Retailers buoyed as Amazon’s Australian launch falls flat

Fears Amazon’s local launch would spell disaster for Australian retailers appeared overblown yesterday.

Fears Amazon’s local launch would spell disaster for Australian retailers appeared overblown yesterday as details emerged of the behemoth’s “patchy” retail offerings and the share prices of local competitors soared.

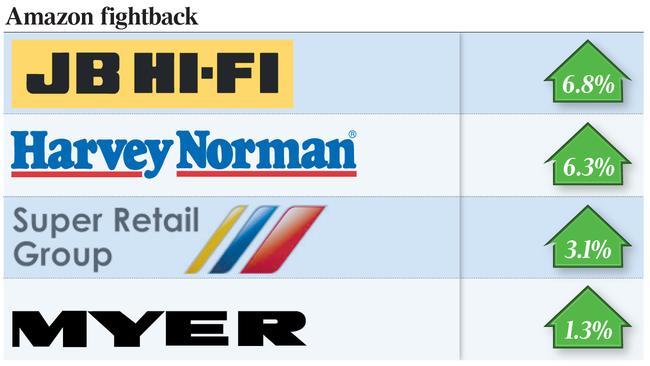

Just hours after the US firm’s Australian website went live, shares in JB Hi-Fi and Harvey Norman jumped more than 6 per cent — on a day the overall market went backwards. “Amazon is finally here, and it’s ‘meh’,” exclaimed respected stockbroker Richard Coppleson. “And in an embarrassing oversight its own Kindle is $20 cheaper at Officeworks. Amazon’s range is patchy across and within categories,” added analysts at Citi, noting 40,000 toys and games but not televisions were available on the site. “We don’t expect Amazon to be disruptive to Australian retailers this Christmas.”

Shares in some of the biggest retail companies, including Myer and Super Retail Group which owns Rebel, had fallen by as much as 20 per cent in the months leading up to Amazon’s launch. There were fears the US giant, which generates more than $130 billion of sales globally, would cost Australian competitors billions of dollars. But Myer shares bounced 1.3 per cent on a day the benchmark ASX 200 index fell 0.2 per cent. “We will continue to play to our strengths: providing leading brands, experiences and service,” a Myer spokesman said. “These are things that set us apart from our competitors and represent a real point of difference for Myer.’’

Retail billionaire Gerry Harvey last night criticised Amazon for engaging in unsustainable low pricing to capture market share.

“Amazon can afford to go out there, that is why they are so dangerous, they can go out there and sell 20 per cent below cost,’’ he told Sky Business. “Amazon, which has paid no GST here for 10 years, no tax, probably never will, they can do it and we can’t.”

National Retailers Association chief executive Dominique Lamb said: “Australia is a vast country, which is sparsely populated when compared with other Amazon hot spots like the US and UK, and less infrastructure to support it, as well as some of the most complex and challenging IR laws and some of the highest wages in the developed world.”

Amazon’s lacklustre reception wasn’t the only good news for local outfits. Bricks-and-mortar retail spending rose 0.5 per cent in October, twice as fast as expected. “Amazon may have officially launched but domestic retailers have their own reasons to be cheerful,” said CommSec’s Craig James. “It is hoped that October’s broad-based bounce in sales will provide a strong lead into the Christmas trading period.”

The retail cheer failed to shift the Reserve Bank’s expectation of a gradual increase in inflation and wage growth. In its final meeting of the year, the RBA kept the cash rate on hold at 1.5 per cent.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout