Insurers turn to risky bonds in hunt for yield

Australia’s largest insurance companies are ramping up their holdings of low grade and junk investment bonds.

Australia’s largest insurance companies are ramping up their holdings of low grade and junk investment bonds in a risky bid to maintain profits amid record low interest rates.

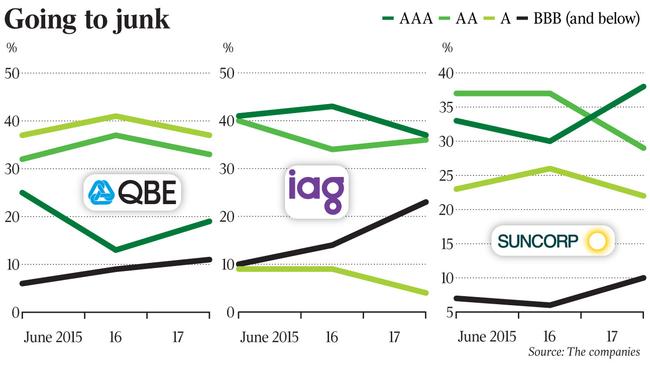

Insurance Australia Group, Suncorp and QBE have been bulking up on riskier financial investments over the past two years, partly to diversify the groups’ fixed income holdings away from major Australian companies. Profits in the insurance sector are under sustained pressure as premium prices flatline and natural disasters spark large claims blowouts.

Insurers derive a large part of their profitability from investment income and must find investments with yields high enough to support the company and pay claims, while at the same time tempering risk in order not to jeopardise their financial position.

With global interest rates at record lows, high yields are mostly found in riskier investments, and insurers have had to look towards bonds with lower credit ratings, including non-investment-grade assets known as junk bonds that pay a higher rate of interest.

Global credit ratings agencies assess corporate and government bonds on a scale from AAA to C. Anything below BBB is deemed “junk”. The worse the rating, the more likely it is the creditor will default on its payments, which could risk the stability of the insurer relying on the income to pay claims.

The Australian recently revealed concerns with the weakening credit portfolio at the country’s largest retirement insurer, Challenger. A large 31 per cent of Challenger’s $10.4bn portfolio is rated BBB — just one notch above junk. That’s up from 21 per cent in 2014. Just 9 per cent of the book is AAA rated, down from a peak of 17 per cent in 2015.

But a review of investment portfolios across the general insurance sector reveals the country’s largest general insurers are increasing their holdings in riskier assets.

Insurance Australia Group, the largest domestic insurer in the country, has increased its holdings in BBB-rated assets and junk bonds to 23 per cent of its $10.3 billion portfolio. That’s more than double the 10 per cent share low-rated investments accounted for in 2015. Over the same period, the share of AAA, AA and A-rated bonds in IAG’s book have fallen.

IAG had not responded to questions put to the company by the time The Australian went to print. The company has been pouring cash into equities and alternative investments while reducing holdings in fixed interest assets. The company also has a reinsurance deal with Warren Buffett’s Berkshire Hathaway group which has allowed it to reduce the size of its investment portfolio.

At the same time, the group swapped higher-rated assets for low-rated bonds, which Velocity Trade analyst Brett Le Mesurier said was a bid to increase shareholder returns.

“Insurers actively look at changing investment allocations based on their view of investment markets, subject to APRA’s capital requirements,” Mr Le Mesurier told The Australian. “They are seeking to enhance the return on equity at a time when their underlying performance is problematic.”

QBE, one of the largest global insurance companies, has almost doubled its holdings in BBB-rated financial assets and junk bonds since 2015, which now account for 11 per cent of the group’s interest bearing investments.

QBE chief investment officer Gary Brader said the company had “modestly” grown its low-grade investments “from a low base”.

“As much as anything this reflects diversification away from banks, as a high proportion of global industrials are BBB,” Mr Brader told The Australian.

He said 1.7 per cent of fixed income assets in the group’s $25bn portfolio were junk or unrated, but this was attributed to “assets held in sub investment grade countries” which “match locally written insurance liabilities”.

QBE’s own analysis suggested the average BBB-or-below exposure of its global insurance peers was 27 per cent, while QBE maintains a 20 per cent maximum.

Brisbane-based Suncorp’s holdings in low-rated assets has climbed from 7 to 10 per cent over the last two years.

However, the company has offset this with an increase in its holdings of AAA-rated investments.

“Our average credit quality across the investment portfolio is AA. It’s been stable and there is no intention to change that,” a Suncorp spokesman said.

Suncorp had lifted the share of its highest-rated assets to cushion the impact from a move to diversify its investments and reduce “concentration risk” in its portfolio. “We are diversifying by geography and sector by shifting some Australian fixed income to global fixed income, with global indexed funds carrying a slightly higher ratio of BBB investments,” Suncorp said. “Another factor is our investment in Australian regional bank paper, with the banks recently having had their credit ratings changed to BBB+.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout