They might be separated by more than 15,000km but the connection between these regions and the US was at the heart of my motivation for travelling to DC. The economic relationship between Australia and America is full of mutual benefits, shared interests and big opportunities.

We want to maximise those opportunities in the interests of the people of our two great countries, from main street America to the towns of middle Australia, like Singleton and Somersby, near Gosford, where I met with local businesses on Thursday.

We are longstanding, trusted allies with shared interests, which makes for the best kind of economic partnership too. Australia’s relationship with the US – stretching across 14 presidents and 16 prime ministers since the ANZUS treaty was signed – is testament to this.

It’s a relationship that has stood the test of time, it’s a relationship that benefits both sides, and it’s a relationship with great potential in the years ahead.

From capital markets to critical minerals, trade to technology, the opportunity on offer through close economic relations with our American counterparts is significant and substantial.

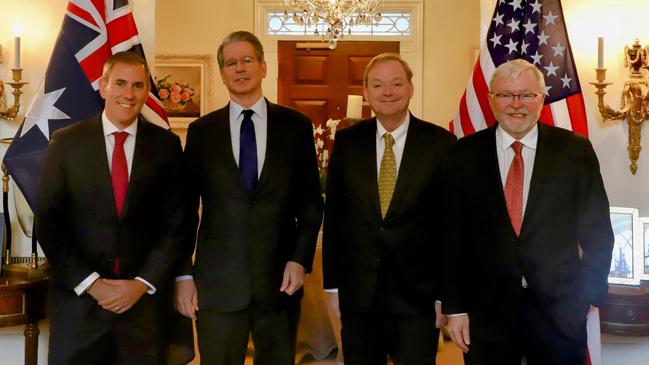

To incentivise investment, promote productivity and drive growth, we need to work even more closely with our closest partners. That was the focus of my discussions with US Treasury Secretary Scott Bessent and National Economic Council director Kevin Hassett in Washington DC this week.

It was a constructive conversation, and we were able to cover a lot of ground over the course of an hour or so. It was wide-ranging, positive and productive.

The future of our trading relationship and potential steel and aluminium tariffs were part of my discussions with Secretary Bessent and Director Hassett, but not the only part. It was a chance to highlight how an exemption would serve both our economies, benefiting industries and workers on both sides.

We were able to continue, but not conclude, the important discussions President Donald Trump and Prime Minister Anthony Albanese had around two weeks ago on steel and aluminium.

Australia has a lot to gain from markets that are open. We’ve made that point for a long time now and we’ve been a big beneficiary of that in the past.

We also discussed how greater investment can continue to drive growth and dynamism in both our economies, bolstering industry, strengthening resilience, and creating jobs and opportunity. This meeting, among the first the secretary and director have taken with counterparts since being sworn in, augurs well for the kind of access Australia has in Washington DC since the inauguration of President Trump.

It builds on Prime Minister Albanese’s recent call with President Trump, and the Foreign Minister and Deputy Prime Minister’s meetings with their counterparts in DC.

The economic relationship between Australia and the US is already deep, strong and mutually beneficial. The US has maintained a trade surplus with Australia since 1952, with a two-to-one advantage. We impose zero tariffs on US imports and around half of our exports feed into American industry.

Meanwhile, the US is our largest source of foreign investment – by far – and one of our top five two-way trading partners. We’re two of the best-positioned economies in the world right now to capitalise on the opportunities ahead.

While both headline and core inflation are higher in the US than Australia, in both economies inflation has moderated to be less than a third of its peak. We’ve both been able to achieve this while maintaining solid labour market outcomes.

Both economies have low unemployment, with the US unemployment rate at 4 per cent, only a touch below the 4.1 per cent we have here at home. Australia also has a record high participation rate of 67.3 per cent, whereas in the US participation has not recovered to its pre-pandemic levels and sits at 62.6 per cent.

So our economies are both growing, inflation is down, and our labour markets are strong. This is a unique combination and a sound foundation that positions us to be the primary beneficiaries of the churn and change that define uncertain times in the global economy.

One of the ways to help make Australians and Americans those beneficiaries is through closer collaboration between our world-leading superannuation sector and US business.

Another focus of my engagement in Washington DC was the inaugural Australian Superannuation Investment Summit convened by ambassador Kevin Rudd.

This Summit was all about stronger returns for Australians and stronger economic ties with the Americans. It was a powerful demonstration of the economic alignment between our two countries, which has done so much to secure prosperity for our people.

The Australian super funds represented at the summit manage about $1.5 trillion and the US companies and investment firms had a combined market cap of nearly $3 trillion.

Governors or members of congress from California, Illinois, Florida, Tennessee and Connecticut, accounting for more than a quarter of US GDP, were also present.

Bringing all these groups together was a useful chance to discuss the opportunities we have on offer through more co-operation and more investment.

While most of Australians’ super is invested domestically, we have a lot to offer by way of investment in American industry and we have a lot to gain by way of bigger and better returns for Australians through this diversification.

Whether it was in my meetings with Blackstone CEO Stephen Schwarzman, Citigroup CEO Jane Fraser or JPMorgan CEO Jamie Dimon, they all recognised the mutual benefits on offer.

We’ll continue to work with the new administration to get stronger returns for middle Australia through stronger ties with middle America. By investing in each other’s successes, we will build a better future for Australians and Americans.

Jim Chalmers is the federal Treasurer.

The first stop back in Australia for me after a brief but important two days in Washington DC was the Hunter and Central Coast in New South Wales.