Trading Day blog: live markets coverage; Add retail to cart: Morgan Stanley; plus analysis and opinion

The ASX curbs steep losses but fails to shake weak offshore leads as banks trade mixed and metals markets hit miners.

And that’s the Trading Day blog for Wednesday, December 6.

Samantha Woodhill 4.40pm: Local stocks enter damage control

The local share market finished the session considerably lower following lacklustre leads from Wall Street.

At the close of trade, the benchmark S & P/ASX200 was down 25.720 points or 0.43 per cent at 5946.102 points. The broader All Ordinaries index was down 26.910 points or 0.44 per cent, at 6030.398 points.

CMC Markets chief market strategist Michael McCarthy said that despite closing lower, the market has been fairly robust in the face of dismal leads.

“Once again we’re seeing remarkable resilience from Australian investors,” he said.

“We’ve come in facing some fairly dire leads for the market and while we’ve seen an opening response to those leads, the ability of the market to spring back and recapture most of the losses has been quite impressive.

“Once again the story of the bounce off those lows suggests that bargain hunters remain in the market and buying dips mean that any sell offs we’re seeing at the moment are quite shallow.”

In financials, NAB ticked 0.34 per cent lower to $29.46. Commonwealth Bank edged down 0.18 per cent to $78.60. Westpac added 0.45 per cent to $30.97 and ANZ put on 0.68 per cent to $28.24.

Bridget Carter 4.36pm: Billabong likely Surfstitch suitor

Billabong is believed to have made a cash offer for troubled retailer Surfstitch worth between $15 million and $20 million in the hope to protect its distribution channels as the company remains a takeover target.

An update to creditors was being prepared for release to the market on Wednesday afternoon indicating that offers have been received for the business.

DataRoom understands one of the offers is from surf wear label Billabong, which Quicksilver is trying to buy for $1 per share.

Billabong previously owned between 40 per cent and 50 per cent of Surfstitch and sold out for around $35m, but now remains an important customer for the surfwear brand.

It comes after Surfstitch went into administration in August, with FTI Consulting appointed — read more from DataRoom

BBG last 92 cents, SRF last 7 cents

John Durie 4.13pm: Market drivers hard to find

The Australian stock market is treading water after rallying 25 per cent from February 2016 lows, and from here, drivers for outperformance are hard to find.

The market is selling on 15.5 times forecast earnings, which is a touch on the high side against long term averages, and long on complacency.

Credit Suisse strategist Hasan Tevfik sits on the bullish side of the market with forecast 10 per cent growth from here to 6500 points.

UBS’s David Cassidy is looking for just five per cent growth to 6250 points.

So far this year the market is up five per cent in price terms and 9.5 per cent including dividends.

Samantha Woodhill 4.05pm: Tick for Slater & Gordon rescue

Shareholders have approved a plan to recapitalise troubled law firm Slater and Gordon as they handed the firm its second strike, voting against the company’s remuneration report for the second consecutive year.

Chairman John Skippen pleaded with shareholders to vote in favour of the recapitalisation to save the law firm from insolvency at the company’s annual general meeting.

“Recapitalisation is essential for Slater and Gordon to avoid insolvency,” Mr Skippen said — read more

SGH last 4 cents

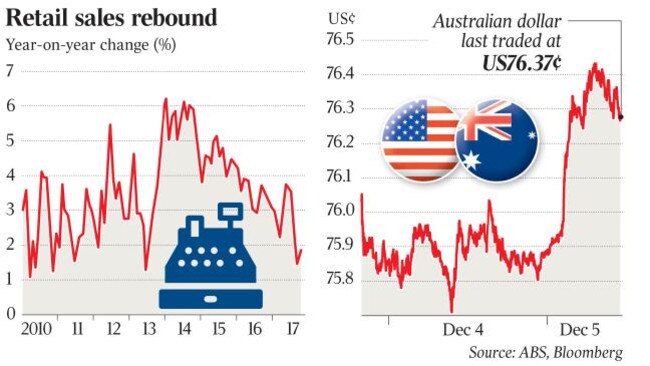

3.42pm: Economists’ GDP hopes crushed

Economists’ hopes of 3 per cent GDP growth between September quarters end-to-end were crushed earlier today after the ABS revealed the Australian economy undershot on these terms with growth to the tune of a mere 2.8 per cent throughout the period.

The optimistic consensus baked into currency investors’ positioning, the Australian dollar fell sharply by 0.5 per cent on the data release and remains at those levels, last buying $US75.80 cents.

A conventional and hotly contested measure of real economic growth, GDP rose 0.6 per cent throughout the quarter or, as Adam Creighton writes, 0.2 per cent after removing that attributable to population growth.

In the United States GDP growth ticked along at a steady 2.6 per cent, in the United Kingdom at 1.5 per cent and a whopping 6.8 per cent in China, placing Australia in the middle of the pack with its own concerns over wage stagnation, inflation and the balance between levels of household debt and savings.

“Over recent periods, wages growth has remained low but consumers have dipped into their savings to increase consumption,” says AMP’s Shane Oliver.

“Solid gains in wealth gave households the confidence to run down their savings rate, but the savings rate has now fallen to 3.2pc from nearly 8pc three years ago and it’s doubtful that households will want to keep running it down as house price gains in Sydney and Melbourne fade.”

Read: Growth slower than expected, writes James Glynn

Sarah-Jane Tasker 3.12pm: Crunch time for Cochlear: JPMorgan

The risk-reward opportunity of investing in Cochlear is “unappealing”, according to JPMorgan, which has downgraded its recommendation on the stock.

But after revisiting its forecast for the hearing implant maker’s earnings, the investment bank has increased its price target on Cochlear shares to $162 from $145.

In a research note to clients, JPMorgan said it had revised its medium-term earnings estimates to better reflect the large “seniors” opportunity that the company had begun to tap, resulting in a solid lift in its valuation of the Australian-listed stock.

With one in three people over the age of 65 affected by hearing loss, seniors represent the largest market opportunity.

“The potential is undoubtedly substantial, but we are wary expectations have become elevated given the likely challenge of consistently expanding rates of implantation into this aged cohort,” JPMorgan said.

“We also note management’s stated intention to invest in market development as aggressively as its financial situation allows, limiting the potential for a near-term earnings surprise.”

Cochlear shares are up over 50 per cent this year, thus the investment bank concludes the risk-reward opportunity is, on balance, unappealing.

JPMorgan now has a “lighten” recommendation on the stock after previously branding it a “hold”.

COH last down 0.4 per cent on $180.21

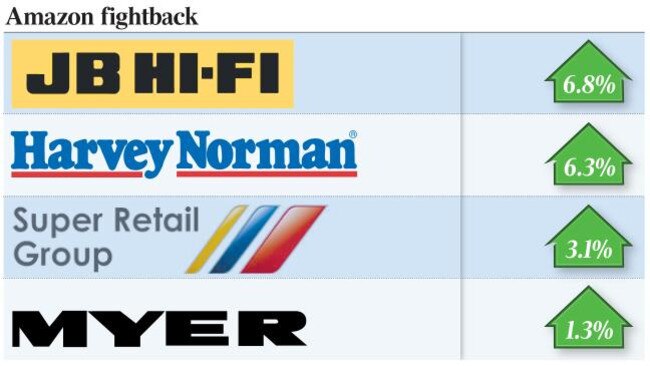

2.49pm: Retailers 1, Amazon 0 at tea

ASX-listed discretionary retailers chop around in afternoon trade, however those considered to be at the pointy end of competitive pressure from Amazon remain in the black after the boheometh launched its full offering on its ‘.au’ yesterday.

JB Hi-Fi holds onto a 4 per cent two-day gain in late trade, Harvey Norman up 3.3 per cent on the same basis, Super Retail Group is up 2.4 per cent on its Monday close and Myer remains 1 per cent in black (albeit down 0.6 per cent today).

Typically associated with volatility, short positioning in these stocks remains elevated. Using lagged ASIC data, shortman.com.au shows JB Hi-Fi the 4th most shorted ASX200 stock five days ago at 15.14 per cent of shares on issue, Myer 11th on the same basis at 10.8 per cent and Harvey Norman 14th on 9.48 per cent.

As Samantha Woodhill writes, analyst weren’t bowled over by an initial competitive threat from Amazon in terms price or delivery, but remain cautious over domestic retail stocks as its Australian operations grow.

According to Bloombergs data, the analyst community rate the stocks as follows:

JB Hi-Fi: 5 buys, 7 holds and 2 sells

Harvey Norman: 3 buys, 4 holds and 4 sells

Super Retail Group: 9 buys, 3 holds and 1 sells

Myer: 1 buy, 6 holds and 4 sells

Read: Amamzon claims record sales, writes Chris Griffith

Supratim Adhikari 2.19pm: TPG cops first strike on exec pay

TPG Telecom has copped a first strike over executive pay, with anxious shareholders lodging a stiff protest vote against the telco’s remuneration report.

The telco’s annual general meeting on Wednesday saw a protest vote of 29.8 per cent against the remuneration report, with TP director Denis Ledbury acknowledging that some shareholders had been left frustrated by the actions of the telco’s board — more to come.

TPM last up 1 per cent on $6.09

2.15pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Asher Tan — CEO/Founder, CoinJar

2.20pm: Tim Larkworthy — Fixed Income, FIIG Securities

3.00pm: Craig Sydney — Shaw and Partners

3.05pm: Jack Lowenstien — Morphic Asset Managment

(All times in AEST)

2.09pm: Implied 8pc QBE discount: Morgan Stanley

A “rebating” or lowering of QBE’s earnings guidance by incoming CEO Patrick Regan at the FY17 result on Feb 26 looks priced in, according to Morgan Stanley.

Morgan Stanley analyst Daniel Toohey considers three scenarios for QBE’s ‘Combined Operating Ratio’ guidance for FY18, one of which is his base case is for FY18 COR guidance of between 94.5 and 96 per cent.

“We estimate QBE is currently priced for a 96 to 97 per cent FY18 Combined Operating Ratio versus [our] $11.60 probability weighted outcome for the above scenarios,” he says.

In an insurance context, combined ratios are a profitability measure of expenses and losses to earned premium.

Read: UBS treads lightly around QBE

This implies the share price could rise about 8 per cent from the current level of $10.72.

“Given the probability weighted outcomes, we reiterate our Overweight call and $12.90 target price. Any rebating needs to be tempered with a likely more upbeat pricing cycle, benefiting FY19 earnings. We also assume the remaining $860m of the A$1bn 3 year buyback is spread evenly over 2018 and 2019.”

QBE last flat at $10.74 after falling as much as 1 per cent at the open.

Matt Chambers 1.43pm: Resource-led gas glut to linger

The global LNG glut that Australia’s resources boom has helped drive could last another 10 years or longer as more projects come on line and put pressure on contract pricing of the nation’s second-biggest export, according to Macquarie analysts.

The report casts doubt on recent statements from the industry and analysts that forecast a supply balance early next decade as Chinese demand increases and small-scale floating regasification terminals drive demand in smaller gas markets.

1.15pm: ASX resources to pave 6400 path

Resources stocks are still likely to boost Australia’s S & P/ASX 200 share index to 6400 points next year according to Citi.

That implies a potential 8 per cent rise from the current level of 5948.8 points for the benchmark index.

“Even after earlier upgrades, we continue to estimate that spot commodity prices, if they persist, could lift FY18 market earnings forecasts another 5 per cent,” equity strategist Paul Brennan says.

“If the market moves up to our forecast of 6400 by end next year, we see performance concentrated in the resource sector still. Other cyclical sectors, majority household facing, seem to offer less now, including banks, but the added areas we see opportunities in remain some of the other oligopolies, supermarkets and insurers, though not yet telecoms.”

He notes that consensus FY18 market earnings growth ex-resources has been pared by as much as 1.5pc since August reporting season, but market growth has been raised 2pc overall due to resource earnings.

Overall he says operating environment for Australian companies seems to be getting better, despite varying across sectors.

Note: Materials lead losses on the ASX as investors exercise caution in the wake of heavy selling in base metal markets — Asian iron ore futures trade also indicates a lower spot price ahead for the key export.

12.52pm: ASX under water as miners feel pinch

Local shares shrink losses, the ASX200 down 0.2 per cent on 5958.7 after falling to a 2-week low of 5939.1 in early trading.

Big miners feel the pinch of dour sector sentiment in the wake of heavy selling in base metals markets, BHP down 1.7 per cent and Rio Tinto 1.9 per cent lower, while the sector’s more volatile stocks reflect LME copper’s sharp 4.5 per cet fall overnight.

Big Four bank shares, however, all trade at least 0.3 per cent in the black.

SWING STOCKS

+ Corporate Travel Managment (3.5pc), FlexiGroup (3.2pc), Southern Cross Media (2.5pc), Myer (1.9pc)

— Orocobre (5.5pc), Western Areas (4.9pc), Independence Group (4pc), South32 (3.4pc), Oz Minerals (2.5pc)

12.32pm: UBS treads lightly around QBE

UBS says it remains cautious on QBE because FY18 guidance — to be outlined by incoming CEO Pat Regan on its February results day — will likely be “conservative”.

The broker trims its target price to $11.85 from $12.20, however it keeps its “buy” rating given “macro support” and its view that a near-term downgrade is mostly factored in.

“We don’t see QBE’s balance sheet as a significant management succession risk, however can’t argue the same level of comfort about medium-term profitability, particularly with respect to expense targets,” UBS analyst James Coghill says.

“We’ve therefore increased our FY18E Combined Operating Ratio assumption from 95 to 95.5pc and tempered yields from 2.9 to 2.7pc, the main drivers behind FY18E EPS reducing by 9.3pc.

In an insurance context, combined ratios are a profitability measure of expenses and losses to earned premium.

The investment bank says its latest analysis is conservative to ‘recognise’ the likely approach of new management rather than any driver in particular.

“Beyond FY18E, we believe a COR of 95pc or better is still achievable — FY19E COR largely unchanged, limiting EPS reductions to 4.7pc.”

This view is more or less consistent with Morgan Stanley’s latest research on the company.

QBE last down 0.2pc at $10.72 after falling as much as 1pc in early trade.

11.38pm: DATA: GDP growth misses expectations

AUD/USD fell 0.5pc to $US75.72 as 3Q GDP missed estimates.

GDP grew 0.6pc in the third-quarter compared with 0.7pc expected by economists. Year-on-year GDP grew 2.8pc vs. 3.0pc expected.

Somewhat ominously, the household savings rate of 3.2 per cent remains stuck near a decade low.

11.08am: DATA: 3Q GDP due 11.30am AEDT

September quarter GDP data are due for release at 11.30am (AEDT).

Bloomberg’s consensus estimates are for increases of 0.7pc Q/Q and a 3.0pc Y/Y.

The annual figure is expected to surge from 1.8pc in the June quarter due to favourable base effects.

“[The] report should underline the solid growth outlook for the economy,” says ANZ economist Felicity Emmett, “however, we expect the wage and price measures to suggest ongoing weak inflation pressures.”

10.58am: ASX falls amid heavy retail trade

Australia’s S & P/ASX 200 share index is down 0.3pc at 5951.9 after hitting a 2-week low of 5939.1 in early trading.

Charts now show a head & shoulders pattern targeting 5815 — assuming today’s fall is sustained — though volume is light at this stage.

Materials are weakest after LME copper fell 4.5pc overnight and most sectors are down after decent falls on Wall Street.

Retailers are still seeing a lot of volume and Myer is up 3.2pc after a generally disappointing launch by Amazon in Australia.

Base metals producers including South32, Oz Minerals, Independence and Western Areas are down more than 2pc, while BHP is down only 1.5pc and remains range bound.

Some of the market darlings remain under pressure with Orocobre, Qantas, Estia Health and Bega Cheese down more than 2pc in early trading.

10.51am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Live cross — Morgans Financial

11.15am: Ric Spooner — Chief Markets Analyst, CMC Markets

11.30am: Paul Bloxham — Chief Economist, HSBC

11.45am: Andrew Tyrell — Senior Investment Advisor, Shaw and Parnters

12.00pm: Greg McKenna from Axi Trader and Henry Jennings from Marcus Today

12.00pm: Ben Le Brun — Charles Schwab

12.15pm: James King — Currency Analyst, AFEX Australia

12.45pm: Paul Dales — Chief Economist, Capital Economics

(All times in AEST)

Michael Roddan 10.40am: APRA takes aim at super funds

The prudential regulator will push ahead with new rules that force greater transparency on how superannuation fund boards spend member savings, regardless of the Turnbull government’s stalled efforts to pass controversial reforms.

Although the government’s super “slush fund” clampdown bill aimed at tackling hidden payments was withdrawn on Monday, regulators have already investigated or are reviewing instances of questionable spending by funds, which were raised by members of the Coalition.

10.19am: WATCH: Gerry Harvey on Amazon launch

10.16am: Retail stocks book opening gains

Harvey Norman posts gains over 2 per cent, JB Hi-Fi is up 1 per cent and Super Retail Group trades 0.6 per cent higher at the open as the market buoys discretionary retailers after a strong recovery the session previous on the debut of Amazon’s full offering to Australian customers.

Read: Add retail to cart, says Morgan Stanley

Supratim Adhikari 10.11am: TPG laments NBN headwinds

TPG boss David Teoh has apologised to shareholders for the slide in the challenger telco’s share price, citing the impact of the National Broadband Network as a major headwind for the company.

Speaking to TPG shareholders on Wednesday, Mr Teoh said that the telco’s board had a strategy in place to counter the headwinds in place, even as it pushes ahead with the building of its mobile network — read more

TPM last $6.03

10.00am: Leads tip ASX lower at open

Australia’s S & P/ASX 200 share index is expected to open down 0.4pc based on futures versus fair value.

This follows a 0.4pc fall in the S & P 500 led by an ominous 1.4pc fall in the Dow Jones Transportation Average. The other red flag was a 4.5pc fall in LME copper — the biggest in more than two years — amid rising LME inventory.

But the VIX index fell slightly, and Brent crude rose 0.4pc to $US62.67, while spot iron ore was unchanged. Still, BHP ADR’s equivalent close at $27.22 was 1.9pc below BHP’s Australian closing yesterday.

On the charts a close below “neckline” support today at 5973 would target 5918 based on a head & shoulders pattern.

Index last 5971.8.

9.48am: Add retail to cart: Morgan Stanley

Amazon’s Australian offering “isn’t that competitive” and its launch here was “less disruptive than expected”, according to Morgan Stanley.

Moreover shares of retailers including JB Hi-Fi, Myer, Super Retail Group and Harvey Norman — which were sold before launch of Amazon — should see a “reprieve”

JBH and HVN shares surged more than 6pc yesterday while SUL shares rose 3.1pc and MYR rose 1.3pc.

“While clearly Amazon will improve its offer over the coming years, the prospects of a pricing reset is low, ranging is relatively weak and delivery times aren’t as favourable as existing leading retailers,” Morgan Stanley analyst Tom Kierath says.

He says the width and depth of the offering is “very low”, and while Amazon launched 20 categories, Mr Kierath struggled to find market leading brands within the range.

His pricing comparisons found consumer electronics are about 13pc more expensive on Amazon, Apparel and Sports is largely in line with leading retailers and dry grocery is 13pc cheaper than Coles and Woolworths.

Delivery time and cost look “in line with existing retailers, perhaps even a little slower and more expensive”, Kierath says.

Metro delivery times of 3-5 days is in line with retailers and guaranteed next day delivery for $9.99 is more expensive versus JB Hi-Fi at $9.99 for same day.

“So we doubt that consumers will purchase on Amazon for the speed/cost of delivery,” he says.

He does note that Amazon’s delivery times could fall when it launches its Prime service in mid ‘18.

Morgan Stanley currently have a “tactical buy” rating on JB Hi Fi and Super Retail Group.

9.13am: Analyst rating changes

Cochlear cut to Underweight — JPMorgan

Virgin Australia cut to Sell — Goldman Sachs

Suncorp raised to Buy — Bell Potter

IAG cut to Hold — Bell Potter

Galaxy Resources raised to Buy — Bell Potter

Appen raised to Buy — Bell Potter

Corporate Travel raised to Add — Morgans

Reported yesterday:

Oil Search raised to Outperform — Macquarie

Santos cut to Neutral — Macquarie

9.08am: Incitec’s BHP deal to expire

Incitec Pivot will cease to be BHP Iron Ore’s supplier of ammonium nitrate prill from November 28 2019 upon the expiry of its current contract.

The company expects no financial impact in FY18 and FY19 and a maximum NPAT impact of $10m in FY20, $25m in FY21 and “minimal” beyond — read more

IPL last $3.98

9.04am: CFSGAM float inches froward

Scott Murdoch and Bridget Carter write:

The Commonwealth Bank could be inching forward on a Colonial First State Global Asset Management float, with meetings held in the past week with major fund managers overseas.

The bank, Australia’s largest by market capitalisation, flagged in September that CFSGAM was officially on the block, ending months of speculation.

8.53am: Amazon launch falls flat

Adam Creighton and Eli Greenblat write:

Fears Amazon’s local launch would spell disaster for Australian retailers appeared overblown yesterday as details emerged of the behemoth’s “patchy” retail offerings and the share prices of local competitors soared.

Just hours after the US firm’s Australian website went live, shares in JB Hi-Fi and Harvey Norman jumped more than 6 per cent — on a day the overall market went backwards. “Amazon is finally here, and it’s ‘meh’,” exclaimed respected stockbroker Richard Coppleson. “And in an embarrassing oversight its own Kindle is $20 cheaper at Officeworks. Amazon’s range is patchy across and within categories,” added analysts at Citi, noting 40,000 toys and games but not televisions were available on the site.

“We don’t expect Amazon to be disruptive to Australian retailers this Christmas.”

8.27am: Wall St tech bounce falls flat

Michael Wursthorn and David Hodari write:

U.S. stocks pulled back Tuesday, even as shares of technology companies rose following losses in recent sessions.

The S & P 500 declined 0.4pc, while the Dow Jones Industrial Averaged shed 109 points, or 0.5pc, to 24180. The teach-heavy Nasdaq Composite slipped 0.2pc, its third consecutive session of declines.

“The market feels directionless with the uncertainty in the political environment,” said Mike Allison, a portfolio manager with Eaton Vance. Mr. Allison added that volatility has picked up among the underlying sectors, giving investors some buying opportunities.

“The market is looking for relative winners from tax reform and relative losers,” Mr. Allison said.

Most of the S & P 500’s sectors declined Tuesday, with the exception of technology. The declines were steepest among telecommunications companies, off 1.8pc, and utilities, down 1.2pc.

Declines offset gains among technology firms. Shares of tech companies in the S & P 500 rose 0.2pc Tuesday, recouping some of the losses suffered Monday.

Shares of Facebook gained 0.8pc but are down more than 5pc over the past week. Nvidia rose 0.6pc, paring its one-week decline to 11pc.

“Investors have a sense that the fundamentals are still in shape for tech,” said Mike Bailey, director of research at FBB Capital Partners, a wealth manager with $1 billion in assets. He added that FBB plans to use the recent weakness among tech stocks to increase the firm’s exposure. “This tech correction has helped us put a couple of things at the top of our list,” Mr. Bailey said.

Dow Jones Newswires

8.23am: Upbeat RBA expects pick-up

The Reserve Bank has set the scene for a pick-up in the animal spirits needed to fire up the economy as the central bank took a more upbeat stance even as it left the official cash rate at a record low of 1.5 per cent at its monthly board meeting yesterday.

Ahead of this morning’s release of national accounts figures, which are expected to show that year-on-year economic growth accelerated to a 15-month high of 3 per cent, the RBA said the outlook for non-mining investment had “improved further” and noted “some employers are finding it more difficult to hire workers with the necessary skills”, which could ultimately lead to a long-awaited pick-up in wages growth.

8.00am: Gold at 2-month low

Gold has dropped one per cent to a two-month low as the US dollar rises against a basket of currencies and US stocks rebounded as investors assessed details of the US tax overhaul legislation.

The US dollar gained for a second consecutive session and US technology stocks bounced, both benefiting from optimism surrounding the US tax plan. The House of Representatives on Monday voted to go to conference with the Senate on their differing versions of the tax legislation, setting up formal negotiations on the bill.

Spot gold was down 1 per cent at $US1,263.02 an ounce by 5.49am (AEDT), after dropping to a two-month low of $US1,260.71. US gold futures for February delivery settled down $US12.80, or 1 per cent, at $US1,264.90 per ounce.

“With this move today, that opens the door to more liquidation until you get more geopolitical risk and uncertainty in the world,” said Josh Graves, senior commodities strategist at RJO Futures in Chicago.

Psychological support could come in at around $US1,250 an ounce, Graves added.

Reuters

7.45am: ASX set for weaker start

The Australian share market looks set to open firmly in the red following Wall Street’s the negative lead with the Dow and the S & P500 down as investors weigh the impact of a tax overhaul.

At 7am (AEDT), the share price futures index was down 27 points, or 0.45 per cent, at 5,953.

In the US, investors have been reallocating money to banks, retailers and other stocks seen as winning the most from tax cuts promised by President Donald Trump.

In late US afternoon trading, the Dow Jones Industrial Average was down 0.36 per cent, the S & P 500 had lost 0.028 per cent, while the Nasdaq Composite had added 0.02 per cent to 6,776.79.

Locally, in economic news today, the Australian Bureau of Statistics is due to release national accounts, including gross domestic product, data for the September quarter.

In equities news, TPG Telecom’s annual general meeting is set down for today, while Slater and Gordon has scheduled its shareholders’ claim meeting for today, along with its AGM.

News Corp chief executive Robert Thomson is scheduled to participate in the UBS Annual Global Media and Communications Conference in the US.

The Australian market yesterday lost ground as falls in the heavyweight financial, mining and healthcare sectors outweighed a good session for retailers.

The benchmark S & P/ASX200 index fell 13.9 points, or 0.23 per cent, to 5,971.7 points.

The broader All Ordinaries index lost 13.8 points, or 0.23 per cent, to 6,056.8 points.

AAP

7.00am: Dollar down

The Australian dollar is weaker against its US counterpart, and back flirting with the US76 cent mark.

At 6.35am (AEDT), the Australian dollar was worth US76.07 cents, down from US76.48 cents yesterday.

The US dollar overnight has strengthened for its second straight session a day after posting its biggest daily rise in a week.

The currency has continued to benefit from the optimism spawned by the Republicans tax reform bill passing through the Senate.

The Aussie dollar is Australian dollar is also down against the yen and the euro.

AAP

6.50am: Copper cops it

Copper had its biggest drop for two years with the price hitting its lowest level in two months as inventories rose and the dollar firmed on expectations of US tax reform.

Benchmark copper closed 4.2 per cent lower at $US6,542 per tonne, after touching its lowest level since October 5 at $US6,533.50.

The metal, which is widely used in power systems and construction, fell by the most in one session since July 2015. “Because of the strength of the dollar this week we are seeing metal prices which are denominated in dollars coming under pressure,” FOREX.com analyst Fawad Razaqzada said.

A trader said there was also market talk that demand for copper was set to weaken due to plentiful stocks, adding that the next support is seen at $US6,440-$US6,480.

Reuters

6.45am: US stocks fade after tech rebound

Shares of US technology companies rebounded in US morning trade, pulling major US indexes higher before they faded late in the day.

By an hour before the close, US indexes were down. The Dow Jones was down by around 88 points or 0.4 per cent. The S & P 500 index fell by 0.3 per cent and the Nasdaq was down by around 8 points or 0.1 per cent after declining for two consecutive sessions.

Australian stocks are tipped to fall at the open. At 6.50am (AEDT) the SPI futures index was down 24 points.

“The market feels directionless with the uncertainty in the political environment,” said Mike Allison, a portfolio manager with Eaton Vance. Mr Allison added that volatility has picked up among the underlying sectors, giving investors some buying opportunities.

“The market is looking for relative winners from tax reform and relative losers,” Mr Allison said.

Most of the S & P 500’s sectors declined, with the exception of technology. The declines were steepest among telecommunications companies, off 1.4 per cent, and utilities, down 1.3 per cent.

Consumer-discretionary stocks in the S & P 500 were also trading lower after 12 consecutive sessions of gains. Analysts partly attributed the recent rally to prospects of a lower corporate tax rate for retailers that tend to pay a relatively high tax bill.

Dow Jones

6.40am: European equities mark a pause

Europe’s major stock markets wobbled as investors fretted over brewing Brexit uncertainty.

Frankfurt stocks dipped 0.08 per cent while Paris shed 0.3 per cent. A weak pound helped shore up London’s FTSE 100 index, which traded in the green for much of the day, but it closed 0.2 per cent lower.

Sterling remained under pressure one day after British and European negotiators failed to reach an agreement on Brexit.

A weak British unit boosts multinationals that earn in currencies other than the pound.

“The FTSE 100 was being assisted by the weakness in the pound, but now has slipped into the red,” said David Madden, analyst at IG trading group, shortly before the close of trading.

“The London index is comprised of a lot of companies that rely heavily on international business, so the softness in sterling is boosting some of the companies that make up the FTSE 100.”

The pound had initially rallied yesterday on hopes that British Prime Minister Theresa May was close to a divorce deal with Brussels.

But talks collapsed after Arlene Foster, leader of the pro-British Democratic Unionist Party (DUP), objected to May’s position on the future of Northern Ireland’s border with eurozone member Ireland.

“It was no deal but a lot of excitement during yesterday’s European session, however ultimately it was disappointment yet again when it comes to Brexit, as optimism was quickly wiped out,” noted AxiTrader analyst James Hughes.

AFP