Sezzle’s star rising in buy now, pay later land grab

Sezzle has emerged as the new star of Australia’s fast-growing buy now, pay later players, but the sector’s white-hot run could be in danger.

Sezzle has emerged as the new star of Australia’s fast-growing “buy now, pay later” players, but the white-hot run of the tech sector threatens to be derailed by the stalling of consumer spending habits.

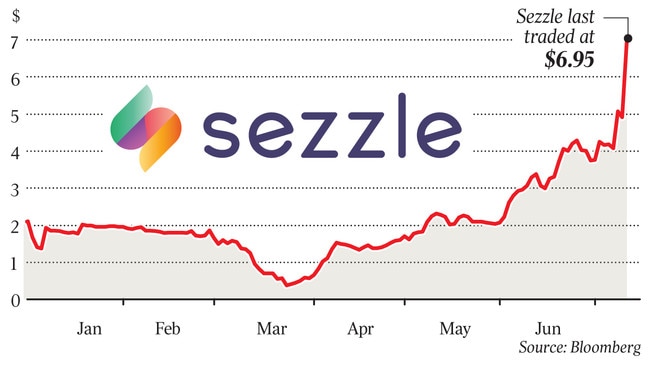

Sezzle is the latest to tap the market, on Friday launching an $87m placement and share purchase plan after its shares soared to record highs of $6.95 — a surge of almost 800 per cent since April 1, with the payments company yet to turn a profit.

The recent price surge also compared to the $1.22 IPO price in July last year.

If Afterpay’s recent oversubscribed $650m institutional placement, or the other three BNPL equity raisings in the past three months, are anything to go by, the Australian-listed, Minneapolis-based Sezzle will have little to worry about.

The $5 floor price for its bookbuild represents a 28 per cent discount to the stock’s last trading price.

The majority of Sezzle stock is owned in house, with co-founder and chief executive Charlie Youakim owning 49.55 per cent (which at current prices is worth $586m), while fellow co-founder and company president Paul Paradis owns a 5.6 per cent, which is valued at $66m.

Youakim is an engineer and software developer who before Sezzle built a parking and transit mobile payments company in Minneapolis called Passport. That was in 2010.

Paradis has more than 10 years of sales, marketing and operations experience, working in the payments, management consulting, medical device and entertainment industries.

A large share of the Sezzle placement proceeds have been slated for sales and marketing, as the firm jostles for market share in an increasingly crowded sector.

But competition is rising — this week credit card giant American Express joined the BNPL fold, announcing its new Plan It feature that allows credit card holders to move a portion of their statement balances into payment plans of three to 12 months, with a fixed monthly fee.

At the same time, global payments giant Visa last year said it was planning its own “buy now, pay later” service.

As Afterpay has itself become a verb, so too is Sezzle pushing for consumers to “Sezzle it”.

Still, there’s no shortage of backers for BNPL, which targets millennials’ aversion to credit cards and proclivity to spend no matter the economic circumstances.

While the sector is riding high, consumer experts warn that the market for “buy now, pay later” services could drastically soften with changing economic circumstances.

“(The services) are no less susceptible to an economic downturn than merchandise itself, so once people buy less, then they will also use these services less,” said Kai Rieme from the University of Sydney Business School.

“In the short term, if people are pressed for cash in the pandemic, they (the companies) might actually benefit from the current situation. There’s no guarantee in the middle or long term that they might do well.”

He said the termination of government payments such as JobKeeper may pose a problem, but Bell Direct’s Jess Amir pointed out that not all instalment services were created equal.

Across the six ASX-listed services, including Zip, Openpay, FlexiGroup and Splitit, she notes that there are a broad spread of product offerings.

“The rapid growth trajectory of the BNPL sector is expected to continue, snatching market share from credit cards and PayPal,” Amir said. “Lockdowns and the shift to online shopping is a huge tailwind, but with reward there is of course risk, with the underlying credit profile of the users of their services.

“Still, Afterpay’s recent capital raising will be enough to cover bad debts. Keep in mind Afterpay has a very small bad and doubtful debt provision, given the service is not used on big-ticket items, whereas Zip and Splitit are prone to more risk, given customers are able to splurge on larger items.”

Of Sezzle’s raising outlined on Friday, $11.5m is to be used to bolster the group’s balance sheet, including costs for potential debt facility refinancing and to increase cash reserves.

Lead manager of Sezzle’s raising, Ord Minnett, says it has increased the company’s revenue estimates by 8-16 per cent and its valuation to $5.95 a share. “Sezzle is highly exposed to the rapid increase in market share for e-commerce, and its recent growth numbers highlight this, along with first-rate execution,” the brokerage said in a note to clients.

RBC’s Tim Piper has an outperform rating on the stock, highlighting its focus on product innovation with Sezzle Up, Sezzle Spend and Sezzle Anywhere products due to roll out in coming months.

“The raising provides additional capital to accelerate growth in Sezzle’s key markets,” he said.

“Our forecasts on profitability is not until 2023, which may see upside risk if loss rates continue current trajectories, and/or operational expenditure growth comes in lower than RBC estimates.”

The question of value and profitability in the sector is one that has plagued many an investor, as even the $20bn Afterpay is yet to notch a profit.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout