‘This is not Ansett’: administration not the end for Virgin, Treasurer declares

Josh Frydenberg has poured cold water on the idea that Virgin entering voluntary administration will be the end of the airline.

Josh Frydenberg has poured cold water on the idea that Virgin entering voluntary administration will be the end of the airline, declaring “this is not Ansett”.

Virgin was this morning placed in voluntary administration after the Morrison government rejected an 11th-hour appeal for a $200m grant to keep it afloat for another two weeks, as private equity firms circle the airline.

“This is not liquidation. This is not Ansett. This is not the end of the airline,” the Treasurer said on Tuesday.

“Virgin Australia is a very good airline performing a very important role and this is a difficult day for its staff, for its suppliers, and for the aviation sector more broadly. But the government was not going to bail out five large foreign shareholders with deep pockets who, together, own 90 per cent of this airline.”

Mr Frydenberg announced the government was appointing former CEO of Macquarie Nicholas Moore to engage with Deloitte, the Virgin’s administrator, on the government’s behalf.

“Our objective is a market-led solution. Our objective is two commercially viable, major domestic airlines operating in Australia. And we will work constructively with Deloitte.”

Virgin bailout an inappropriate ‘precedent across the economy’

Earlier, Finance Minister Mathias Cormann said bailing out Virgin Australia would set an inappropriate “precedent across the economy” for the government to bail out big businesses.

In one of several media appearances on Tuesday morning, Senator Cormann told Radio National government could ultimately provide “sensible support” for Virgin, but the government only wanted to take sector-wide measures.

“There’s some other issues at play here and clearly there were some substantial problems that needed to be resolved … there are parts of the Virgin business that have been performing well, and there are other parts that obviously caused the problem, there’s a significant level of debt that will have to be dealt with,” Senator Cormann said.

Asked about the government stepping in to rescue the struggling airline, Senator Cormann said “if there is an opportunity to provide some sensible support in an appropriate fashion we would of course consider that”.

“We are dealing here with taxpayers’ money, $1.4 billion is a huge amount of money and you’ve got to make sure that the decisions you make are principles-based and that you’re making the right decisions for the right reasons.

“In all of the circumstances, we didn’t believe it was appropriate to provide specific support of that size to one individual business, setting a precedent across the economy. We’ve stuck to an economy-wide sector wide approach rather than to bail out individual businesses and we don’t believe that all of the private sector opportunities have been exhausted here, and we believe they should be.

“I’m not going to pre-empt any of this … We’ll continue to talk to all of the relevant stakeholders and if there is appropriate opportunity for the government to provide sector-wide support as we have in the past that then of course, we would consider that but I’m not going to pre-empt any of these things.”

Senator Cormann said Virgin’s employees will still receive the $1500 a fortnight JobKeeper wage subsidy payment during a period of administration.

Virgin’s crash landing

A board meeting of international shareholders late on Monday signed off on the move to put the company into administration in the wake of coronavirus travel restrictions shutting down the airline and there being no prospect of a government bailout.

The dramatic development has plunged 16,000 direct and indirect Virgin jobs into greater doubt and capped a day of turmoil for Australia’s aviation and tourism industries that also left travellers with price rise fears.

Aviation consultant Neil Hansford said airfares might climb “10 or 20 per cent” under a monopoly, but would not return to the days of $700 prices to fly one way from Sydney to Melbourne.

“I think (Australian Competition & Consumer Commission chairman) Rod Sims will be all over Qantas like a bad-fitting suit,” Mr Hansford said.

The move by Virgin extinguishes its current foreign ownership, leaving expectations it will emerge from administration as a scaled-down, low-cost, domestic airline once the skies are opened up again post-pandemic.

Two serious bidders are believed to be in play, including Australian-run private equity firm BGH and another consortium involving Etihad Airways.

A senior government source said voluntary administration was now believed to be the best option for the airline as it would virtually dissolve its foreign ownership and resurrect the airline as a low-cost domestic carrier.

“Under this model, our preferred outcome is that the airline emerges as a competitor with Qantas but not costing the government a dollar,” a senior government source said.

“Labor, on the other hand, wanted to line the pockets of foreign owners and billionaires.”

The Morrison government has sent mixed messages to the airline since The Australian revealed last month it had sought a $1.4bn loan to ensure it could survive the pandemic.

The Australian can reveal that the airline’s executives sought a last-minute grant of $200m from the federal government over the weekend so it could keep paying bills for another week — two weeks at most — and avoid administration while it worked through potential commercial deals.

Virgin’s descent into administration came as the NSW and Queensland governments duked it out over separate offers to rescue the airline. The Queensland government has warned NSW to “back off” Virgin Australia, as NSW revealed it wanted to entice the headquarters of the airline from Brisbane to Sydney.

Queensland State Development Minister Cameron Dick said Queensland would not let it go without a fight.

The Queensland government put $200m on the table as a rescue package for Virgin, contingent on federal government backing and Virgin’s headquarters staying in Brisbane. There are 5000 Virgin jobs in Queensland, including 1200 jobs at its headquarters in Bowen Hills. “(There is) nothing more dangerous than Queenslanders with their backs to the wall … we will stop at nothing to ensure the headquarters of Virgin remains in Queensland,” Mr Dick said.

The NSW government has confirmed it is in talks with Virgin about giving the cash-strapped ¬airline a possible financial lifeline, but only if it moved its national headquarters from Brisbane to Sydney.

NSW Premier Gladys Berejiklian also signalled her interest in providing financial support for Virgin on the condition the airline relocated to Badgerys Creek where Western Sydney Airport is under construction.

A business park planned for the Badgerys Creek site would be able to house various types of companies with commercial office space and campus-style accommodation.

The Australian understands private equity firm BGH is a frontrunner to buy the airline. Suggestions that the Chinese Communist Party-owned China Southern Airlines could step in were dismissed by senior cabinet ministers as “never going to happen”.

The likely outcome is that any buyer would move to split the businesses with the $1bn frequent-flyer program Velocity expected to be sold off and the airline scaled back to a low-cost domestic carrier.

The airline was put into a trading halt last week as it sought to find a private sector deal. Creditors are likely to walk away with little more than one cent in the dollar on the $5bn debt carried by the airline.

It is understood that Deloitte has accepted the administration role and the appointment will see the existing management team remain in place.

Much of the focus remains on the restructuring of Virgin’s debt.

Even so, the collapse of Australia’s second-biggest airline has sent shockwaves through the aviation and tourism industries, although it is understood there is an expectation that the underlying business can be saved through a debt restructure with support of an equity injection.

Both secured and unsecured creditors are expected to take a significant haircut.

Virgin Australia is currently owned by Etihad, Singapore Airlines and Chinese airlines HNA and Nanshan Group, which all hold about 20 per cent.

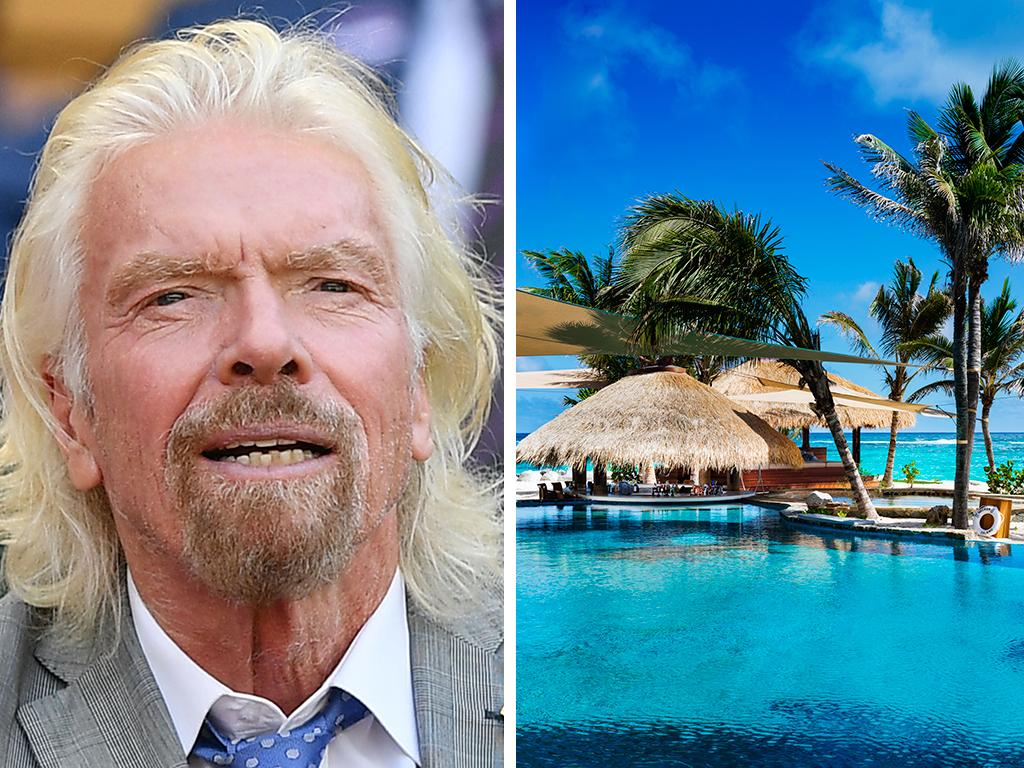

Richard Branson’s Virgin Group owns 10 per cent and listed equity investors the remainder. The identity of the airline that would be involved in the deal is known not to be Mr Branson’s Virgin Group, founder of the Virgin Atlantic airline.

NSW Nationals MP David Gillespie said he was “disappointed that it’s come to this” and the Morrison government made a miscalculation in refusing to provide the airline with the $1.4bn loan it wanted to help ride out the pandemic.

“I’m disappointed that we weren’t able to support their request for help,” he said. “We had two major airlines going into the coronavirus epidemic but it looks like we’ll have just one coming out the other side.

“Regional Australian MPs will be disappointed … The market solution probably means administration and a sell-off, and this is when the vultures start circling and the sharks start picking away at the profitable bits and they jettison the less profitable routes.”

While the airline was the victim of the coronavirus, with chief executive Paul Scurrah having already embarked on a restructure plan before the pandemic hit, cabinet was split over whether to rescue the airline.

“It didn’t trade its way into this mess,” another senior government source said. “It was the government that shut down the skies.”

The government has said it would not let Virgin fail and leave Qantas with a virtual monopoly.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout