It couldn’t be a more important time given new efforts to boost growth in the Chinese economy.

We recognise more stable links between Australia and China are a good thing for Australian workers, businesses, investors and for our country more broadly.

The Albanese Labor government has made substantial progress in re-establishing dialogue with our largest trading partner since coming to office. This has included Prime Minister Anthony Albanese’s meetings in China in November last year, Chinese Premier Li Qiang’s in Australia in June, and a number of other important ministerial engagements.

We’ve worked diligently and deliberately to re-engage after years of difficulties, without compromising our values or interests.

Our approach has been to co-operate where we can, disagree where we must, and engage in our national interest.

The Albanese government’s efforts have delivered outcomes for the Australian people. We have succeeded in ensuring a range of Australian exports re-enter the Chinese market.

When we came to government, trade impediments affected more than $20bn worth of Australian exports. Now less than $1bn worth of exports remain impeded and the Chinese market is once again open to Australian coal, cotton, copper ores and concentrates, timber logs, oaten hay, barley and wine.

Total two-way trade reached a record $327bn in 2023, more than double what it was when the China-Australia Free Trade Agreement commenced in 2015.

A lot of this progress is thanks to the considered diplomacy of the Prime Minister, Deputy Prime Minister Richard Marles, Foreign Minister Penny Wong and Trade Minister Don Farrell, whose persistent work in public and private has helped lay the groundwork for this week’s exchange.

Opportunity comes with engagement, not estrangement.

It has not just been a government effort. Australian businesses have continued to develop ties with China, while also recognising the need to diversify.

In the week before heading to Beijing, I met with a host of CEOs, chairs and senior executives of major China-facing Australian employers, including Rio Tinto, Wesfarmers, BHP, Woodside, Fortescue, Macquarie, BlueScope, HSBC, King & Wood Mallesons, the Port of Newcastle, Sydney Airport, Cochlear, the University of NSW and GrainCorp, as well as the Business Council of Australia.

Their perspectives have been invaluable and I’m drawing on their insights in all my meetings.

Over many decades, trade in resources, education and agriculture has built a strong economic bridge. But the relationship with China is now facing new realities that make this engagement timely.

International challenges and uncertainties, including persistent inflation, sluggish growth, ongoing disruptions in supply chains and conflict in the Middle East, continue to weigh heavily on the global economy.

As well as these international pressures, China is also contending with its own economic slowdown and structural challenges, with consequences for us as well.

Our resilience and prosperity are closely connected to China’s economy and the global economy. This is why we monitor the Chinese economy so closely. It’s why we are focused on strengthening existing connections, while also diversifying our trade and investments and advancing our own national interests.

Treasury is forecasting China to grow below 5 per cent for the next three years. This would be the weakest period of growth since China began opening up in the late 1970s.

To put that in perspective, a one-percentage-point drop in China’s GDP growth roughly costs Australia a quarter of a percentage point of our growth, or about $6bn in lost output.

Softer demand for iron ore, weighed down by the slowing China economy, is also a threat to the budget bottom line. In one of the Treasury’s scenarios, a faster fall in iron ore and metallurgical coal prices could cost the budget $4.5bn.

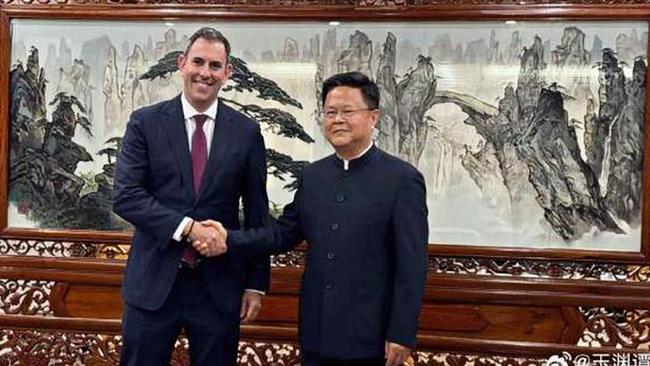

This is why the Strategic Economic Dialogue I am co-chairing in China is so essential. This meeting has not been convened since 2017 but the Albanese government agreed with our counterparts to restart it.

In addition to the Dialogue, I am meeting other Chinese government counterparts.

All of my engagements in China focus on how we can advance our economic ties, while also addressing the global challenges we both face. It is a chance to ensure our relationship continues to support mutual prosperity.

This is the case in areas of traditional strength and also in new industries and products as the world moves to net zero. We can co-operate in areas such as decarbonising steel supply chains and certifying green products and investments consistently to maintain the complementarity of our economies.

Of course, it would be naive to pretend that all is smooth sailing. Constructive engagement doesn’t mean there’s no disagreement. Instead, it means finding common ground while maintaining the integrity of who we are as a nation and preserving our national interest.

Our dialogue with China is about ensuring stability at a time of significant uncertainty. With rising geopolitical tensions globally and in our region, it’s more important than ever to maintain open lines of communication.

While our systems are different, the fact remains that our economies are deeply intertwined. Ensuring that we can navigate these complexities with respect and clarity will be crucial for both nations in the years ahead.

There’s a lot at stake and there’s a lot to gain.

Jim Chalmers is federal Treasurer.

More Coverage

This week I am the first Australian treasurer in seven years to meet with Chinese counterparts in China. It is another important step in stabilising a crucial relationship, full of complexity and opportunity.