Shares extend sell-off to 2.5pc as RBA warns on output slip

The local sell-off extended to 2.5 per cent by the close, to cement the worst two-day drop in five weeks.

- Elective surgery to restart next week

- Virgin collapses into administration

- BHP braces for ‘sharp’ US, EU contraction

- Premier to close stores for longer

That’s it for the Trading Day blog for Tuesday, April 21. The local market sell-off extended for a second day, with shares finishing down 2.5 per cent to mark the ASX200’s worst two-day drop in five weeks.

Oil weakness continued to weigh on investors after trade fell into negative overnight on fears of a supply glut.

BHP warned of a sharp demand contraction across US and Europe while Virgin collapsed into voluntary administration, providing a slight boost to rival Qantas but a further slide in travel names such as Webjet.

4.46pm: Tech, not energy, finishes last

Despite the plunge in world oil prices, energy was not the worst performing sector for the session – finishing the day down 2 per cent, while tech shares dropped 4.9 per cent.

Oil Search posted a near 10 per cent drop in first quarter revenue, still beating estimates, but its shares were the worst hit in the sector, falling by 6 per cent to $2.50.

Woodside gave up 1.3 per cent to $19.89, Santos lost 2.9 per cent to $4.01 and Beach Energy lost 3.4 per cent to $1.29.

BHP, which has some oil exposure through its partnership with Woodside, among others, handed down its quarterly production report, saying it expects a sharp contraction in the US, Europe and India. Its shares finished the session down 2.5 per cent to $30.03 while Rio Tinto lost 2.1 per cent to $87.06 and Fortescue wound back by 2.2 per cent to $11.10.

Gold mining names were the only relief, buoyed by defensive buying. Newcrest put on 0.6 per cent to $27.66 as Evolution jumped by 5 per cent to $4.99, Regis Resources put on 4.3 per cent to $4.15 and Northern Star lifted by 4.2 per cent to $12.99.

Here’s the biggest movers at the close:

4.13pm: ASX slides 2.5pc on RBA warning

The local market was awash with negative news on Tuesday, sending the ASX to its worst two-day drop in five weeks.

Crude oil prices collapsed into negative trade overnight for the first time in history on fears of a supply glut caused by coronavirus shutdowns, but the knockout strike for the market was the RBA’s latest estimates for economic growth.

The speech by Governor Philip Lowe, released at 3pm, sent the ASX200 into a tailspin to finish the session down by 132 points or 2.46 per cent at 5221 – marking a 4.85pc decline in just the past two days.

4.01pm: COVID-19 crisis unprecedented: VGI

Robert Luciano, the executive chairman of listed hedge and long term fund VGI Partners said the current COVID-19 crisis is “quite different and frankly unprecedented” from anything he has ever seen.

“This time we are dealing with a broadbased consumer crisis stemming from an economic shutdown rather than a financial crisis. We have never before seen entire economies put into hibernation with the result that, in the space of only a few weeks, tens of millions of people have joined the ranks of the unemployed or underemployed,” Luciano tells investors in an update.

While he notes that markets have “rallied hard off their March lows”, he says “we are deeply concerned”.

“We don’t yet know what shape the consumer or economy will be in when this situation settles but there is no basis for optimism in the data to date. The range of potential scenarios for how things unfold from here – coupled with the market’s apparent confidence that the eventual recovery will be V-shaped – is creating fresh challenges for how we position our portfolios”.

Still he says there is no fundamental change to VGI’s investment approach.

“We invest in high-quality businesses that are easy to understand and that trade at prices we believe exhibit a sufficient margin of safety – that is, trading at prices that are significantly below our assessment of the intrinsic value of the business.

“Second, we use little or no leverage and keep prudent cash buffers. In some cases, we have used recent volatility to build our position in businesses that have been on our target list. However, we remain very cautious and have also increased our short positions and cash weightings in the last couple of months”.

3.53pm: Shares fall 2.6pc

Gloomy comments from RBA Governor Lowe have added to downward pressure on shares from plunging oil prices, a US halt on immigration and a bearish wedge pattern on the chart.

The S&P/ASX 200 is down 2.6pc at 5215.5 after falling an additional 47 points following his speech, though AUD/USD was unaffected.

The index is currently down 5.1pc in the past two-days, on track for its worst two days in five weeks, after bouncing 26pc from a 7-year low of 4402.5 four weeks ago.

3.34pm: RBA bond purchases pass $47bn

Reserve Bank governor Philip Lowe says the RBA has bought around $47bn of government bonds so far to help support debt markets.

“We have bought bonds along the yield curve and bonds issued by the Australian government and by the states and territories. We have done this through daily auctions in the secondary market. The initial daily purchases were quite large – $4 and $5bn a day.

“In those first days we were keen to underline our commitment to the target and we were also seeking to relieve some of the very severe dislocation in the government bond market at the time,” Dr Lowe says in a speech this afternoon.

“As conditions in the market have improved and the 3-year yield has settled around 25 basis points, we have scaled back our daily bond purchases – over recent days, the purchases have averaged around $750m. We will scale up these purchases again if needed and we will buy bonds in whatever quantity is required to achieve our goals”.

#RBA Gov Lowe stresses the RBA not buying bonds from the gov and so "does not finance the gov".

— Shane Oliver (@ShaneOliverAMP) April 21, 2020

(So its not "helicopter money" or "MMT" - my comment)

But "our actions are affecting funding costs" for gov & priv borrowers "as they should in the exceptional circumstances we face" pic.twitter.com/8m54FQTBie

3.15pm: ASX extends decline

Losses on the local market are extending to 2pc as RBA governor Philip Lowe sets out his economic forecasts for the year.

The ASX200 is trading down by 2 per cent at daily lows of 5246.1.

3.09pm: Lowe lays out ‘plausible’ recovery plan

Dr Lowe lays out a plausible scenario for recovery, tipping restrictions to be progressively lessened into the middle of the year and “mostly removed by late in the year, except perhaps the restrictions on international travel”.

“Under this scenario we could expect the economy to begin its bounce-back in the September quarter and for that bounce-back to strengthen from there. If this is how things play out, the economy could be expected to grow very strongly next year, with GDP growth of perhaps 6–7 per cent, after a fall of around 6 per cent this year.

“There is though quite a lot of uncertainty around the numbers, with the exact profile of the recovery depending not only upon when the restrictions are lifted but also on the resolution of the uncertainty that people feel about the future.”

Dr Lowe’s comments are doing little to shake the Aussie dollar, last at US63.01c.

3.02pm: RBA warns of 10pc output drop

Reserve Bank governor Philip Lowe has warned of a 10pc fall in national output for the first half of the year as coronavirus lockdowns crimp growth.

In an economic and financial update this afternoon, Dr Lowe stressed “precise numbers on the magnitude of this contraction is difficult”.

Here’s some of his key points:

- National output is likely to fall by around 10 per cent over the first half of 2020, with most of this decline taking place in the June quarter

- Total hours worked in Australia are likely to decline by around 20 per cent over the first half of this year

- The unemployment rate is likely to be around 10 per cent by June, though he is hopeful that it might be lower than this if businesses are able to retain their employees on lower hours. The unemployment rate would have been much higher than this without the government’s JobKeeper wage subsidy.

“These are all very large numbers and ones that were inconceivable just a few months ago. They speak to the immense challenge faced by our society to contain the virus,” he said.

RBA says economy to take massive hit and unless our leaders cooperate beyond this initial emergency, the recovery will disappoint. Quite clear the implication is that it will be the private sector that leads us out of this supported by govt investment

— Warren Hogan (@_warrenhogan) April 21, 2020

Jared Lynch 2.53pm: AusPost gets temporary delivery relief

Australia Post will deliver mail every second business day in metro areas while interstate mail will be delayed by up to five days after the Morrison Government granted the postal service temporary relief from its community service obligations.

AusPost will also suspend its priority letters service, which accounts for 12 per cent of daily letter volumes under the relief package, which aims to combat coronavirus-led restrictions such as strict social distancing measures and travel bans.

But AusPost will maintain its express post service and frequency of deliveries in rural and regional areas.

AusPost must operate a five-day a week delivery service under its community service obligations, which currently sets a performance standard of delivering mail within three business days in same-state metro areas and five business days between interstate cities.

The relief – which applies until June 30 – will allow AusPost to deliver from every business day to every second business day in cities, while interstate deliveries will be pushed out by five days.

2.42pm: Weekly jobs read on bleak trajectory: NAB

The latest weekly jobs data from the ABS has the local economy on track for its worst monthly decline since the survey started in 1978.

Data released this morning showed a 6pc drop in payroll employment since Mid-March – different to the official measures of employment as it counts the number of jobs (where people can work more than one job) and excludes the self-employed.

NAB economist Kaixin Owyong notes that the data hints at a worrying trajectory.

“Mindful of these differences, it is worth stressing that if a similar decline is captured in the labour force survey in April, it would equate to a loss of 0.8m jobs,” she writes.

“If this occurs, it would represent the largest percentage decline since monthly data were first published in 1978, with quarterly data suggesting it would be the largest fall since before federation.”

Read more: 780,000 jobs gone and counting

2.35pm: Raisings eating into cash holdings: UBS

Cash levels among investors remain elevated, but the over $10 billion in new equity raised since 25th March has “clearly had some impact on cash balances,” says UBS analyst Richard Sleijpen in a media call.

“We have seen an increasing tendency for some existing shareholders to bid for only their pro-rata share rather than bid for any over-allocation as they preserve cash for other potential offerings,” he says.

“This makes targeting the right new investors that have excess cash balances all the more important to ensure the best terms and a successful raising.”

Mr Sleijpen notes that of investors still overweight cash, those with more flexible mandates – which had up to 50pc cash in mid-March – have almost halved that to around 25 per cent.

“This is around the historic average for those investors, but this still provides significant excess capacity which we expect to be deployed into liquidity events as the market continues to rally,” he says.

While equity raising activity moderated from a record pace in the prior week, it was still elevated with almost $2 billion raised across 6 deals of more than $50m, compared to the prior week with 10 deals raising over $4 billion.

Five of those were placements and only 1 had an accompanying rights issue – but all of those placements were below 15pc of issued capital with no companies using the increased 25pc placement capacity.

“We also saw a clear shift in use of proceeds and messaging towards proactive balance sheet management and growth which we expect to be more likely going forward, versus the prior week of balance sheet restoration and immediate cash injections which were phase 1 of the current capital raising cycle,” Mr Sleijpen says.

2.02pm: US bounce has gone too far: Citi

Citi’s chief US equity strategist Tobias Levkovich says US share prices have rebounded “potentially a bit too much given all the uncertainties” and the S&P 500 “may be ahead of itself” after bouncing as much as 31pc in 5 weeks.

“There are mixed signals from shorter time frame sentiment data and those showing up in what might be priced into equities longer term plus risk premiums,” Mr Levkovich says in a report.

“In essence, confusion may reign, but stock prices recovered by more than 25 per cent in about a month’s time. Thus, the volatile swings have made it gruelling to be able to either sell or buy stocks given the speed of the moves and liquidity dynamics as well.

“Overall, we would wait for more opportune times to buy stocks and think that a shift toward value names makes some sense versus chasing the current winners, as too many investors seem crowded in them already.”

With his Panic/Euphoria Model is “no longer in panic territory”, Mr Levkovich says “we find it hard to suggest buying equities right now”.

“Getting back to work in a pre-virus manner seems challenging to understand right now, as people are likely to edge back in versus returning to their lives as they were in early January,” he adds.

Jared Lynch 1.52pm: Elective surgery to restart next week

Private hospitals will be able to restart elective surgeries from next week after the Federal Government lifted restrictions on non-essential procedures as the number of Australian coronavirus infections slows.

Prime Minister Scott Morrison said 25 per cent of elective surgeries in public and private hospitals will be allowed to be performed from next Monday.

This includes all IVF procedures, screening and testing procedures, post cancer reconstruction surgery, dental operations, hip, knee and other joint replacements, all surgery on children under 18 and colonoscopies and endoscopies.

The lifting of restrictions will be welcomed by private hospitals, which have been under significant financial pressure after the government banned all elective surgeries – the private health sector’s major revenue driver – last month.

Still, Ramsay Health Care, one of the country’s largest private health providers, is trading lower by 0.5pc to $65.17.

Read more: Elective surgery under the microscope

Adam Creighton 1.46pm: Sharp uptick may be too optimistic: RBA

Billions of dollars of cash handouts to bolster the economy might not work, and hopes of a sharp economic rebound in September once the coronavirus passes might prove optimistic, the Reserve Bank of Australia’s Board has heard.

In its first meeting since launching an unprecedented quantitative easing program and ultra-cheap loans to banks, the RBA Board said it expected lockdown measures to remain in place for “at least a couple of months in most countries”.

“GDP could fall significantly in the June quarter and remain subdued in the September quarter,” the minutes of the April board meeting, released on Tuesday, said.

Read more: No guarantees on quick rebound: RBA

1.35pm: Defensive buying buoys gold names

Gold names are offering a rare spot of optimism on Tuesday, as traders turn broadly risk averse.

As the market trades lower by 1.7pc, local gold miners are dominating.

Evolution Mining is higher by 4.4pc, Northern Star by 3pc, Newcrest by 0.5pc and Regis Resources by 3.8pc.

Overnight, gold prices climbed as much a 1pc – coming back from a recent one-week low as a plunging oil price shattered risk sentiment.

1.17pm: Nine CEO trims stake in settlement

Nine chief executive Hugh Marks has trimmed his stake in the company as part of his divorce settlement, with 216,000 shares transferred to his ex-wife.

The pair reportedly split late last year, after a marriage of more than two decades.

In a filing to the market this afternoon, Nine said Mr Marks had transferred 216,216 shares in the company to his wife “pursuant to his marital settlement agreement”.

At today’s market price of $1.16 apiece, the stake would be worth $250,800.

Post the transfer, the Nine boss retains 1.95 million directly held shares, along with 282,00 held indirectly and more subject to vesting.

Read more: Marks’ days as Nine boss may be numbered

1.02pm: Shares extend daily loss to 1.9pc

Shares extended the day’s losses to 1.9 per cent in lunch trade, falling sharply alongside weakness in US futures.

At 1pm, the benchmark is trading at 5263.9, down 1.7pc and with only utilities in the green.

Energy is still weaker by 2.2pc but tech and industrials are now performing worse – down 3.3pc and 3pc respectively.

Major miners BHP and Rio are both off by more than 2pc – while all of the major banks are down by between 0.7pc and 1.5pc.

Here’s the biggest movers at lunch:

Bridget Carter 12.47pm: Virgin bondholders call in the lawyers

DataRoom | Law firm Corrs Chambers Westgarth is understood to have landed a role working for some of the Virgin Australia bondholders, believed to be owed up to about $2bn.

It comes after Virgin Australia entered administration early this week, making it the largest airline collapse in Australian history.

Working for Virgin Australia has been law firm Clayton Utz, restructuring firm Houlihan Lokey, investment banks UBS and Morgan Stanley, and Deloitte, which is now the administrator.

Law firm Clifford Chance is said to be helping some of the lenders that have up to $3bn worth of debt secured against Virgin Australia’s aircraft.

Mayor providers in the industry of aircraft leases include groups such as conglomerate GE, based in the United States, and Macquarie Group.

Read more: Virgin enters administration

12.41pm: Trump halts immigration, US futures drop

US President Donald Trump says he is halting immigration into the US in a bid to protect US jobs.

In a tweet this afternoon, Mr Trump announced the move “in light of the attack from the Invisible Enemy” – coronavirus.

“I will be signing an Executive Order to temporarily suspend immigration into the United States!” he said.

US futures are pulling lower on the news, last down 1.1pc.

In light of the attack from the Invisible Enemy, as well as the need to protect the jobs of our GREAT American Citizens, I will be signing an Executive Order to temporarily suspend immigration into the United States!

— Donald J. Trump (@realDonaldTrump) April 21, 2020

12.32pm: Shares, dollar extend declines

The Australian dollar and shares are falling fairly sharply today.

AUD/USD fell 0.7pc to 0.6289 in an intraday sell-off that started at 10:15am.

The S&P/ASX 200 fell 1.2pc to a 6-day low of 5290.6 though volume has been light.

These falls will give succour to those looking for pullbacks as the currency and shares lose momentum after strong gains in the past few weeks.

Both now appear to have broken down from rising wedge patterns which may presage a renewed sell-off in these risk assets.

Collapsing oil prices are an obvious catalyst despite today’s bounce in oil, but spot gold is down 0.3pc today.

12.19pm: Korea takes hit on fear of leader’s health

Korea’s stockmarket and currency are taking a hit amid reports North Korean leader Kim Jong-un may be in “grave danger after a surgery”.

Mr Kim is believed to be in a serious condition after heart surgery, according to intelligence sources being monitored by the US.

Kim has not been seen for more than a week and missed Wednesday’s key anniversary celebration of the birthday of Kim Il Sung, his grandfather and the nation’s founding father.

Seoul’s benchmark KOSPI is lower by 1.81pc while its volatility index spikes and the Korean Won trades lower.

Read more: Kim ‘in serious condition’

Korean won is down against everything at the moment pic.twitter.com/oRhWVKMmTe

— David Ingles (@DavidInglesTV) April 21, 2020

12.17pm: Low oil prices to persist: State Street

Very low prices for crude are likely through 2020 at a minimum, according to State Street.

“This is the inevitable progression of a world where demand destruction is ubiquitous yet temporary,” says Daniel Gerard, senior multi asset strategist at State Street Global Markets.

“Steep contango puts additional pressure on the search for storage in excess of the supply that was already looking for a home as demand collapses.”

He warns that US production “may just fill the gap” that planned OPEC+ cuts leave and if prices don’t stabilise, cutbacks are a “deadweight loss” for the major producers who are highly dependent on oil revenue.

“This storage crisis is not going away for at least a few months which means we will continue to see volatility with spot futures, and rolls,” Mr Gerard says.

“Barring a grand agreement from Saudi Arabia, Russia and Texas, which seems highly unlikely, current dynamics and low oil prices will persist. We see very low prices through the rest of 2020 at a minimum.”

12.04pm: Webjet brushes off Virgin collapse

Webjet shares have sunk to new lows even as it reassured investors that despite its strong long-term relationship with Virgin, it did not have a material financial exposure to the collapsed airline.

In a statement after Virgin’s announcement of the appointment of voluntary administrators this morning, Webjet said it saw the airline “occupying a vital position within the ongoing Australasian travel landscape”.

Webjet added that it was simply an agent to the airline, would not have a material financial exposure should administrators restructure the airline or cease trading.

Still, its shares fell to new 4.5-year lows of $2.33 in early trade this morning – marking an 81pc drop year-to-date.

The travel group said it was working with customers to process refunds or credits for flights cancelled due to COVID-19 cancellations.

“While the travel industry will be impacted by COVID-19 for some time, Webjet considers that it will emerge with a strong competitive position given the diversity of geographic markets in which it operates, its diverse product offers and its capital position following the recent capital raise,” the company said in a brief statement.

WEB last traded down 0.4pc to $2.48.

— Virgin Australia (@VirginAustralia) April 20, 2020

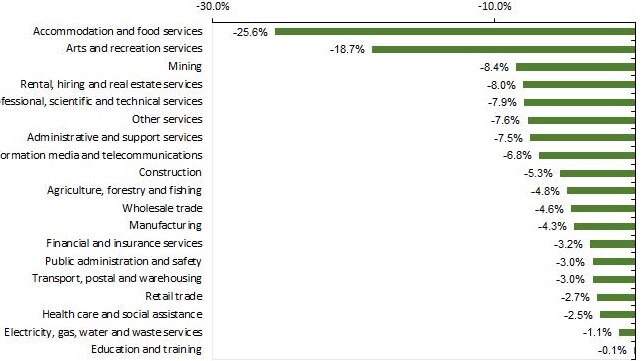

Patrick Commins 11.50am: 1 in 10 workers under 20 out of a job

The COVID-19 crisis has led to the loss of 780,000 jobs over the three weeks to April 4, with one on four employees in the accommodation and food services industry losing their jobs over the period, according to new ABS payroll data.

The figures offer the first, robust look at the devastating impact of the COVID crisis on employment over the past month. They show that younger Australians have been hit particularly hard, with one in ten of those under 20 years old losing employment.

The new ABS data release covers all employing businesses who report through the single touch payroll system to the Australian Taxation Office, which covers nearly all large and medium sized businesses, and around 70 per cent of small businesses.

11.45am: WTI jump as Texas eyes quotas

WTI crude oil prices surged in Asia ahead of a meeting Tuesday by Texas regulators on whether to curb supply.

Front month May WTI crude surged almost $US40 a barrel to $US2.54 from -$US37.63 in NY after collapsing almost $US60 a barrel to a record low of -$US40.32.

Despite the bounce today, traders clearly still don’t want to risk a lack of storage or refining capacity for crude oil futures, which are deliverable when the May contract expires Tuesday.

The active June WTI contract rose as much as 10pc to $US22.29 a barrel after falling 18pc on Monday. Brent crude rose 2.5pc to $US26.22 after falling 8.9pc on Monday.

Any decision on cutbacks by the Texas Railroad Commission later Tuesday won’t be enforceable. Proposed intervention last week was widely opposed by large producers.

But the bounce in prices has helped the Australian energy sector pare its early declines. Woodside Petroleum is down just 0.4pc at $20.06 after falling 3.3pc to $19.47 earlier.

Elias Visontay 11.42am: ‘This is not Ansett’: Treasurer

Josh Frydenberg has thrown water on the idea that Virgin entering voluntary administration will be the end of the airline, declaring “this is not Ansett”.

“This is not liquidation. This is not Ansett. This is not the end of the airline,” the Treasurer said on Tuesday.

“Virgin Australia is a very good airline performing a very important role and this is a difficult day for its staff, for its suppliers, and for the aviation sector more broadly. But the Government was not going to bail out five large foreign shareholders with deep pockets who, together, own 90 per cent of this airline.”

Mr Frydenberg announced the government was appointing former CEO of Macquarie Nicholas Moore to engage with Deloitte, the Virgin’s administrator, on the government’s behalf.

“Our objective is a market-led solution. Our objective is two commercially viable, major domestic airlines operating in Australia. And we will work constructively with Deloitte.”

Read more: Why Virgin wasn’t built to last

11.13am: UBS sees promise in retail names

UBS has lifted the weighting of discretionary retail stocks in its model portfolio by 19.5pc to 10pc, given significant policy stimulus to combat the COVID-19 led global downturn.

A negative weight in G8 Education was removed to reflect government policy changes to childcare as well as the recent capital raising and a position in Breville was increased.

In response to the relatively attractive valuations of stocks directly affected by COVID-19, the model has moved to positive weights in Webjet, Transurban, Crown Resorts, Star Entertainment, Qantas and Premier Investments.

The model retains a positive weight in Utilities, given a probable recession. Ausnet Services was cut to increase the beta of the portfolio but exposure to APA group was increased further.

The model is positive on Infrastructure after adding Transurban, but has reduced its weight in Media by 7pc after cutting REA Group and Carsales.com.

“COVID-19 restrictions have seen new property listings fall to more than decade lows, while car purchases are likely to fall ahead,” notes UBS analyst Pieter Stoltz.

“We also reduced positive weights in Other Materials by 6 per cent through a removal of James Hardie and CSR. This reflects our economists’ expectation of falls in property prices of at least 10 per cent due to COVID-19 over the next year.”

10.58am: Metcash slips after $300m raise

Metcash is the worst performer in the top 200 in early trade, after completing its $300m institutional placement and returning to trade this morning.

The group is set to issue 107.1 million new shares at $2.80 a piece to shore up its balance sheet against the COVID-19 downturn.

In a filing to the market this morning, the grocery and hardware distributor said its placement had generated significant demand, with approximately 95pc of the placement allocated to existing institutional shareholders.

“These proceeds ensure we have financial flexibility to continue to support our independent retailers through this challenging period, while also continuing to invest in our MFuture growth program and consider potential new growth opportunities that align with our strategic direction,” chief Jeff Adams said.

Eligible shareholders are also offered shares at the same price through its $30m share purchase plan to be launched on Friday.

The company was also downgraded by UBS, JP Morgan and Jefferies, which could be adding to the negativity.

MTS last traded down 9.2pc to $2.76.

Read more: Metcash taps the market for $300m

10.43am: Oil Search revenue falls 20pc

Oil Search reported a 20pc fall in first-quarter revenue, reflecting lower sales and the impact of a steep drop in global oil prices.

Oil Search said its revenue totalled $US359.4m in the three months through March compared to $US446.7m in the final quarter of the 2019 fiscal year.

Total sales of 6.87 million barrels of oil equivalent in the quarter were 13pc lower than the previous three months, largely due to the timing of shipments, while Oil Search said oil prices dropped by 20pc.

“The first quarter of 2020 has been one of the most volatile periods in history for Oil Search and the global oil and gas industry in general,” said Managing Director Keiran Wulff. “The COVID-19 pandemic, limiting movement of personnel and equipment, the fall in oil demand and the substantial drop in oil prices have created unprecedented challenges.”

Oil Search, based in the Papua New Guinea capital Port Moresby and listed in Australia, this month raised $1.08bn through an entitlement offer and placement of new shares after the sharp fall in oil prices and the impact of coronavirus on operations from Papua New Guinea to Alaska stretched its balance sheet.

OSH last down 0.8pc to $2.64.

Read more: Oil Search raising proves popular

10.34am: Valuation to restrain further upside: Macq

Macquarie’s Matthew Brooks says high valuations will “likely constrain further upside” in the ASX200 after it rose more than 25pc from its March 23rd low.

“The ASX 200 PE ratio is more than 1 standard deviation above average and higher than 96 per cent of month-end PEs since 2002,” he says.

“If you look past the peak impact of the virus to the second 12 months EPS, the PE is higher than 94 per cent of observations since 2002. These are not cheap valuations for a contracting economy where over one-third of the largest ASX companies have withdrawn guidance.”

He notes that earnings downgrades accelerated, guidance withdrawals continuing at a slower pace in the past two weeks.

Moreover earnings pressure is driving dividend cuts and capital raisings, albeit they have been profitable.

The average return on the issue price has been 28pc and 96pc of the deals have made money, according to Mr Brooks.

“Policy stimulus reduced uncertainty, but until we see how the economy ramps up after the shutdown ends, earnings visibility remains low,” he warns.

“You will know the outlook is improving when companies reinstate guidance.”

10.30am: ASX hits six-day low

Early falls on the ASX this morning are adding to its worst drop in three weeks yesterday – pulling the benchmark to its worst levels in six days.

The ASX200 fell as much as 0.8 per cent to 5310.8 – largely thanks to weakness in energy names.

10.22am: Qantas jumps as Virgin collapses

Qantas shares have jumped as much as 7 per cent in early trading, as key competitor Virgin calls in administrators.

Virgin this morning formally confirmed it had entered voluntary administration, and that it hoped it could emerge in stronger financial position afterwards.

Shares in Qantas jumped to $3.85 at the open – its highest levels in more than a month.

QAN last traded up 3.1pc to $3.70.

10.13am: Shares slip under energy weakness

The local market is slipping 22 points or 0.42 per cent to 5330 in early trade, as markets grapple with a collapse in the oil market overnight.

Energy names are hardest hit – down 2.3 per cent at the open and led by 2.3pc fall in Oil Search and 2.1pc decline in Woodside.

Just utilities and health cares stocks are trading higher at the open.

Nick Evans 9.58am: Gold Road closes hedges early

Gold Road Resources says it has taken a hit on its gold revenue in order to mitigate the risk of the coronavirus impacting production from its Gruyere gold mine in WA, saying it had closed out some hedging positions early as a precautionary measure.

Gruyere is run by South African major Gold Fields in a 50/50 joint venture with Gold Road, and produced 59.595 ounces in the March quarter at an all-in sustaining cost of $1135 an ounce.

And while the coronavirus crisis has not yet had an impact on the operation of the remote mine, and the two companies left cost and production guidance unchanged, Gold Road said it was not “business as usual” at the mine, and it could still withdraw earlier guidance.

Gold Road said it was preparing for any potential impact on the mine by paying down debt, closing out a $50m working capital facility in the March period.

It had also delivered gold into hedging positions due for delivery in the current quarter to “mitigate against potential production risks related to COVID-19”.

That gold, if it had been sold at spot prices, would have delivered an additional $4.7m to the company, Gold Road said.

The company finished March with cash and bullion worth $115m, and $80m in debt, repayable in February 2023.

9.52am: Hints of virus recovery lift confidence

The latest consumer confidence survey from ANZ showed a third week of gains, up 7.7 per cent broadly despite a 2.6pc slip in views of current finances.

Future financial conditions gained 6.6pc and now has been in positive territory for the last four weeks, according to today’s data – a measure of sentiment from 1715 respondents conducted over the weekend.

“The flattening in the pandemic curve and the recovery in equity markets may be helping to lift consumer confidence. Better-than-expected news on the labour market may also have boosted sentiment,” ANZ head of Australian Economics David Plank said.

“Confidence is now close to 30pc above the historic low reached on the last weekend of March. While the recovery has been solid, sentiment is still well below average.”

Better news on confidence, with it now up close to 30% from the historic low at the of March, but not so good news on inflation expectations. https://t.co/MI1G9gesKZ

— David Plank (@DavidPlank12) April 20, 2020

9.43am: APA trims earnings, keeps payout

APA Group has maintained its distribution guidance even as it trimmed its earnings guidance citing delays in its gas processing plant.

The group trimmed earnings expectations to between $1.635bn to $1.655bn from earlier guidance between $1.66bn to $1.69bn, still up between 3.8pc and 5.2pc on last years earnings.

Distribution guidance has been held at 50c per security, a lift of 6.4pc on FY2019.

APA said that there had been no material impacts from COVID-19 and that it continued to provide essential services to keep Australia operating.

“APA is a stable, low risk business, and as an essential service provider our focus is on keeping our assets running safely and reliably at all times in accordance with our Customer Promise,” chief Rob Wheals said.

Read more: APA tipped as best bet for dividend payout

9.37am: ASX headed for 6-day low

Australia’s sharemarket is likely to hit a 6-day low in early trading after sharp falls on Wall Street amid plunging oil prices.

Overnight futures relative to fair value suggest the S&P/ASX 200 will open down about 0.3pc near 5335 points. The index may retest its March low at 4402.5 in coming weeks while the recent high of 5563.6 caps, based on a bearish wedge pattern.

The S&P/ASX 200 fell 2.5pc to 5353 on Monday, but the S&P 500 fell 1.8pc overnight, whereas futures were down just 0.5pc when the ASX closed.

The Energy sector may lead falls after front month crude (expiring Tuesday) crashed 305pc to -$US37.63 as traders rolled to June to avoid delivery amid rapidly diminishing storage capacity.

The active June contract was also extremely weak, down 18.4pc to $20.43, and Brent fell 9pc to $US25.57, highlighting the fact that plunging oil prices remain a major risk for risk assets.

S&P 500 futures are up 0.5pc this morning and June WTI crude is up 80pc to -$US7.81, with June up 5.1pc to $US21.48, but there’s nothing to suggest the short-term oil oversupply problem is solved.

RBA minutes for April and preliminary retail sales for March are due at 11.30am and RBA Governor Lowe will give an “Economics & Financial Update” at 3.00pm.

Eli Greenblat 9.26am: Premier to close stores for longer

Solomon Lew’s Premier Investments, whose retail brands include Dotti, Just Jeans, Portmans, Smiggle and Peter Alexander, said it has no choice but to continue the temporary closure of its retail stores in Australia which will remain closed until at least May 11.

Initially Premier had planned to re-open its stores on April 22, a month from initial closures on March 26 after sending 9000 staff sent home.

Premier also repeated this morning that it would use the fact many of its leases in Australia were expired to squeeze landlords for a better rental deal and rent relief in the wake of the coronavirus pandemic.

“As previously announced, in Australia and New Zealand, close to 70 per cent of our stores are already in holdover or with leases expiring in 2020. These extraordinary circumstances provide Premier with maximum flexibility. Premier intends to continue not paying any rent globally for the duration of the shutdown,” it said.

Premier said it will work closely with shopping centre landlords to ensure that appropriate safety measures are implemented in a timely manner.

All seven of Premier’s brands are currently trading strongly online in Australia, the retailer said.

Read more: Solomon Lew picks perfect time to battle landlords

9.17am: What’s on the broker radar?

- Evolution cut to Underweight – JPMorgan

- G8 Education cut to Underperform – Macquarie

- GPT Group raised to Buy – UBS

- Metcash cut to Hold – Jefferies

- Metcash cut to Neutral – JPMorgan

- Metcash cut to Neutral – UBS

- Northern Star cut to Underweight – JP Morgan

- OceanaGold GDRs cut to Neutral – JP Morgan

- Perpetual price target cut 24pc to $42 – Morgan Stanley

- Scentre raised to Neutral – Macquarie

- South32 cut to Neutral – Macquarie

- Vicinity Centres raised to Outperform – Macquarie

- Xero cut to Sector Perform – RBC

Nick Evans 9.02am: BHP bracing for ‘sharp’ US, EU contraction

Global mining giant says it expects a “sharp” contraction in the US, Europe and India to hit the outlook for its commodities, but said Chinese demand was strengthening.

BHP is forecasting a double-digit fall in global steel output outside of China, but says the world’s biggest steel producer is continuing to ramp up output as it returns its industrial heartland from curtailments due to the coronavirus crisis.

The mining giant released its March quarter production report on Tuesday, flagging a pullback on capital spending on its oil and gas projects in response to the collapse of the oil price, saying its WA iron ore operations hit a production record in the nine months to the end of March, despite the early impacts of COVID-19.

Oil prices tumbled to below $US10 a barrel this week and BHP said that, although its long-term commitment to its oil and gas division was unchanged, it was preparing changes to its five-year plan to reflect the oil price shock.

BHP noted its support for Woodside’s decision to defer work on the Scarborough gas field off the coast of WA, and said it was preparing to slash its exploration and evaluation spending in the division by about 30 per cent, with $US200m worth of spending under review for the 2021 financial year.

BHP last traded at $30.82

8.54am: Virgin enters voluntary administration

Virgin has formally entered voluntary administration “to recapitalise the business and help ensure it emerges in a stronger financial position on the other side of the COVID-19 crisis”.

Deloitte’s Vaughan Strawbridge, John Greig, Sal Algeri and Richard Hughes have been appointed as administrators of the company and a number of its subsidiaries, to be supported by the group’s current management team led by chief executive Paul Scurrah.

“We are committed to working with Paul and the Virgin Australia team and are progressing well on some immediate steps. We have commenced a process of seeking interest from parties for participation in the recapitalisation of the business and its future, and there have been several expressions of interest so far,” Mr Strawbridge said.

The group’s frequent flyer arm, Velocity is a separate company and is not in administration. Virgin will continue to operate its scheduled international and domestic flights.

Read more: Why we won’t rescue Virgin: Cormann explains

"The Board of Directors regret that these events have come to pass and acknowledge all the Group’s employees for their hard work and contribution." Virgin Australia's statement to ASX confirming airline has gone into voluntary administration.

— Robyn Ironside (@ironsider) April 20, 2020

8.53am: RBNZ to open up mortgage lending

The Reserve Bank of New Zealand is planning to remove restrictions on mortgage lending in an expansion of its response to a recession caused by the coronavirus pandemic.

The central bank will carry out a seven-day consultation on the plan and make a prompt final decision after that, it said Tuesday.

“This move will help banks to keep lending to support customers, including with mortgage deferrals,” the Reserve Bank said.

The loan-to-value restrictions place limits on how much banks can lend to home buyers and residential property investors with low down payments, aiming to limit the impact of any housing market downturn.

The Reserve Bank said the restrictions could be reinstated after a year. Currently, banks can make no more than a fifth of their residential property lending to borrowers with deposits of less than 20pc of property value and no more than 5.0pc to residential property investors with deposits less than 30pc of property value.

Dow Jones Newswires

Damon Kitney 8.34am Vic signs Bosch for ventilators

Bosch Australia’s Manufacturing Solutions division has been awarded a $1m project as part of an industry consortium to build ventilators in Victoria.

Technology commercialisation company Grey Innovation has secured a licence from major global manufacturer to develop ventilators in Australia and Australia will build the units at it Clayton campus in south east Melbourne.

The program will supply 2000 units to the Australian Government, and the Victorian Government has announced its intention to purchase another 2000 units.

“This consortium shows the strength and skill of the Australian manufacturing sector to be versatile and to work together. We are proud to contribute to the highly advanced manufacturing capability in Victoria, and particularly with this project, to help in the fight against COVID-19”, Bosch Australia president Gavin Smith said.

8.20am: Incitec Pivot to keep fertilisers

Incitec Pivot says that following a strategic review, it has decided to keep its fertilisers business.

The company launched a review last year with the options being a sale, demerger, or retention of the fertiliser business.

“IPL has concluded, given the extraordinary market uncertainty and travel restrictions caused by the COVID-19 pandemic, that the right outcome for its shareholders is for the company to retain Incitec Pivot fertilisers and focus on its core operations, as an industry leader in the supply of fertilisers and services to Australian agriculture.”

Incitec Pivot said COVID-19 had not had a significant impact on its business operations so far, but had created “extraordinary uncertainty”.

The company said recent widespread rainfall across eastern Australia had created significant demand by farmers for fertiliser. “The business is also well-placed to benefit from any future improvement in global fertiliser prices.”

IPL will release its half year results on May 12.

8.10am: US to add oil to strategic reserve

President Donald Trump said the US would take advantage of the historic drop in oil prices to buy 75 million barrels to replenish the national strategic stockpile.

“We are filling up our national petroleum reserves … You know, the strategic reserves. And we are looking to put as much as 75 million barrels into the reserves themselves,” Trump told reporters at his daily coronavirus press conference.

Oil prices crashed into negative territory Monday after coronavirus lockdowns around the globe shrivelled demand.

AFP

7.55am: Gold jumps

Gold climbed as much as 1 per cent overnight after earlier hitting a more-than one-week low, with the collapse of US crude oil prices to a record low hitting risk assets and driving investors to the safety of bullion.

Spot gold gained 0.5 per cent to $US1,692.26 per ounce, after earlier hitting the lowest level since April 9, at $US1,670.55. US gold futures settled up 0.7 per cent, at $US1,711.20.

Reuters

7.35am: ASX set to slide

The Australian share market is expected to follow Wall Street lower in early trade after US crude oil futures turned negative for the first time amid a coronavirus-induced supply glut.

At 7am (AEST) the SPI 200 futures contract was down 53 points, or 0.99 per cent, at 5,311.0, pointing to a sharp drop at the open for local stocks.

US crude oil futures collapsed below $US0 on Monday for the first time in history, ending the day at minus $US37.63 a barrel as desperate traders paid to get rid of oil.

Brent crude also slumped but was nowhere near as weak, as more storage is available worldwide.

The US crude tumble into negative territory is unlikely to have an impact on Australian fuel prices, although the Brent benchmark price has also fallen steeply.

The Dow Jones Industrial Average dropped 2.44 per cent to end at 23,650.44 points, while the S&P 500 lost 1.79 per cent to 2,823.16.

The Nasdaq Composite dropped 1.03 per cent to 8,560.73.

The Australian Bureau of Statistics is on Tuesday scheduled to release the latest in its new range of COVID-19 economic data updates: weekly payroll jobs and wages.

The minutes of the Reserve Bank’s April board meeting will also be released at 11.30am (AEST) and Governor Philip Lowe will address media in the afternoon.

The Australian dollar is worth US63.37 cents, down from US63.62 cents at Monday’s close.

AAP

7.10am: Saudis consider early oil cut

Saudi Arabia and other OPEC members are considering cutting their oil output as soon as possible, rather than waiting until next month when the group’s recent production agreement with the US and Russia is set to begin, people familiar with the matter said.

The considerations come as US oil prices turned negative for the first time in history.

“Something has to be done about this bloodbath,” said a Saudi official familiar with the matter. “But it might be a little bit too late.”

Under a multinational agreement forged little more than a week ago, Saudi Arabia agreed to restrict its output as part of a broad effort to boost plummeting prices. State-run giant Saudi Arabian Oil Co. said Friday that it would market 8.5 million barrels a day of crude beginning in May, down from 12.3 million barrels a day early April.

Under a proposal being considered in the kingdom, Saudi Arabia could start the cuts immediately. Still, such a decision would depend on the kingdom’s legal obligations and deliveries already agreed upon with buyers, one person said. The proposal to bring forward the cuts could also be applied throughout the Organisation of the Petroleum Exporting Countries, the people familiar with the matter said.

Dow Jones

6.05am: Wall Street closes lower

US stocks slid to start to another potentially volatile week as investors continued to try to gauge the extent of the economic damage from the coronavirus pandemic.

Major US indexes opened sharply lower, eased their losses midday and then slumped again late in the session in conjunction with a historic plunge in oil prices.

The Dow Jones Industrial Average fell about 596 points, or 2.5 per cent, pulled down by losses in energy stocks. The S&P 500 dropped 1.8 per cent, while the Nasdaq Composite lost 1 per cent after spending much of the day in positive territory.

After falling oil prices sent Australian shares falling yesterday, the ASX is set for more weakness, at least at the open. At 6am (AEST) the SPI futures index was down 61 points, or 1.2 per cent.

US investors have parsed a deluge of economic and health information in recent weeks about the fast-spreading coronavirus, which has shuttered local economies, forced millions of lay-offs and prompted unprecedented intervention from the Federal Reserve and the U.S. government.

For the past two weeks, many have appeared optimistic about an eventual economic recovery, driving the Dow to close Friday with its best two-week performance since the 1930s.

That rally, however, paused Monday, as investors looked ahead to a busy week of earnings reports and an uncertain coronavirus landscape.

Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, said on ABC’s “Good Morning America” that the country could set itself back if officials “jump the gun” on reopening the economy.

A plunge in oil prices into negative territory also exacerbated losses, and sent the Cboe Volatility Index, a closely watched measure of turbulence in U.S. stocks, surging higher.

“After the gains of the last few weeks, a pause to me is warranted,” said Jeff Mortimer, director of investment strategy at BNY Mellon Wealth Management. “We’re down [slightly] on the S&P 500 — if you talk to a statistician, that’s noise. I look at this as a digestion.”

Still, there were bright spots amid the stock losses. Netflix jumped 4pc as technology stocks rallied, increasing the streaming platform’s gains to 36% for the year. The S&P 500, in contrast, remains down 12pc in 2020.

But any gains in the market were largely overshadowed by losses. Continental Resources tumbled 7pc, Exxon Mobil lost 4.5pc and Marathon Oil fell 4.7pc as the price of oil plunged.

The price for a barrel of West Texas Intermediate crude to be delivered next month ended Monday at negative $US35.20, meaning that sellers must effectively pay buyers to take barrels off their hands.

In Europe, stocks fared better. The pan-continental Stoxx Europe 600 ended the day up 0.7pc. Germany’s DAX equity benchmark gained 0.5pc, even after the country’s central bank said its economy has plunged into a severe recession from which it is unlikely to rebound quickly.

In Asia, meanwhile, stocks were mixed. The Shanghai Composite gained 0.5pc after the central bank in China cut a key lending rate. Japan’s Nikkei 225 fell 1.1pc.

Dow Jones Newswires

5.45am: Virgin to go into administration

Virgin Australia is expected to be put into voluntary administration today after the Morrison government rejected an 11th-hour appeal for a $100m grant to keep it afloat for another two weeks, as private equity firms circle the airline.

A board meeting of international shareholders late on Monday signed off on the move to put the company into administration in the wake of coronavirus travel restrictions shutting down the airline and there being no prospect of a government bailout.

The dramatic development has plunged 16,000 direct and indirect Virgin jobs into greater doubt and capped a day of turmoil for Australia’s aviation and tourism industries that also left travellers with price rise fears.

Jacquelin Magnay 5.40am: Branson plea for Virgin

Virgin Group chief Sir Richard Branson has offered his Caribbean island retreat Necker as collateral for a government loan, believed to be worth half a billion pounds.

While the Virgin Group’s airline in Australia faces administration, his other airline, Virgin Atlantic, owned 49 per cent by Delta, is also in trouble.

So far the Australian government has refused a request for a $1.4bn loan for Virgin Australia, which is also owned by Etihad, Singapore Airlines and China’s HNA,

In an open letter to his staff on Monday, Sir Richard said: "The brilliant Virgin Australia team is fighting to survive and need support to get through this catastrophic global crisis.

”We are hopeful that Virgin Australia can emerge stronger than ever, as a more sustainable, financially viable airline.”

He warned: “If Virgin Australia disappears, Qantas would effectively have a monopoly of the Australian skies. We all know what that would lead to.”

Sir Richard, believed to be worth around £4bn, has turned to the British government as well to help to bail out the airlines, hit hard by the coronavirus pandemic and lockdowns in various countries around the world.

Sir Richard said the crisis was unprecedented but said he didn’t have cash in a bank account ready to withdraw.

He said: ”I’ve seen lots of comments about my net worth – but that is calculated on the value of Virgin businesses around the world before this crisis, not sitting as cash in a bank account ready to withdraw.

“Over the years significant profits have never been taken out of the Virgin Group, instead they have been reinvested in building businesses that create value and opportunities.”

He added: ”Many airlines around the world need government support and many have already received it.’’

Sir Richard said his ‘’beautiful Necker Island, along with other Virgin assets will be used as collateral to try and save as many jobs as possible’’ across the Group.

5.35am: US oil price turns negative

Oil prices ended New York trading in the negative for the first time ever, as a supply glut forced traders to pay others to take the commodity.

With space to store oil scarce, US benchmark West Texas Intermediate for May delivery ended trading at -$US37.63 a barrel ahead of Tuesday’s close for futures contracts — when traders who buy and sell the commodity for profit would have had to take physical possession of it.

“It’s a contract for something that nobody wants to buy,” said Matt Smith of ClipperData.

The unprecedented price drop is a consequence of the coronavirus pandemic, which has devastated the global economy by forcing billions of people to stay home to stop its spread, and an ongoing price war between top producers Saudi Arabia and Russia.

That price war contributed to an oversupply that drove crude lower, to the disadvantage of US shale producers.

A deal announced last week between OPEC and its peers would have lowered production by about 10 million barrels a day from May, but that’s plainly not enough.

“There is no demand for gasoline and diesel fuel,” said John Kilduff of Again Capital. “The demand has just plummeted.” Smith however noted that Monday’s negative prices were a reaction to the storage shortage ahead of the Tuesday deadline, and once that passes, they should turn positive again.

“In two days, it will be gone,” he said.

AFP

5.32am: European stocks higher

Most European markets ended the day higher as governments start to consider how and when to ease the lockdowns that have crippled the global economy.

Italy, Spain, France and Britain reported drops in daily death tolls and slowing infection rates, while Germany began allowing some shops to reopen and Norway restarted nurseries.

Mounting evidence suggests that the lockdowns and social distancing are slowing the spread of the virus.

That has intensified planning in many countries to begin loosening curbs on movement and easing the crushing pressure on national economies.

Frankfurt closed up 0.5 per cent, while Paris ended up 0.7 per cent.

AFP

5.30am: Aust miner in flower research

A mining company has announced a $US168,000 grant to the University of Nevada, Reno to extend a research contract for five years to study a rare desert wildflower that critics say could be harmed by plans to build a lithium mine in northern Nevada.

The Australian-based ioneer Ltd. with offices in Nevada recently spent $US60,000 on a year-long study at UNR to grow hundreds of Tiehm’s buckwheat seedlings in a campus greenhouse to determine whether it’s feasible to transplant them in the wild to bolster its limited population.

Ioneer has spent millions exploring the site about 320 km southeast of Reno, which it says is one of the world’s biggest undeveloped lithium-boron deposits critical to making batteries for electric cars. It’s also the only place the plant is known to exist on earth.

AP

5.25am: Merkel issues warning

Chancellor Angela Merkel urged discipline in the fight against the coronavirus pandemic, warning that Germany is not “out of the woods” even as the country took small steps in easing curbs imposed to slow contagion.

With small shops opening on Monday for the first time in a month, Merkel said the authorities can only allow such small cautious steps each time to avoid a devastating relapse.

“We must not lose sight of the fact that we stand at the beginning of the pandemic and are still a long way from being out of the woods,” she told journalists after chairing a cabinet session on the coronavirus battle.

It would be a “crying shame if we were to stumble into a relapse with our eyes wide open,” she added.

Merkel and regional state premiers announced the decision to reopen last week — but were careful to cast it as a cautious first step.

From florists to fashion stores, the majority of shops smaller than 800 square metres (8,600 square feet) were allowed to welcome customers again in much of Germany, in a first wave of scaling back lockdown measures introduced last month.

AFP

5.22am: Philips pins hopes on ventilators

Dutch electronics giant Philips announced Monday net profits plunged in the first quarter due to the coronavirus outbreak but pinned its hopes on an explosion of orders for medical equipment to boost its coffers.

Amsterdam-based Philips, which has abandoned its home appliance arm in order to focus on the health sector, said its net profit sunk by 75.93 per cent year-on-year to 39 million euros ($US42 million) — a result it said had been considerably impacted by the COVID-19 epidemic.

The pressing demand for ventilators and other medical equipment around the world to fight the coronavirus epidemic saw the group’s orders jump by 23 per cent on a comparative basis, it said.

Philips said it was now focused on the production of ventilators to help COVID-19 patients breathe, in particular in the United States where the Dutch company has several factories.

AFP

5.20am: Europe takes steps to ease lockdowns

Germany and other parts of Europe took tentative steps to ease lockdown measures on Monday but officials warned the battle against the coronavirus pandemic was far from over.

Some shops reopened in Germany and parents dropped their children off at nurseries in Norway as tight restrictions in place for weeks were lifted in parts of the continent.

After being hit hard by the virus that first emerged in China late last year, Europe has seen encouraging signs in recent days, with death rates dropping in Italy, Spain, France and Britain.

The hope is tempered by fears of new waves of infections, warnings that life will not be back to normal for many months and deep concern over the devastating impact the virus is having on the global economy.

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout