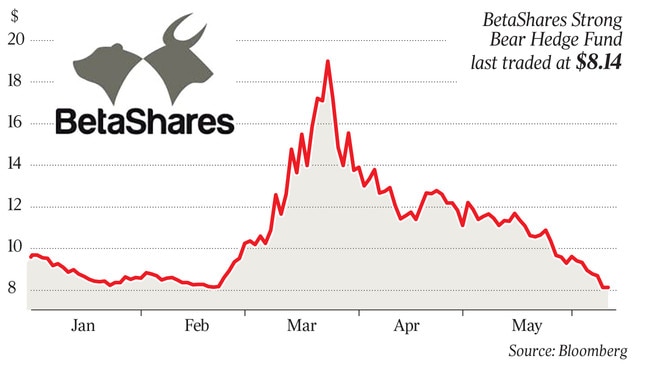

The funds, which promise to rise if the markets fall, worked like a dream through March, doubling the money of anyone who picked them up at the right time.

Unfortunately, they also nosedive when things get better.

BetaShares Australian Equities Strong Bear Fund (BBOZ) was the single most heavily traded Exchange Traded Fund over the recent crash.

The turnover in the fund reached a remarkable $2bn over the month of March.

As Ilan Israelstan of Betashares puts it, “on many days, it was trading more than Telstra,” one of the most widely held shares on the S&P/ASX 200.

The problem is that panicked markets turn on a dime and anyone left inside any of the listed bear funds has been losing money very quickly as the wider market rebounds.

BBOZ itself, the benchmark fund in this area is down by about 30 per cent since its March top - that’s worse than the actual fall in the wider ASX 200 at the depths of the crash.

Regularly put forth by financial advisers as a defence against falling market the “bear” products have never been fully tested in our local market until this latest downturn - the sector was still in its infancy during the global financial crisis.

To be fair, the majority of bear funds and related products did their job in the crash: that is they went up when the market went down.

The issue is whether retail investors made the fatal error of regarding the funds as ETFs like any other, where you might buy and hold.

With “bear” products, you get in and get out fast if you want to make a turn.

At diversified robo adviser group, Stockspot, CEO Chris Brycki says: “The bear funds work fine, for traders. The concern is whether they are at all suitable for retail investors. I question if they should even be called ETFs.”

“I expect many investors have not moved fast enough, I mean, really, if you can time the market it’s a rare talent ... you should be a full-time trader,’’ says Brycki a trader previously himself.

Roughly one dollar in five of the bear funds are estimated to be held by retail investors.

At their best, these funds act as an alternative to derivatives - and a safer one where you can’t lose more than you have invested.

But even if the volumes in the bear funds are now rolling off their exceptional levels, in the depths of the crisis the numbers are still significant.

At BBOZ in March, the turnover was $2bn, in April it was $1.5bn and in May $900m - suggesting the turnover in the bear funds is still running at least twice as high as it was at the start of the year.

“Investors really need to get that these are short-term trading instruments, they are not funds in the sense many people understand- I worry that a lot of everyday investors could be shooting themselves in the foot,” says Jessica Amir of Bell Direct.

In reality, bear funds lose money most of the time. It’s deductive - historically markets rise over the long term.

These are funds you buy to sell. Perhaps that has not become obvious until now.

Bear funds looked like a great choice earlier this year when the prospect of making money from a downturn in an overheated market looked like a good bet.