The evidence is in, with signs of life in the economy and retailers bouncing back in May, but the 2020 financial year is one most executives will want to forget.

That theory would look even better if there was evidence of actual growth investment through increased capital expenditure, which as the distinct lack of lines outside the big bank lending windows shows is sadly not evident. Now is the time for some farsighted companies to draw a line in the sand and make a bold corporate statement with new investment either at home or through expansion.

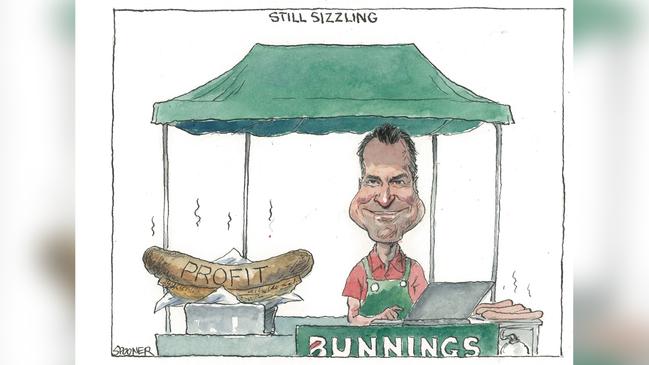

The government’s fiscal stimulus has boosted retail sales in May, with Wesfarmers reporting strong sales growth, led by Officeworks and Bunnings, with general merchandise also picking up in recent weeks.

The strong retail sales numbers were backed by the NAB business conditions report, which showed a bounce in May but it is still well into negative territory.

MST strategist Hasan Tevfik works out price earnings ratios by looking at earnings over a 10-year average, and on that “through the cycle” basis he has the S&P/ASX 200 trading at 18 times, below the long-term average of 21 times.

This suggests some upside to a stockmarket that on most counts is vulnerable to some near-term falls.

Retail sales are volatile, having jumped 9 per cent in March as hoarding set in, slumped 17 per cent in April, but picked up in May.

NAB said business conditions overall fell 45 per cent in April but picked up to be down “only” 20 per cent in May against a long-term average of plus 5.2 per cent.

May showed improvements but, for the overall economy, the numbers are still negative, with most economists tipping GPD to fall 8 per cent or more this quarter after being flat in the first quarter.

Forward orders, according to the NAB survey, were negative 35 per cent in April and down 29 per cent in May.

Wesfarmers surprisingly released its sales update for the financial year for the 11 months to the end of May showing Bunnings up strongly. It doesn’t separately release third-quarter sales numbers, but wanted to get some “clarity” in terms of better-than- expected numbers on the table.

It seems everyone staying at home in the lockdown means the more time you have at home the more you spend on the home.

This is on top of the booming sales at Officeworks, JB Hi-Fi and Harvey Norman with people setting up their home offices.

The Wesfarmers statement underlined talk in the trade saying May was a strong month all around after weak sales in March and April. This suggests the government’s stimulus had the desired effect of boosting sales in the middle of the lockdown.

It also showed some reward for Wesfarmers’ push into online sales and quick adjustment to lockdown conditions.

Whether improved sales continue as the stimulus winds down in September remains to be seen.

Wesfarmers showed strong online growth, up 60 per cent in the financial year to date to $1.4bn, and $1.9bn including new acquisition Catch.

Bunnings posted first-half sales increases of 5.8 per cent, and 11.3 per cent for the 11 months ended May.

Officeworks was up 11.5 per cent and 19.3 per cent respectively.

Kmart was up 7.6 per cent and 6.1 per cent respectively, while online group Catch was up 21.4 per cent, and 43.7 per cent.

Wesfarmers said increased costs, including Target, would mean general merchandise profits would be weaker in the second half of the year.

The group has cost increases of $70m in the second half, including the New Zealand shutdown.

Bunnings spent an extra $20m in cleaning costs, but this was minimal compared to Woolworths, which has told the market its costs increased by $250m during the shutdown with extra security and cleaning.

The bottom line for the retail sector is that the numbers are better than expected, but the real crunch may come at the end of September, when the stimulus ends and banks begin collecting on the home loan deferrals.

Infigen’s short circuit

Amid the stockmarket rally, Infigen’s price fell 0.4 per cent to 81c despite being in receipt of an 80c-a-share takeover bid.

A falling stock price on the day the bidding statement is lodged is not ideal, but then again this deal has its complexities.

The conditionality being the prime objection cited so far, which is not a great starting point.

The other big renewable play in the market is Macquarie’s sale of John Laing Infrastructure which is a roughly $650m play.

With the UK company a seller, maybe Infigen was a potential buyer, but that equation is now a little more complex.

Infigen is a wind-power company born from the late and great Babcock & Brown of pre-global financial crisis fame.

It was listed in 2005 with three wind farms and has grown since to be valued at just under $800m in equity terms with at least $500m in debt.

The debt was refinanced a couple of years ago by Goldman Sachs in what many regarded as an expensive deal.

One question the market has is what sort of change of control trigger is in the refinancing, which could be material.

The major long-term shareholder is UK-based hedge fund the Children’s Investment Foundation, which despite its name is a leading activist, and has shown remarkable patience with Infigen with its 34 per cent stake.

The bidders have no minimum acceptance condition in a highly conditional bid, which is smart given the register.

But given the cash on the table, there is also every chance the UK fund could be a seller.

The bidders, known as UAC, are led by 186-year-old Philippines conglomerate Ayala, which is valued at $14bn and in recent years has expanded into renewable energy in Asia.

They think Infigen is vulnerable because of a proven inability to develop projects and are offering shareholders a new start.

Credit Suisse is advising UAC, with Lazard and Goldman Sachs on the defence in a deal that is in the early stages.

UAC is sitting on 13 per cent and, with the UK hedge fund on 34 per cent, that is 47 per cent of the company in two hands, which is fundamentally unbalanced.

This means Infigen chairman Len Gill is in need of an alternate defence.

FIRB rules ‘too scary’

King & Wood Mallesons in its review of the proposed FIRB rules has called on Josh Frydenberg to consider a staged return away from the $0 threshold on FIRB reviews before the new rules start in January next year.

The concern overall is the Treasurer’s continuation of a trend towards a more legalistic review of proposals that will add time and cost to the process.

The fear is that the new approach will scare away welcome investment.

Bonuses and stock price gains are off the agenda, so it’s a perfect time to load up the costs ready for a 2021 financial year bounce.