Lew has complained about his landlords, but last half his retail guru Mark McInnes managed to achieve the rare double of a 7.5 per cent increase in sales while reducing wages from 23.1 per cent of sales to 22 per cent, and rent from 17.1 per cent of sales to 15.9 per cent.

With 75 per cent of his stores up for renegotiation, on the back of a bumper half year with $58m in cash in the dividend basket but held back to cope with the crisis, and the malls losing business fast, there has probably not been a better time for Lew to press his claims.

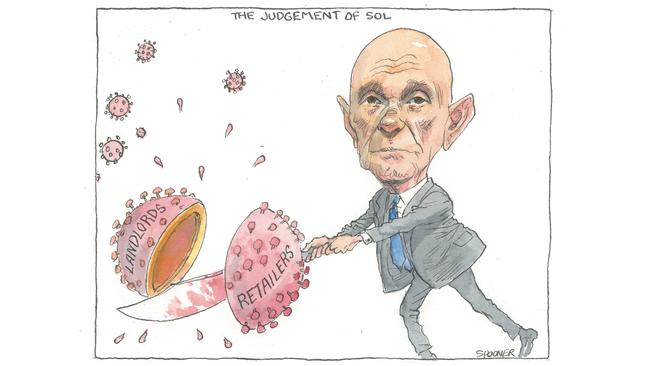

His fight is against the big landlords which, while enjoying status as essential services outside the supermarkets and medical centres in their town centres, have long ago lost the moral high ground.

As he steps up his battle with Scentre’s Peter Allen, Vicinity’s Grant Kelley, Stockland’s Mark Steinert and GPT’s Bob Johnston, there is a growing concern that if Solly is using the crisis for his own purposes then just maybe Scott Morrison is wasting the crisis.

The argument is being seen as a battle between the states led by Victoria’s Daniel Andrews and the Prime Minister in terms of health versus the economy.

The issue should be seen in much wider terms from the perspective of what sort of society emerges from the mayhem.

Andrews is one of the few on centre stage who appears to appreciate that there is more to it than health versus the economy, and the two are intertwined in the communities people live in.

They are communities that amid the shutdown will be under extraordinary pressure from a dramatic rise in unemployment, particularly youth unemployment hitting regional Australia hard, increased domestic violence and a society that will be under unprecedented stress.

These issues don’t hit the headlines much, but maybe they should get some focus as the big end of town such as Cochlear, Qantas and Transurban step up to fill their coffers.

There is actually more at play than simply getting business moving again.

The new economy also needs a voice, but the message should be there is more to it than just getting business going again — the oft-quoted bridge to normality raises the question of just what sort community will be standing on the other side.

The feds’ virus commission led by former Fortescue chief Nev Power was comprised of some of the smartest minds in old business, including Paul Little, David Thodey and Catherine Tanna, and some smart government policy folk like Jane Halton, Phil “Gidget” Gaetjens and Home Affairs boss Mike Pezzullo.

With the possible exception of Greg Combet and Thodey, the panel is a first-rate old economy combination aimed at getting the ship moving again when the virus subsides.

What role does technology play in that revival and what sort of community will emerge from an extraordinary hit?

Malls’ tough times

Solly Lew’s decision to shut down his empire comes at a difficult time for the mall owners, with Scott Morrison banging the drum urging flexibility from landlords.

Refusing to pay rent is arguably a breach of contract and there is an obvious risk in removing yourself from the market to let consumers find alternate suppliers.

Lew probably figures the next few weeks will not be a buoyant time for discretionary retailers, with Sussan’s Naomi Milgrom for one wondering aloud why the malls are still open in any case.

From his perspective, Lew has some time on his side even if his 9000 staff now find themselves on the street hoping the madness ends sometime soon. The mall owners see it somewhat differently, arguing that by keeping the centres open they are supporting the retailers and in the process helping keep the economy alive.

Scentre’s Peter Allen talks of doing it for “Team Australia”. His business had 15 million customers going to 12,000 stores owned by 3600 businesses, but the reality today is somewhat different.

Lew has now closed all his stores, which range from Smiggle to NineWest, FCUK and Peter Alexander.

Skroo Turner at Flight Centre was a little more sanguine when he confided about the stores he is closing. He said: “Where possible we aim to bring them back as soon as restrictions are lifted and demand starts to increase.”

Magazines backflip

The ACCC has done a major backflip on the combination of Bauer Media and Pacific Magazines, approving the deal after first expressing real doubts.

Having battled successfully for five months to talk some sense into the ACCC, the folk at Bauer must now be wondering whether it is all worthwhile.

The deal combines its Woman’s Day magazine with Pac Mag’s New Idea, the top two women’s titles in a struggling magazine market.

At first instance the ACCC said the relevant market was women’s magazines but on further consideration it has noted falling revenues and sales and a realisation that consumers are more sporadic than first thought.

This means the pricing power first imagined wasn’t there and Bauer was unlikely to shut either title.

The decision comes against a backdrop in which another part of the ACCC has spent the last couple of years studying the impact of the big digital platforms on traditional media and concluding that Google, Facebook et al needed to be stopped.

This realisation made the original decision look decidedly odd, but common sense has prevailed.

Gupta reinforces case

Sanjeev Gupta has learned to play the anti-dumping game better than his duopolist friends at BlueScope and this is demonstrated well in the steel reinforcing market.

His company InfraBuild (the old Arrium) has dumping complaints in train against, among others, China, Greece, India, Korea, Spain, Taiwan, Thailand, Singapore and Turkey.

No surprise then to see him pop up with Perth-based Bet Bar, which is one of the biggest importers of reinforcing steel as well as being a distributor of InfraBuild.

The company built by Grant Johnston is owned in part by Indian giant Tata Steel.

The ACCC is looking at the deal with a decision due in June and the interaction between Gupta’s heavy-handed dumping action and the merger will be one of the issues.

Market mayhem aside, Gupta has often talked up the chance of refloating the old Arrium, which would be a stretch given he has spent so much time telling the Anti-Dumping Authority how imports are hurting his business and causing serious damage.

Solly Lew knows better than most, you should never waste a good crisis, which is why he drew a big line in the sand in his fight with the shopping mall owners, shutting his retail empire, putting everyone off and importantly not paying the rent.