Second wave hits whole economy as reopening slows

Corporates and major banks bracing for a significant revenue hit given their exposure to the Victorian economy.

A second wave of coronavirus and a new round of lockdowns will deliver a significant hit to the nation’s economic recovery, as the Victorian outbreak slows the pace of reopening across other states, economists have warned.

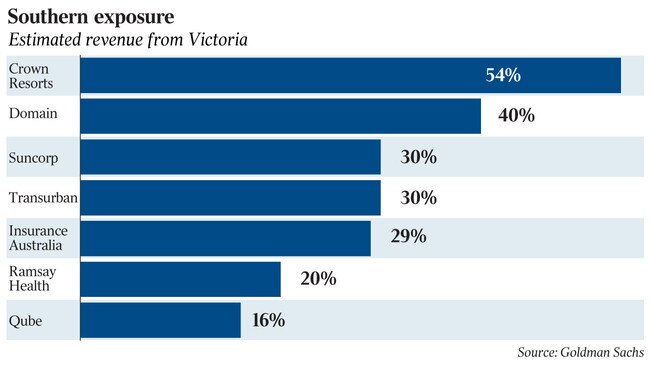

The comments by brokerage Goldman Sachs show the extent of the impact from the Melbourne lockdown with string of corporates and major banks bracing for a significant revenue hit given their exposure to the Victorian economy.

Australian Unity chief Rohan Mead said Victoria’s second lockdown could be used as a starting point for reforms beneficial to the entire economy.

“Both federal and state governments have a unique opportunity to seize on community alignment for microeconomic and general economic reform initiatives,” Mr Mead told The Australian.

“I can’t think of a situation in recent memory where we’ve had so many good reasons as a community to chart a better course ahead that takes Australia’s significant economic advantages and really pushes ourselves further.

“Reform has been difficult to push through for the past 10 or 15 years — here we have an opportunity to put that chapter behind us, to re-engage with the spirit of the 80s and 90s.”

Mr Mead said specific reforms should occur in industrial relations and in health, aged and community care.

New figures released on Monday showed mall vacancies have hit a 20-year high as eased coronavirus restrictions and increased foot traffic fail to alleviate the pain felt by many retailers.

With coronavirus shutdowns and restrictions putting pressure on retailers, the proportion of empty shopfronts in shopping centres around the country rose to 5.1 per cent in June from 3.8 per cent in December 2019.

As case numbers in Melbourne came in at 177 on Monday, Goldman Sachs warned that the decision to lock down Melbourne again was likely to be less successful than the first, saying adherence to restrictions was likely be weaker “as residents’ frustration builds, especially given Australia’s very low levels of COVID-19-related hospitalisations/deaths and the continuing reopening of the wider state and country”.

“While Australia reopened much faster than initially expected after the first lockdown, there seems greater risk that this one extends beyond the slated six weeks,” analysts led by Matthew Ross cautioned.

“So far, transmission from Victoria to NSW has been very limited, but the higher rate of Victorian infections means the risks have increased. The Victorian experience may also see other states adopt a slower reopening, and more importantly, a faster return to lockdown if required.”

‘Significant hit’

Goldman noted that this “significant hit” to Australia increased the probability that the federal government would extend its JobKeeper and JobSeeker stimulus, adding to Commonwealth Bank forecasts of a fresh round of job losses to be revealed in Tuesday’s labour force data.

“The coming fourth quarter ‘fiscal cliff’ has been a significant concern to investors as fiscal support packages were slated to roll off, just as mortgage and rental deferrals came to an end,” said Mr Ross.

“We have already seen the major banks announce an extension to their programs, and given the Melbourne lockdown will provide a large hit to at least a quarter of the nation’s economy, we think it is more likely the federal government will need to act, turning the fiscal cliff into more of a slope.”

The Australian Banking Association estimates 800,000 customers have deferred their loan repayments through the deferral scheme, now extended for a further four months in light of the new wave of restrictions.

In terms of locally listed exposure, Goldman said the financial sector as a whole was largely overweight Sydney and Melbourne, but pointed out that regional lender Bendigo Bank had the largest exposure to the city’s homeowners with 38 per cent of its mortgage book in Victoria, while ANZ had 33 per cent and NAB less than 30 per cent.

The retail ‘‘silver lining’’ of increased spending on home improvements and office supplies, as well as the lift in supermarket spending due to panic buying, was less likely to buffer the economic blow under the current circumstances, the broker added.

“While overall consumer spending was significantly depressed during the first lockdown, many businesses saw unprecedented increases in sales as consumers geared up to work, study and exercise at home, and used the time to work on home improvements,” the broker said.

“And although ‘pantry stocking” will likely return, many of the categories that benefited the first time around could see much smaller increases this time.”

Companies such as JB Hi-Fi, Harvey Norman or even Domino’s could feel the sting — along with real estate trusts such as Chadstone owner Vicinity Centres or Highpoint’s GPT, whose rental assistance is likely to be extended to buffer the blow to store owners, Goldman predicts.

Retailer Premier Investments already flagged the hit to mall landlords last week as the operator of Just Jeans, Smiggle and Dotti said it “does not intend to pay any rent” at stores affected by the Melbourne lockdown.

Just as confidence in business conditions was rebounding, Goldman added that businesses may be more cautious in re-hiring and restocking when restrictions were eventually lifted, with a greater chance of businesses not coming back at all.

“Those firms that were just managing to survive the first time could possibly not make it through a second.”

The Victorian government has moved quickly to provide additional grants for struggling businesses, but Endeavour Asset Management director Hayden Beamish warned they were grossly ineffective, dismissing the $5000 grants as ‘‘a joke’’.

“That won’t stop a company going under that was struggling before. It won’t move the needle, so I think that needs to be increased — it should be five times the size,” Mr Beamish said, adding that targeted funds for capital expenditure would be useful.

“I’d like to see a grant from this government to help these private businesses digitise — like getting on Uber Eats, with the government covering Uber Eats fees … It would be a great incentive to force these businesses to position themselves for the future — this might be the new normal.”

Detailing the hit to several ASX-listed sectors, the Goldman analysis highlighted the fact that more than half of Crown Resorts’ gaming venue was attributable to Melbourne, or a total of 60 per cent of the stock’s valuation, while 30 per cent of Transurban’s toll revenues were generated in the city and were likely to be wiped out by the restrictions.

Real estate listings group Domain’s east coast exposure set it up for a hit, with up to 40 per cent of its revenues from Melbourne, analysts suggested, while REA’s strength outside major cities would be a buffer.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout