ASX lower by 0.6pc as tech slides

Afterpay led a slide in tech stocks after the Nasdaq reversed, but one BNPL stock bucked the market’s 0.6pc loss, adding more than 9pc.

- Tech weakness follows Nasdaq dive

- Westpac appoints new CFO

- RegTech could be key export, committee hears

- Jobs recovery was already stalling: NAB

That’s all from the Trading Day blog for Tuesday, July 14. A drop in tech stocks sent the ASX down 0.6pc by the close, after weakness on Wall Street amid concerns of the spread of local and US outbreaks.

In the local session, NAB business confidence was positive for the third consecutive month, while a committee in Canberra discussed the merits of fintech and regtech. Afterpay led BNPL stocks lower, and Westpac appointed a new CFO.

Jared Lynch 8.33pm: Not so blessed are the cheesemakers

Cheesemakers are looking far from the cats that swallowed the cream under a proposed shake up of Australia’s health ratings system that could see many of their products plummet to one star.

In possibly a welcome distraction to border lockdowns, state and federal ministers will meet on Friday to thrash out a revised health star rating system for food.

One of the decisions will be whether to proceed with the controversial Calculator 2 regime, which would see more than half of everyday household cheese products rate less than three stars, with some scoring as low as one star.

Dairy processors are fearful of this proposal, which will place cheese far behind the four-star rating given to Milo cereal. As one dairy insider put it: “You put milk in the Milo cereal.”

The Calculator 2 regime therefore has dairy producers cheesed off. Giving some cheese a rating of one star would place it lower than a box of Arnotts Pizza Shapes, which has two stars - even a box of Cheddar Shapes would have a higher rating at 1.5 stars.

But it would be ahead of Tim Tams and Toblerone: each has half a star.

Mackenzie Scott 8.12pm: House sales recoil

More than half the homes taken to auction since April failed to sell under the hammer in a market forced to adapt quickly to nationwide coronavirus restrictions.

The national capital city clearance rate fell to 47.9 per cent over the quarter from April to June, according to property researcher CoreLogic.

Falls reflected the strict six-week lockdown of the property market put in place at the end of March, which banned open homes and public auctions to slow the spread of COVID-19.

Uncertainty caused many nervous sellers to hold off or withdraw their homes from the market, with the number of auctioned properties falling 27 per cent in the past three months.

CoreLogic head of research Eliza Owen said the fall was felt across the whole property market.

“The initial market response to COVID-19 was a severe drop in sales and listings across both auction and private treaty sales methods. Many vendors who did not have to sell were initially unwilling to take their property to market in a time of high uncertainty,” she said.

David Ross 7.15pm: Janet Yellen warns of COVID bankruptcies

Former Federal Reserve chair Janet Yellen has warned the economic crisis triggered by COVID-19 is not set for a “V-shaped” recovery but a Nike-shaped “swoosh”, with the potential for related bankruptcies to create their own corporate debt crises.

Speaking on Monday night in Magellan’s annual investor update, Dr Yellen, who is an adviser to the funds manager, said the crisis could have huge and long-term impacts on the global economy and investment landscape as government support ends.

“I expect high levels of bankruptcies and defaults. The underwriting standards on leverage loans have deteriorated enormously. I think the losses on those loans, if they default, could well be far higher than investors are accustomed to,” she said.

Lachlan Moffet Gray 6.55pm: Major double dip on early super

The number of applications made by Australians seeking to access a second payout from their superannuation under the government’s early release scheme has rocketed past 300,000 within the first week of the new financial year, with applicants, on average, also asking for more money than they did the first time.

The scheme, launched on April 20, allowed Australians to withdraw up to $10,000 from their superannuation in the last financial year and withdraw a further $10,000 in the current financial year.

Data released by the Australian Prudential Regulation Authority (APRA) on Tuesday showed that between June 29 and July 5, 346,00 applications to withdraw money from superannuation accounts were made by individuals who had submitted an application last financial year.

The average amount applied for by second-time applicants was $8904, higher than the average of $7476 sought by a first-time applicant, and the average payment of $7511.

AMP Capital chief economist Shane Oliver told The Australian that the increased figure for repeat applications didn’t necessarily mean that Australians were attempting to drain their super.

“I suspect that what’s happened is that they took an amount out the first time that they expected would cover their costs but then found that economic conditions are harder than they first thought,” Dr Oliver said.

James Kirby 6.24pm: Can US strip ESG from retirement funds?

After a remarkable run of success in the investment sector, ethical investing has received an unwelcome jolt from the US government with a Trump administration proposal to remove so-called Environmental, Social and Governance (ESG) investments from retirement funds.

With the policy-making US Department of Labor controlling funds representing one third of the entire US sharemarket - the announcement has sent shockwaves through the global ESG sector.

The CEO of the Responsible Investment Association Australasia, Simon O’Connor, has branded the measure as “a backward step”.

Meanwhile, investment research group Morningstar warned: “The Trump move could conceivably spark similar measures by other regulators in the months ahead.”

With funds of $US9 trillion ($13 trillion) under its control, the US Department of Labor says that fund managers acting on behalf of American workers should only follow “objective risk criteria” when buying stocks and bonds.

In essence, the proposal puts forward a hardline traditional view of investment objectives where the sole purpose of retirement funds is to make money for members.

Perry Williams 5.50pm: Seven Group boosts Boral stake

The Kerry Stokes-controlled Seven Group has boosted its interest in Boral, buying an extra 4 per cent stake in the embattled construction materials giant to lift its ownership over 16 per cent.

After amassing an initial 10 per cent stake over the last few months and then topping that up to 12 per cent in late June, the conglomerate controlled by one of Australia’s richest men acquired an extra 50m shares from July 3 to July 14 to hand it a 16.31 per cent stake, according to a substantial shareholder notice lodged with the ASX.

Seven’s success in gradually building up a 30 per cent stake in Beach Energy, where it holds two board seats, may prove a blueprint for its strategy on Boral.

After buying its initial 10 per cent holding, there were expectations it would creep up the Boral register to gain both influence on strategy and expected growth from an Australian infrastructure boom.

Seven Group indicated earlier in June it will push for changes at Boral after describing the construction materials giant as facing challenges around leadership, strategy, litigation and execution.

Boral’s new new chief executive Zlatko Todorcevski, appointed on June 15, said he expects the housing materials player will make a final decision by October over the fate of its struggling US division, amid investor pressure to sell its North American operations to accelerate a business turnaround.

Boral shares rose 0.8 per cent to $3.74.

4.30pm: Tech weakness follows Nasdaq dive

Weakness in US tech heavyweights weighed on the local sector on Tuesday, with BNPL stocks bearing the brunt of selling.

High profile Afterpay did much of the damage, sliding 7.3pc and prompting similar moves across the rest of its listed peers.

Zip lost 7.7pc, Sezzle 12pc and Splitit lot 6.8pc. Lesser known rival Openpay was the only in the sector to notch a gain - up 9.2pc to $4.40 at the close ahead of an investor briefing tomorrow.

Elsewhere in the sector Altium slipped 3.6pc and Appen lost 3.1pc.

Here’s the biggest movers at the close:

4.11pm: ASX pares losses to 0.6pc

The local market has rounded out a choppy session lower by 0.6 per cent, reversing most of the previous day’s gains as technology shares stumbled.

Shares pared daily losses to 0.3 per cent at lunch as China data surprised to the upside, but settled to a loss of 36 points or 0.61 per cent at 5941.1.

All sectors bar consumer staples finished lower, with tech shares doing the most damage after weakness on the Nasdaq, thanks to a 7.3pc slide in Afterpay, 4.4pc fall in Xero and 3.1pc drop in Appen.

Major banks lost between 0.5pc to 1.1pc, while Rio and Fortescue helped to offset declines with lift of 1.4pc and 1pc respectively.

3.58pm: Sentiment catching up with data: Innes

The recent reversal in equities is a symptom of sentiment succumbing to a confluence of negative factors, says AxiCorp markets strategist Stephen Innes.

He argues the bounce in economic data seen in the past few weeks was not true evidence of a recovery.

“With so many states re-imposing lockdown measures, the fear is that the US economy slows again. But in fact, the economy likely did not get going in the first place, and instead, we bore witness to pent up demand,” he writes.

“There is a difference between the bounce from the lows after the astounding sudden stop of March and April and a bottom-line economic recovery. Indeed, this view is getting fleshed out on every high-frequency data dashboard. Bloomberg shows an across-the-board moderation on their panel on most if not all high frequency metrics

“Consumer income and spending are especially vulnerable, as are the credit cycle issues, mainly as lockdowns increase.”

He argues that store sales, restaurant bookings and public transport use are all headed back to lower, “all of which is suggesting we’re moving into a near term critical zone for risk sentiment”.

3.37pm: Tech jitters take bite out of BNPL

Afterpay is leading weakness in the tech sector after the Nasdaq reversed from record highs overnight.

After a recent run to record highs of $76.62, the stock is now down 7.5pc to $66.33, and the decline is rubbing off on its largest listed rival Zip, which is trading lower by 6.6pc to $7.13.

Elsewhere, Sezzle is lower by 10.9pc to $7.57 after its own record trade last week, while Flexigroup loses 2.4pc to $1.20 and Splitit is taking a 5pc hit to $1.61.

Lesser known name Openpay is the only to notch gains in Tuesday’s session - adding 8.7pc to $4.38 and making back some ground against its rivals.

Read more: Sezzle’s star rising in BNPL land grab

3.07pm: Manuka jumps 30pc on debut

Gold explorer Manuka Resources has made a positive debut on the ASX today, rising more than 30 per cent from its IPO offer price.

In the first gold IPO for the year, the NSW-based Manuka raised $4m at 20c apiece, proceeds of which have been earmarked for resource extension and regional exploration.

The company lists Woolworths chief Brad Banducci as a 2pc shareholder, and says it had received offers in the IPO well in excess of the maximum raising.

“In becoming an ASX-listed company, we are extremely proud to have attracted the support of our IPO investors... The capital they have provided will enable it to exploit its tenement package adn hopefully deliver more ounces into our refurbished and upgraded mill at Wonawinta,” chairman Dennis Karp said.

MKR last traded at 26.5c.

2.52pm: Hot demand for ‘monster bond’

The government’s fund raising arm the Australian Office of Financial Management had more than $50bn worth of bids for its latest “monster bond”.

A new $17bn 5-year bond was this morning price at a yield to maturity of 0.495 per cent. There was a total of $50.6bn of bids at the final clearing price.

BofA Securities, JP Morgan Securities Australia Limited, UBS AG, Australia Branch and Westpac Institutional Bank were Joint Lead Managers for the issue.

The AOFM said it will be “mindful of the performance of the bond” when considering the timing of future 5-year bonds.

2.12pm: Qantas extends SPP

Qantas has extended the closing date of its $500m share purchase plan by two weeks.

The group said today that the offer would now close on August 5, clarifying that “at this stage”, the lockdown and state border restriction in Victoria was not expected to have a materially adverse impact on its three year recovery plan.

The move is perhaps a sign the airline could be having difficulty canvassing enough interest.

Shares in the SPP are offered at $3.65 apiece.

QAN last traded down 0.6pc at $3.49.

1.56pm: Jobs recovery was already stalling: NAB

Today’s slowdown in payrolls growth mirrors yesterday’s household survey, suggesting the local economic recovery was stalling even before Melbourne’s new lockdown.

NAB market economist Kaixin Owyong noted today’s ABS data showing weekly payrolls fell 1pc in the last week of June, up just 0.5pc over the past four weeks.

“To date, over a third (35pc) of payroll jobs lost have been recovered, although the moderation in jobs growth is worrying and the Melbourne lockdown is likely to weigh on the recovery in July and August,” she writes.

“That said, we note these data are subject to revision, where the revised figures suggest upside risk to our June employment forecast of +175k (consensus +102k).”

Ms Owyong adds that the relative strength of the wages bill to payroll jobs suggests many existing employees were given more paid hours over the period.

Read more: NSW outbreak grows, Vic has 270 new cases

1.40pm: Overseas arrivals down 98pc

Overseas arrivals for June were down 98 per cent in June, compared to the same time last year, as shuttered bordered crimp any migration.

The latest data from the ABS shows arrivals did tick higher from May, from 19,400 to 25,800 in June.

Nearly two of three arrivals either Australian or New Zealand citizens, the latter increasing by 18pc from the previous month.

Of the rest of the arrivals, 1400 came from India, 1200 from China, 800 from the UK and 460 from the US – with approximately 8.5pc of all arrivals entering the country on permanent skilled visas.

1.29pm: Shares hit high on China data

Australia’s sharemarket hit an intraday high as China’s imports and exports beat estimates for June.

While the trade balance fell to CNY328.94bn vs. CNY425bn expected, imports rose 2.7pc vs. -9pc expected and exports rose 0.5pc vs. -2pc expected, giving encouraging signals for China’s internal and external demand.

Still, a smaller-than-expected trade surplus may give downside risk for 2Q GDP data due Thursday along with industrial production, retail sales and property & fixed asset investment.

The S&P/ASX 200 share index was down 0.4pc at 5954 after bouncing to 5958, while the Australian dollar was little changed around 0.6940.

David Ross 1.07pm: TM Lewin administrators mull options

Administrators for the up-market men’s shirts retail chain TM Lewin met yesterday to discuss what to do with the business which collapsed in July.

The chain, which has shops in Sydney, Melbourne and Brisbane, owes $10m to 70 creditors, of which $8.6m is owed to the TM Lewin related entities in the UK.

Torque Brands owns the UK parent, which it bought from Bain Capital in May.

EY Partner, Stewart McCallum said there had been a number of unsolicited approaches for the business but the formal sale had yet to commence.

“There were a number of reasons TM Lewin has gone into administration, including the collapse of the parent company in the UK in conjunction with the impact of COVID-19, which resulted in significant reduction in foot traffic in the CBDs,” he said.

“Different parts of the retail sector are performing differently during COVID, and have been impacted differently by COVID. In TM Lewin Australia’s case, the reduction in foot traffic in the CBD – as a result of significantly increased working from home – had a material negative impact on the business.”

All TM Lewin shops have been shut since March, but plans are underway to reopen the Brisbane and Sydney stores amid the broader reawakening of those cities.

The approximately 40 staff employed by the Australian business have remained on Job Keeper since this period.

The second meeting by administrators on the fate of TM Lewin’s Australian operations will take place in October 2020.

1.02pm: Shares trim losses while tech slides

Local shares are trading near their best levels of the day, trimming losses to just 0.3 per cent at lunch thanks to a bounce in banks and lift in consumer staples.

At 1pm, the benchmark ASX200 is lower by 20 points or 0.33 per cent to 5957.6.

Tech shares are hardest hit, down 3.3pc thanks in large part to a 6.5pc drop in Afterpay and 3.6pc slide in Appen.

Here’s the biggest movers at 1pm:

Samantha Bailey 12.49pm: WFH a key tailwind for Breville: MS

Shares in Breville are the best performing in lunch trade, up 8pc after Morgan Stanley analysts said the appliance maker stands to benefit from a long-term trend to work remotely, as people spend more on their home to make it a more comfortable environment.

In a note to clients, Morgan Stanley flagged “material upside” for the company, given its global expansion strategy, its competitive advantage and its solid balance sheet.

Initiating coverage of the stock, the analysts rated the stock as overweight with a target price of $28.00. The investment bank said it had a long term valuation of $62 a share, implying 10 per cent compounded returns over the next 10 years.

Modelling by Morgan Stanley suggested that the global serviceable market for Breville is $10bn a year, compared to the company’s global products revenue base of $770m, implying a “material upside” from a successful attempt to secure more market share.

BRG last traded up 6.5pc to $24.47.

Perry Williams 12.45pm: Oil Search to cut exploration spend

Oil Search will likely cut spending on exploration given some opposition in the market and a writedown of up to $575m on its Papua New Guinea assets, UBS says.

The Sydney-based company said on Monday it will take a non-cash, pre-tax charge of between $US360-400m at its 2020 interim results to be released on August 25 after reviewing the value of its assets at June 30.

Oil Search blamed the deteriorating long-term impact of a weaker economy and the weaker outlook for oil and gas prices for the impairment.

UBS said the market “has generally been opposed” to the level of exploration spend of up to $US200m annually in PNG alone and expects it to fall to $US100m in 2021 from $US230m in 2020.

“The absence of an exploration program in Alaska over the northern hemisphere winter of 2020/21 is a big driver of this reduction, but today’s announcement could see this reduced even further. An update on spend is expected with the half year result,” UBS analysts Glyn Lawcock and Joseph Wong said.

Oil Search had the highest all-in break-even cost of $US46 a barrel at the start of this year, according to UBS estimates, compared with Santos and Woodside at $US32 a barrel. Cost cutting and refocusing the business under chief executive Keiran Wulff should see Oil Search’s break-even fall below $US40 a barrel. Brent crude is trading at $US41 a barrel.

Oil Search is likely to disclose the oil price assumptions behind its carrying values at the 1H result on August 25, Macquarie said.

“We expect the carrying value of these ‘tailgas’ or ‘domgas’ assets has become challenged with a more conservative accounting stance from management and given deteriorated global LNG industry conditions. The important point for investors is that the core expansion fields have not been impaired, which indicates that management expect project economics remain robust,” Macquarie noted.

Oil Search last up 1.7 per cent to $2.99.

Read more: Oil Search takes $575m impairment hit from COVID-19

12.38pm: Singapore GDP falls 42pc into recession

Singapore plunged into recession in the second quarter as the economy contracted more than 40 per cent, preliminary data showed Tuesday, with the trade-dependent city state hammered by the coronavirus in another ominous sign for the global recovery.

The economy shrank 41.2 per cent quarter-on-quarter and 12.6 per cent on-year between April and June, according to data from the trade ministry, and analysts said it was the worst quarterly figure for gross domestic product ever recorded in Singapore.

It marked the second consecutive quarter of contraction, meaning the city state has entered a recession for the first time since 2009, when it was hard hit during the global financial crisis.

AFP

Singapore slumps into recession with GDP falling 41.2%, providing a window on how severe a contraction other Asian economies are likely to face https://t.co/ADG98Zqv6s pic.twitter.com/T60X5RgrJs

— Bloomberg (@business) July 14, 2020

12.35pm: China exports rising

China’s exports in yuan terms in June rose 4.3pc compared with the same period a year earlier, improving from May’s 1.4pc increase, according to data from the General Administration of Customs on Tuesday.

China’s imports in yuan terms also increased 6.2pc, recovering from a 12.7pc decline in May, official data showed.

The customs bureau will release the trade data in dollar terms later today.

Dow Jones Newswires

12.00pm: Prices not reflecting risk: Mirrabooka

It’s worth noting Mirrabooka Investments’ rationale for reducing its investment portfolio to 52 from 62 stocks over the past financial year.

Apart from pointing to “extreme volatility and deteriorating economic outlook”, the leading small-to-mid-cap LIC managed by Mark Freeman said: “This was partly driven by the view that equity prices have been boosted by very low interest rates and the impact of fiscal stimulus to the point where prices were not reflecting sufficient compensation for the risk associated with many investments.”

It comes after the VIX index of volatility in S&P 500 futures surged 4.9bp to a two-week high 32.2 per cent on Monday.

Barring additional US fiscal and monetary stimulus, there remains a risk of an equity market sell-off as the VIX continues to bounce off its 200-DMA at 26.4pc.

Read more: Lower dividends hit Mirrabooka full-year profit

11.46am: Slattery backing sparks Pointerra rally

Backing from heavyweight tech investor Bevan Slattery has sparked a 60pc surge in 3D data specialist Pointerra.

The $33m company this morning said Mr Slattery had invested $2.5m in the business, at 5c per share.

The tech entrepreneur, also the founder of Superloop, said the opportunity was large given the “exponential growth in geospatial data”.

“I am excited that Pointerra has the potential to be a world leader in this field and ultimately to help feed the geospatial systems behind industries including telecommunications, renewable energy and autonomous vehicles. I am tremendously excited that an Australian team is building this global capability,” he said.

Trade in the company reached 11c per share this morning, and last traded up 61pc to 8.7c.

Proceeds from the placement are to be used to accelerate the appointment new development and sales resources in Australia and the US.

Read more: Superloop surges as broadband demand soars during pandemic

11.34am: Payroll job losses at 5.7pc

Weekly payrolls data shows the recovery in jobs faded at the end of June, according to the ABS.

In the latest data, total payroll jobs for the two weeks to June 27 were still 5.7pc below mid-March, when Australia recorded its 100th COVID-19 case.

Still, since the low in mid-April, total jobs have increased by 3.3pc, with roughly 35pc of jobs initially lost now regained.

Payroll jobs worked by people under 20 were the fastest to recover over June, increasing by 11.3pc.

Australia Weekly Payrolls, Wages – ABShttps://t.co/XD6G8rve1Q pic.twitter.com/nMgX3Rzmgq

— LiveSquawk (@LiveSquawk) July 14, 2020

Samantha Bailey 11.31am: Business confidence hits positive territory

Business confidence turned positive in June, rebounding from record lows over the previous three months, according to the NAB monthly business survey.

But while confidence lifted into positive territory, business conditions remained negative and well below average, a sign that activity still has some way to go.

NAB’s confidence index rose by 21 points to +1 points while the business conditions index rose 17 points to -7 points, its highest level since February.

“Like last month, the improvement in trading conditions and profitability lines up with our internal NAB data which suggest significant improvement in activity,” said NAB chief economist Alan Oster.

ASX last down 0.93 per cent to 5922. AUDUSD slightly lower at US69.34c.

Read more: Business confidence rebounds

Bridget Carter 11.12am: Pushpay selldown priced at $NZ8.40

DataRoom | Shares in Pushpay Holdings have been priced at $NZ8.40 (AU$8.12) for a $NZ121m sell down of a major stake in the company by the Huljich family.

Working on the trade after market on Monday was JPMorgan and UBS.

Shares were sold in a bookbuild at an underwritten floor price of NZ$8.40 per share, which was a 9.1 per cent discount to the last traded price on the New Zealand stock exchange.

Bids were taken in NZ10c increments up to NZ$8.80 per share. On offer were 14.4 million shares, or 5.2 per cent of shares outstanding.

Following the sale, the New Zealand-based Hujlich family would reduce their stake in the company to 15.7 per cent from 20.9 per cent.

Read more: Huljich family cuts Pushpay stake

Nick Evans 11.07am: Challenger Exploration raising $20m

DataRoom | South America-focused gold explorer Challenger Exploration has joined the junior raising rush, tapping the market for $20m to push ahead with its Argentinian and Ecuadorean projects.

The $20m placement at 20c – a 3c discount to its 23c closing price on Monday – is being led by Foster Stockbroking, Peloton Capital and Henslow, with the funds to be earmarked mainly for a drilling program and scoping studies at its Hualilan project in Argentina.

The project already has an inventory of about 600,000oz of gold – but the project has been locked up in disputes between previous owners, including former TSX-listed La Mancha, for the last 15 years and the resource is not compliant with Australian reporting standards, the company says.

Challenger is only the latest of a rush of gold juniors to take advantage of the surging gold price to tuck away a significant raising. This within the few weeks WA’s Black Cat Syndicate called a trading halt as it seeks about $8m, Bellevue Gold launched a $100m placement, Bardoc Gold put away $24m, and Navarre Minerals raised $8m.

10.55am: Pendal reports $2.5bn in outflows

Investment manager Pendal has reported $2.5bn in outflows for the June quarter, but a rebound in equity markets has helped it snag an increase in funds under management.

The group reported funds under management of $89.4bn to June 30, up 4pc on the previous quarter, with a $11.1bn boost from the equity market rebound, but $5.2bn drag as the Aussie dollar appreciated against major currencies.

Chief executive Emilio Gonzalez attributed the outflows to negative sentiment toward European equities and reshaping of a key institutional client’s Australian equities portfolio.

Pendal Australia performance fees for the year were $13.6m, up $12m from last year.

PDL last traded up 2.3pc to $5.89

Lachlan Moffet Gray 10.48am: Start-ups left out of JobKeeper

The select committee on fintech and regtech has heard a suggestion that JobKeeper should be extended for high-growth companies, with many in the tech sector left out of the current support package.

Ms Young said that 50 per cent of her members said they were receiving the JobKeeper subsidy or equivalent, 30 per cent received some kind of tax relief, but “an astounding 40 per cent received no help”.

She noted that start-ups with no sales contracts could not qualify for the subsidy as they could not show a revenue downturn of 30 per cent.

“If you were an early stage start up without revenue, you were not going to qualify for it,” she said.

Australian Small Business and Family Enterprise Ombudsman Kate Carnell said that the government could help the industry by putting out tenders for regtech and fintech solutions to government activities.

“This is, in our view, a time when government purchasing power could really help stimulate the economy,” she said.

10.37am: Village Roadshow, BGH extend talks

Theme park operator Village Roadshow has extended its exclusivity agreement with private equity suitor BGH Capital for a third time by a further two weeks.

The two are negotiating a revised takeover deal worth $469m at $2.40 per share, after BGH withdrew its first offer of $4 apiece at the onset of the pandemic.

In a brief note to the market today Village Roadshow said the transaction process deed with BGH had been amended and extended to July 28.

“VRL will continue to keep the market informed of any material developments in accordance with its continuous disclosure requirements,” it said.

At the last extension on June 16, Village Roadshow said it had extended the negotiations for a further two weeks, with the option to extend another two “if the parties continue to actively pursue the potential transaction”.

VRL last traded at $2.04.

Lachlan Moffet Gray 10.20am: RegTech could be a key export industry

Deborah Young, CEO of the RegTech association, has told the select committee on financial fintech and regtech that the industry poses tremendous potential for Australia as an export industry.

Rod Schneider, head of strategic partnerships at Tanda PaySure told the submission that as an operator of an award calculator and rostering technology platform, the government can help the industry by providing exact legal interpretations of certain regulations, like pay awards, and by reducing taxes to encourage the growth of start up industries.

“The government must ensure that regtech businesses in Australia have clarity on correct legal interpretations … In Tanda’s case, we are faced with the complexity and uncertainty of modern awards,” he said.

Mr Stirling also submitted that the Government consider amending the Fair Work Act to make investment in compliant payroll calculation technology a factor that courts must consider when imposing civil penalties in the case of underpayments, and that the Fair Work Ombudsman develop a “true payroll calculator” on its website.

10.11am: Afterpay, Xero lead tech slip

A reversal on Wall Street and growing virus concerns at home are pulling the ASX lower by 0.6pc in early trade, with falls led by energy and tech stocks.

At the open, the benchmark ASX200 is lower by 36 points or 0.61 per cent to 5941.9.

The sharp dive on the Nasdaq overnight is hitting local tech shares hardest – the sector down 1.6pc as Afterpay drops 3.7pc, Xero loses 2.5pc and WiseTech slips 0.3pc. Altium is bucking the negativity with a 2pc lift after some encouraging signs of market dominance at its unaudited full year results.

Elsewhere, the major banks are off by around 0.3pc.

Lachlan Moffet Gray 10.01am: Regtech a key solution for small biz

A public hearing of the select committee on financial technology (fintech) and regulatory technology (regtech) is underway in Canberra.

Chaired by Senator Andrew Bragg, the committee will today continue its work the size and scope of the opportunity for Australian consumers and business in regards to fintech and regtech, the barriers for taking up new technologies in the financial sector and the effectiveness of current initiatives for promoting start-ups in the sectors.

In her opening statement Kate Carnell, Ombudsman for the Australian Small Business and Family Enterprise Ombudsman endorsed a “regtech solution” for helping small businesses navigate the complexity of labour laws, awards, OHS and tax law, and pushed for the government to empower the private sector to produce solutions.

“Regtech is a really important mechanism to be able to simplify the significantly complex regulatory environment that small businesses find themselves in,” she said, noting 97pc of small businesses in Australia have less than 20 employees.

“Our regulatory environment is often the same as it is for BHP as it is for the corner store … most small business people want to do the right thing but sometimes they find the complexity of regulation makes that hard.”

Patrick Commins 9.55am: Consumer confidence falls for third week

Consumer confidence fell for the third consecutive week, as the COVID-19 outbreak in Victoria sparks worries around the economic recovery.

The latest ANZ-Roy Morgan survey – conducted over the weekend – shows confidence fell a further 0.5 per cent to 91.6. It’s now 6 per cent lower than in mid-June, driven by a 15 per cent fall in sentiment around “current economic conditions”, which is down around 15 per cent over this period.

The average reading since 1990 is 113 points.

ANZ head of Australian economics David Plank said the deteriorating conditions in Melbourne and the renewed lockdown were “most likely the primary contributor to the turn in sentiment”.

“How this fiscal support will evolve over the months ahead is the most critical decision facing the government and the economy,” Mr Plank said.

Consumer confidence has fallen for its third week in a row. https://t.co/ffjMUKciZn

— David Plank (@DavidPlank12) July 13, 2020

9.41am: Tech to lead ASX fall

The IT sector should lead a fall in the Australian share market today as it did in the US overnight.

Futures relative to fair value suggest the S&P/ASX 200 will open down 0.4pc at 5954 points after the S&P 500 fell 0.9pc to 3155.2 after hitting a 5-month high of 3235.3.

More significantly, the Nasdaq Composite fell 2.2pc to 10390.8 after hitting a record high of 10824.8, also forming a bearish key reversal pattern after leading global markets with a 63pc rise since late March.

NYFANG led the Nasdaq with a 3.1pc fall and Telsa went from up 16pc to down 3.1pc. Recent price action in the US tech sector may be a red flag of a stimulus-related tech bubble that could burst at some point.

It came as California shut all indoor activities – cafes/bars/restaurants/theatres – after reporting a record number of daily infections on Saturday. Florida reported over 12,000 new cases on Monday, albeit the percentage of positive tests fell to a 2-week low.

But US-China tensions worsened with China announcing sanctions on several US officials, and US Secretary of State Michael Pompeo taking a hard line against China’s claims in the South China Sea.

“We are making clear: Beijing’s claims to offshore resources across most of the South China Sea are completely unlawful, as is its campaign of bullying to control them,” he said.

Materials stocks may continue to outperform after spot iron ore rose 5.2pc to $108.4 a tonne, the LME Metals index rose 1.8pc, and Australian dollar gold rose 0.3pc, though Energy stocks are vulnerable after WTI crude fell 2.3pc to $39.62 a barrel.

ANZ’s weekly consumer confidence index fell to its lowest point in 9 weeks, NAB’s monthly business survey is due at 11.30am along with ABS weekly payroll jobs and wages data, while China’s monthly trade data is also due.

9.39am: What’s on the broker radar?

- BHP cut to Hold – SBG Securities

- Breville rated new Overweight – Morgan Stanley

- PointsBet rated new Underweight – JP Morgan

- Technology One raised to Buy – Bell Potter

- Warrego Energy rated new Buy – Canaccord

- Webcentral Group raised to Hold – Bell Potter

9.35am: Coronado output slumps as mines idled

Production at US and Australian coal producer Coronado Global slumped in the June period as the company idled its US mines in the face of falling prices and the coronavirus crisis.

June quarter sales fell 14.7 per cent on the previous period, to 3.8 million tonnes, after Coronado temporarily idled its Buchanan and Logan operations in the US – both of which returned to production in May – and put its Greenbrier mine into mothballs until the metallurgical price recovers.

The company’s run-of-mine production fell 27.2 per cent to 5mt, with saleable production in the period down 22.1 per cent to 3.5mt.

Coronado boss Gerry Spindler said the performance of its Australian Curragh operations improved in the June period, with the mine producing 3.5mt of saleable coal, up 11 per cent.

But the price Coronado received for its product plunged in the period, with the average price of its Australian metallurgical coal down 23.6 per cent to $US91.9o a tonne, well short of the $US120.30/t it was getting in the March quarter.

Realised prices for its US coal went up, however, lifting from $US84.70 in the March period to $US90.80 in the June quarter.

Mr Spindler said prices had lifted towards the end of period as markets in China improved.

“Our expectation is that prices are likely to remain supported over the short term as demand from India resumes following the monsoon season,” he said.

Coronado shares closed Monday at 96c.

9.24am: Whitehaven achieves output, sales guidance

Whitehaven Coal said it achieved annual guidance for coal output and sales in the year through June, despite challenges posed by a crippling drought in Australia, wildfires and the ongoing coronavirus pandemic.

Whitehaven reported run-of-mine coal output of 8.2 million tonnes in the three months through June, up 17pc on a year earlier. That brought annual production to 20.6 million tonnes, down 7pc on fiscal 2019.

Managed sales of produced coal totalled 5.3 million tonnes in the fourth quarter, up 29pc on a year earlier. That brought annual sales to 17.5 million tonnes, down 7pc on fiscal 2019.

“Against an uncertain global economic backdrop Whitehaven is focused on optimising existing operations and observing disciplined capital management,” said chief executive Paul Flynn.

Whitehaven said it would provide guidance for the 2021 fiscal year alongside its annual earnings in August 26.

Dow Jones Newswires

Samantha Bailey 9.18am: Majority of refinancings switching lenders

A record number of mortgage holders refinanced in May, the majority of which were switching lenders as the major banks fight for customers.

According to the latest ABS data, the number of mortgage holders who refinanced jumped 30 per cent from April to May. Of those who refinanced, 64 per cent switched lenders, which was a record proportion, according to analysis by comparison website Finder.

The total value of these refinanced home loans exceeded $15.1bn in May, up 26 per cent from the previous high of $12bn in April.

“As budgets are stretched, a record number of people are deciding to get a better deal on their largest investment,” Finder insights manager Graham Cooke said.

“While the value of houses may well drop in the next year, the mortgages on them will not. Historically low interest rates and a lack of investor spending are a double whammy to banks, but a boon for mortgage holders.”

Just yesterday, St George moved to lure first home buyers by offering $1 mortgage insurance.

Read more: Fears for property as home lending collapses

9.01am: Victoria spending in sharp decline: CBA

The reimposition of lockdowns in Victoria has sparked a drop-off in spending, and is rubbing off across the rest of the country too, according to the latest data from Commonwealth Bank.

The bank’s latest survey of their own transaction data showed household spending eased over the week to be 7.2pc higher than a year ago, but momentum in Victoria turned negative.

Senior economist Kristina Clifton wrote that while spending in QLD, NSW and WA each eased slightly, they remained higher by roughly 10pc from a year ago. In contract, Victoria’s drop off was more pronounced and into the negative – driven by a sharp reversal in clothing and personal care spend.

Read more: Second wave hits national recovery

8.39am: Altium accelerates industry dominance

Tech outfit Altium has fallen $11m short of its aspirational $US200m revenue target for the year as a result of COVID-19 uncertainty, but says the pandemic has “dramatically accelerated” its move toward market dominance.

Releasing its unaudited full year results, Altium reported worldwide revenue of $US189m, up 10pc on the previous year, and record growth of 17pc in its subscription base to well over 50,000 subscribers.

Chief Aram Mirkazemi said the pandemic and associated lockdowns has sped up the shift to online work, increasing the take up of its new cloud platform and new online selling capabilities.

“While COVID-19 prevented us from reaching our long standing aspirational goal of $US200m in revenue, conditions surrounding COVID-19 have dramatically accelerated our movement towards market dominance and the implementation of our transformative agenda for the industry,” said Mr Mirkazemi.

Altium will release its full year results on August 17.

7.55am: Westpac appoints new CFO

Westpac says Michael Rowland has been appointed the group’s chief financial officer.

Mr Rowland joins Westpac from KPMG, where he is a partner in management consulting after previously holding number of senior executive positions at ANZ from 1999 to 2013.

Westpac CEO Peter King said Mr Rowland brings deep experience across the financial services industry having held senior positions at KPMG, ANZ and ING Australia.

“Michael’s experience is broad across both CFO and business leadership roles. His most recent experience in consulting as a senior partner at KPMG also brings valuable external perspectives,” Mr King said.

“In particular, Michael’s expertise in business restructuring, delivering sustainable productivity and revenue programs and in disciplined financial management will be an important contributor to making Westpac a simpler and stronger bank.”

Gary Thursby, who has been acting CFO since December 2019, will continue acting in this role until Mr Rowland joins Westpac later in the year.

Read more: KPMG partner named new Westpac CFO

7.35am: Huljich family cuts Pushpay stake

The Huljich family has sold 25 per cent of its shares in church-friendly donations payment business Pushpay Holdings.

However Pushpay says shareholders associated with the Huljich family are expected to remain the largest shareholder, with a combined interest in 43.2 million shares.

“The Huljich family remains strongly committed to Pushpay,” it said.

Peter Huljich will remain on the Pushpay board, with Christopher Huljich continuing to act as his alternate director.

“The Huljich family confirms that it does not have any current intention to sell further shares in Pushpay and has provided an undertaking to the underwriters not to sell further shares in Pushpay until after Pushpay’s FY21 interim results are announced on the NZX and ASX.”

7.00am: Virus surge ‘slowing US recovery’

Recent US economic data points to a slowing recovery as cases of illness related to the coronavirus pandemic surge across the country, Federal Reserve Bank of Dallas President Robert Kaplan said.

“We were hoping for meaningful double-digit growth in the third and fourth quarters, and I think we were seeing it until, say, the second week in June,” Mr. Kaplan said during a video appearance. But as things now stand, “I think growth is slowing,” he added.

Mr Kaplan, who has a vote on the rate setting Federal Open Market Committee this year, was addressing mounting signs that the economy’s rebound may be losing momentum.

“I think it’s unlikely we are going to go back to where we were in early April,” when the economy was in severe distress, he said. But he added that “The issue is how fast are we going to grow out of this big decline we had in the second quarter, and unfortunately with this resurgence in disease, it’s muting that rebound.”

If the health situation gets worse, “that will further mute growth,” Mr. Kaplan said.

For now, Mr. Kaplan still expects the US economy to shrink by 4.5 per cent to 5 per cent for the year as a whole, with above trend growth likely next year. He also expects the unemployment rate will likely fall from its current 11.1 per cent to between 9 per cent and 10 per cent by the end of this year and to between 7 per cent and 8 per cent by the close of 2021. The U.S. started this year with the unemployment rate at 3.6 per cent.

Dow Jones

6.40am: Oil falls

Oil futures fell, with traders awaiting the outcome of an OPEC+ Joint Ministerial Monitoring Committee meeting later this week.

Members of the Organisation of the Petroleum Exporting Countries and their allies will decide whether to extend current production cuts by an extra month or “risk a taper tantrum as countries continue to experience reopening setbacks,” said Craig Erlam, senior market analyst at Oanda.

August West Texas Intermediate oil fell 45 cents, or 1.1 per cent, to settle at $US40.10 a barrel on the New York Mercantile Exchange.

The Brent crude price fell by US52 cents or 1.2 per cent to $US42.72 a barrel.

6.20am: ASX tipped to open lower

Australian stocks are set to open firmly lower at the open after Wall Street lost ground in volatile trade.

After Australian stocks finished 1 per cent higher on Monday, the SPI futures index was down 47 points, or 0.8 per cent, at about 6am, pointing to a weaker open.

The Australian dollar was down at US69.42c, from US69.71c at yesterday’s close.

On Wall Street, the Nasdaq tumbled 2.1 per cent, the Dow mustered a narrow gain of less than 0.1 per cent and the S&P 500 shed 0.9 per cent.

6.10am: US rally loses steam

A rally in US stocks fizzled after California rolled back its reopening plans, spurring worries about another coronavirus lockdown.

Major stocks had been sharply higher earlier in the session, with Dow Jones Industrial Average rising more than 500 points. But sentiment shifted after California moved to close all indoor dining, bars and other businesses. The Los Angeles Unified School District, the nation’s second largest, said it would start the school year online.

The Dow edged up 10 points, or less than 0.1 per cent, following two consecutive weeks of gains.

The S&P 500 fell 0.9 per cent. The technology-heavy Nasdaq Composite, which has been at record highs in recent days, dropped 2.1 per cent.

Markets have remained resilient in recent weeks despite rising coronavirus infections in many US states. The Dow and S&P 500 have surged more than 40 per cent since late March, though they remain down around 10 per cent and 5 per cent from their February records, respectively.

“The markets are looking out six months from now, and saying that things will be a whole lot better by then,” said Randy Frederick, vice president of trading and derivatives at Charles Schwab. He cautioned that uncertainty about the pandemic or the upcoming US election could still sour the market’s rally in the coming months.

Pfizer shares added 4.1 per cent to lead the Dow. The pharmaceuticals giant and German biotech company BioNTech said Monday that they received “fast track” designation from the Food and Drug Administrations for two coronavirus vaccine candidates that they are partnering on, allowing them to speed up testing.

Investors were looking ahead to second-quarter earnings season for any signals about the shape and pace of economic recovery following the disruption caused by the pandemic.

Economists generally agree that the quarter ended in June was likely the worst of the downturn, but the extent of the damage is still unclear. The rise in US coronavirus cases has prompted renewed restrictions on business and social gatherings in some areas and threatens to slow down the economy’s revival.

Earnings for S&P 500 companies are expected to decline nearly 45 per cent compared with the second quarter of 2019, which would mark the steepest year-over-year drop since 2008, according to FactSet.

Overseas, the pan-continental Stoxx Europe 600 rose 1 per cent. Most major Asian markets ended the day sharply higher, with the Shanghai Composite Index rising 1.8 per cent.

The Shanghai index has climbed nearly 13 per cent this year, making it one of the world’s best-performing major indexes. Growing conviction that China’s economy is recovering from the coronavirus has encouraged investment in Chinese stocks from foreign institutions and the millions of individual investors who dominate trading in China.

Dow Jones

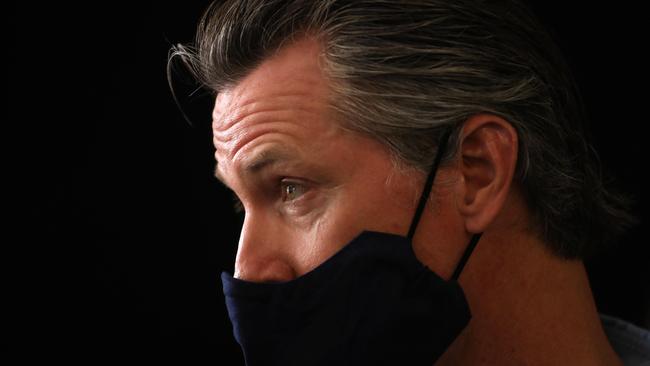

5.45am: California extends closures

California Governor Gavin Newsom extended the closure of bars and indoor dining statewide and ordered gyms, churches and hair salons closed in most places as coronavirus cases keep rising in the nation’s most populated state.

On July 1, Newsom ordered 19 counties with a surging number of confirmed infections to close bars and indoor operations at restaurants, wineries, zoos and family entertainment centres like bowling alleys and miniature golf.

The Democratic governor extended that order statewide Monday. He also imposed additional restrictions on the 30 counties now with rising numbers, including the most populated of Los Angeles and San Diego, by ordering worship services to stop and gyms, hair salons, indoor malls and offices for non-critical industries to shut down.

“The data suggests not everybody is practising common sense,” said Newsom, whose order takes effect immediately.

AP

5.35am: US deficit soars

The massive government rescue payments to help businesses and households survive the economic hit from the coronavirus pandemic drove a surge in the US deficit last month, the Treasury Department said.

With outlays in June surging to $US1.1 trillion and receipts falling, the funding gap in the first nine months of the current fiscal year soared 267 per cent compared to a year earlier, hitting $US2.74 trillion, Treasury said.

“Driven by the impact of the COVID-19 outbreak and government response, the deficit for June 2020 was $US864 billion, compared to $US8 billion in June 2019,” Treasury said in the monthly report statement.

“More than half of this increase was due to a $US511 billion increase in Small Business Administration budget outlays, primarily for the Paycheck Protection Program (PPP).”

AFP

5.33am: Huawei reports sales rise

Chinese telecom giant Huawei reported a first-half revenue rise of 13.1 per cent year-on-year as it appeared to emerge from a sales slump seen at the start of the year.

Also reporting a net profit margin of 9.2 per cent, Huawei said communications technologies were both a tool for combating the coronavirus and an engine for economic recovery.

Huawei is the world’s top supplier of telecom networking equipment and number-two smartphone maker behind Samsung.

The 454 billion yuan ($US64.9 billion) first half revenue figure points to a sharp uptick in sales for the second quarter, after first-quarter revenue came in at just 182.2 billion yuan, a mere 1.4 per cent increase year-on-year.

Analysts blamed the downturn in the three months to end-March on the coronavirus and international efforts to contain the company’s involvement in foreign telecom networks.

AFP

5.30am: Stocks rise as US earnings loom

World stock markets advanced, helped by investor confidence in upcoming US quarterly earnings and the business outlook, and by hopes for progress towards a coronavirus vaccine, dealers said.

A spike in COVID-19 infections across the globe kept a lid on gains, they said. “The mood remains upbeat as the new week kicks off and US earning season moves into focus,” said City Index analyst Fiona Cincotta.

Results from JP Morgan, Citigroup, Wells Fargo, Goldman Sachs, Netflix and Johnson & Johnson would help give further insights into corporate America’s performance following the full coronavirus lockdown, she said.

Weak earnings for the quarter to June “should be priced in” already, said Fawad Razaqzada at ThinkMarkets. “What investors will be looking for more than anything is forward guidance,” he said.

Key European stock markets were well over one per cent up by the close, with London and Frankfurt both up 1.3 per cent, and Paris gaining by 1.7 per cent.

Earlier, Asia had led the way with solid gains across the region. Oil prices fell on festering fears over demand-destroying coronavirus, and before this week’s expanded OPEC+ technical gathering of key crude producers who are expected to curb production cuts.

Investors welcomed comments on Friday from the head of German biotech firm BioNTech who said a vaccine candidate would be ready for regulatory review by the end of the year, while Gilead Sciences said its drug remdesivir had been relatively effective in clinical trials.

“There was a sense of optimism circulating on the back of hopes for a treatment for coronavirus,” said CMC Markets analyst David Madden.

Trillions of dollars in government support is keeping global equities well supported, but confidence is being strangled by the spread of the disease, with an explosion of cases forcing some countries to reimpose containment measures just weeks after easing lockdowns.

AFP

5.30am: US consumers remain worried

American families were slightly less pessimistic about their finances and jobs in June, but remained concerned about their economic prospects amid the coronavirus pandemic, according to a survey.

The results came before the recent uptick in COVID-19 cases and deaths in states like Florida, Texas and California, which has led to a tightening of restrictions in those areas.

The Federal Reserve’s New York bank found US workers are less concerned about losing their job than in May, but more fearful that they won’t find a job if they need one.

Fewer worry about missing a debt payment in the next three months or that their financial situations will worsen in the coming year, the survey found.

However, “While improved relative to readings from March to May, perceptions and expectations of financial conditions remain weaker compared to pre-COVID-19 readings,” the New York Fed said of its findings.

Earnings expectations for the coming year declined, well below the 12-month average to 1.6 per cent, a new series low.

AFP

5.25am: UK mulls Huawei removal

The head of British telecommunications giant BT said Monday that it would be “impossible” to remove controversial Chinese giant Huawei’s equipment from Britain’s infrastructure in under 10 years.

BT chief executive Philip Jansen, speaking to the BBC, also warned that Britain could suffer “outages” and potential security risks if the sector was forced to stop dealing with the Chinese firm.

British Prime Minister Boris Johnson will reportedly decide this week whether to phase out the Chinese technology giant’s equipment from the UK’s 5G network because of persistent spying concerns.

The BBC on Monday reported that the government could stop installing Huawei equipment after 2021, and could possibly try to remove all of the company’s 5G kit by 2025.

AFP

5.20am: $US20.9bn semiconductor deal

American semiconductor firm Analog Devices has agreed to buy rival Maxim Integrated in an all-stock transaction valued at $US20.91 billion, the companies announced.

The acquisition, one of the biggest deals of the year, would create an enterprise with a combined worth of $US68 billion and estimated revenues of $US8.2 billion.

“Maxim’s strength in the automotive and data centre markets, combined with ADI’s strength across the broad industrial, communications and digital healthcare markets are highly complementary,” the statement said.

Under the terms of the deal, Maxim would receive 0.63 shares of ADI for each of its shares, giving its shareholders 31 per cent ownership of the combined company.

At Friday’s closing prices, Maxim had a market value of $US17 billion and ADI of $US48 billion.

The combined company will be positioned to serve “more than 125,000 customers and capture a larger share of a $60 billion total addressable market,” a statement said.

The deal, which still has to be approved by regulators, is expected to close in 2021.

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout