It’s the sort of unnerving behaviour that hangs over the Australia-China relationship and compels Canberra to be realistic about what is possible in its relationship with Beijing.

As if to underline the point, the People’s Liberation Army navy also had all three of its enormous aircraft carriers patrolling waters off China’s coast for the first time.

Meanwhile, an Australian navy vessel on Wednesday sailed through the Taiwan Strait with their navy counterparts from Japan and, wait for it, New Zealand. Don’t we live in interesting times.

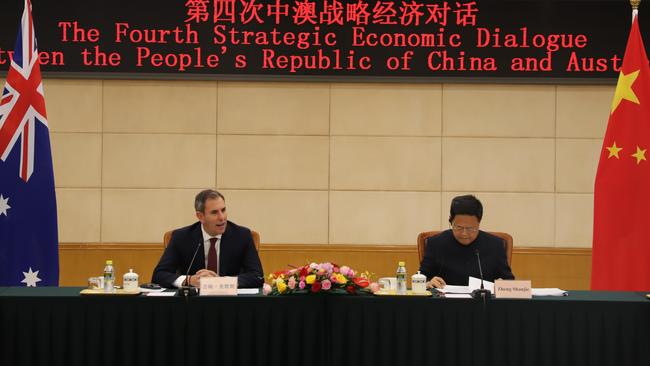

China’s economic policy makers wanted to focus on the “economic” part of the Australia-China Strategic Economic Dialogue, which the Treasurer co-chaired in Beijing late on Thursday.

Chinese President Xi Jinping even did his bit to put the economy in the headlines, gathering a group of his top comrades to discuss his country’s economic problems hours before the Australian Treasurer co-chaired the Australia-China dialogue with the head of the National Development and Reform Commission chairman Zheng Shanjie.

Chalmers had a lot of questions he wanted to pose about what he candidly described as the “weakness” in China’s economy.

What is Beijing’s assessment of its problems? What is Beijing doing about it? And, in the Australian government debriefs after the meeting, is Beijing’s plan credible?

It’s clear that Xi and his colleagues are seeing worrying data that has urged them into action. Their success, or otherwise, is profoundly important to Australia.

The Treasurer didn’t need to speak to bigwigs at BHP, Rio Tinto or Fortescue – not to mention his opinionated mentor Paul Keating – to learn that what happens in China is hugely consequential to Australia.

His own department is all over it.

A one percentage point drop in China’s GDP growth knocks off about one-quarter of a percentage point of growth in Australia, or about $6bn in lost output.

And currently, Treasury is forecasting China to grow below 5 per cent for the next three years.

That would be the weakest period of growth since China began opening up in the late ’70s, the Treasurer noted.

For all the considerable gloom that hangs over the Chinese economy, many of Australia’s most profitable companies – and biggest taxpayers – continue to make extraordinary sums from trading with China.

Last year two-way trade hit a record $327bn, including more than $200bn of Australian exports to China. No country in the world has as big a trade surplus with China as Australia.

But those rockets and aircraft carriers niggle.

“Project Stabilisation” is not going to make them go away.

Australia’s “strategic” problems with China, as the euphemism goes, are the new normal of the relationship – a part of its backdrop now as expected as the green tea served during all the visiting Treasurer’s meetings during his brief two-day trip.

Dr Chalmers wasn’t wrong to note the improvement in Australia’s relations with China in the 2½ years the Albanese government has been in office.

That ministerial dialogue with China is taking place at its current tempo is undoubtedly a good thing.

But beyond the warm headlines in the Chinese press about the visit by the latest Australian government minister, loom troubling signs of what could be in store in the rest of Xi’s second decade in power.

Hours before Jim Chalmers touched down in Beijing, China’s rocket force blasted an intercontinental ballistic missile over the Pacific Ocean for the first time in 44 years.