Fate of $2bn Virgin bond holders hangs fire

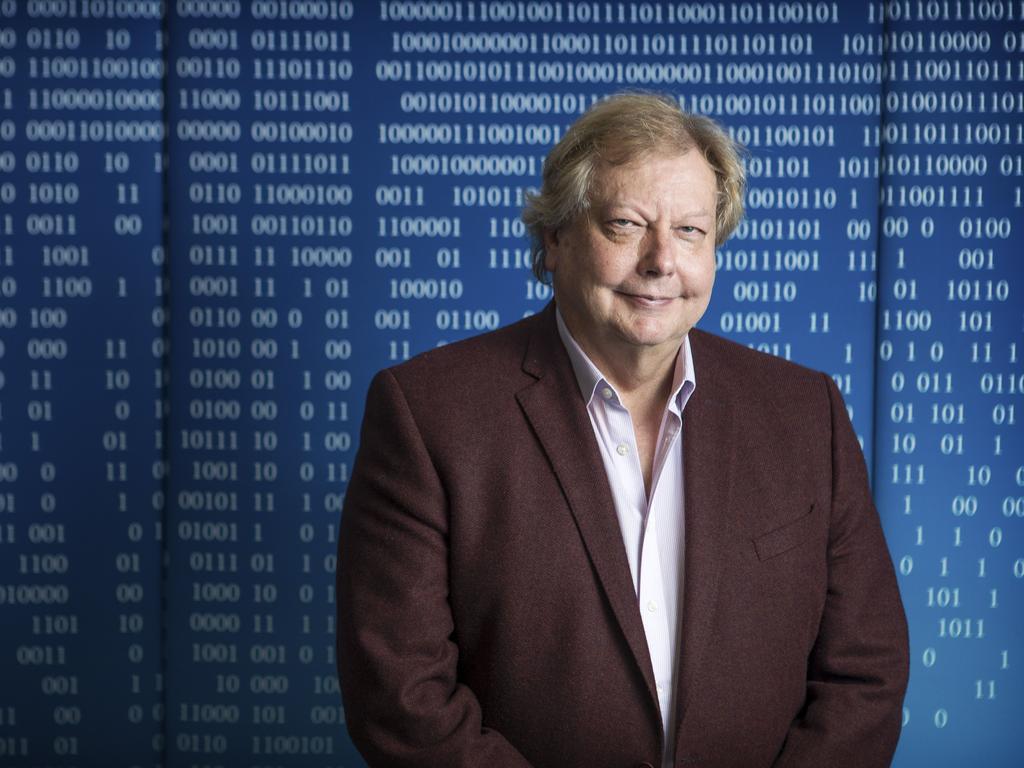

Steven Wright of Morgans says the fate of the Virgin bond holders could affect public confidence in corporate bond market.

The fate of the $2bn unsecured bond holders in Virgin Australia could affect public confidence in the emerging corporate bond market in Australia, Steven Wright, a Brisbane-based director of stockbroker Morgans warned yesterday.

In an interview with The Australian, Mr Wright — whose organisation represents more than 500 mum and dad investors in Virgin bonds, now worried they could lose their investment — said thousands of retail investors in the Virgin bonds and other potential retail investors in corporate bonds were now watching how the bond holders were being treated in the sale process for the airline. “A lot of people are watching to see how the bond holders fare in the administration process,” he said.

Deloitte’s Vaughan Strawbridge, who was appointed administrator of the airline on April 21, is now in discussions with two short-listed bidders, Bain Capital and New York hedge fund Cyrus Capital.

The two bidders have to make binding offers for Virgin by June 22, with Strawbridge selecting his preferred bidder by the end of June. Creditors including bond holders will get to vote on a proposal put to them by Strawbridge at their next meeting on August 22. Mr Wright said the federal government was keen to encourage the development of a corporate bond market in Australia.

He said the success of the Virgin note raising last November was seen as an important step forward in the development of a corporate bond market for retail investors in Australia. But now that the airline had gone into administration with debts of almost $7bn, he said retail investors would be studying the fate of the unsecured bonds holders.

“In all investments there is an element of risk,” he said. “And no one could have predict the COVID-19 pandemic. But we would expect the administrators will treat the bond holders fairly and that they get a level of value for the investments they have made.”

“Investors who have invested in Virgin bonds and notes will be watching.

“This might frame the decisions they make in terms of future investments. People watching the development of the corporate bond market will be watching how this plays out.”

As unsecured creditors bond and note holders ranked the lowest of all creditors.

The two final bidders are expected to brief representatives of the bond holders over the next week on their plans for the airline and their investment proposals.

While Bain has outlined in some detail its plans for the airline Cyrus Capital is yet to make any public statement about its plans for the airline, its staff or the bond holders.

On Tuesday the Secretary of the Department of Infrastructure, Transport, Regional Development and Communications Simon Atkinson told the Senate’s Rural and Regional Affairs and Transport Legislation Committee that subsidies would not save the sector as more than a billion dollars had already been spent to prop up an aviation sector running at 3 per cent capacity.

“The only thing that will restore the aviation sector to a normal commercial basis is the reopening of the economy,” he said, adding that only 31 people passed through Brisbane airport at Easter as opposed to 39,000 in March 2019.

“The number one thing that could materially make a difference to the aviation sector is getting Australians to realise that they can fly safely through COVID-19,” Mr Atkinson said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout