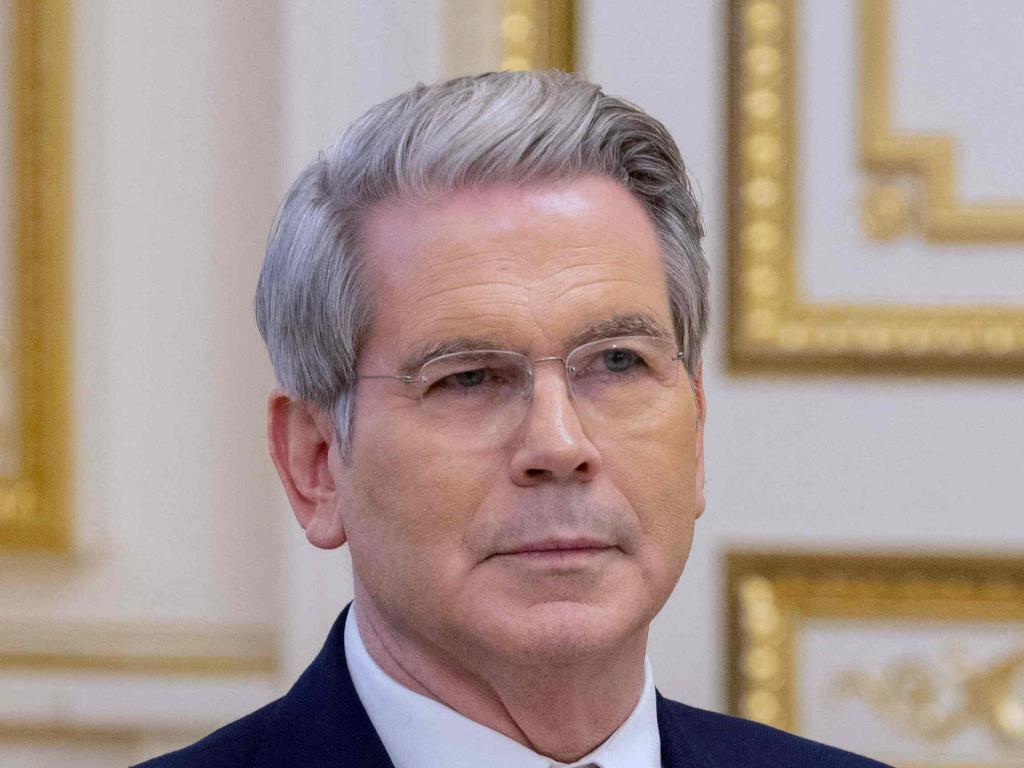

US Treasury Secretary Scott Bessent to address super summit

In a diplomatic win for Australia, Scott Bessent will appear at the inaugural Australian Super Summit in Washington as Labor works to leverage Sydney as the next financial services centre for the Indo-Pacific region.

US Treasury Secretary Scott Bessent will address the inaugural Australian Super Summit in Washington this week in a diplomatic win for Australia, as the Albanese government works to leverage Sydney as the next financial services centre for the Indo-Pacific region.

The super summit is part of a key diplomatic initiative by the Albanese government – nine months in the making – aimed at unlocking greater returns for Australians by developing stronger investment partnerships and opportunities in the US economy.

The push by the Albanese government to unlock opportunities for super funds in the US and potentially expand investment by tens of billions of dollars comes as it ramps up the diplomatic campaign to secure an exemption from Donald Trump’s planned 25 per cent tariffs on steel and aluminium.

Jim Chalmers arrived in Washington on Sunday night, local time, and is due to hold his own meeting with Mr Bessent, where the Treasurer will raise the case for tariff exemptions, before delivering his own address to the Super Summit at the Australian embassy in Washington on Tuesday.

Australia has the fastest-growing pool of retirement savings in the world, with super funds increasingly looking to expand their investments in the US in a bid to deliver greater returns and diversification for members.

Anthony Albanese discussed the size of Australia’s $4 trillion pool of retirement savings with the US President in his February 10 phone call, during which Mr Trump agreed to consider Australia’s request for an exemption from the planned tariffs that are scheduled to commence from March 12.

Mr Bessent’s attendance at the summit is a positive sign Australia is engaging the Trump administration at the highest levels amid a period of heightened uncertainty as the US upends the global trading system.

Earlier this month, Mr Bessent travelled to Kyiv where he tried to secure an agreement with Ukrainian leader Volodymyr Zelensky for the US to take a key share in the nation’s mineral wealth as part of the broader push for a negotiated settlement to end the hostilities in Eastern Europe.

The Super Summit will include a range of US federal and state officials, leading figures from the US investment community and the chairs and chief executives of Australia’s leading super funds. It will also feature representatives from the venture capital, private equity, infrastructure and innovation ecosystems.

The summit – sponsored by Macquarie Group – will be hosted for two days at the Australian embassy in Washington DC on February 24 and 25 before shifting to the Australian Consulate-General in New York on February 26 and 27.

Australia’s US ambassador Kevin Rudd will open the summit and moderate a discussion with Mr Bessent. Dr Chalmers is scheduled to deliver an address as well as Mr Bessent, Macquarie Group chief executive Shemara Wikramanayake and IFM Investors chair Cath Bowtell.

Dr Chalmers said the Super Summit was about delivering “stronger returns for Australians from stronger ties with the American economy”.

“Australia’s super funds are global leaders in long-term investment, and this summit strengthens their access to the best opportunities in the world’s largest economy,” he said.

“The US market offers scale, diversification and strong returns, helping Australian’s retirement savings keep working to their full potential. This is another demonstration of the mutual benefits in the Australia-US economic relationship.”

Ahead of the summit this week, a fresh report from economic and research advisory firm Mandala found that Australian super fund investments in US private markets alone could exceed $US240bn ($378bn) by 2035 if deeper financial partnerships with America could be forged – a major increase on the $US140bn forecast on current trends.

Commissioned by IFM Investors and based on analysis from the Super Members Council, the report models that total Australian super fund investment in the US will more than double over the decade from $US400bn to $US1 trillion.

Ms Wikramanayake said Macquarie Group looked “forward to continuing to connect Australia’s super funds with compelling investment opportunities in the region and to positively impact the communities in which we operate”.

Paul Schroder, chief executive of the nation’s largest super fund, AustralianSuper, said the US presented a “great opportunity to deliver strong investment returns for Australians in retirement”.

“In the last century, the worst bet anyone could have made was against the United States. That’s not about to change. We are growing our presence in the United States because we believe our shared history, underpinned by more than 100 years of shared values and common interests, is an opportunity to build strong connections and open dialogue,” Mr Schroder said.

Senior economics adviser at the US Studies Centre and former chief of staff to prime minister Scott Morrison, John Kunkel, said it was a “good sign that Mr Bessent is coming to do this”.

He said that Australian diplomacy would be critical given it was still unclear how the Trump administration would look upon exemptions from tariffs for Washington’s close allies.

“There is no obvious sign that there will be a formal exclusion process. So it will very much come down to a diplomatic dance as to how much leverage we can actually exercise because we see in someone like (top Trump trade adviser) Peter Navarro there is very much a blanket approach – without exemptions for friends and allies,” Dr Kunkel said.

“The balance of it is a bit murky … beyond the President there are about five people – Scott Bessent, Howard Lutnick, Jamieson Greer, Peter Navarro and Kevin Hassett – who are sort of the core of the international economic team. And as you expect they don’t always line up on the same page every day – I think some of us are just trying to keep up with who has got the pen on the executive orders.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout