The reversal on the ASX, which briefly entered “bear market” territory was dramatic, however the 3 per cent lift registered at the closing bell was directly parallel to the rise of 3 per cent seen in US futures during the session, reconfirming the ASX is now utterly dependent on Wall Street for momentum.

Moreover, the late turn on the ASX failed to carry with it a string of key stocks, most notably leading property trusts, or A-REITS.

Stockland, Scentre, Goodman and Vicinity were among the key stocks that failed to catch the upswing.

The lack of buying in the property sector was most likely explained by rumours some shopping centre groups might be close to raising equity in what would be a very demanding market. Struggling retailers and landlords have been wrangling for months over rental agreements as retail trade endured one of its worst stretches on record.

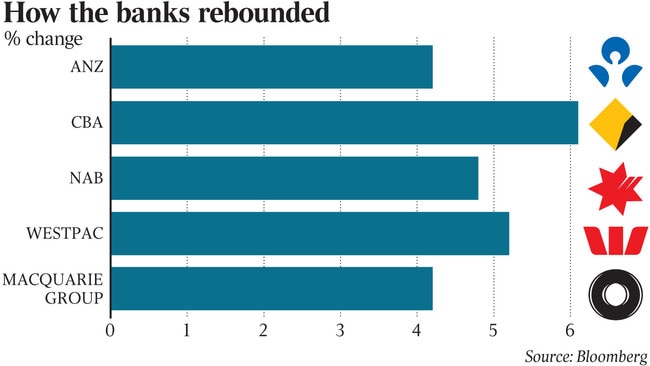

Technically, Tuesday’s rally was driven by bank stocks - the single most important sector on the exchange. All of the major banks put on at least 4 per cent over the session. The standout among bank stocks was Commonwealth Bank which had gained 6 per cent by the close.

Energy companies also added considerable weight to the rebound - but energy stocks did not come close to recovering from the 10 per cent-plus sell-off that followed the alarming plunge in crude prices. Woodside Petroleum rose by 2.1 per cent, Oil Search gained 1.8 per cent, while Santos edged higher by a more moderate 0.6 per cent.

Several so-called market ‘defensives’ such as supermarket group Woolworths and key infrastructure utility stocks such as APA and Sydney Airport also failed to rebound in a market that remains highly volatile.

Traders are waiting to see the nature of fiscal and monetary moves at home and abroad aimed at cushioning the blow of the coronavirus outbreak,

In fact, the majority of analysts were reluctant to draw any conclusions on the panic-like trading patterns this week.

“It is much too early to see a clear pattern in what is being sold off just now - the guiding principle is actually liquidity,” said Mike Aked, director of research for Australia at Research Affiliates.

“However, looking out more broadly, I’d say that Australian valuations are relatively better than many overseas markets and I would include Wall Street valuations in that assessment,” Aked suggested.

Across the market, some globally focussed professional investors are watching the virus recovery statistics inside China - along with recent rallies in China based markets - which some suggest could indicate China will be the first major market to recover economically from the virus drama.

Paul O’Connor, the UK-based head of the multi-asset team at fund manager Janus Henderson said: “Concern has now shifted to the US, where the number of confirmed cases looks set to surge in the weeks ahead. Against that backdrop, investors seem unwilling to recognise that trends are now looking more favourable in China.”

With $US374bn ($566bn) under management at the London fund manager, O’Connor has issued a plucky call: “While it would be foolish to try to call the bottom in the markets, we would rather be buying in this environment rather than selling. We are gradually rebuilding risk exposures into market weakness.”

Australian stocks staged a classic “relief rally” as traders clutched at news the US will soon launch an economic stimulus package.