Upbeat RBA expects pick-up in economy

The Reserve Bank has set the scene for a pick-up in the animal spirits needed to fire up the economy.

The Reserve Bank has set the scene for a pick-up in the animal spirits needed to fire up the economy as the central bank took a more upbeat stance even as it left the official cash rate at a record low of 1.5 per cent at its monthly board meeting yesterday.

Ahead of this morning’s release of national accounts figures, which are expected to show that year-on-year economic growth accelerated to a 15-month high of 3 per cent, the RBA said the outlook for non-mining investment had “improved further” and noted “some employers are finding it more difficult to hire workers with the necessary skills”, which could ultimately lead to a long-awaited pick-up in wages growth.

The more positive tone in the prepared comments accompanying the RBA’s monthly board meeting was consistent with the optimism over the outlook for employment, wages and investment expressed by RBA officials including governor Philip Lowe in recent weeks.

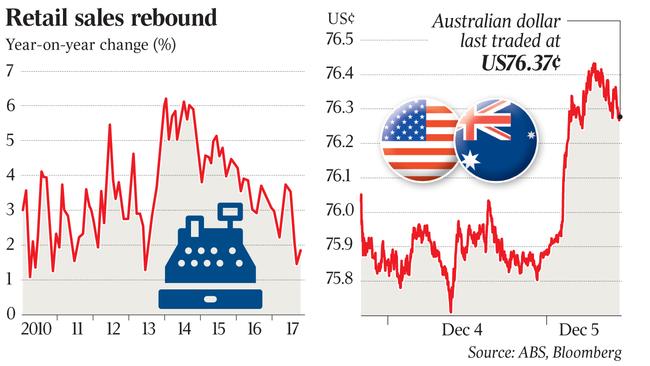

Reflecting the more upbeat tone of the RBA, the dollar hit a three-week high of US76.54c after the statement, extending a rise from around US76.08c that followed stronger-than-expected retail sales data. Last night the dollar was trading at US76.37c.

Bricks-and-mortar retail spending rose 0.5 per cent in October, twice as fast as expected. Adding to confidence among local retailers was online giant Amazon’s lacklustre debut, which sent shares in JB Hi-Fi and Harvey Norman surging more than 6 per cent.

“Amazon may have officially launched but domestic retailers have their own reasons to be cheerful,” said CommSec’s Craig James.

“It is hoped that October’s broad-based bounce in sales will provide a strong lead into the Christmas trading period.”

The market-implied chance of an official interest rate increase occurring by mid-2018 remained about 35 per cent and the chance of a lift by the end of 2018 stayed near 90 per cent.

While maintaining that “holding the stance of monetary policy unchanged at this meeting would be consistent with sustainable growth in the economy and achieving the inflation target over time”, Dr Lowe yesterday also appeared open to the possibility of an earlier-than-expected rise in inflation and he was no longer worried about the dollar being too high for the economy.

Last month’s comment that “inflation is likely to remain low for some time” was not included, and comments that the “higher exchange rate is expected to contribute to continued subdued price pressures” and is “weighing on the outlook for output and employment” were also cut, with the Australian dollar trade-weighted index having fallen about 1.7 per cent since the November meeting.

Still, the RBA governor reiterated that “an appreciating exchange rate would be expected to result in a slower pick-up in economic activity and inflation than currently forecast”.

“This we believe was probably the most important change in the statement ... while wage growth remains weak, some sectors are starting to report difficulty in hiring workers with the necessary skills,” Barclays economist Rahul Bajoria said.

“In our view, this does not mean that the RBA expects wages to rise sharply, but it may reassert the policy rationale that wages eventually should start to rise at a faster pace if the stronger conditions in labour markets persist.”

But balance of payments data also released yesterday showed that net exports will make a flat contribution to economic growth in the September quarter, whereas economists expected a 0.3 per cent boost.

“Overall, (the) policy decision remains in sync with RBA’s recent narrative of being in a holding pattern until it sees a material shift in data in either direction,” Barclays Bajoria said.

“The recent improvement in the global PMIs (purchasing managers indexes) and the increase in global demand is a positive for the 2018 outlook, but in terms of monetary policy, we expect the RBA to remain on hold through the first half of 2018 and wait for signs of a more broad-based recovery across businesses and in household incomes before firmly signalling any change in its policy stance.”

ANZ senior economist Felicity Emmett agreed that the RBA was likely to keep interest rates on hold until it was more confident that wages and inflation were moving higher.

“We expect that by the middle of next year the bank will be confident enough that wages and inflation are picking up to lift rates off the 1.5 per cent low,” she said.

HSBC chief economist Paul Bloxham said he expected the Australian economy to continue growing at an above-trend pace above 3 per cent, year on year, in the coming quarters, pushing the unemployment rate down further than the Reserve Bank currently expected.

“We expect the tightening of the labour market to mean that wage growth will pick up modestly from here,” he said. “In short, our view is similar to the RBA’s, but we see the pick-up in underlying inflation arriving more quickly than the central bank is currently forecasting.”

But Capital Economics chief economist Paul Dales said hopes of stronger economic growth and inflation next year would prove to be wishful thinking on the part of the RBA.

“While the comments in today’s statement that ‘the central forecast is for GDP growth to average around 3 per cent over the next few years’ and that the ‘central forecast remains for inflation to pick up gradually’ sound fairly optimistic, the minutes of November’s meeting and Lowe’s speech suggest that the RBA is steadily acknowledging the downside risks to its forecasts,” he said.

“We think this is the right approach to take and believe that the RBA will have to go further and revise down its central forecasts for economic growth and inflation.”

“Interest rates may not rise until late in 2019,” he added.

“The financial markets are slowly coming round to this view, but a further fall in their rate expectations could contribute to the Australian dollar weakening from US76c now to around US70c next year.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout