Trading Day: live markets coverage; Stocks build on multi-month highs; plus analysis and opinion

The ASX books a post-Trump stimulus hope milestone, while Rio Tinto jumps over 3 per cent as iron ore surges.

Welcome to Trading Day for Monday, October 16.

4.45pm: Stocks tap five-month high

Local shares sealed their best seven-day consecutive gain since hopes of Trump-led fiscal stimulus buoyed global equities, buyers leapt into resources and propelled Rio Tinto to its highest level in three-and-a-half years.

At the close, the S & P/ASX200 index had risen 0.6 per cent, or 32.6 points to 5,846.8, while the broader All Ordinaries index also climbed 0.6 per cent, or 32.4 points to 5,917.2.

The share market sealed its best gain over seven consecutive sessions since early November, lifting 3.5 per cent, led by a 3.4 per cent tear by Rio Tinto shares to a three-and-a-half-year high of $70.55 after prices of iron ore jumped 4 per cent and crude oil rose on strong China demand.

“We’ve got generally quite a good risk on move in international markets, as evidenced not only by stronger stockmarkets here but stronger commodity markets in the Asian time zone,” said CMC chief markets analyst Ric Spooner,

BHP rose 2.2 per cent to $26.95, while iron ore pure-play Fortescue closed 1 per cent in the black at $4.94

Eli Greenblat 4.00pm: Lew primes for Myer strategy day

Billionaire retailer Solomon Lew, has ratcheted up the pressure on Myer and its board in the lead up to its crucial strategy day on November 1, demanding an update on first quarter trading and promising to scrutinise any changes made to the “New Myer” strategy launched in 2015.

And in a shot across the bows to incoming Myer chairman Garry Hounsell, Mr Lew’s flagship investment company Premier Investments has said it will closely examine Myers recent performance and the sustainability of the New Myer strategy after Mr Hounsell last week publicly voiced his support of the strategy as unveiled by Myer CEO Richard Umbers in 2015.

In a statement issued this afternoon Mr Lew through his Premier Investments group, which in March bought a 10.8 per cent stake in Myer to become its biggest shareholder, said Myer must also release its first quarter trading, sales and profit performance to see if there have been any operational improvement — read more

MYR last down 1.3 per cent at $0.74

Producers note: Myer shares were downgraded by Citi ahead of the open to “hold” by Citi analysts.

3.35pm: China consumer price growth slows

Grace Zhu writes:

China’s consumer inflation slowed in September on renewed weakness in food prices, official data showed Monday.

China’s consumer price index in September increased 1.6 per cent from the same period a year earlier, after a 1.8 per cent gain in August, the National Bureau of Statistics said.

Food prices declined 1.4 per cent compared with a year ago, after dropping 0.2 per cent in August. Non-food prices grew 2.4 per cent compared with a year ago, after growing 2.3 per cent in August — read more

Dow Jones Newswires

3.25pm: Banks, resources choice clear: Deutsche Bank

Resources now offer the best combination of valuations and growth in the Australian share market, according to Deutsche Bank.

Equity strategist Tim Baker says resources are trading on 16 times estimated earnings-per-share (EPS) and FY18 EPS consensus for is for 16 per cent growth.

Banks are “relatively cheap” on 13.1 times estimated EPS and only 3 per cent growth in EPS expected.`

Industrials are “expensive” on 18 times forward EPS, with “moderate growth” of 8 per cent expected.

Among industrials, “defensives are a fraction cheaper than cyclicals, but have worse earnings momentum”.

Mr Baker notes that after solid performance in 2016, Australian equities have lagged global peers in 2017, with underperforming banks a headwind along with relative valuations.

“Valuations now look better, but the growth profile isn’t great vs. offshore especially outside of resources,” he says. “On the positive side, Australia continues to offer a world-leading dividend yield.”

3.05pm: Big miners haul home gains

ASX miners haul the index higher after prices of key underlying commodities iron ore and crude oil rose, while Deutsche Bank lobs in more upside by way of a 15 per cent increase to its end-FY18 mining sector aggregate earnings forecast.

“Our top pick of the bulks remains RIO [on] sector leading production growth, and ongoing capital management,” says Deutsche Bank.

“We also rate BHP a ‘buy’, with our thesis predicated on delivering a revamped strategy to increase group returns.”

The investment house lifts its FY18 earnings-per-share forecast for Rio Tinto by 10 per cent and for BHP by 26 per cent.

DB analysts see a global growth tailwind and a foreseeable uptick in M & A activity as positive catalysts in their sector outlook, while predicted supply shortfalls in metallurgic coal, copper, nickel, zinc and minerals sands associated with a slowdown in northern-hemisphere activity over winter are behind their recent calendar year 2018 price forecast upgrades to the underlying commodities.

“We rate SBM, SFR, AQG and DCN a ‘buy’ and NCM, NST, RRL & WSA a ‘sell’.”

Meanwhile, the broader share market holds firm gains backed by those in the heavyweight resources, BHP trades 2 pc higher at $26.90 and Rio Tinto stacks on 2.9pc to $70.20.

Index last 0.6 per cent higher on 5848.3

2.45pm: Black mark on Medibank health bill

Healthcare’s hopes of sustainably lower private policy premiums on $1bn Federal government industry reforms face a considerable consumer hurdle, according to Deutsche Bank, the investment house arbitrating with a downgrade on Medibank Private shares to “hold” from “buy” after recent share price performance.

The Federal government delivered its healthcare reform agenda last week including the planned reduction in price benchmarks on the nation’s prostheses list, a measure insurers have singled out as a significant cost saving to be passed on to consumers.

Whether or not Australians are listening is another story.

Over 11 million Australians held private health cover as of June, down 10 000 from a year earlier according to Deutsche Bank, with the sharpest decline led by 20-30 year olds.

“This is one of the most important groups in the system, as young people tend to be relatively light claimants,” say Deustche Bank analysts, “the risk is that consumer confidence in Australia remains low, unavoidable costs such as electricity and rent continue to increase, and discretionary items such as PHI may prove a luxury item despite the reduction.”

The analysts do, however, upgrade their 12-month target price forecast for Medibank to $3.20 from $3.10 and see lower participation rate decline over the “medium term”. The rate at which it will do so, however, isn’t enough by the analysts’ estimate to shift upward their forecast of 1 per cent decline in premium growth.

“We have reduced our rating to ‘hold’ following strong share price performance,” say the analysts

MPL last down 0.7 per cent at $3.08

Samantha Woodhill 2.42pm: Iron ore served China trade boost

Iron ore prices have bounced back, surging 4.5 per cent after new China trade figures.

It comes after the spot price last week fell below $US60 for the first time since June.

Prices regained ground at the weekend to US$60.00 a tonne, according to The Steel Index.

National Australia Bank FX strategy head Ray Attrill said the gains were driven by China trade data released last week, which showed iron ore imports rose above 100 million tonnes for the first time on record in September.

“Friday’s gain was probably more psychology-driven than anything else,” he said.

Andrew White 2.38pm: New move in power price war

Efforts to curb the appeal rights of network operators who have been labelled the biggest single cause of electricity price rises for the past year have taken another step forward, with a Senate committee endorsing the government’s planned abolition of the limited merits review.

In a report released this afternoon the Senate standing committees on environment and communications said the LMR had not fulfilled its brief and was contributing to the increase in energy prices for consumers.

“The committee supports the abolition of limited merits review (LMR). It considers that the abolition of limited merits review will ensure that regulatory regimen is focused on the long-term interests of consumers and businesses and ensure an efficient and sustainable national energy market.”

John Durie 2.20pm: New firm blooms as Sims fumes

Just as ACCC boss Rod Sims is banging the table about the impact of market dominance on the energy market, a new venture chaired by Oliver Yates is attempting to boost the amount of supply coming from energy producers in Australia.

Clean Energy Derivatives Corp (CEDC) is raising at least $250 million to fund a new venture providing contract certainty to new entrants in the market.

The idea is to write long-term contracts for a set amount of supply and CEDC will fund the supply under an agreement by which the venture supplies the national grid and if the price is above the contracted level then the money goes back to CEDC but if it falls below the contracted price then CEDC pays the supplier.

Damon Kitney 1.35pm: Big biscuits tread lightly around Shapes

One of the most powerful food industry executives in America knows all too well the dangers of messing with the make-up of one of Australia’s favourite snack biscuits.

The Campbell Soup Company took full control of Australian snack food icon Arnott’s in 1997 following a controversial takeover, after increasing its stake in the company through the 1980s.

More recently it decided to introduce a range of new Shape flavours into the local market. It was a big deal.

‘‘We had blind tests, and big wins, even among heavy users,’’ Campbell’s senior vice-president of global R & D, Carlos J. Barroso, told The Wall Street Journal’s annual Global Food Forum event in New York this week.

Eli Greenblat 12.55pm: Protest urged against bank tax

One of Australia’s most respected chairmen and leading corporate directors, former ANZ and Woodside Petroleum chair Charles Goode, has launched a scathing attack on the federal government’s proposed bank tax, calling it discriminatory, unfair and poor policy.

Speaking at a shareholders’ meeting for the twin listed investment companies he chairs, Australian United Investments and Diversified United Investments, Mr Goode — who has been a Liberal party fundraiser — urged shareholders to pick up their pens and in an old-fashioned protest “write to their local federal member of parliament” to ask for a review of the “unwarranted” bank tax.

John Durie 12.20pm: ANZ chief to assume ABA chair

ANZ chief Shayne Elliott will be the next chair of the Australian Banks Association replacing NAB chief Andrew Thorburn who steps down after two years.

The chair is rotated among the big banks and, while CBA was next in line, the imminent departure of that banks chief executive, Ian Narev, has prompted a change in plans.

Mr Elliott was considered a potential outsider given he has tried to run a campaign independent of the big banks but has since decided to lead the charge.

12.15pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Sean Callow — Senior Currency Strategist, Westpac

12.45pm: Stephen Walters — Chief Economist, AICD

1.10pm: Ben Le Brun — OptionsXpress

1.50pm: Live cross — Bloomberg Asia

12.00pm: Peter O’Connor — Shaw and Partners

(All times in AEST)

Elizabeth Redman 12.05pm: Takeovers panel nixes NextDC request

360 Capital’s attempt to gain control of Asia Pacific Data Centre Group looks a step closer after the Takeovers Panel declined to conduct proceedings on an application from rival suitor NextDC.

360 Capital (TGP), which owns 21 per cent of the target (AJD), has made an offer of $1.95 per APDC security that the target’s board has backed in the absence of a superior proposal.

But rival NextDC (NXT) owns 29 per cent of the target which could prove a challenge to 360 Capital’s aspirations, even after NextDC’s $1.87 bid has lapsed.

11.35am: Evolution posts strong quarter

Prashant Mehra writes:

Gold miner Evolution has lifted production and cut costs in the September quarter, helped by a strong performance at its Cowal mine in NSW and its Ernest Henry and Mt Carlton mines in Queensland.`

Australia’s second largest gold miner produced 220,971 ounces in the three months to September 30, up 1.3 per cent from the preceding quarter. All-in sustaining cost dropped to a record low of $786 an ounce from $825 an ounce in the prior quarter.

The company said its operating mine cash flow during the September quarter rose nearly five per cent to $210.4 million, despite a 2.8 per cent decrease in the gold price it realised.

The gold miner earlier this month completed the sale of its Edna May mine in Western Australia to Ramelius Resources for up to $90 million — read more

EVN last up 1.8 per cent at $2.30

Rowan Calliack 10.55am: China scours ‘dreadful’ Aussie ventures

The former chairman of a Chinese state-owned enterprise has been handed over to prosecutors for investigation after the company’s investments in several Australian mining ventures lost more than $1 billion.

Li Jinming, who chaired Guangdong Rising Assets Management, which is owned by Guangdong province, was earlier expelled from the Communist Party following an investigation that began in 2014 over losses that the disciplinary inspection team described as “dreadful”.

The company was established 17 years ago with $2bn capital, the South China Morning Post reported, and it began investing in Australia after the Global Financial Crisis pushed down asset and commodity prices.

It acquired, through different subsidiaries, lead-zinc producer Perilya for $45.5 million, coal producer Caledon Resources for $500m, copper and gold company PanAust — with a massive prospect awaiting commitment in Papua New Guinea at Frieda River — for $180m, and rare earths producer Northern Minerals for $60m,

It also paid $15m for a large stake in gold and base metal explorer Hawthorn Resources.

10.40am: ASX200 hits 5-month high early

Australia’s S & P/ASX 200 jumped 0.6pc to a 5-month high of 5846.9 in early trading.

That followed slight gains on Wall Street and solid gains in commodities which boosted resources.

The index is now up 3.4pc in seven days, its strongest seven-day rise in 8 months.

With little change in estimated EPS, the forward PE ratio has risen to 16.1 times versus a decade average of 13.8 times.

As such the local market will remain heavily dependent on Wall Street for any further gains.

Index last up 0.5pc at 5845.2

10.30am: Oil rallies on China, Iran pressures

Scott DiSavino writes:

Oil prices on Friday closed at their highest level in October on bullish news from strong Chinese oil imports, U.S. President Donald Trump’s decision not to certify that Iran is complying with a nuclear agreement and other tensions in the Middle East.

Brent futures gained 92 US cents, or 1.6 per cent, to settle at $US57.17 a barrel, while U.S. crude rose 85 US cents, or 1.7 per cent, to settle at $US51.45 per barrel.

That put both contracts at their highest settlements since Sept. 29. For the week, Brent was up almost 3 per cent and U.S. was up over 4 per cent. Traders said the oil market pulled back from even higher gains — both contracts were up over 2 per cent — earlier in the day out of relief that Trump did not immediately seek to impose sanction on Iran.

Instead, he gave the U.S. Congress 60 days to decide whether to reimpose sanctions.

Unrest in Iraq also underpinned prices.

Tensions between the two, which traders fear could impinge on oil exports from the region, have been building since Iraq’s Kurds overwhelmingly backed independence in a Sept. 25 vote.

Reuters

Producers note: Woodside (WPL) up 0.6pc, Santos (STO) up 0.7pc and Oil Search (OSH) up 1.1 per cent in early trade.

9.55am: ASX200 to rise as profit takers lurk

Australia’s S & P/ASX 200 is expected to open up 0.2pc amid strength in resources.

That follows a 0.1pc rise in the S & P 500, a 4.1pc rise in spot iron ore and a 1.7pc gain in WTI crude.

BHP ADR’s equivalent close at $26.74 was 1.4pc above Friday’s close in Sydney.

The S & P/ASX 200 is near key technical resistance from the June 14 peak at 5636.4.

There’s also resistance at 5632 from the 61.8pc Fibonacci retracement of the May to June fall.

And after rising 2.9pc in the past six days, the index could be capped by profit taking before key events this week.

China’s September inflation data is due this afternoon with economists expecting consumer price growth (CPI) to slow 20 basis points to 1.6pc, while producer price growth (PPI) is expected to rise 10 basis points to 6.4 per cent.

The nation’s National Party Congress starts Wednesday, while more economic activity data from our largest trading partner is due Thursday along with Aussie jobs data.

Index last 5814.15

9.45am: Yellen flags gradual rate hikes

Harriet Torry writes:

Federal Reserve Chairwoman Janet Yellen kept the door open to another increase in short-term interest rates this year, but sounded a note of caution on still weak inflation in the US and abroad.

The “ongoing strength of the economy will warrant gradual increases” in short-term interest rates, the Fed chairwoman said, although she didn’t specify when the next rate increase would come.

Gradual increases in the benchmark federal-funds rate “are likely to be appropriate over the next few years to sustain the economic expansion,” Ms Yellen told a Group of 30 banking seminar in Washington.

9.40am: Oz Minerals to close pit early

Robb M. Stewart writes:

Oz Minerals’ copper production continued to rise in the latest quarter as it targeted accelerated mining of the open pit at its Prominent Hill operations in South Australia.

Copper production hit 28,880 tonnes in the third quarter, up 2.5 per cent on the prior quarter, while gold production fell to 29,264 troy ounces from 32,136 ounces — read more

OZL last $8.05

9.30am: Bendigo in $300m preference share raising

Bendigo and Adelaide Bank has issued a $300 million preference share offer, the securitisation of which will qualify as additional Tier One capital according to the bank, while proceeds may be used for existing preference share redemption.

BEN last $11.65

Glenda Korporaal 9.15am: ‘Market vulnerable to crash’

Two people who saw the stockmarket crash of 1987 first hand, former Bain chief stockbroker Maurice Newman and former Sydney Futures Exchange chief executive Les Hosking, have no doubt that another crash could occur again.

“We are still vulnerable to market collapses,” says Hosking, who is now chairman of ASX-listed Adelaide Brighton. “Back in 1987, the good signal that something was going to happen was the stockmarket was separating itself from the typical spreads between stock values and bond values.”

“Shares were going up but bonds were getting weaker.

“We have a set of circumstances now which would indicate that something similar could happen in some markets,” Hosking says. “We have strong stockmarkets but very weak bond markets and a property bubble. It is a mixture, which is out of the normal.

Adam Creighton 9.05am: Why is our super so expensive?

Peter Costello was right to highlight the gross inefficiency of our superannuation system last week in a speech he delivered in Melbourne. It was timely in a week when US economist Richard Thaler, who highlighted the folly of forcing people to choose privately managed retirement plans, was awarded the Nobel prize for Economics.

Here’s a fun fact: a family in Australia with a combined superannuation balance of $300,000 is paying more in fund management fees than it is on electricity — even after the latest 20 per cent price jump in power prices.

You might expect electricity to be expensive: fossil fuels need to be extracted and refined, sent to costly generators and then pumped around vast distribution networks. And that’s before the cost of administering customers’ accounts.

8.55am: Analyst rating changes

OZ Minerals raised to Hold — Deutsche Bank

Western Areas cut to Sell — Deutsche Bank

Independence Group cut to Hold — Deutsche Bank

Medibank Private cut to Hold — Deutsche Bank

St Barbara initiated at Overweight — JPMorgan

Regis Resources cut to Underweight — JPMorgan

Northern Star initiated at Neutral — JPMorgan

Red River initiated at Buy — Ballieu Holst

OceanaGold cut to Hold — Deutche Bank

Mantra cut to Neutral — UBS

Alan Kohler 8.30am: Bitcoin: a boy’s best friend

Two interesting things happened at once over the weekend: the price of bitcoins hit a record high and the leaders of America’s biggest bank and the world’s largest asset manager said that governments would soon “crush” it — that it was all a big waste of time.

JP Morgan Chase CEO Jamie Dimon said that “if you’re stupid enough to buy it, you’ll pay a price for it one day” and the CEO of BlackRock, Larry Fink, said the price of bitcoin was basically an “index of money laundering”.

Around the same time on Friday night our time, that so-called money laundering index was racing to a new record of US$5856.10. It has retraced a bit, back to around US$5500, and a market cap of $US92.7 billion, which would make it Australia’s second largest company, ahead of Westpac.

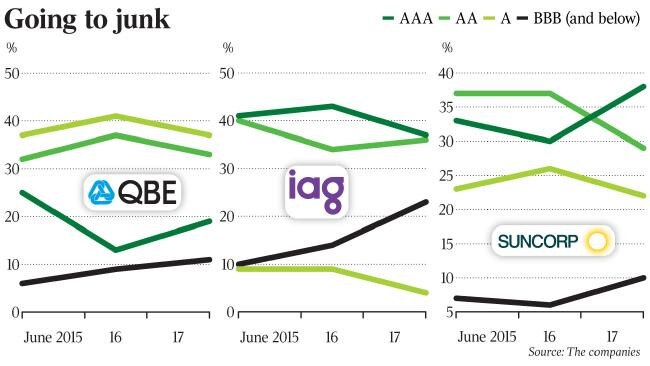

Michael Roddan 8.15am: Insurers bulk up on junk

Australia’s largest insurance companies are ramping up their holdings of low grade and junk investment bonds in a risky bid to maintain profits amid record low interest rates.

Insurance Australia Group, Suncorp and QBE have been bulking up on riskier financial investments over the past two years, partly to diversify the groups’ fixed income holdings away from major Australian companies. Profits in the insurance sector are under sustained pressure as premium prices flatline and natural disasters spark large claims blowouts.

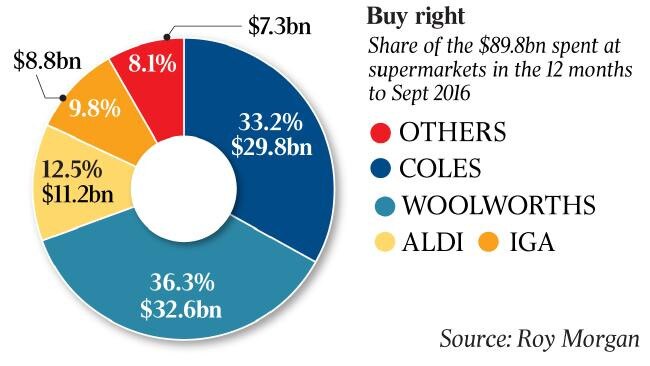

Eli Greenblat 8.10am: Kaufland ramps up growth plan

German supermarket giant Kaufland has unveiled ambitious plans for when it invades Australia’s grocery sector.

Kaufland lifted the veil on its ambitious expansion plans by advertising for executives, including a head of business intelligence and property developers based in Brisbane, Sydney, Melbourne and Adelaide, as it joins with Aldi, Costco and a looming Amazon as disrupters in the nation’s $90 billion grocery sector.

Kaufland, which The Australian reported last week has been given nearly $50 million by its parent to begin amassing a portfolio of supermarket sites and warehouses in Australia, is now forming management ranks that will include key executives charged with sharpening the chain’s competitive thrust into the Australian food and grocery market.

7.40am: Stocks set to start higher

The Australian share market is poised to open higher following gains on Wall Street on Friday after upbeat economic data.

At 7am (AEDT), the local share price futures index was up 12 points, or 0.21 per cent, at 5,806.

US stocks closed higher on Friday after data showed US retail sales jumped in September, and the University of Michigan’s consumer sentiment index hit its highest since January 2004.

Another report showed consumer prices recorded their biggest increase in eight months as hurricanes Harvey and Irma boosted demand but underlying inflation remained muted.

The Dow Jones Industrial Average rose 30.71 points, or 0.13 per cent, to end at 22,871.72, and the S & P 500 gained 2.24 points, or 0.09 per cent, to 2,553.17. The Nasdaq Composite added 14.29 points, or 0.22 per cent, to 6,605.80.

In local economic news, the Australian Bureau of Statistics will release lending finance data for August, while the Reserve Bank will hold a briefing on its half yearly Financial Stability Review released on Friday, which showed moves by regulators to tighten mortgage lending standards are working and have helped ease Australia’s overheated property market.

In equities news, the NSW Supreme Court will hold a hearing to begin the process of transferring all of Ten Network shares to CBS, while Evolution Mining will detail its quarterly report.

The Australian share market on Friday closed at its highest level since June, with investors starting to find value and Chinese trade data boosting sentiment.

The benchmark S & P/ASX200 index ended up by 19.7 points, 0.34 per cent, to 5,814.2 points, while the broader All Ordinaries index was up 20.6 points, or 0.35 per cent, higher at 5,884.7 points.

AAP

6.50am: Aussie gains against weaker US dollar

The Australian dollar has gained against its US counterpart, after the greenback slipped following a lower than expected US inflation report on Friday.

At 6.30am (AEDT), the local currency was worth US78.82 cents, up from US78.34 cents on Friday.

Data showed on Friday that US CPI rose 0.5 per cent in September against an expectation of 0.6 per cent, while the core measure rose only 0.1 per cent versus 0.2 per cent expected.

The data pushed stocks higher, but bond yields and the US dollar fell. The Australian dollar rose as high as 78.97 US cents before consolidating gains.

Westpac senior market strategist Imre Speizer expects the Aussie dollar to rise past the 79 US cents level if there is further correction in the greenback.

Today, the local currency was also slightly higher against the Japanese yen and the euro.

AAP

6.40am: ASX tipped to open higher

A reasonably good opening is expected on the local markets today after Wall St posted small gains to close last week.

“It should be a positive start, I suspect it will open up,” said AMP Capital’s chief economist Shane Oliver.

At 6.30am (AEDT), the API futures index was up 12 points.

Locally, investors will be awaiting tomorrow’s release of the minutes of the most recent meeting a fortnight ago of the Reserve Bank of Australia. Dr Oliver said it’s likely the minutes will reflect a desire to keep interest rates remaining on hold for the foreseeable future.

September jobs figures will come out on Thursday, with a general consensus that around 15,000 jobs were created for the month.

There has been a steady rise in job creation for the past year, so Dr Oliver warns sooner or later there will be a negative gain in jobs. Internationally, the big signpost should be the Chinese National People’s Congress, which begins on Wednesday.

“I don’t expect any huge surprises from the Congress,” Dr Oliver said. Ultimately the Congress will decide on a five-year plan for Chinese leadership and policies, but with inflation figures coming out today likely to show steady growth Dr Oliver doesn’t expect any big changes to economic policies.

The Australian share market on Friday closed at its highest level since June. The benchmark S & P/ASX200 index ended up by 19.7 points, 0.34 per cent, to 5,814.2 points, with nearly all sectors making gains and capping a solid week to leave the market up 1.8 per cent for the five-day period. The Aussie dollar was trading at 78.34 US cents.

Wall St also closed higher after upbeat economic data and gains in technology shares.

The Dow Jones index and the S & P 500 had a fifth straight week of gains.

AAP