not unusual for navies to conduct the exercises you describe in the Taiwan Strait. These are routine activities. They are conducted in accordance with international law,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout