Crude plunge ripples through energy sector

The plunging oil price is one of many issues for global markets yet to be addressed by fiscal stimulus since the COVID-19 crisis.

The plunging oil price is one of many issues for global markets that haven’t been solved by the unprecedented addition of central bank liquidity and fiscal stimulus since the global COVID-19 crisis.

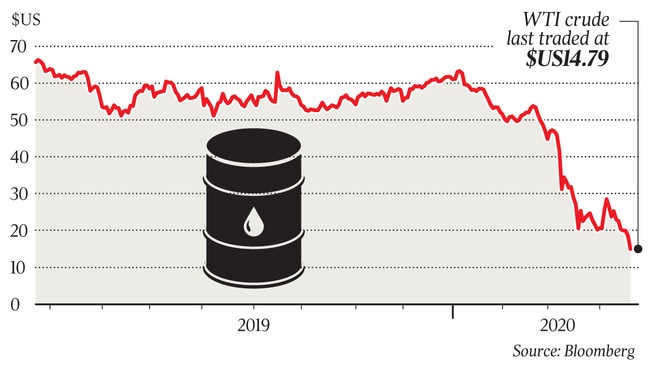

West Texas crude futures expiring in May dropped $US3.80, or 21 per cent, to a two-decade low of $US14.47 a barrel — even after a much-heralded supply pact between OPEC+ and other producers. The collapse in the May contract came after a decision by the US Oil Fund ETF to hold about 20 per cent of its portfolio in the second-month contract (June in this case) from last Friday.

But even with a 9.7 million-barrels-a-day OPEC+ cutback due to start in June, the June contract dived 9.3 per cent to $US22.71 on Monday, highlighting concern that crude oil storage is maxing out.

Demand destruction in the energy sector now threatens to bankrupt the US oil sector and could trigger sovereign debt problems for vulnerable producers. Mexico’s sovereign debt rating was recently cut to just above junk, sending the Mexican peso down as much as 2 per cent against the US dollar on Monday.

And the energy sector led broadbased falls in the Australian sharemarket to start the week.

After bouncing as much as 26 per cent in the past five weeks, the benchmark S&P/ASX 200 share index tumbled 2.5 per cent to 5353 points, triggering a “bearish wedge” pattern on the charts.

The biggest fall in the Australian sharemarket in the past three weeks came despite the fact that slowing coronavirus infection rates and angst over the economic damage from lockdowns are expected to see some lessening of lockdowns in Europe and the US in the weeks ahead. The degree to which that can be done without reigniting the coronavirus pandemic is unknown.

With global sharemarkets having recovered about 50 per cent of the February-March sell-off due to slowing infection rates and official stimulus, they may even falter in the short term despite a lessening of restrictions, as some economic normalisation has already been priced in.

No doubt the central banks have more tricks up their sleeves — like adding more liquidity and potentially widening their asset buying programs to include equity ETFs if the global sharemarket falls sharply again. For its part, Australia’s Reserve Bank has been able to taper its daily bond buying to just $500m.

And more fiscal stimulus is on the way in the US, with the Trump administration and congressional leaders reportedly close to approving $US400bn ($635bn) of funding to top up the US Paycheck Protection Program for small businesses and boost funding for hospitals and testing.

But investors will also be weighing up the risk of premature exits from lockdown — in the absence of a vaccine, herd immunity and widespread testing — causing a bigger contraction in economic growth.

Singapore — which had eased restrictions — saw daily virus cases surge past 1000 for the first time to 1426 people on Monday, mostly among foreign workers living in packed dormitories.

South Korea has had 179 cases of “virus relapse”, which is potentially very worrying for markets.

The recent supply chain disruption caused by unprecedented lockdowns won’t be completely resolved while countries remain in different degrees of lockdown.

In the longer term, attempts by countries to lessen their reliance on China, in response to the outbreak and the geopolitical risks it has fostered, may, together with maximum stimulus, cause an outbreak of inflation, which would be negative on bonds and equities.

The US and Australia have called for an independent review of the outbreak.

And Australian Strategic Policy Institute executive director and former deputy secretary for the Defence Department, Peter Jennings, wrote in The Weekend Australian that China is trying to use the crisis to advance its geopolitical ambitions, particularly on Taiwan.

Meanwhile, the Grattan Institute has warned that Australia’s unemployment rate will probably hit 12 per cent, rather than the 8.5 per cent projected by the government, and that’s assuming a high degree of take-up of the federal government’s JobKeeper wages subsidy.

AGL’s chief executive, Brett Redman, was quoted as saying that more than 10,000 customers have already asked for their payments to be delayed. Meanwhile the weekly jobs survey from the ABS showed employment fell 3 per cent in the first week of April and hours worked dived 24 per cent, and the ATO said nearly 900,000 people have already registered to take super payments out of their funds.

Highlighting the vulnerability of the sharemarket’s rebound from its lows, Karen Jorritsma, head of equities at RBC Capital Markets, pointed to the economic data yet to be revealed.

“Much of the commentary we are seeing and hearing is anecdotal to date as we are in the early stages of the data being collected here, but I look at the Afterpay share price and struggle to understand how it looks like it’s on a trajectory back to record highs.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout