Afterpay successfully raises $650m

Afterpay says the market responded strongly as it raised $650m via an institutional placement, as part of its $800m capital raising.

Afterpay says it secured $650 million through its fully underwritten institutional placement, as part of its $800m capital raising, with Chinese tech giant Tencent understood to has sought to retain its cornerstone holding through the issue.

The placement was priced at $66 a share, representing a 2.9 per cent discount on the company’s share price at the close of trade on Monday.

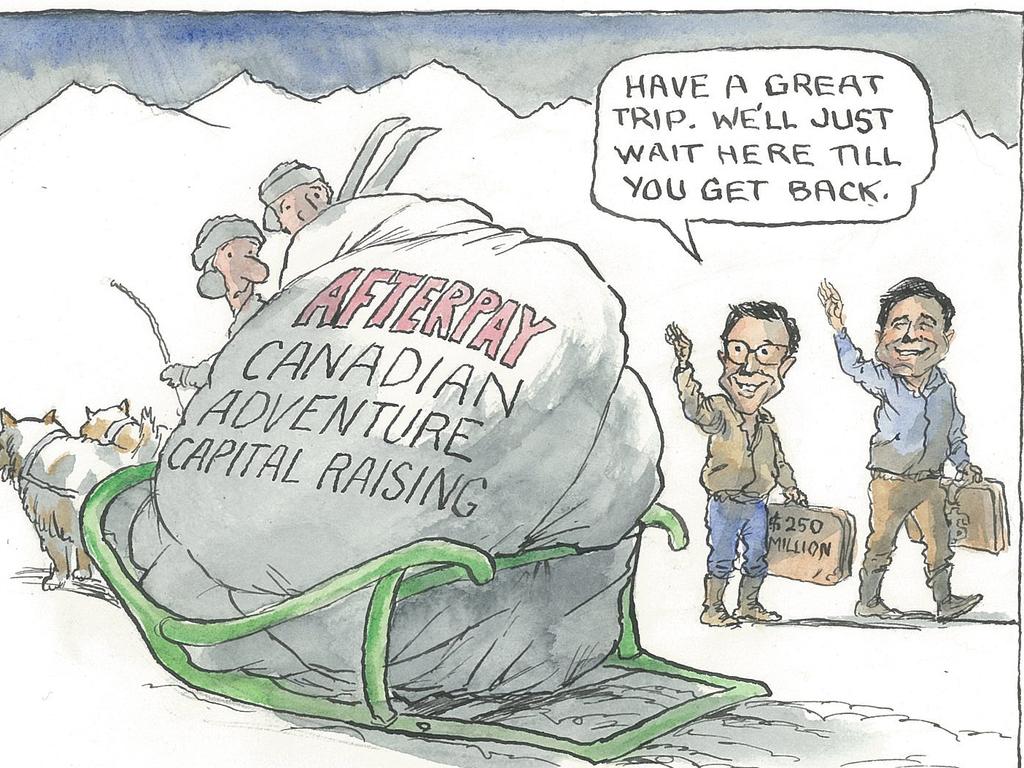

The “buy now, pay later” market darling entered a trading halt on Tuesday as it announced plans for the capital raising, which is set to fund investment in growing underlying sales and its expansion into Canada.

“The market has responded strongly to our aspiration to further accelerate our investment in growing underlying sales and expanding our global footprint, with the placement being oversubscribed,” said Elana Rubin, on behalf of the company’s independent directors.

“We are very pleased with the support we have received from our existing shareholders and we welcome our new investors to the register.”

A non-underwritten share purchase plan aiming to raise approximately $150m will be launched in the coming days.

An Afterpay spokeswoman said that given Chinese tech giant Tencent is an existing shareholder, the company had the opportunity to bid for their existing holding and more if they chose to.

The spokeswoman said the company could not disclose the amount what was allocated to Tencent. It is understood Tencent bid to retain its 5 per cent position.

Tencent’s stake in Afterpay has been a major driver behind the company’s recent share price spike, with investors expecting the partnership to translate in to a lucrative push into Asia.

Tencent is one of the world’s largest companies and is the fifth biggest globally by valuation, with more than a billion people using its services every day. It can be thought of like Facebook or Amazon in terms of its reach and influence and owns 10 per cent of the world’s largest music company, Universal.

Analysts consider a takeover unlikely, however.

“A strategic investment from a global technology of Tencent’s calibre isn’t just a testament to our business or our model, it’s a testament to Australia’s growing reputation for fintech and innovation more broadly on the international stage,” Afterpay co-founder Nick Molnar recently told The Australian.

The fintech isn’t just targeting Asia, it’s also got its sights set on Canada, which the company hopes will be similarly successful to its US and UK expansions.

Afterpay said an accelerated shift to e-commerce spending as a result of COVID-19 had helped it deliver an underlying sales figure of $11.1 billion for financial year 2020, up 112 per cent on the previous year.

Updating the market on its capital raising on Wednesday, Afterpay said its earnings before interest, tax, depreciation and amortisation (excluding significant items) were expected to be between $20m and $25m.

Aferpay co-founders Anthony Eisen and Nicholas Molnar sold 2.05 million shares each at the placement price of $66.00 per share. This delivered the two a combined $270m.

UBS analysts retained their sell rating on Afterpay, but said the raising “significantly de-risks” the company’s operating model, helping it to finance its forecast 2022 sales and reducing the company’s reliance on debt.