Much at stake in Jim Chalmers’ 2024-25 budget balancing act

The point of the budget, Chalmers says, is to provide cost-of-living assistance to low- and middle-income earners while not adding to inflationary pressures; continue to bank most of the revenue upgrades across the forward estimates, and deliver a fiscally prudent economic statement, and; put in place reforms that accelerate long-term growth.

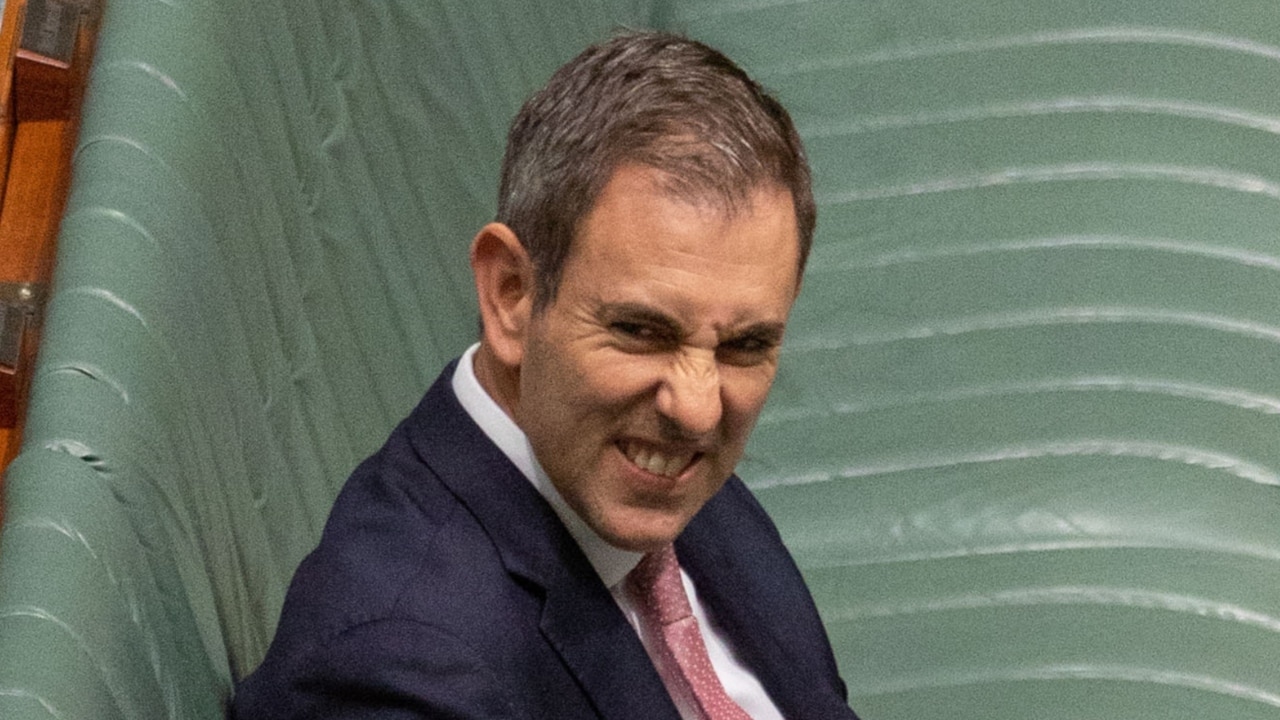

All treasurers need to be storytellers and Chalmers has defined a purpose for the Albanese government at a time when most voters see the government in a state of perpetual drift this year, without clear policy goals, a coherent strategy to achieve them or a narrative to explain its vision for the nation.

Chalmers is using the budget to seize control of the government’s messaging. With a frenetic schedule of radio and television interviews, media conferences and a series of set-piece speeches to business groups and think tanks over the past month, the Treasurer has developed a focused policy approach and wrapped it in a clear framework.

We can debate whether the government has the right policies and the most effective communications strategy, but this is what treasurers should do. Treasurers must take the lead on economic policy, win debates in cabinet and their party, work cooperatively with the prime minister and other ministers, and be a strong and clear communicator of the government’s objectives in parliament and to the public.

Moreover, budgets offer a chance for a government to reset its agenda and sharpen its language to better define itself and its ambitions. It is the most important initiative of a government each year, and the process is led by the treasurer. Before the hard slog of expenditure review committee meetings, Chalmers outlined the strategy for the budget at the start of the year and stuck to it.

The stage three income tax cuts, at a cost of $359bn over 10 years, will be up in lights. All 13.6 million taxpayers will receive a larger take-home pay, but most of the additional relief goes to those on low and middle incomes. This redesign of the previous government’s tax cuts has long been an aim of Chalmers, and he achieved it despite initial cabinet opposition.

The risk is that these income tax cuts, and other cost-of-living relief, will not dampen demand but add to it and be inflationary. The Reserve Bank could be forced to raise the official cash rate even further, which will mean more pain for homeowners. But Chalmers insists the tax cuts are not inflationary and nor is other targeted relief, which may include extending energy bill rebates or other welfare assistance.

The Reserve Bank forecasts inflation to be 3.2 per cent at the end of next financial year. It made this assumption in advance of the budget.

But Treasury forecasts inflation to be 2.75 per cent by the end of 2024-25 and remain at that level in 2025-26. This is within the 2-3 per cent target band for the central bank. It means the inflation challenge will have passed – assuming Treasury is correct.

The budget will again show a significant upward revision in revenue, perhaps to the tune of $25bn over the forward estimates, but not as much as in the previous two budgets. Chalmers and Finance Minister Katy Gallagher insist most of these upgrades, due to commodity prices and a strong labour market, are going to be saved rather than spent.

But this will still be a big-spending budget. Expect big increases in payments to the states for infrastructure, health and education. There is $6bn for defence projects over the next four years, and $50bn over the next decade. There are pay increases for childcare workers alongside student teachers, social workers, nurses and midwives. Plus more fee-free technical college education places and pre-apprenticeships. The government will also forego $3bn in revenue from student debt payments.

A test for how fiscally responsible Chalmers will be is clocking future expenditure on the NDIS, aged care, health and defence, in addition to arresting payments on government debt. These areas of the budget account for about a third or more of all expenditure, although runaway NDIS spending is expected to be reined in. Chalmers’ “restraint” in these areas is essential.

Still, he delivered a surplus in 2022-23 and is almost certain to deliver one in this financial year, 2023-24. If it were so easy, his recent predecessors – Wayne Swan, Joe Hockey, Scott Morrison and Josh Frydenberg – would have delivered surpluses.

Indeed, some promised multiple surpluses but never delivered. There is a good chance Chalmers will deliver a third surplus in 2024-25 but he is downplaying expectations.

With an eye on the long term, Chalmers has used the budget to initiate what he told me last week was “a new growth model” for the economy that used both public and private investment to benefit from the decarbonisation of the global economy. The umbrella program for this is Made in Australia, which will see billions of dollars flow to companies developing solar panels, quantum computing and rare earth metals production.

This approach has its critics – including me – because governments generally do not have a good track record when it comes to industry policy based on picking winners. It also challenges the Hawke-Keating model of smaller government, less market intervention and privatisation of public assets. But he calls it the new economic “orthodoxy”. Chalmers would regard me as a “nostalgist” rather than a “strategist”.

Chalmers better get all of this right. The fate of struggling renters and long-suffering families with home mortgages – and the Albanese government, which will seek re-election in the next year – depends on it.

If the Treasurer and his department have miscalculated the inflation challenge, then the result could be calamitous for many Australians. Good luck, Jim.

When Treasurer Jim Chalmers steps up to the Despatch Box to deliver the 2024-25 federal budget on Tuesday night, his third in less than two years, much will be at stake. In seeking to balance seemingly competing economic objectives, he has adopted the mantra of “relief, restraint and reform”, and repeated it endlessly.