Second virus wave would cost economy $25bn

The OECD has described what is at stake as the government ‘walks the tightrope’ between opening up the economy and keeping COVID-19 under control.

A second wave of COVID-19 infections in Australia would carve another $25bn from the economy and flatten the vaunted recovery in 2021, “resulting in substantial and rising bankruptcies and job losses”, a new report from the OECD has warned.

In its latest economic outlook, the Organisation for Economic Co-operation and Development described what is at stake as governments around the world attempt to “walk the tightrope” between opening up economies while keeping the worst global health crisis in a hundred years under control.

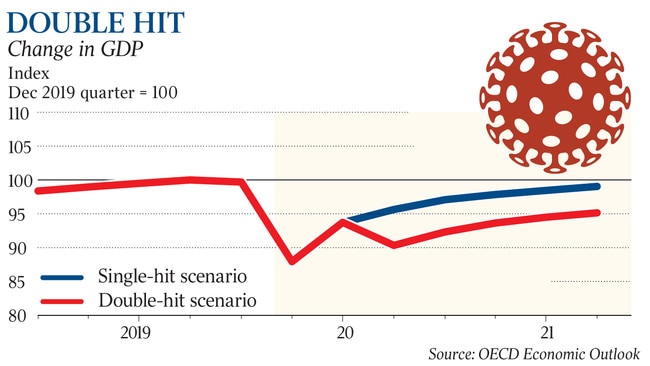

In Australia, a second wave of infections in the December quarter would lead to a year-on-year fall in national output of 6.3 per cent, versus the OECD’s base case expectation for a 5 per cent fall equivalent to about $25bn.

The impact on the recovery, however, is devastating: an anaemic 1 per cent lift in GDP in 2021 under a second-wave scenario, versus the 4.1 per cent rebound currently anticipated. This would leave Australia’s economy $60bn smaller than it would have been without a second wave.

The OECD expects that Australia’s GDP will, on its current trajectory, return to nearly pre-COVID levels by the end of 2021. A second wave, however, would leave it 5 per cent smaller.

OECD chief economist Laurence Boone said that under the “double-hit” scenario, “even if further policy support is provided, such a long period of stress on many companies, particularly in sectors where activity would be severely restricted once again, is likely to result in substantial and rising bankruptcies and job losses”.

The Morrison government is intent on transitioning the economy off “life support” in coming months, and on Monday announced the end of free childcare from July 13 alongside a plan to transition the sector’s workers off the JobKeeper wage subsidy program.

Australia will record one of the shallowest downturns among advanced economies this year, with the projected 5 per cent contraction in 2020 well below the average fall among OECD countries of 7.5 per cent. Among OECD economies, only Korea and Turkey are expected to do better, the report shows.

Josh Frydenberg said Australia’s economic outlook compares “remarkably well to other nations”.

“There is still a long way to go in recovering from this pandemic but we are heading in the right direction and we will continue to do all that is necessary to ensure Australia bounces back stronger on the other side of this crisis,” the Treasurer said.

But the OECD’s decision to highlight the potential for a recurrence of mass coronavirus outbreaks underlines the high stakes of striking a balance between the economic benefits of easing restrictions and the associated risks of a second wave of infections.

Mr Boone said that “as long as no vaccine or treatment is widely available, extraordinary policies will be required to walk the tightrope towards recovery”.

The report details that under the Paris-based organisation’s base-case “single-hit” scenario, world output is projected to decline by 6 per cent this year, but will have almost regained the pre-crisis level at the end of 2021. But a second wave of infections would plunge economies back into contraction through the December quarter and leave global GDP down by 7.6 per cent in 2020 and remain well short of its pre-crisis level by the end of next year.

The grim predictions come as success in squashing the spread of the virus has put state governments under increased pressure to further loosen social distancing restrictions and follows warnings from health officials of a potential coronavirus outbreak in the wake of mass protests in major cities.

Treasury will complete a review of the functioning of the JobKeeper program by the end of June, which will form the basis for any decisions on the future of JobKeeper and other stimulus measure to be announced in the July 23 mini-budget.

Mr Boone said that surging growth in some sectors through the recovery period will be offset by continued weakness in others, which will leave overall activity “muted for a while”.

Governments can provide safety nets to allow workers and businesses to adjust, but they “cannot uphold private sector activity, employment and wages for a prolonged period,” he said.

“Capital and workers from impaired sectors and businesses will have to move towards expanding ones. Such transitions are difficult, and rarely happen fast enough to prevent the number of failing firms from rising and a sustained period of unemployment.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout