Health insurers’ $1bn remedy

Australia’s health insurers have backed the most comprehensive reforms to hit the industry in almost 20 years.

Australia’s health insurers have backed the most comprehensive reforms to hit the industry in almost 20 years and promised to deliver lower premium increases after winning more than $1 billion in savings on the cost of medical devices.

Health Minister Greg Hunt will today announce a list of private health insurance reforms, including categorising policies as Gold, Silver, Bronze and Basic Bronze, a discount for young people and more power for the Private Health Insurance Ombudsman.

The key reform that will immediately translate to lower premiums next year is a measure to cut prices on the prostheses list, which sets the price insurers must pay for medical devices. The insurance industry has long argued they are overcharged, compared to Australia’s public system and comparable countries.

The prostheses reform is said to represent a $1.5bn saving to the private insurance industry over the next four years. That measure included a four-year agreement between the government and the Medical Technology Association of Australia.

Ian Burgess, chief executive of the MTAA, said the deal ended a long period of uncertainty for the industry but it came at a price.

“These cuts are significant and will impact on jobs and investment in the industry. However, the MTAA membership took the view the agreement was in the best interests of the industry and ultimately patients,” Mr Burgess said.

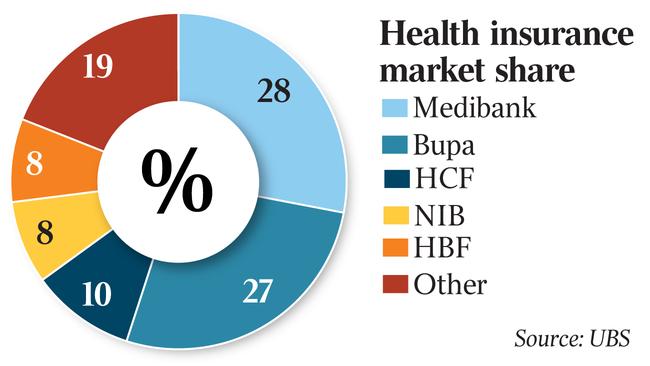

NIB chief executive Mark Fitzgibbon said the price cuts to the prostheses list would drive down the average annual premium increase to the “low end of 4 per cent”. Premiums rose by an average 4.84 per cent this year, the lowest in a decade.

Mr Fitzgibbon said consumers in private hospitals had been paying “wildly inflated” prices for medical devices.

“It’s bordering on a scandal and all credit to minister Hunt in taking on the self-interests that have perpetuated the madness,” he said.

Matthew Koce, chief executive of industry body Hirmaa, said the $188 million in savings to be realised in the first year of the prostheses price cuts equated to an average saving of just over $34 per policy.

“All our funds have provided an iron-clad commitment to pass on every single dollar of savings to consumers once they have been realised,” he said.

HBF chief executive John Van Der Wielen said the cuts to prostheses prices would save the insurer about $15m each year.

“That is significant but set against the $1.5bn in total health claims we paid members last year, it’s not a game-changer,” he said.

“The goal must be to bring the prices insurers are charged for prostheses down to parity with the public sector.”

Medibank chief executive Craig Drummond said the reform package was essential to keep premiums affordable. “In an environment where the cost of healthcare continues to rise, reforms like this are paramount to addressing the issue of affordability,” he said.

Gerard Fogarty, chief executive of Defence Health, argued that while the reforms were a start, they were far from sufficient to result in immediate, significant reductions in premiums.

“Forming committees to look into matters like out-of-pocket expenses is just hand-wringing. The government knows the issues. It simply needs to act,” he said.

The insurers agreed that the new discount for young people, which will reduce premiums by up to 2 per cent for each year an adult is aged under 30, was a key victory.

Private Healthcare Australia chief executive Rachel David said the reverse Lifetime Health Cover policy would be a major factor in addressing membership rates and improving participation and affordability.

Bupa’s Australian health insurance boss Dwayne Crombie said it was a comprehensive package of reforms, developed in close consultation with all stakeholders.

“It is an important first step and we look forward to continuing to work with the minister on measures to increase participation in private health insurance, make it simpler and more transparent,” he said.

Sheena Jack, chief executive of HCF, said there was no question private health insurance had been in need of reform to ensure the industry was focused on the best outcomes for patients.

“Empowered consumers are a win for everyone. Consumers with the right policies will be better covered and have their expectations met when they come to claim,” she said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout