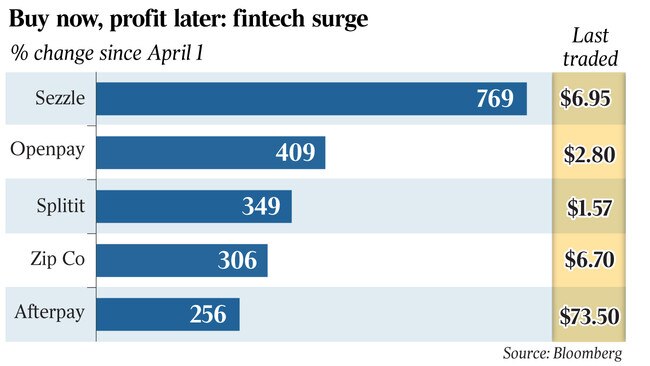

Afterpay on a roll to $100 as buy now, pay later sector soars

Market darling Afterpay is tipped to become the next $100 stock as it spearheads a fintech bubble on the ASX.

Market darling Afterpay is tipped to become the next $100 stock as it spearheads a fintech boom on the ASX, with the nascent buy now, pay later sector surging to a market value more than $25bn.

While uncertainty has plagued much of the broader stockmarket during the coronavirus crisis, the so-called BNPL sector has been riding a wave of e-commerce, as locked-up consumers take to online shopping for their retail therapy.

Several locally listed names have this week touted record quarterly sales growth. Afterpay said it had processed $3.8bn in sales over the past quarter, while Splitit reported $94m over the same period and Sezzle a total of $272m.

Combined, the six listed stocks in the space — also including OpenPay, FlexiGroup and Zip — have a market capitalisation of $25bn, equal to that of blue chips Fortescue or Newcrest, and are fast dethroning the WAAAX stocks (WiseTech, Afterpay, Altium, Appen and Xero) as the top ASX growth options.

On Thursday, strength in BNPL drove the tech sector to gains of 3.1 per cent following a strong lead from the US Nasdaq which hit record highs again, supported by rallies in Apple and Amazon. Afterpay shares set a record of $75.26 in the session, just days after raising $650m from institutional investors at $66 apiece, the top of its bid range. Not even a $307m sell-down by the firm’s founders could stop a run on the stock.

The stock, which closed up 11.4 per cent to $73.50, is now the 18th largest on the ASX by market valuation, behind Woodside and just ahead of Brambles and ASX Ltd itself.

Meanwhile, US-focused Sezzle soared as much as 70 per cent intraday before halting shares at $6.95 as the tech company prepared to tap investors for as much as $80m in a capital raising. Sezzle earlier this week reported record growth for the June quarter as it forecast annualised sales to reach $1.4bn by the end of the year.

Brokerage Morgan Stanley on Thursday joined a growing chorus of upgrades for Afterpay, upping its target price on the stock by a hefty 180 per cent to $101 a share after Citi, RBC and UBS last week hiked their own targets.

The broker is now by far the most bullish on the stock, with analyst Andrei Stadnik noting that the e-commerce tailwind was likely to support the stock for some time to come.

“The market opportunity is large and Afterpay has addressed our concerns on credit quality and diversifying from the fashion segment, removing many of the downside risks,” Mr Stadnik wrote, highlighting that the company’s partnership with eBay locally had the potential to go global.

“Overall, our price target is up around 200 per cent to $101 given Afterpay’s displayed ability to balance accelerated revenue growth and credit quality through the downturn and a sound strategy to sustain strong growth going forward.

“We also think Afterpay remains under-owned by Australian institutional investors. Our price target also captures the upside risk of earnings breaking even in financial 2021.” He noted that the stock had outperformed the market — up 130 per cent year-to-date versus a 9 per cent loss for the benchmark ASX200.

Afterpay bull Richard Coppleson, Bell Potter’s head of institutional sales, noted that COVID-19 had intensified the shift to online shopping, benefiting the whole of the BNPL sector.

“What COVID has done was to accelerate the moves by consumers online in three months, what would have in normal times taken two years, which has been translated into the share price moving faster and higher than was conceivable just four months ago,” he said.

Adding to the momentum was a sharp spike in daytraders, said Cyan’s Dean Fergie.

He noted recent reports of a rush in retail investors joining the sharemarket as COVID-19 put many out of work with easy access to cash from superannuation.

“There is a wave of hype on the sector and retail punters don’t have a cap on value. They just see the price going through the roof and follow the hype,” he said.

“What we are seeing now is a snowball effect.

“As the sector grows now index funds can’t afford to not have the stock either.

“Everyone is chasing their tail and simply following the share price.

“These businesses have not been tested through any downturn in the economic cycle or credit cycle — bad debts are never a problem until you have them.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout