Here’s the lesson in having an undiversified portfolio.

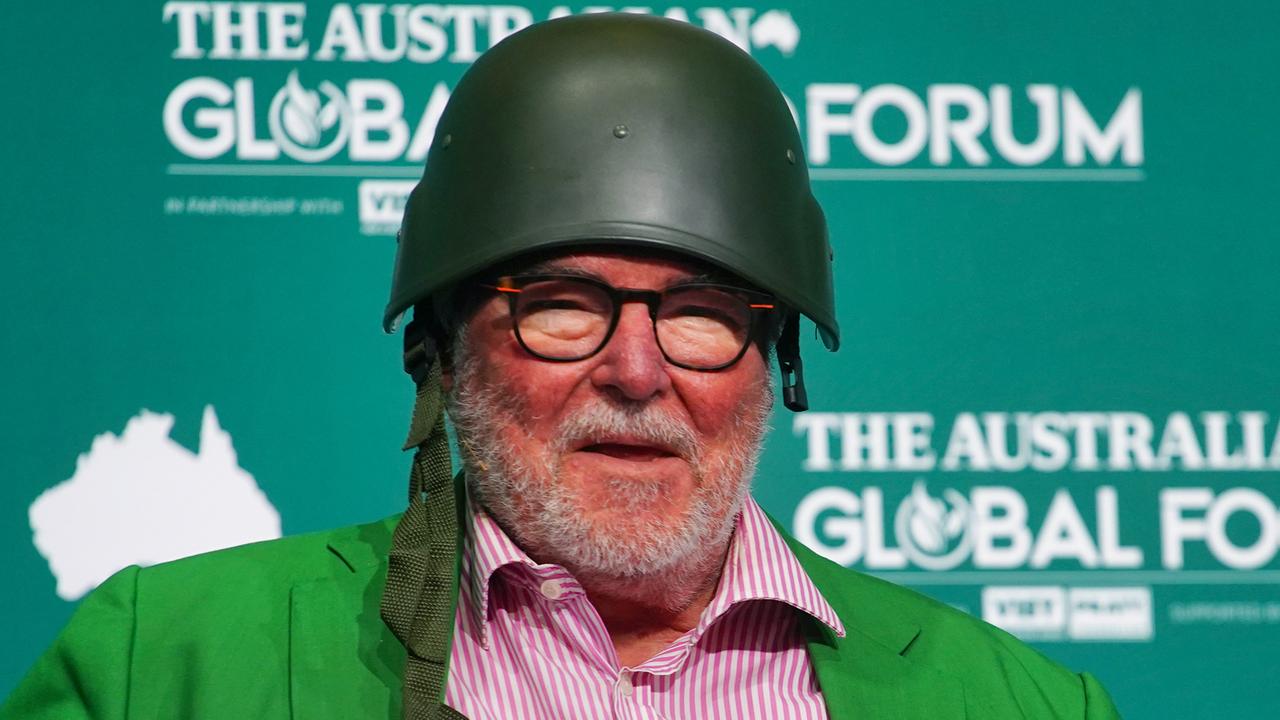

While gaming billionaire James Packer and his trusted lieutenants await news on the future of the Patricia Bergin-led NSW gaming regulator’s paused inquiry into Crown Resorts, shares in the Australian businessman’s listed empire are crumbling amid the unfolding equity market rout.

Coronavirus and the regulatory uncertainty that is overhanging Crown has seen the group’s shares fall by about one-third in value since the start of December last year.

That decline has wiped more than $1bn from the 52-year-old Packer’s personal wealth that’s tied up in Crown.

Ouch.

The now reclusive billionaire has about 35 per cent of the listed Crown, thanks to the collapse of his deal with Hong Kong billionaire, close friend and former business partner Lawrence Ho, who was supposed to buy almost 20 per cent of Crown in a deal that was eventually scaled back to 10 per cent.

At the end of November, Packer’s 237.03 million Crown shares were worth about $3.2bn as the stock traded at $13.18. But since then Crown shares have dropped like a stone to trade down at $8.88. Packer’s stake is now valued at $2.1bn.

That’s $1.1bn down the toilet as traffic at Crown’s Melbourne gambling den continues to decline, thanks to concerns about catching COVID-19 there.

It’s all looking like a hospital pass to new Crown boss Ken Barton and chair Helen Coonan, who took over from former executive chair John Alexander at the end of January.

The news isn’t great for new shareholder Ho either.

He paid $13 a share for his 67.675 million Crown shares and so is down $280m on the deal.

They might do better playing the pokies.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout