ASX reverses decline as Trump unveils ‘major’ US stimulus

European markets are mostly higher as oil claws back losses after the ASX closed up 3.1pc on hopes of a US stimulus plan.

- Xi Jinping visits virus epicentre

- BHP on bargain hunt amid slump

- US stimulus buffers ASX fall

- NAB business conditions at lowest since 2013

- Qantas grounds most A380s as flights cut

- Virus impact worse than GFC: PM

That’s all from Trading Day for Tuesday, March 10. Join us Wednesday for real-time coverage of the markets.

In London, the FTSE 100 opened 0.6 per cent lower as WTI crude oil rose 4.8 per cent to $US32.63 a barrel, and Brent was up 4.5 per cent, at $US35.92 a barrel.

Germany’s DAX was 0.9 per cent higher in opening trade. Italy’s FTSE MIB was up 1 per cent and the CAC 40 in Paris was 1.3 per cent higher as the market started trading.

In the latest rollercoaster session for the ASX, the market clawed a 3.1 per cent daily gain, coming back from a 3.8 per cent early tumble.

The swing was largely fuelled by hopes of US stimulus as US President Donald Trump foreshadowed likely payroll tax cuts and assistance for hourly wage earners. Energy names such as Woodside and Santos led the recovery, rebounding by more than 6pc after 20pc falls yesterday.

Local strength came despite a near-7 per cent plunge across all Wall Street indexes overnight that forced a 15 minute trading time-out – its first in more than two decades. The Australian dollar was lower by 0.4pc to US65.59c and futures trade suggests a 2.6pc lift on US markets tonight.

For more markets content – listen to this special Money Cafe episode covering off all the market turmoil.

Glenda Korporaal 9.00pm: Miners can absorb virus shock

In mid-January, Fortescue Metals Group chief executive, Elizabeth Gaines, was in Shanghai opening the company’s new office in China.

China’s steel production had hit a new record of almost a billion tonnes (996 million tonnes) in 2019, up by 8.3 per cent from the previous year thanks to strong growth in the property sector and government spending on infrastructure.

Gaines had met with representatives from the powerful China Iron and Street Association and its customers who indicated that they were expecting it to go up by another 2-4 per cent this year.

For Fortescue, which sells most of its iron ore to China, producing the ore “at full pelt” from its operations in the Pilbara, and supplies from rival Brazilian iron ore miner Vale still down, it was another strong outlook.

Fast-forward two months and it is a very different atmosphere in China. Given the coronavirus crisis, Gaines is not travelling to China later this month for the annual Boao forum on Hainan Island which Fortescue has backed for the past 12 years. It has been cancelled along with all other conferences in China.

Cliona O’Dowd Exclusive 8.35pm: Fund managers urge caution

After the most panicked selling in markets since the global financial crisis, investors are braving the turmoil to hunt for bargains. But fund managers are cautioning that care must be taken when buying in a volatile environment.

“We always keep a bit of powder dry for moments like this, so we’ve got a bit of cash we can deploy,” Contact Asset Management portfolio manager Tom Millner told The Australian.

Sydney Airport, Transurban and BHP are among the companies that look attractive at current levels, Mr Millner said, because “they’re good quality long-term holdings and we’ll be comfortable holding the position in the portfolio for a long time”.

Healthcare, likewise, looked more resilient in the current market than some other sectors, he noted, as he called out Sonic Healthcare, Ramsey and Invocare as potential opportunities.

7.45pm: CBA cuts rates on business loans

Commonwealth Bank said on Tuesday night that in response to potential coronavirus impact, it was reducing rates on business loans by 25 basis points.

The bank said it will provide additional resourcing and extended hours for commercial lending teams to ensure faster decision times for small business loans and provide a range of support measures to impacted business customers by deferring repayments and waiving fees.

CBA said it will work to prioritise payments to small and medium business suppliers, and look at ways to offer flexibility to those whose activities have suffered disruption due to the coronavirus outbreak.

“Currently two-thirds of our suppliers are on immediate payment terms, and we will continue to move more of our existing suppliers to immediate payment terms where practical,” the bank said in a statement on Tuesday.

CBA CEO Matt Comyn said: “Commonwealth Bank’s strong financial position means Australians can have confidence in our ability to support the economy in this period of difficulty, through to a time of recovery.”

Commonwealth Bank outlined a range of measures and support available to customers and businesses in response to the spread of coronavirus (COVID-19).

7.15pm: FTSE opens 0.6pc down; oil gains

International markets regained ground after Monday’s bruising selloff, with American stock futures gaining 2.6 per cent, as investors welcomed the prospect of new US tax cuts and other measures to counter the economic pain caused by the coronavirus.

In London, the FTSE 100 opened 0.6 per cent lower as WTI crude oil rose 4.8 per cent to $US32.63 a barrel, and Brent was up 4.5 per cent, at $US35.92 a barrel. Germany’s DAX was 0.9 per cent higher in opening trade. Italy’s FTSE MIB was up 1 per cent and the CAC 40 in Paris was 1.3 per cent higher as the market started trading.

Dow Jones Newswires

James Kirby, Wealth editor 7.05pm: Key stocks miss ASX ‘relief rally’

Australian stocks staged a classic “relief rally” as traders clutched at news the US will soon launch an economic stimulus package.

The reversal on the ASX, which briefly entered “bear market” territory was dramatic, however the 3 per cent lift registered at the closing bell was directly parallel to the rise of 3 per cent seen in US futures during the session, reconfirming the ASX is now utterly dependent on Wall Street for momentum.

Moreover, the late turn on the ASX failed to carry with it a string of key stocks, most notably leading property trusts, or A-REITS.

Stockland, Scentre, Goodman and Vicinity were among the key stocks that failed to catch the upswing.

6.57pm: Virgin Australia ‘has flexibility’: Fitch

Ratings agency Fitch said air carrier Virgin Australia “has the flexibility” to manage potential cashflow pressures over the short term that may stem from falling demand for air travel due to the COVID-19 outbreak. The airline is rated B+ by Fitch.

“The airline’s high levels of liquidity reported at 31 December 2019, combined with cost savings already achieved under its strategic cost-reduction program and enhanced operational discipline under the airline’s new CEO, will provide the airline with time to implement measures to address any issues it may face,” Fitch said.

The comments follow a pounding of Virgin’s share price in recent weeks with the air carrier closing on Tuesday at 7.5c, down 6.2 per cent.

Nick Evans 6.21pm: Copper Mountain defers Canada mine expansion

Dual-listed Copper Mountain Mining says it has deferred an expansion of its Canadian copper mine, blaming the coronavirus-driven market meltdown for the decision.

Copper Mountain said on Monday it has rejigged the plan at its mine in British Columbia, downgrading 2020 production and pushing back the installation of a new ball mill at the processing plant to save cash amid a falling copper price.

The company downgraded production to 31,000 to 34,000 tonnes of copper, from 39,000 to 43,000t. It also expects to produce 24,000 to 28,000 ounces of gold.

Copper Mountain had $C32.1m ($35.9m) in cash at the end of December, after posting a $C28.4m loss in 2019.

Copper has fallen from a 2020 high of $US6302 in mid-January to $US5535 on Tuesday as fears of a global economic slowdown took hold.

Copper Mountain shares fell 4.5c, or 8.9 per cent, on Tuesday to close at 46c.

Ben Wilmot 4.52pm: Scentre suspends $800m share buyback

Market turmoil has up-ended the traditional safe haven of property and Westfield owner, the Scentre Group, on Tuesday said it had suspended its $800m share buyback due to increased levels of market volatility.

The mall landlord had bought about 126.61 million shares for $479m under its $800m buyback plan at an average price of $3.78. This was well above its price of $3.025 in late Tuesday trading.

Scentre said it would now use the remaining $321m to reduce outstanding debt and to provide it with additional liquidity.

Jefferies analyst Sholto Maconochie said that since its full year result on February 18, Scentre had acquired $175m of units at an average price of $3.61, implying a 19 per cent discount to its net asset backing of $4.46.

Scentre trades at about a 32.1 per cent discount to asset backing, with a forward dividend yield of 7.7 per cent.

Jefferies said the buyback was not a good use of capital given Scentre’s balance sheet and market conditions but was 0.6 per cent accretive.

4.42pm: Energy stocks lead a market bounce

Energy stocks led the rebound on Tuesday, with gains across the sector as oil prices staged a slight rebound – by the close, crude oil and WTI futures were gaining by roughly 7 per cent.

That was after both benchmarks plunged 25 per cent on Monday, dropping to their lowest since February 2016 and recording their biggest one-day percentage declines since January 17, 1991, when oil prices fell at the outset of the US Gulf War.

Woodside Petroleum rose by 2.1 per cent to $22, Oil Search gained 1.8 per cent to $3.63 while Santos edged higher by a more moderate 0.6 per cent to $4.92.

Caltex edged higher by 2.5 per cent to $27.50 and Origin put on 3.9 per cent to $5.94.

The shine extended to heavyweight miners – BHP put on 6.2 per cent to $29.25 as chairman Ken MacKenzie said the miner was looking to capitalise on the market turmoil.

Rio Tinto put on 3.5 per cent to $83.61 while Fortescue gained 6.8 per cent to $9.16.

Here’s the biggest movers at the close:

4.13pm: US stimulus fuels ASX bounce

Expectations for major US stimulus measures and a slight rebound in oil prices, sparked a more than 7 per cent intraday turnaround on the ASX, to finish at daily highs.

The turbulent session followed a more than 7.5 per cent drop across all three major US indexes for the worst fall since the GFC in what was termed as “Black Monday, even triggering an emergency 15-minute trading time out for the first time in since 1997.

At the local open, shares sunk as much as 3.8 per cent to lows of 5538.9 – putting the index firmly in bear market territory, that is a 22 per cent drop from its recent record highs of 7162.5.

A marked shift in sentiment took over the market by midday however, with shares staging a strong 7.2 per cent intraday swing after US President Donald Trump foreshadowed stimulus measures to combat the coronavirus outbreak – including a possible payroll-tax cut and help for hourly wage earners.

By the close, the benchmark ASX200 was higher by 179 points or 3.11 per cent to 5939.6.

That takes the market out of bear territory, but still, considering the market’s $140bn wipe-out yesterday, there’s still a long way to go.

The All Ords meanwhile added 173 points or 2.98 per cent at 5995.8.

Will Glasgow 3.15pm: Xi Jinping visits virus epicentre

China’s President Xi Jinping has arrived in Wuhan – the epicentre of the COVID-19 outbreak – just over three months after he first gave orders on the health crisis in early January.

China’s state controlled CCTV has reported that Xi, who is also the General Secretary of China’s Communist Party, arrived in Hubei’s capital on Tuesday morning.

A report in the Hong Kong media over the weekend said that Xi’s trip to Hubei would include visits to coronavirus hospitals, including the two Leishenshan and Huoshenshan “flat pack” hospitals whose hasty construction has featured prominently in China’s propaganda campaign about the central government’s response to the crisis.

#China President Xi Jinping flies to #coronavirus epicenter Wuhan to inspect prevention/control work Tue AM, state media report. Xi visited medical staff, military, police, officials, community. (Good sign Beijing believes it has #COVIDー19 under control for Xi to show up there.)

— Eunice Yoon (@onlyyoontv) March 10, 2020

John Durie 3.13pm: ANZ extends travel ban domestically

ANZ this morning extended a non essential travel ban from international to domestic flights as part of its attempts to limit exposure to the coronavirus.

Chief executive Shayne Elliott told the British Australia Chamber of Commerce lunch in Melbourne he had also decided to convert a leadership conference of his top 60 executives next week to a teleconference rather than meeting in Melbourne as planned.

When asked if people were overreacting to the virus he said possible but “we are dealing with the real world and whether rational or not people are reacting”.

“We will do anything sensible we can to look after our people,” he added.

2.40pm: US stimulus may miss travel industry

Bloomberg says the US virus aid package due later Tuesday will likely leave out any aid for the travel industry, according to unnamed people familiar with the matter.

President Donald Trump earlier today said stimulus measures would likely include a payroll tax cut and a short-term expansion of paid sick leave, but the absence of support for the travel industry raises the risk that the plan won’t go far enough to satisfy investors.

Risk assets remain hopeful at this point, with S&P 500 futures up 2.5pc. But such large gains in Asia are rarely realised in the day session.

2.02pm: Qantas balance sheet strong: Moody’s

Ratings agency Moody’s says Qantas has a strong “balance sheet and good liquidity” to navigate the crisis.

While the coronavirus “is clearly credit negative for the airline industry” Moody’s notes Qantas has a financial framework that is forward-looking and is used to make capital allocation decisions.

“With the outlook for both Qantas as well as the airline industry globally deteriorating rapidly, the framework dictates that Qantas take pre-emptive action to ensure it maintains its credit metrics within the parameters for its Baa2 rating”.

Comments follow Qantas earlier Tuesday slashing capacity as part of efforts to cut costs.

1.55pm: BHP on hunt for bargains amid slump

BHP is well positioned to seize investment opportunities that arise amid the global slump, according to chairman Ken MacKenzie, as cited in a Bloomberg report.

Mr MacKenzie noted that “value is created at the bottom of the cycle” and that BHP has worked to create “a business that is ready for the bottom of the cycle at all times”.

“I’m not sure if there will be any opportunities that come from this, but if there are we are actually in a position to act.”

BHP shares last up 3.1pc to $28.41.

1.52pm: Industrials re-entry level emerging: Citi

After a drop in basic industrials to 52-week lows, Citi analysts note there are some re-entry opportunities emerging, particularly for Amcor and James Hardie.

Analyst Daniel Kang notes that the global outbreak of coronavirus has weighed on the sector, but with stimulus measures underway, together with OPEC’s breakdown and subsequent oil price collapse, there could be scope for buying.

“The market has also been quick to price in potential balance sheet risks from a weaker growth environment. This has seen Boral, Adelaide Brighton and Incitec Pivot underperform their Basic Industrial peers. In our view, these fears may have been overplayed,” Mr Kang says.

He highlights Amcor as an attractive portfolio holding with high single digit growth, and reiterates preference for James Hardie as the US housing market recovers.

1.36pm: RBNZ not out of ammunition yet

The Reserve Bank of New Zealand says it has several other tools with which to influence the economy if it runs out of interest-rate ammunition.

The central bank on Tuesday outlined “unconventional” monetary policy options that it has been researching and which range from purchasing New Zealand government bonds to implementing measures against cash hoarding by banks.

RBNZ Governor Adrian Orr said New Zealand doesn’t need to use such tools yet, but it is better to be prepared for a zero interest rate environment.

The central bank is expected to cut its cash rate, currently at 1.0pc, to a new record low to help cushion the economy from the coronavirus epidemic. The RBNZ is due to meet on March 25.

Mr Orr said prerequisites for using unconventional policy would include the capacity to meet the central bank’s statutory goals for inflation and employment.

Dow Jones Newswires

1.13pm: China’s CPI eases for Feb

China’s consumer inflation moderated slightly in February, after hitting its highest level in more than eight years in January, as non-food prices eased.

The consumer price index rose 5.2pc in February, slowing from a 5.4pc in the previous month, according to data released by the National Bureau of Statistics on Tuesday. The key inflation reading was slightly higher than a median forecast of 5.1pc increase by economists in a poll by The Wall Street Journal.

Food prices in February grew 21.9pc from a year earlier, accelerating from 20.6pc in January. Pork prices surged 135.2pc on year in February, higher than a 116pc increase in January. Pork prices alone boosted headline CPI by 3.19 percentage points in February.

Non-food prices rose 0.9pc in February, easing from a 1.6pc increase in January. Consumer prices in February rose 0.8pc on month, moderating from a 1.4pc growth in January.

1.02pm: Energy leads market recovery

The local market has staged a recovery in lunch trade, coming back from a drop of 3.8pc to trade higher by 1 per cent.

After taking a more than 20pc battering yesterday, energy stocks are leading the lift – Woodside up 5.4pc, Santos by 4.6pc and Oil Search by 3.9pc.

Even Qantas is higher by 10.4pc despite cutting capacity on its international flights earlier today.

Here’s the biggest movers at 1pm:

12.56pm: Oil prices claw back ground

Oil prices surged more than six per cent in Asian trade Tuesday following heavy losses a day earlier after top exporter Saudi Arabia began a price war with Russia.

West Texas Intermediate was trading up 6.1 per cent at more than $33 a barrel while Brent crude advanced 6.6 per cent to over $36 a barrel.

Prices had plunged by almost a third Monday, the biggest drop since the 1991 Gulf War, after Riyadh drove through massive price cuts in a bid to win market share.

That came after Russia rejected calls from oil-exporting group OPEC, which includes Saudi Arabia, for deeper output cuts to combat a coronavirus-fuelled slump in demand.

AFP

12.49pm: ASX could avoid bear market

Australia’s sharemarket now back in the green, having bounced 5.9pc from an intraday low of 5538.9.

The S&P/ASX 200 is up now 1.8pc at 5871, led by a 2.6pc rise in S&P 500 futures on amid hope of US fiscal stimulus.

Having pared its fall from the record high close to 18pc, the S&P/ASX 200 might avoid entering an official “bear market” today after all.

But as was the case last week when the S&P 500 rose more than 4pc on two occasions, it should be said though that bounces of this magnitude were frequent during the GFC.

12.39pm: Markets in need of fiscal fix: Innes

Global financial markets are “desperately in need of a fiscal fix” as the world is “on the verge of a credit crisis,” according to AxiTrader chief market strategist APAC, Stephen Innes.

“As we saw in 2016, not many shale or oil sands or even standard energy companies are cash flow positive with oil below $US40,” he notes after crude oil plunged 25pc on the breakdown of OPEC+ supply talks.

“Meanwhile, missed payments from airlines, tourism companies, and the hospitality industry are likely coming soon. Credit was already trading on edge Friday before the Saudi donned the boxing gloves.”

In his view a global fiscal response is needed “because we are potentially on the cusp of a credit crisis driven by cash flow shortages and bankruptcies across a meaningful list of industries”.

12.29pm: Mesoblast therapy tested for COVID-19

Dual-listed Mesoblast says its stem cell therapy is being evaluated for treatment of patients with lung disease caused by coronavirus (COVID-19).

In a notice to the market, the company said its Remestemcel-L had the potential for use in the treatment of acute respiratory distress syndrome, noted as the principal cause of death in coronavirus infection.

“The Company is in active discussions with various government and regulatory authorities, medical institutions and pharmaceutical companies to implement these activities,” it said.

Shares in the group are up 26pc to $2.31.

12.12pm: Market hopes riding on US stimulus

There’s clearly a lot of hope riding on US President Trump’s stimulus plans due to be unveiled Tuesday afternoon US time.

Of course in the current environment of extreme volatility the risk is that it won’t be enough and investors will react by selling risk assets “on the fact”.

Australia’s S&P/ASX 200 is down 0.4pc at 5737 after briefly regaining positive territory following an early 3.8pc fall to a 15-month low of 5538.90.

The early sell-off was much less than a 5.6pc fall implied by overnight futures as US futures surged as much as 2.1pc after Trump called for stimulus.

Volume was almost twice the 20-day average, suggesting that there was strong buying, not just an absence of selling.

The bond market is also pricing something in with the US 10-year yield up 12bps to 0.6633pc.

12.06pm: Qantas snaps 12-day losing streak

Qantas shares have bounced to 1.7pc gains in midday trade to cap a 12-day losing streak, as chief Alan Joyce took the drastic step to forgo his pay for three months amid the coronavirus crisis.

The company this morning announced it would slash its international capacity to curb the virus impact, while Mr Joyce, chairman Richard Goyder and executive management all are set to have their pay cut.

QAN shares have been under the pump over the past month, hitting lows of $3.85 but last traded up 1.7pc to $4.22.

11.48am: Energy in broad recovery

Local energy stocks are reversing yesterday’s losses with all of the sector in the green bar Whitehaven Coal.

Woodside is notching outsized gains of 4.7pc or $1.02 while Santos is adding 2.9pc, Oil Search by 3.9pc and Worley Parsons by 2.7pc.

Local gas developer Cooper Energy is adding 7.3 per cent in morning trade after a 13pc drop amid the oil wipe-out yesterday. Beach Energy is also up 6.2pc to $1.41.

Whitehaven is the only slightly lower – down 0.3pc.

11.36am: Nikkei tumbles 3.7pc

Tokyo’s key Nikkei index is shedding 3.7 per cent in early trade on Tuesday following a blistering sell-off on Wall Street sparked by a crash in oil prices and fears over the coronavirus.

The benchmark Nikkei 225 index slipped after the opening bell, trading down 3.7 per cent or 724 points at 18,904.5 while the broader Topix was down 2.85 per cent or 39.53 points at 1,349.44.

“Japanese shares are seen falling sharply in reaction to the rout in the US market, and the Nikkei 225 may dip below the 19,000 level,” Toshiyuki Kanayama, senior market analyst at Monex, said in a commentary.

AFP

Gerard Cockburn 11.34am: Business conditions at lowest since 2013

Business confidence and conditions fell last month, with the impact of coronavirus expected to further drag down a weakened Australian economy.

According to the latest NAB monthly business survey, confidence fell three points to minus four and business conditions fell 2 points to zero – the lowest since 2013.

Forward orders significantly deteriorated well into the negative, falling three points to negative four.

Business sentiment weakens, interestingly with NAB reporting 50% of firms suggest no impact this month - seems little doubt this is to come and a further deterioration should be expected, lack of timely assistance for the business sector would only exacerbate this #ausbiz pic.twitter.com/tCB0Kt8Fg0

— Alex Joiner (@IFM_Economist) March 10, 2020

11.30am: Telstra wins federal payphone fight

Telstra has won a court fight against major Australian councils over upgraded payphones featuring 75-inch billboards.

Melbourne, Sydney and Brisbane city councils took the telco giant to the Federal Court, arguing large digital screens on the back of the Telstra’s payphones were masquerading as ads and required planning approval.

Justice David O’Callaghan on Tuesday ruled the payphones were low impact and tossed out the councils’ court challenge.

TLS shares last traded down 1.3pc to $3.44.

AAP

Michael Roddan 11.21am: Virus may force double stimulus: Costello

Peter Costello has raised the prospect the Morrison government could be forced to unveil a secondary stimulus package in the May federal budget if the coronavirus crisis hits the economy deeper than expected.

The former Treasurer also called on the government to lower the deeming rate, arguing a rate that was out of step with the falling Reserve Bank cash rate could push retirees into risky investments, such as the stockmarket, when they should be gearing their portfolios conservatively.

Scott Morrison is expected to announced a limited stimulus package this week aimed at encouraging employers not to sack workers and to encourage household spending.

Mr Costello said the federal government was unlikely to be able to follow US President Donald Trump, who is considering a payroll tax cut to keep workers in jobs, as the state governments would demand the shortfall in revenue to be footed by Canberra.

“The government will have to do, they will have to change the deeming rates,” Mr Costello told a business forum on Tuesday.

“We don’t want our deeming rates to push people back into risky investments. We will have to change those deeming rates.”

Bridget Carter 11.13am: Scentre tipped for equity raise

DataRoom | Westfield shopping centre owner Scentre Group is being tipped as among the most likely of the retail-related real estate stocks that will be forced to raise equity, as panic selling continued on the market Tuesday morning.

As retail tenants fight for survival, valuations of its malls have fallen, leaving Scentre’s balance sheet in need of replenishment, according to some market analysts, who say its debt to equity ratio has narrowed.

During its full year results, Scentre Group, which owns Australian Westfield centres, said its net debt was $12.9bn. Its market value is now $15.87bn with its share price falling to $2.96 in Tuesday morning trade after hitting $4 in January.

In February, Scentre posted a $1.2bn net profit.

More to come

Leo Shanahan 11.08am: Seven West debt now 3x its market value

Seven West Media shares have sunk to another all time low of 11 cents amid a struggling media environment and further speculation the Olympics will cancelled because of the coronavirus.

Seven has debts of around $550m, more than three times its current market cap.

The Australian reported last week that Seven was making contingency plans for the cancellation of the games, but it was still not clear whether insurance would cover advertising deal worth an estimated $90m – $100m.

Seven says its latest advice from the IOC is the Olympics are proceeding as planned.

SWM last flat at 11.5c.

Bridget Carter 11.03am: Virgin in spotlight as bonds slide

DataRoom | Virgin Australia debt investors remain on tenterhooks as they watch the $100 price they paid for their bonds slide to about $62 Tuesday morning only months after taking up the offer.

The bonds closed at below $70 on Monday. However, trading was slim in the Virgin bonds, which are listed here in Australia, with only 16,631 bonds traded.

Sources on Tuesday said that the primary bond market was mostly closed, with spreads on oil-related stocks such as Santos blowing out.

Investment bank UBS helped Virgin Australia last year on its bond raising, which secured $325m to help pay for its acquisition of the remaining 35 per cent stake in the Velocity frequent flyer program that it did not own for $700m.

At the end of December, Virgin Australia’s adjusted net debt was $5bn, up from $3.9bn and it posted an $88.6m statutory loss.

10.57am: Aussie energy better placed to handle crash: MS

Australian energy stocks are better positioned now to handle a period of low oil prices than they were during the last oil price correction, according to Morgan Stanley.

Analyst Adam Martin points out that at the time of the last oil slump, many local companies were mid way through a heavy LNG construction cycle.

“This time around, balance sheets are better, operating costs are lower and spending really hasn’t started on expansion opportunities. There is time to delay these plans and ensure the commodity environment firms up,” Mr Martin notes.

He says Woodside will likely have to delay its Scarbrough expansion, while Santos could slow spend on growth but Oil Search will remain under the pump after the hit from its roadblocks in PNG.

“The energy stocks are now starting to imply prices below even the most conservative long-term expectations across the investor base. Energy stocks may be close to finding a floor but it’s not easy to predict in the shorter term given COVID-19,” Mr Martin adds.

10.40am: Energy, tech reverse losses to trade up

Energy and tech names are now firmly in the green as investors take some reassurance from “very substantial relief” from Donald Trump.

President Trump said the administration would discuss with Congress several measures to ease the economic pain inflicted by the coronavirus, including a possible payroll-tax cut and help for hourly wage earners.

Woodside is reversing yesterday’s more than 20pc drop to trade up 1pc, while Oil Search puts on 1.7pc and the major miners BHP and Rio Tinto recover most of their losses from early in the session.

10.32am: US stimulus prospects buffer ASX fall

US President Trump’s call for “major” fiscal stimulus pushed US futures up sharply at the Asia open and has fuelled a 160 point bounce in the ASX.

S&P 500 futures rose are rising 1.5pc in early trading, preventing Australia’s S&P/ASX 200 from achieving the expected 5.6pc opening fall based on overnight futures.

The ASX hit a low of 5538.9 but is now just 20 points lower to 5739.9.

However a daily close today below 5730 will start a “bear market” defined as a fall of at least 20 per cent from a peak.

But there have been some sharp dives in major stocks with CSL, NAB, NAB, Sydney Airport and Goodman Group falling more than 10pc in early trading.

The Tech sector is the only underperforming now but all sectors are still in the red.

[CHART] ASX 200: selling urgency eases on Tuesday - market bounces having been down 3.8% at opening lows; US futures rally in after hours trade reacting to news US President Trump will seek payroll tax cut & “very substantial relief†industries hit by the virus #ausbiz pic.twitter.com/yTxhqLrYsV

— CommSec (@CommSec) March 9, 2020

10.25am: ANZ confidence drops to May ’14 low

ANZ’s read on consumer confidence fell for a third consecutive week, marking a more than 8pc cumulative decline.

The survey’s read on ‘current economic conditions’ was the worst hit, down 8pc and adding to the massive 16.6pc decline in the previous reading.

ANZ head of Australian Economics, David Plank said fears of the near-term economic outlook were now at the lowest since the GFC.

“Sharply weaker equity prices and the RBA rate cut probably added to the negative sentiment. The cumulative fall over the last two weeks for the index is more than 7pc,” he said.

“There have been only four instances when the cumulative two-week fall was greater, emphasising the downside risks posed by current developments.”

ANZ-Roy Morgan Australian Consumer Confidence fell 4.2% last week. This was the third consecutive fall, for a cumulative decline of more than 8%, taking the index to a low last seen in May 2014. #ausecon #ausretail @DavidPlank12 @roymorganonline pic.twitter.com/T8r6VzLjuU

— ANZ_Research (@ANZ_Research) March 9, 2020

10.12am: Shares shed 4pc, enter bear market

Local shares are lower by 3.8 per cent or 218 points to 5542.2 in early trade, a slightly smaller drop than futures had indicated.

Still, that puts the ASX firmly in bear market territory – down 22pc from its recent record highs of 7162.5.

Energy shares are still coming under pressure, but its healthcare that is posting outsized losses, down 5.1pc.

10.07am: Don’t be anchored to past losses: Macq

Don’t be anchored to the past, Macquarie Wealth management’s analysts say now it the time to look at holding quality shares.

“During periods of volatility, equity investors rotate to low volatility stocks with higher earnings certainty, while also keeping some exposure to sectors that have already sold-off,” they say.

“While some names are sold at a loss, it’s important not to be anchored to past decisions when the outlook changes. Shifting to quality is a common response in volatility, as it is often higher quality stocks that lead the market higher when it eventually bottoms.”

Max Maddison 9.58am: Market volatility will ease: PM

Global markets will become “less volatile” as coronavirus datasets become more available, says Scott Morrison.

In a speech to business leaders on Tuesday morning, the Prime Minister said markets were currently attempting to reprice the risk surrounding the path and trajectory of COVID-19.

“There’s a lot of uncertainty. So as they reach around and seek a price there’s a lot of volatility, and we see the challenge to liquidity in these markets,” Mr Morrison said. “I would expect to see that settle in terms of price risk with more information.”

Mr Morrison also said it was important for the Reserve Bank to keep an eye on liquidity issues, but wouldn’t be drawn into speculating whether Australia could expect to see quantitative easing in the near future.

“I’ll leave questions about quantitative easing to Phillip Lowe,” he said.

Read more: PM’s fast-track cash to beat coronavirus

9.56am: ING boosts Aussie profits 10pc

Dutch multinational ING says it boosted its Australian profit by nearly 10 per cent to $440m in 2019 as it grew its local customer base.

The bank on Tuesday said it attracted 423,000 new Australian customers last year for a total 2.6 million, with a 30 per cent rise in the number of Australians treating ING as their main bank. ING said its primary customers now total 833,000.

The bank said retail deposits grew 9.9 per cent to $37bn in its 20th year of operating in Australia, with mortgages up 6.3 per cent to $52bn, and business loans expanding by 9.2 per cent to $4.9bn. Personal loans surpassed $245m.

“Savings and loans are the backbone of the business, but I have been particularly pleased with the growth of our consumer lending through personal loans and the Orange One credit card,” ING Australia chief executive Uday Sareen said on Tuesday.

AAP

9.51am: Forced selling to dominate moves

Another trader says today will be “the” day of forced selling.

“I don’t think that anyone will stand in front of this until we get to 5000’ish which will be a 30 per cent fall from the 7200 high,” he notes.

But he adds the market will initially try to hold 5410 – the December 2018 low.

It’s worth noting that the equivalent level held on the SPI last night at 5330.

9.45am: Margin selling to add to market turmoil

Forced selling of Australian shares to close margin accounts, even those with massive buffers, is expected to feature heavily again today.

Most of that selling is likely to go through at 11.00am but the market could fall extremely sharply early to make room for the selling.

“If the market drops heavily again this morning, some who have had huge margins will come into the firing line,” says an institutional trader.

“These ones you expect to have been more prudent given they gave themselves a big margin to work with that has not been cut to very skinny.

“Some will just want all the worries to go away and will liquidate. So I’d say there will be some more today but after that if the market then bounces, as it will very soon, that may be the washout of all the margin selling from this -20 per cent washout so far.”

He expects institutional buying to emerge at some stage but warns our market will also track US futures amid vulnerable global markets.

Another trader says he can’t even get through to his margin lender to check this morning, and on that basis suspects there’s more to come.

Read more: Margin calls quadruple amid rout

Adeshola Ore 9.44am: Gov’t advises against cruise travel

The federal government’s Smart Traveller website is warning Australians to reconsider overseas cruise travel.

“Australians, particularly those with underlying health concerns should reconsider taking an overseas cruise at this time due to COVID-19,” the statement on its website reads. The federal government says Australians should not rely on being repatriated from cruise ships affected by the virus.

The advice is in line with the US State Department’s warning that US citizens with underlying health conditions should not travel on cruise ships.

Read more: Aussies warned over cruises

9.38am: Futures suggest 5.6pc early drop

Australia’s sharemarket is set for another huge fall today, as global markets closed near their lows, plunging as expected on the oil price collapse.

The S&P 500 was pummelled by 7.3pc to a 9-month low of 2646.56 in its worst day since the GFC as its energy sector fell 20pc, financials fell 11pc and materials and industrials fell more than 11pc.

Brent crude closed down 24pc at $34.36 on the apparent breakdown of the OPEC+ alliance to control supply.

Overnight futures on the S&P/ASX 200 fell 4.8pc but the index is expected to open down 5.6pc at a 15-month low of 5438 after adjusting for fair value. That will leave the index 24 per cent down from its record high of 7162.5 just over two weeks ago.

A close at or below 5730 will start a “bear market”, defined as a fall of at least 20pc from the high.

Another heavy round of forced selling related to margin accounts is expected by some traders. Most margin loans are likely to be cleaned out in the next 24 hours given the speed of the fall. That could lessen the pressure on the market, but a bottom will obviously depend on global factors.

NAB’s monthly business survey for February is due at 11.30am.

9.29am: Watch for oil bankruptcies: Saxo

The COVID-19 outbreak had already pushed global markets to a “double whammy” supply and demand shock, but the oil price war and breakdown of the OPEC+ alliance will send ripples through nervous credit markets.

That’s according to Saxo Markets’ strategist Eleanor Creagh who cautions that the ripple effect of cratering oil prices could further blow out high yield spreads.

“Airlines, hotels, travel and leisure providers and autos are the most at risk industries here. But now we also face a wave of chapter 11 bankruptcies across the US shale industry for smaller unhedged players and high cost producers,” she notes.

“The energy sector is a highly capital intense sector with many highly leveraged players already struggling prior to this collapse in oil prices driven by a simultaneous sustained oversupply and demand wipe-out due to COVID-19 containment measures.”

Kieran Gair 9.24am: PM urges ‘perspective’ amid market meltdown

Scott Morrison has urged Australians to “get some perspective” and remain “level-headed” after panic selling rocked global markets overnight amid the accelerating threat of COVID-19.

“It has nowhere near the mortality rates that we’ve seen from SARS and MERS,” he said.

“It’s still a very serious virus but it is moving more towards a very bad flu than it is to a dead type of virus,” he said.

Mr Morrison, however, conceded the virus had the “potential” to derail the government’s budget surplus ambitions and was likely to be a “greater” economic threat than the global financial crisis.

“Markets are attempting to reprice risk and what we are seeing at the moment is a slot of uncertainty regarding the future path and trajectory of this virus.”

9.18am: Global trade ties being redefined: BHP

This week’s oil dispute is evidence of how global trading relationships are being redefined, says BHP chairman MacKenzie this morning at a speech in Sydney.

A Bloomberg report noted Mr MacKenzie had called out issues including Brexit and now the clash between OPEC+ members as key turning points.

“Trade tensions continue to simmer between the US and China, and as of yesterday between Russia and Saudi Arabia,” MacKenzie said.

He added that BHP and others need to co-operate to “reduce the impacts of the coronavirus outbreak on people and this is going to challenge our global supply chains”.

9.06am: What’s impressing analysts, what’s not

- ARB raised to Hold – Morningstar

- Afterpay raised to Hold, price target cut 13pc to $35 – Morningstar

- Altium raised to Buy – Bell Potter

- Boss Resources rated new Speculative Buy – Canaccord

- Breville raised to hold – Morningstar

- Caltex cut to Sell – Shaw and Partners

- Caltex raised to Buy – Morningstar

- Carsales.com raised to Buy – Morningstar

- Orora raised to Overweight – Morgan Stanley

- Stockland raised to Neutral – UBS

- Suncorp raised to Buy – Morningstar

8.57am: Could this be an omen for today’s trade?

In an ominous sign for the session ahead, Burman chief investment officer Julia Lee points out that the low of the GFC was on March 10, 2009.

“Will we see the low of for the coronavirus today?” she tweeted.

Today is the 11th anniversary of the S&P market low. (3/9/2009)

— Carl Quintanilla (@carlquintanilla) March 9, 2020

The next morning, Mark Haines made his famous call, which we now call the "Haines Bottom".@CNBC @ErinBurnett @SquawkStreet pic.twitter.com/r226g1v6VQ

8.52am: Qantas grounds A380s as flights cut

Qantas will ground most of its fleet of Airbus A380s, the airline’s largest aircraft, as it further cuts its international capacity.

In its latest update, Qantas said it was reducing capacity by almost a quarter for the next six months.

It said it would use smaller aircraft and reduce the frequency of flights, taking eight of its A380s offline, and leaving just two operating.

“The latest cuts follow the spread of the coronavirus into Europe and North America over the past fortnight, as well as its continued spread through Asia, which has resulted in a sudden and significant drop in forward travel demand,” it said.

“These additional changes will bring the total international capacity reduction for Qantas and Jetstar from 5 per cent to 23 per cent versus the same time last year and extend these cuts until mid-September 2020.”

Elias Visontay 8.50am: Virus could be worse than GFC: PM

Scott Morrison has warned business leaders the impact of the coronavirus on Australia could be greater than the GFC because of our reliance on and proximity to China.

“COVID-19 is a global health crisis, but it also has very real and very significant economic impacts, potentially greater than the global financial crisis, especially for Australia,” the Prime Minister told a business forum in Sydney on Tuesday morning.

“The epicentre of this crisis as opposed to that one is much closer to home. The GFC impacts were centred on the North Atlantic, and back then China was in a position to cushion the blow for Australia.

“The initial outbreak of COVID-19 in China saw consumers stay away from shops, and many workers stay away from work, and that continues.”

8.46am: 2008 crisis to guide Fed response

A global market rout could force the Federal Reserve to update its 2008 crisis playbook to prevent sharp market dislocations from turning any economic shock from efforts to contain the novel coronavirus into a full-blown recession.

The central bank took an initial step Monday to keep short-term funding markets operating by boosting the size of short-term lending operations, shelving its plans to gradually pare those offerings.

The New York Fed said it would boost the amount of short-term lending it conducts on a daily and biweekly basis to satisfy rising demand from financial institutions and avoid further strains as US banks and businesses prepare for greater disruptions from the coronavirus epidemic.

A plunge in oil prices on Monday highlights two risks for the Fed as they try to cushion the shock from virus-related disruptions.

First, they raise the risk of a plunge in business investment in the energy-intensive oil-drilling sector and a rise in corporate defaults. Second, they could lead households and businesses to expect lower inflation, driving prices lower.

Dow Jones Newswires

8.00am: Italy completely locked down

The whole of Italy has been placed in lockdown as Prime Minister Giuseppe Conte extended travel restrictions originally imposed in the north to the entire country.

All public gatherings including football matches have been cancelled.

7.33am: Call on banks to help

US banking regulators on Monday urged financial institutions to work with borrowers feeling the impact of the coronavirus outbreak, indicating they will ease up oversight.

Banks “should work constructively with borrowers and other customers in affected communities,” the agencies said in a joint statement, adding that “prudent efforts that are consistent with safe and sound lending practices should not be subject to examiner criticism.”

The regulators including the Federal Reserve and Federal Deposit Insurance Corporation also said they would work to reschedule bank examinations for any institutions facing staffing and other challenges.

AFP

7.06am: Biggest airline crisis since 9/11

The coronavirus has suddenly and unexpectedly created the biggest challenge for the global airline industry since 9/11.

Bookings around the world are falling sharply. US carriers are following Asian and European airlines in cutting flights, grounding planes and enacting draconian cost reductions, such as hiring freezes and unpaid leave.

Foreign airlines are looking for help from governments, banks and investors. Major airlines are trying to reassure passengers with promises of scrubbed cabins, filtered air and free-flowing hand sanitiser.

“Delta has been preparing for such a scenario,” Delta Air Lines chief executive Ed Bastian wrote in an email to customers on Sunday that outlined the airline’s response, insisting that travel “can’t – and shouldn’t – simply stop”.

The International Air Transport Association, a trade body, estimates the virus could reduce passenger revenue worldwide this year by between $US63bn and $US113bn, or as much as 20 per cent. As recently as last month, the trade group was forecasting a hit of less than $US30 billion. The coronavirus has grounded 2000 aircraft around the world, analysts at Jefferies estimate.

By comparison, the September 11, 2001, terrorist attacks cut airline revenue by 7 per cent, or $US23bn, according to IATA.

Dow Jones Newswires

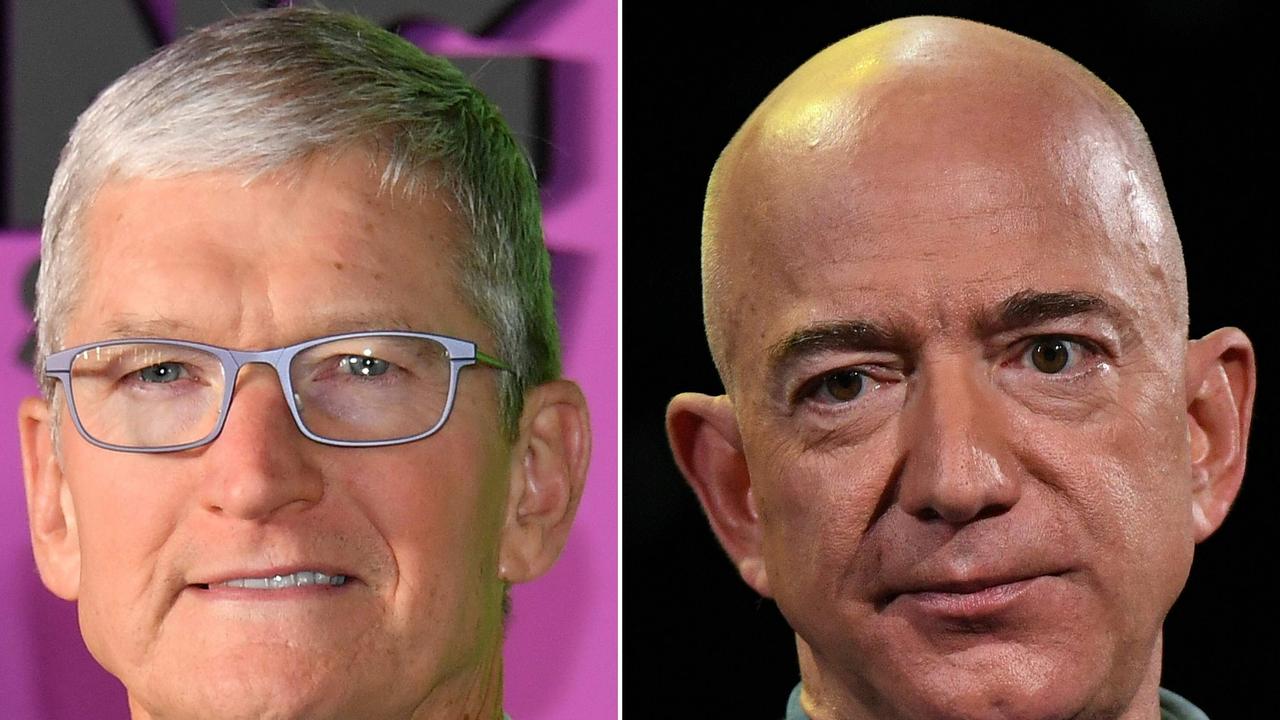

6.55am: Stay home, say Microsoft, Amazon

Add Microsoft and Amazon.com to the growing list of employers urging staffers in New York to stay at home over the next few weeks as the coronavirus outbreak intensifies.

Microsoft is recommending that employees based in New York work from home until March 25, the company confirmed to The Wall Street Journal. Last week the company issued guidance to its Seattle area employees asking them to work from home when possible and advising those still needed in open office spaces to stay 6 feet away from others and avoid prolonged interaction with colleagues.

“The health and safety of our employees is our top priority at Microsoft. We are providing real-time guidance to employees in all affected regions. We will continue to monitor the situation and take action as necessary to help protect employees,” a Microsoft company spokeswoman said.

Amazon.com on Monday advised its employees in New York and New Jersey to work from home from March 10 until the end of the month, if possible. Last week, the company made a similar announcement to employees at its headquarters in Seattle. Amazon’s New York and New Jersey offices have employees in divisions such as marketing, fashion, advertising and cloud-computing, as well as its Audible division.

Dow Jones Newswires

6.48am: Oil plunges 25pc

US oil price plunged 25 per cent at the end of Monday’s bruising session after Saudi Arabia slashed prices on crude following failed OPEC talks last week.

Futures on West Texas Intermediate for delivery in April finished at $US31.13 a barrel in New York.

The rout came amid signs of a price war after Russia and Saudi Arabia failed to reach a deal last week cut production in the wake of lower demand due to the coronavirus outbreak

6.45am: Wall St hits the brakes

US stocks careened on Monday, pushing major indexes closer to bear-market territory as a price war for oil and the fallout from the coronavirus frightened investors, who sought shelter in government bonds and propelled yields to unprecedented lows.

The selling was heavy across markets and geographies, with US stocks falling hard enough after the open to trigger a 15-minute trading halt. Recently, the Dow sank 1,450 points, or 5.6 per cent, to 24414. The S&P 500 fell 5.5 per cent to 2810. And the Nasdaq Composite slid 5.1 per cent to 8146.

All 11 sectors in the S&P 500 were down, led by energy, which slid 17 per cent. Financials were down 8.7 per cent, and materials were down 7 per cent.

When the circuit breaker hit, the Dow and Nasdaq were down 19 per cent from record highs set earlier this year and the S&P had fallen 18 per cent from its peak, leaving them on the brink of bear-market territory. A drop of 20 per cent from the highs would halt a bull-market run that began after the financial crisis — stocks bottomed out 11 years ago to the day, on March 9, 2009.

“The 11-year bull market is over,” said Peter Cecchini, the chief market strategist at Cantor Fitzgerald, noting that it isn’t just about an official 20 per cent drop.

5.38am: Stop stockpiling: Boris

British Prime Minister Boris Johnson on Monday told people to stop stockpiling as supermarkets imposed limits on the purchase of goods after shelves were emptied because of coronavirus fears.

Shelves of toilet paper, antibacterial hand gel, tinned food, soap and paracetamol have all been stripped from stores across the country in recent days because of panic buying.

But Johnson said those responsible should think of others before taking as much as they can.

“I think it is very, very important that people should behave responsibly and think about others,” he told reporters at a Downing Street press conference.

He added that he was “confident” shop shelves would remain stocked. The situation in supermarkets has been fuelled by recommendations last week by health authorities for Britons to “plan ahead” in case they are forced to self-isolate for several weeks.

But the country’s chief scientific adviser Patrick Vallance said he believed there was “absolutely no reason” for the public to panic buy.

Tesco last weekend introduced measures to limit purchases to a maximum five items for products including pasta, antibacterial hand-wipes and gels, and long-life milk.

The supermarket giant, which has nearly 3,500 stores in Britain, is so far the only supermarket chain to have imposed restrictions on food items.

Others such as Waitrose have limited the online sale of some wipes and soaps, while Walmart subsidiary Asda is only allowing the purchase of two antibacterial gels in stores and online.

AFP

5.32am: City’s worst day since GFC

Coronavirus fears have led to British stocks suffering their biggest intraday fall since 2008 and benchmark bond yields turning negative for the first time. However the government says it is not yet time to close mass events, and insists food supplies will continue.

As the worries about the economic impact of the outbreak battered global markets, Britain announced its fourth death from the virus and said it had 319 confirmed cases, up from 273 on Sunday.

The FTSE 100 plunged to a three-year low after Saudi Arabia crashed the oil prices by slashing its own selling prices and raising output. Yields on benchmark British government bonds turned negative for the first time ever as panicked investors rushed to the safety of gilts to hedge against the feared economic shock of the coronavirus.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout