Jim Chalmers takes economic charm offensive to China

The Treasurer has warned that further deterioration in China’s slowing economy would wreak havoc on Australia, with a drop of one percentage point in Chinese GDP growth projected to inflict about $6bn in lost domestic output.

Jim Chalmers has warned that further deterioration in China’s slowing economy would wreak havoc on Australia, with a drop of one percentage point in Chinese GDP growth projected to inflict about $6bn in lost domestic output.

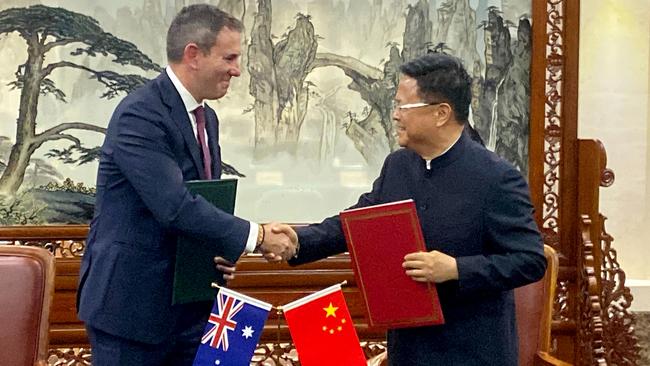

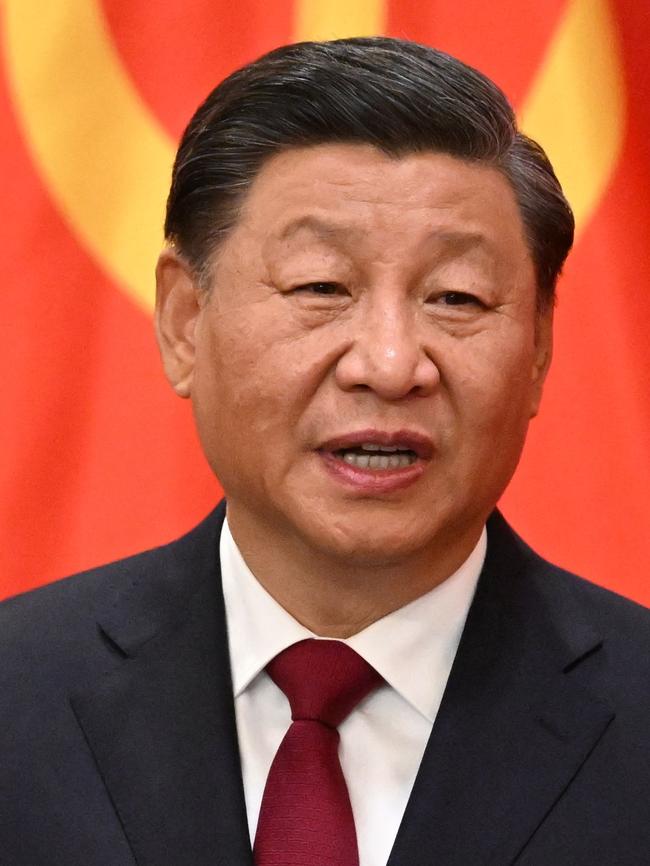

Amid global concerns over the rapid slowdown in China and as President Xi Jinping met his top comrades to discuss their enormous economic challenges, the Treasurer arrived in Beijing on Thursday to meet National Development and Reform Commission chair Zheng Shanjie, who oversees China’s five-year economic plans and the country’s foreign investment regime.

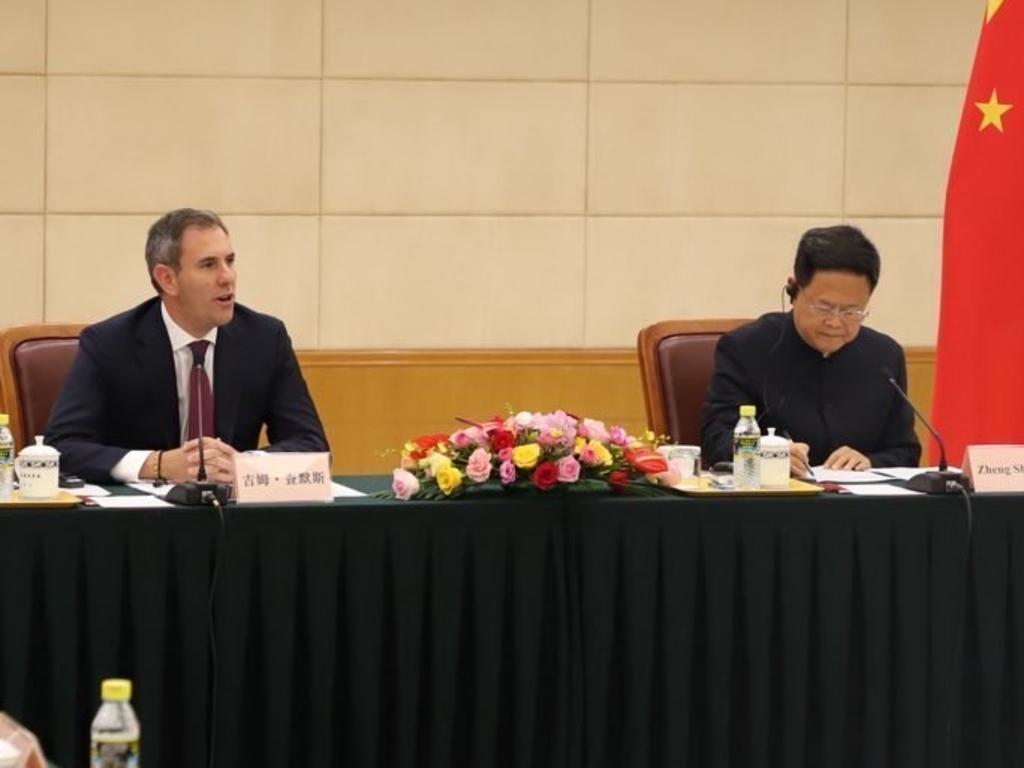

Dr Chalmers, who late on Thursday co-chaired with Mr Zheng the first meeting of the Australia-China Strategic Economic Dialogue since 2017, said there were “consequences for us” if the Communist nation’s economic slowdown and structural challenges worsened.

Writing for The Australian to mark the first visit to Beijing by a treasurer in seven years, Dr Chalmers said Australia’s resilience and prosperity were closely connected to China’s economy and the global economy, which is “why we monitor the Chinese economy so closely”.

Hours before Dr Chalmers met his Chinese counterparts, China’s politburo – led by Mr Xi – pledged a new stimulus package to implement better “the driving role of government investment”.

“We should increase the intensity of counter-cyclical adjustment of fiscal and monetary policies,” state news agency Xinhua cited officials as saying, after the politburo meeting.

Officials pledged action to make the real estate market “stop declining”, although details of the stimulus package remained vague.

China’s CSI 300 Index jumped by 4.2 per cent on the news, erasing losses for the year.

Speaking late on Thursday in Beijing, Dr Chalmers told his Chinese counterparts he was looking forward to “hearing more about efforts to boost growth” in China’s economy.

Mr Zheng struck a positive tone at the opening of the dialogue, thanking Dr Chalmers for “coming from afar”.

“The intrinsic feature of our relationship is mutual benefit and our development represents opportunities rather than challenges,” Mr Zheng said.

Their discussion ranged over the global economic outlook, their respective foreign-investment regimes and ways to “expand co-operation in green and low-carbon development”.

Dr Chalmers’ trip comes as China’s steelmakers, by far the largest customer for Australian iron ore miners, endure their worst crisis since 2015.

“Treasury is forecasting China to grow below 5 per cent for the next three years,” Dr Chalmers writes in The Australian. “This would be the weakest period of growth since China began opening up in the late 70s.

“To put that in perspective, a one-percentage-point drop in China’s GDP growth roughly costs Australia a quarter of a percentage point of our growth, or about $6bn in lost output. Softer demand for iron ore, weighed down by the slowing China economy, is also a threat to the budget bottom line. In one of the Treasury’s scenarios, a faster fall in iron ore and metallurgical coal prices could cost the budget $4.5bn.”

Ahead of announcements overnight, Dr Chalmers flagged a strengthening in ties around new industries and products tied to the net-zero-emissions transition and boosted co-operation on decarbonising steel supply chains and certifying green products and investments.

Chinese government officials were expected to acknowledge the weakness in their economy while insisting Beijing was responding with targeted measures.

The Chinese government this week released stimulus measures including cuts to its benchmark interest rate, support for the struggling Chinese sharemarket and more aid for the troubled real estate sector as policymakers try to enliven an economy struggling to meet its annual 5 per cent target

Closer economic and diplomatic links are being managed carefully alongside geostrategic flashpoints in the Indo-Pacific, with the federal government tightening security, national-interest and foreign-investment rules and strengthening partnerships with the US, Japan, India, the Philippines and other ASEAN nations.

Dr Chalmers’ Chinese counterparts were expected to raise Canberra’s regulatory process for investment from China, a source of frustration and anger since 2017.

“It will be one of their top talking points,” said a source familiar with preparatory discussions before the dialogue.

Beijing mouthpiece The Global Times reported there were “high expectations” for the Treasurer’s visit. “His visit to China is expected to not only promote bilateral economic and trade relations but also to enhance the overall bilateral relationship,” it said.

“Additionally, there may be opportunities for breakthroughs in co-operation between the two nations in new areas, particularly in addressing climate change and clean energy initiatives.”

Dr Chalmers’ visit comes a week after an Australian air force plane was described as an “enemy” in a documentary aired on China’s national broadcaster CCTV.

The delegation to Beijing also follows last week’s Quad leaders’ dialogue summit in Joe Biden’s home state of Delaware, attended by Anthony Albanese, during which the US President was caught on a hot mic warning that China “continued to behave aggressively, testing all of us across the region”.

On Wednesday, an Australian navy vessel joined counterparts from Japan and New Zealand for a combined passage through the Taiwan Strait.

Dr Chalmers said it would be “naive to pretend that all is smooth sailing (and) constructive engagement doesn’t mean there’s no disagreement”.

“Instead, it means finding common ground while maintaining the integrity of who we are as a nation and preserving our national interest,” he wrote.

“Our dialogue with China is about ensuring stability at a time of significant uncertainty. With rising geopolitical tensions globally and in our region, it’s more important than ever to maintain open lines of communication. While our systems are different, the fact remains that our economies are deeply intertwined. Ensuring that we can navigate these complexities with respect and clarity will be crucial for both nations in the years ahead. There’s a lot at stake and there’s a lot to gain.”

After the Prime Minister, Foreign Minister Penny Wong and Trade Minister Don Farrell led an easing in tensions with Beijing following the 2022 federal election, the Chinese government has removed more than $19bn worth of trade sanctions imposed during the Morrison government.

Mr Albanese travelled to Beijing and Shanghai last November for meetings with Mr Xi and Chinese Premier Li Qiang, marking the first visit to China by an Australian prime minister since Malcolm Turnbull in 2016.

Dr Chalmers said less than $1bn worth of exports remained impeded and Chinese markets were open again to Australian coal, cotton, timber, barley and wine.

“Total two-way trade reached a record $327bn in 2023, more than double what it was when the China-Australia free trade agreement commenced in 2015,” he said. “Opportunity comes with engagement, not estrangement. It has not just been a government effort. Australian businesses have continued to develop ties with China, while also recognising the need to diversify.”

Ahead of his China trip, Dr Chalmers sounded out chairs, chief executives and executives at mining giants Rio Tinto, BHP and Fortescue, gas major Woodside, retail and mining conglomerate Wesfarmers, investment giant Macquarie, Chinese-focused law firm King & Wood Mallesons, steelmaker BlueScope, Sydney Airport, hearing aid maker Cochlear, agribusiness GrainCorp and the Business Council of Australia.

Chinese ambassador to Australia Xiao Qian said Dr Chalmers’ visit to China was key to the restoration of the nations’ economic engagement. “As two major economic and trading partners it is very important for China and Australia to conduct strategic dialogue on economic co-operation, not only on bilateral relations but also regional (and) global issues,” Mr Xiao said. “I have a strong hope that there will be a very comprehensive, very significant, substantive dialogue between Mr Chalmers and his counterpart.”

Additional reporting: Ben Packham

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout