ASX extends win streak as Afterpay sets new record

At its worst, the market was down by 0.9pc, but a lift in Afterpay and CSL helped shares to cling to a four point gain at the close.

- We’ve never seen anything like this: Worley

- CommBank faces junk insurance action

- Harvey Norman to deliver surprise payout

- Kogan halted for $115m raise near record highs

That’s all from Trading Day for Wednesday, June 10. The ASX staged a strong intraday reversal, coming back from an early 1pc drop to finish higher by just 4 points, with defensive names leading the charge.

Harvey Norman outperformed as it declared a special dividend, while Afterpay set new highs on the shift to growth stocks, after the Nasdaq climbed higher.

US futures are signalling a lift to come overnight, as the US Fed delivers its latest policy address.

Richard Gluyas 8.42pm: University school of hard knocks

It’s not yet Armageddon for the university sector, but COVID-19 and the diplomatic chill between Beijing and Canberra have put a huge asterisk against $9bn in annual revenue from international student enrolments.

“It would be very strange if any university council is not concerned about the current situation,” one chancellor says, in reference to the latest warning from Chinese authorities on Tuesday that students should avoid Australian campuses.

One of the mystifying things about the crisis is the lack of traction it gets in the national capital.

David Rogers 8.34pm: Pengana’s offer to yield-starved investors

A capital raising by Pengana Private Equity Trust this month will give yield-starved investors exposure to private equity assets at attractive prices, when listed asset markets already look expensive after a spectacular rise on the back of unprecedented monetary and fiscal policy support.

Pengana will offer units in the trust on a 1-for-3 rights basis to existing unitholders as of June 19 at a price of $1.2452 — the May 31 net asset value per unit less the next dividend of 1.25c per unit.

The first equity raising by a listed investment company or trust since the government banned stamping fees to stop conflicts of interest in marketing such vehicles is testament to the fact that there’s plenty of demand for great propositions, says Pengana CEO and co-founder Russel Pillemer.

Pengana Private Equity Trust (PE1) has returned 25 per cent before fees since inception in April 2019 versus less than 3 per cent for the MSCI All Country World index in Australian dollars.

Except for a brief dip below its net asset value during the “sell everything” bear market at the peak of the coronavirus pandemic in March, PE1 is the only ASX-listed international investment vehicle that has consistently traded at a premium to its net asset value — currently around 14 per cent.

Pillemer says private equity is now the hottest space in global financial markets post-COVID.

Lachlan Moffet Gray 8.12pm: CBA sued over ‘junk’ CCI

Commonwealth Bank is being targeted in a class action launched by legal firm Slater and Gordon for allegedly selling “junk” credit card and personal loan insurance to unwitting customers for an eight-year period until 2018.

The action, filed in the federal court on Wednesday, claims that 200,000 people were sold credit protection policies designed to guard them against job losses, despite the fact that the customers were either unemployed or marginally employed at the time they took up the policies.

This meant it was unlikely they would ever be able to claim against the policy they were paid for, with payout rates alleged to be as low as 10-15 per cent of premiums collected.

The products — Creditcard Plus and CBA Loan Protection — drew criticism during the banking royal commission, where it was revealed the bank’s current chief executive Matt Comyn pushed for the bank to stop selling the products while retail banking head in 2015.

Damon Kitney 7.43pm: ‘Day of reckoning’ coming: Alex Waislitz

Billionaire investor Alex Waislitz says a “day of reckoning” is coming for sharemarket investors as unprecedented levels of liquidity in the financial system and buying by index funds have decoupled global markets from the economic reality of a world very different to what it was six months ago.

In a forum for investors in his two listed companies, Thorney Opportunities and Thorney Technologies, on Wednesday, Mr Waislitz also warned of the “sugar candy hit” of government stimulus packages, which had given companies and individuals an artificial “sense of wellbeing”.

While Mr Waislitz said that in the current low interest rate environment higher price-earnings ratios could be justified for some stocks, “at the end of the day you have to go back to the fundamentals of the businesses”.

Eli Greenblat 7.22pm: What we bought after pasta and toilet paper

It wasn’t only toilet paper, rice and pasta shoppers were panic-buying in April and May. As Gerry Harvey looked over the sales figures for his stores from New Zealand to Slovenia he noticed consumers grabbing for the same items, in the same order, as the coronavirus pandemic spread.

“They started with us on freezers, and we sold out of every freezer we had in the country, and then it moved to whitegoods, so they were buying refrigerators and washing machines because they thought maybe the shops would be closed,” Mr Harvey told The Australian.

“Then it moved to TVs and then furniture and bedding. So you had this movement and it was interesting because we are in eight countries and the same things happened in every country.

David Ross 7.01pm: ASIC alleges ‘dishonest conduct’ by adviser

A former high-profile financial planner who lost his career following an appearance in the Hayne financial services royal commission has appeared in court charged with allegedly engaging in dishonest conduct and falsely presenting himself as holding a Masters of Commerce degree.

Corporate regulator ASIC alleges Sam Henderson breached the Corporations Act in 2014 and 2016 by giving at least two clients a financial services guide that suggested he had a Masters of Commerce (financial planning) when he did not.

The regulator also alleges that Mr Henderson had, over several years, engaged in dishonest conduct when in a series of PowerPoint presentations, on his website and in brochures, he allegedly stated he held a Master of Commerce degree.

Mr Henderson did not enter a plea when he appeared in Downing Local Court in Sydney on Tuesday.

The charges follow an ASIC investigation into Henderson Maxwell, the former financial advisory firm he fronted, and Mr Henderson himself after he appeared before the Hayne commission in 2018.

Mr Henderson faces a maximum of 10 years imprisonment for each dishonest conduct offence, while each breach of the Corporations Act could see him face a maximum penalty of five years.

John Stensholt 6.36pm: Pointsbet on a winner

The only thing that makes Pointsbet chief executive Sam Swanell happier than the footy returning is horse racing continuing during the COVID-19 shutdown — and the prospect of American basketball coming back next month.

Pointsbet has become a market darling during the virus pandemic, with its share price more than trebling since March as punters were forced to stay home and just about the only thing they could bet on was Australian horse racing.

The online betting company’s advertising during Seven West Media’s popular Saturday racing coverage was well-timed, with bookmakers usually finding a direct correlation between marketing spending and the signing up of new customers.

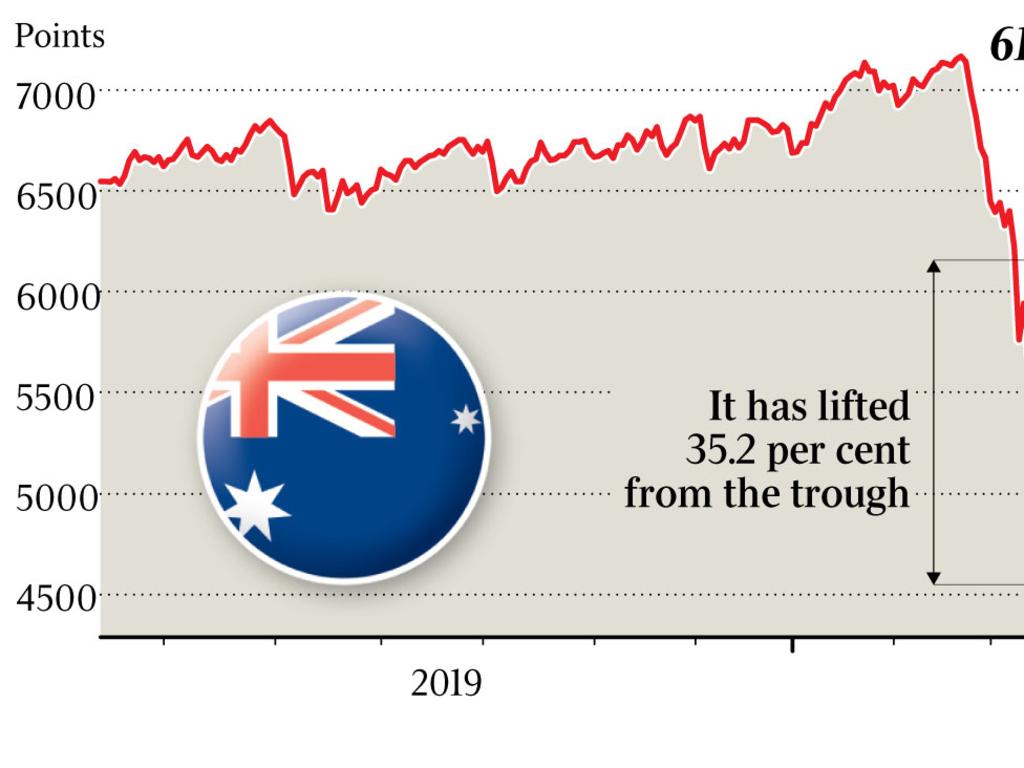

James Kirby 5.56pm: Running from the bears

Bear funds looked like a great choice earlier this year when the prospect of making money from a downturn in an overheated market looked like a good bet.

The funds, which promise to rise if the markets fall, worked like a dream through March, doubling the money of anyone who picked them up at the right time.

Unfortunately, they also nosedive when things get better.

BetaShares Australian Equities Strong Bear Fund (BBOZ) was the single most heavily traded Exchange Traded Fund over the recent crash.

The turnover in the fund reached a remarkable $2bn over the month of March.

As Ilan Israelstan of Betashares puts it, “on many days, it was trading more than Telstra,” one of the most widely held shares on the S&P/ASX 200.

The problem is that panicked markets turn on a dime and anyone left inside any of the listed bear funds has been losing money very quickly as the wider market rebounds.

4.43pm: Tech, gold lead ASX rally

Growth and defensive stocks led the rally on Wednesday – in part as the Nasdaq continued higher overnight.

Afterpay led a 3.1 per cent lift in tech stocks as it hit a new record high of $54.85, settling to a gain of 7.5 per cent to $54.52 at the close. Peer Zip got a 3.4 per cent boost to $6.75 while Splitit rose 1.3 per cent to 79c and FlexiGroup finished flat at $1.43 as Roy Morgan said consumer awareness of the sector was growing significantly.

CSL jumped 2.6 per cent to $285.69, a key defensive mover, while Cochlear edged higher by 0.7 per cent to $194.33.

Gold names too got a boost as investors looked to safe havens ahead of the US Fed decision. Saracen Minerals was one of the best performing stocks on the market, adding 8.5 per cent to $4.60 while Evolution gained 1.2 per cent to $5.30 and Northern Star put on 1.6 per cent to $13.01.

Here are the biggest movers at the close:

4.15pm: Shares cling to gains

Shares bucked a weak offshore lead to cling on to gains for a seventh consecutive session as heavyweight health and tech stocks outperformed.

A rethink of the market’s recent rally, and lofty valuations across some parts of the market, prompted an early slip as much as 0.9 per cent, but shares recovered to trade in the green by the second hour of trade.

At the close, the benchmark ASX200 fought to hang on to a 4 point or 0.06 per cent gain to 6148.4, despite jumping as much as 0.6 per cent through the day.

On the All Ordinaries, shares gained 6 points or 0.1 per cent to 6269.3.

3.52pm: Buy now, pay later gaining familiarity

Australians are becoming more familiar with buy now, pay later services, according to market research firm Roy Morgan – music to the ears of the sector which is again setting records in Wednesday’s trade.

The firm’s March digital payments report shows over 12.3 million Aussies, or 59pc, are now aware of the services, up 22.1 percentage points in only 18 months.

Afterpay, the pioneer of the sector, is the most prominent – more than 55pc of Australians aware of the service in the year to March 2020, while rival Zip is recognised by 35.2pc.

Further, the survey found one-in-ten now use the services.

“Australians aged 25-34 have been the quickest to take to the buy-now-pay-later services with around one-in-five in this age group using these new digital payment systems. However, there are key differences between the two market leaders as Zip’s customer base skews slightly older and their second strongest age group is those aged 35-49 whereas for Afterpay it is the under 25 market,” the research group said.

The findings come as Afterpay sets a new record high of $54.85 in today’s trade, while trades up 2.8pc to $6.72.

Awareness of BNPL services @AfterPayAU & @Zip_AU soars to over 12.3mn Australians (59%) according to the latest Roy Morgan Digital Payments Report - up 22.1% points in only 18 months. Afterpay is the clear market leader with a majority of 55.8% now... https://t.co/zHhrGYoDN6 pic.twitter.com/SA2p57Dfv1

— Roy Morgan (@roymorganonline) June 9, 2020

Bridget Carter 3.44pm: How Virgin suitors will fund bids

DataRoom | As the sale process for Virgin Australia continues to march on, the funding of a transaction by bidders continues to be a point of interest.

Bain Capital is believed to be using its own debt from within its credit arm to provide the funding certainty it has needed to progress in the contest, but is yet to lock in any bank debt.

However, it may refinance the debt once it has acquired Virgin.

It is understood that BGH Capital had not locked in bank debt for its bid before it was knocked out of the competition.

Apparently, bidders were told that funding needed to be in place for any party to proceed through to the final round of the contest.

Read more: Virgin plea to keep JobKeeper, guarantee tickets

3.34pm: Economy well on the way back: ANZ

An ANZ survey of Australia’s search habits shows a move back to “normal” with restaurant bookings surging and home renovation searches hitting record highs.

The alternative data snapshot from the bank analyses Google trends and mobility data to give an insight into consumer behaviour.

Market economist Hayden Dimes and head of Australian economics David Plank note that restaurant bookings have bounced significantly from pandemic lows – now down on average by 40pc, from a 90pc decline a fortnight ago.

They note the lift coincided with easing of restrictions in NSW and Victoria on June 1, “suggesting restrictions, rather than virus concerns were holding patrons back”.

On renovations, they note that “home renovation” searches lifted to record levels off the back of the government’s HomeBuilder stimulus announced last week, while searches for Airbnb has risen sharply to near pre-pandemic levels.

In the week to 6 June, total ANZ-observed spending was up 4.3% y/y. Spending is drifting up in the categories of travel (−45% y/y for week to 6 June from −63% y/y to 7 May) and dining (−13% y/y to 6 June, −38% y/y to 7 May). @adelaide__T @davidplank12 #ausbiz #ausretail pic.twitter.com/q5nHwkTE5F

— ANZ_Research (@ANZ_Research) June 10, 2020

Bridget Carter 2.56pm: Charter Hall ready to pounce on Caltex

DataRoom | Charter Hall is expected to defy perceptions that the COVID-19-affected market is gun shy when it comes to transactions, with the $4.8bn real estate manager said to be shaping up to offer a knock out price to Caltex for its petrol station property portfolio.

Sources in the market say that the Australian listed real estate fund manager that is closing in on half share of the $2bn-plus portfolio is believed to be offering a price that equates to a yield of between 5.3 per cent and 5.4 per cent.

Late last year, Charter Hall purchased a similar portfolio of BP petrol stations, paying a price that reflected a 5.5 per cent yield. At that time, the price was thought to be steep.

The understanding this time around with the Caltex assets is that the portfolio is of better quality, despite the looming transaction happening in weaker macro-economic environment.

The synergies that Charter Hall has with the existing BP assets positions it to pay up for the sites of the service stations.

CHC shares last traded lower by 2.5 per cent to $10.10.

Read more: Charter Hall on the way to manage $40bn

2.53pm: CBA acknowledges class action

Commonwealth Bank says it is reviewing a class action claim for junk insurance products sold to credit card and personal loan customers, brought to light earlier today.

In a brief notice to the market this afternoon, CBA acknowledged the proceedings brought against it and The Colonial Mutual Life Assurance Society.

The claim relates to consumer credit insurance sold between January 1, 2017 and March 7, 2018.

“CBA is reviewing the claim and will provide any update as required,” it said.

Read more: CommBank faces class action for junk insurance

2.36pm: Reject Shop hits multi-year high

Discount retailer The Reject Shop is higher by 6.2 per cent in afternoon trade, to hit its highest levels in more than two years.

The chain has been riding the wave of optimism in the retail sector as recovery of the local economy resumes earlier than tipped, and after a boost from panic buying at the onset of the coronavirus downturn.

Shares hit $7 apiece in afternoon trade, marking a near trebling of its value since hitting $2.40 at the worst of the downturn.

Read more: Reject Shop to delay rent payments

2.32pm: Honda halts operations amid cyber attack

Honda plants in Brazil and India have halted operations as the Japanese carmaker battles to recover from a cyberattack that affected several factories worldwide.

The cyber attack at the beginning of the week targeted Honda’s internal servers and spread a virus through the company’s systems, a spokeswoman told AFP on Wednesday.

Motorcycle plants in India and Brazil were still out of action following the attack, while a four-wheel vehicle plant in Turkey resumed operations on Wednesday, the spokeswoman said.

The firm was “still investigating details”, she said.

In total, the cyberattack affected 11 Honda plants – including five in the US, according to local media reports.

All US plants have resumed operations, the spokeswoman said, declining to elaborate further.

AFP

2.13pm: Will the US Fed do more?

The buy-on-dip-mentality in equities before the FOMC meeting might suggest some expect the US Fed to do something more, like yield curve control.

After the better than expected May jobs data, liquidity-dependent asset markets will at least need a reiteration of previous comments that the pandemic: “poses considerable risks to the economic outlook” and that the Fed will “act as appropriate to support the economy”.

A “dot plot” of Fed Funds rate projections implying no tightening until late 2021 is also in the mix, but it might not be enough, especially if the economic projections show a slower-than-expected recovery.

As AxiTrader’s Stephen Innes puts it, the big question is: “has the market’s recovery bought the Fed some time not to use all its bullets, or will they keep the pedal to the metal?”

“If the Fed wanted to knock it out of the park, bring in yield-curve control, and a ramped-up more extended duration buying feast with open-ended mandates,” Mr Innes says.

“That should carry the market well into 2021 and beyond provided the reopening recovery remains uninterrupted by a secondary virus cluster.”

The Fed has continued to broaden its lending programs, expanding its Main Street Lending Program on Monday.

It has massively tapered its emergency QE from $US75bn to $US4bn a day, albeit that’s still a vast amount of bond buying.

Australia’s S&P/ASX 200 is up 0.4pc after falling 0.9pc intraday, while the region is mixed.

S&P 500 futures are up 0.5pc and the Australian dollar is up 0.2pc and US Treasuries are flat

1.58pm: Iron ore on a ‘knife edge’: UBS

Iron ore prices have outperformed for the year so far, but the price of Australia’s most lucrative export is on a “knife edge” amid uncertain supply-demand dynamics, says UBS.

Mining analyst Glyn Lawcock writes that Chinese imports have remained strong while a halt of Vale’s Itabira complex could keep prices elevated.

He expects the commodity to hold above $US80/t this year as the Vale suspension will likely keep the market in a deficit and raise questions about other producers in the region – which accounts for 23pc of global supply.

As such, the broker lifts its target price for Fortescue, keeping its Buy rating on the stock, noting its attractive yield “even at a long term iron ore price”.

FMG last traded up 0.1pc to $14.96 after setting new record highs of $15.25 yesterday.

Read more: Iron ore upgrades lift Fortescue, BHP

1.35pm: Boral upside unrealised: MS

Boral could benefit from a new boss focused on a meaningful divestment strategy, says Morgan Stanley in a client note highlighting the stock’s “inherent valuation upside”.

In a hypothetical analysis of potential routes for the company, analyst Andrew Scott sees a lift as much as 35pc to 38pc in Boral’s enterprise value if it can realise value from non-core assets and drive organisational change.

Still, the broker rates the stock at equal weight, noting uncertainty given the lack of future leadership plans.

“We believe the divestment of non-core businesses could lead to a strengthening of the balance sheet; shift the focus to the higher-returning, higher-quality assets; reduce complexity; and allow management to run the business more efficiently,” Mr Scott says.

While a buyout of some Boral assets has been speculated in the press, he adds that value could also be found thought an internally generated strategy, or the pursuit of an alternative strategic direction by a new boss.

BLD last traded down 1.3pc to $3.77.

Read more: Boral leaves no stone unturned as pressure mounts

1.02pm: ASX holds gains as Afterpay soars

Shares are holding gains of 0.2 per cent at lunch, extending its win streak to seven days after a brief negative blip in morning trade.

At 1pm, the benchmark ASX200 is higher by 16 points or 0.26 per cent at 6160.6 – after hitting highs of 6182.3.

There is a pronounced shift toward defensives and growth names in today’s trade – with CSL and Afterpay both supporting the market. Afterpay has set a new record high of $54.45, which is rubbing off on its smaller listed competitors too.

Elsewhere, BHP is higher by 0.7pc while Rio and Fortescue trade marginally lower while gold miners are cheering a 1pc lift in gold prices overnight.

Here are the top movers at 1pm:

12.35pm: Car loans plummet

A drop in car loans has spurred a 24.8 per cent plunge in new personal loans in April, the largest fall in the history of the series.

The latest data from the ABS shows loans for road vehicles fell by 37.8pc in the month, dragging the data lower as owner occupier home loads fell 5pc and investor housing fell 4.2pc. Personal fixed term loans fell by 24.8pc.

“Lending institutions reported that COVID-19 impacts were being seen through both reduced demand from borrowers and tighter lending criteria,” chief economist Bruce Hockman says.

“COVID-19 operational impacts experienced by some lending institutions resulted in a backlog of March housing loan applications being processed in April, which moderated the April fall in loan commitments.”

Perry Williams 12.32pm: Never seen anything like this: Worley

Resources contractor Worley has slashed nearly 2000 jobs due to the COVID-19 economic slowdown and committed to net zero emissions by 2030 including cutting its own use of corporate air travel.

Worley has cut 1900 positions since March 31, taking total job losses to nearly 5000 so far this year after it eliminated a further 3000 roles in the first three months of 2020, reflecting falls in lower margin construction activities. It now employs 54,100 people, down from 59,000 at January 31.

Salaries have previously been frozen and non-billable hiring halted with staff cuts, redeployment, early retirement, job sharing and furloughs all being considered to manage the downturn and oil price crash which had seen customers defer projects. It’s also set a new savings target of $275m by the end of 2021 with the biggest cost cuts from changing its use of property and office space.

“We’ve not seen anything like this before,” Worley chief executive Chris Ashton told the company’s investor briefing. “Going back to 2014, when there was the last crash, that was really focused on oil demand and consumption. If you look at the oil price crash here, it’s a much broader societal impact. There is nothing I can compare it to.”

WOR last traded down 4.8pc to $10.15.

12.24pm: Hours worked slashed by 0.8pc

Hours worked in the March quarter fell by 0.8 per cent, the most since the GFC, as restrictions forced job cuts across the country.

The latest data from the ABS shows filled jobs fell by 0.1pc from the December quarter, the first fall since September 2016, with private sector the hardest hit, down 0.1pc while public sector jobs increased by 0.8pc.

“While restrictions to contain the spread of COVID-19 came into effect late in the quarter, they were extensive enough to lead to a fall in hours worked in the quarter of 0.8 per cent, which was the largest quarterly decline since the Global Financial Crisis in June 2009,” head of labour statistics Bjorn Jarvis said.

“In line with the impact seen in other indicators, the largest decline in hours worked was in the Accommodation and food services industry, a decrease of 13.6 per cent.”

12.10pm: Beijing warning won’t hurt unis: Moody’s

The warning from Beijing to its students not to travel to Australia will do little to dent universities revenues this year, according to Moody’s.

The ratings agency notes that the recent travel advice highlights the vulnerability of the local higher education sector to geopolitical tensions, but says they will do little given travel already remains restricted.

“The international travel restrictions already in place will limit the incremental impact of the travel advice on the universities’ revenues this year,” Moody’s vice president John Manning says.

“Next year, revenues will largely depend on whether coronavirus-related travel restrictions are eased. And in the longer term, with a number of universities ranked among the best in the world, we expect Australia’s institutions will remain attractive for international students.”

Read more: Coronavirus exposes the university rankings game

11.54am: Stimulus can’t save building sector: GS

The government’s HomeBuilder stimulus won’t be enough to drive growth in the building and construction sector as migration and population growth stalls, according to Goldman Sachs.

In a note from analyst David Schwartz, the bank remains cautious on stocks with residential exposure both locally and abroad.

He rates CSR at a Sell but James Hardie as a buy and his top pick given its “idiosyncratic growth drivers such as market share gains and internal initiatives”.

“While declining interest rates have historically been a strong forward indicator of a recovery in building approvals, and will likely support a recovery over the medium term, the disruption caused by COVID-19 has instead raised concerns over the replenishment of the property pipeline in a time of economic uncertainty,” Mr Schwartz says.

“We highlight that the historical lag between interest rate changes and building approvals has been c.9 months, but we believe this could be longer given the current circumstances, placing a recovery in actual activity at least 12-18 months away.”

JHX is a Buy with a target price of $32.65, while CSR is a sell with a target price of $3.94, GWA, Boral and Adbri are all rated Neutral.

JHX last traded at 0.1pc.

Read more: Thousands rush for HomeBuilder grants

11.42am: UBS favours cyclicals, value

UBS now favours cyclical and value over growth exposures in the Australian share market for the short-to-medium term, although the broker says growth stocks should do well in the longer term.

In keeping with a more positive view on Australian banks recently, quantitative analyst Pieter Stoltz has turned positive on the sector in his “20/20” long-short model portfolio.

His previously negative portfolio weights on the four major banks have been switched to positive, except for CBA, due to its valuation and to limit sector exposure.

“We also think cyclical sectors are likely to continue to outperform in the short to medium term, given Australia is easing restrictions sooner than expected,” Mr Stoltz says.

“Easing coronavirus restrictions and a potential rebound in the consumer means we are also tilting away from Growth and towards Value even though we think Growth stocks should do well in the longer term, given an ultra-low rate environment.”

He has also tilted the portfolio away from Offshore Earners after the Australian dollar bounced 28pc from an 18-year low of 0.5505 to an 11-month high of 0.7041.

Newcrest has been added in preference for Evolution and Northern Star in gold, given its performance has lagged other gold miners and UBS sees potential upside to its production.

The broker has also increased the model’s positive weight in Qantas, preferring it over Air New Zealand in general industrials, given Air New Zealand’s less favourable liquidity position.

11.16pm: Shares push into positive

Local shares have come back from early losses of almost 1 per cent to trade higher by 8 points in the second hour as US futures turn higher before tonight’s FOMC meeting.

As the major banks pare earlier losses, the benchmark ASX is up by 0.2 per cent to a daily high of 6158.4.

Commonwealth Bank has trimmed its losses to just 0.2pc, while ANZ is the worst performer with a loss of 1.6pc.

Investors have switched out of value and cyclical exposures in favour of growth and defensive stocks after an incredible run up in banks and REITs in particular.

CSL is rising by 2.7pc, Saracen Mineral up by 8.3pc and Afterpay gaining 3.5pc.

11.09am: ETFs ride wave of optimism

Australian exchange traded funds have staged a V-shaped recovery to build their funds under management to within reach of record highs.

BetaShares Australian ETF review for May shows the industry grew by more than 4pc to within just 3pc of its highest end of month peak, as investors use the asset to ride out some of the market’s recent volatility.

Fund under management growth was fuelled in the most part by $1.6bn in net inflows, with the remainder from increased asset values as markets recovered.

“Investors are using ETFs to increase their exposure to risk assets, particularly domestic and international equities,” BetaShares chief Alex Vynokur says.

“The continued strength in trading volumes is also a big positive for the industry – the last four months have been the four highest trading months on record, indicating that in turbulent times Australian investors are finding the liquidity of ETFs attractive, regardless of whether markets are rising or falling.”

Bridget Carter 10.49am: 5G Networks raising $22.3m

DataRoom | 5G Networks is raising $22.3m at $1.23 per share to fund growth.

The company will secure $18.3m through a placement and the rest through a Share Purchase Plan.

The raise represents an 8.9 per cent discount to the last closing price of $1.35 and Wilsons is sole lead manager on the placement.

Proceeds are being used to provide balance sheet flexibility to invest in the expansion of fibre network in Sydney and Melbourne and new builds in Brisbane and Adelaide, focused on central city demand and key data centre locations.

The funds will also be used to pursue mergers and acquisition opportunities and other growth initiatives.

10.35am: Westpac confidence near pre-crisis level

In a further sign the economy is headed toward a recovery, Westpac’s survey of consumer confidence has printed higher by 6.3 per cent to 93.7 points – near levels from before the pandemic.

Westpac chief economist Bill Evans writes that the index has now “remarkably” recovered all of the extreme 20pc drop when the pandemic first threatened the economy in March.

The index is now only 2pc below the average of the preceding September to February period, already weak from bushfires and slow wage growth.

“While the monthly gains are impressive, the Index is still relatively weak by historical standards – in pessimistic territory overall and down 7pc on a year ago,” Mr Evans writes.

“The general picture is of continued intense pressure on family finances and concern about the near- term outlook for the economy but with firming optimism around prospects for finances in the year ahead and the economy’s medium term outlook.”

10.11am: Shares pull back by 0.7pc

The local market has taken its first backwards step in seven sessions as investors weigh lofty stock valuations.

At the open, the ASX200 is lower by 44 points or 0.71 per cent to 6101.

The key drivers of the recent rally are now leading the slip – Banks, energy and real estate.

Of the four majors, Commonwealth is off by 1.8pc, Westpac by 2.6pc, ANZ by 3.3pc and NAB by 2.9pc, even after upgrades from Goldman Sachs.

Elsewhere CSL is headed higher and supporting the healthcare sector, while Wesfarmers buoys staples.

Ben Wilmot 10.05am: Fletcher strengthens covenant terms

Fletcher Building has announced amendments to its banking agreements that give the Australasian company the ability to rely on more favourable terms for covenant testing through to the end of 2021 if required.

Fletcher chief executive Ross Taylor said that given the impact COVID-19 was likely to have on the NZ and Australian markets, the company was taking pre-emptive steps to reinforce its resilience for the medium-term.

It has about $NZ1.5bn liquidity and a leverage ratio of about 0.8 times, below its target range of 1-2 times. “We believe our current balance sheet sets us up well for the period ahead,” he said.

Fletcher may elect to rely on more favourable levels for its total interest cover and senior interest cover covenants and the company said it expects to be in compliance with its normal covenant levels this month.

Read more: Fletcher to cut 1500 jobs from Australia

9.52am: Kogan to raise $115m

Kogan.com, whose shares have nearly tripled in the last year, has launched a $100m placement and $15m share purchase plan to take advantage of the growing shift to online retailing sparked by the coronavirus pandemic.

Shares in the placement will be offered at $11.45 apiece, far from the stock’s drop to $3.45 at the initial onset of the pandemic.

The group said it was well poised to pursue value accretive opportunities and take advantage of “significant pressure on many retailers given prevailing market conditions”.

“Our long-term strategy has enabled us to thrive in the current challenging environment, and we are now in a better position than ever to take advantage of growth opportunities,” chief Ruslan Kogan said.

“Our low cost of doing business and digital expertise have put us in the driver’s seat to capture market share as the retail industry undergoes significant change.”

Last month it acquired furniture retailer Matt Blatt which broadened its exposure to the online furniture market

Read more: Kogan sales jump amid online shopping boom

9.40am: Harvey Norman declares special dividend

Harvey Norman will dish out a fully franked special dividend of 6c per share to all holders after reporting a jump in local sales for the half-to-date.

The move comes after the retailer cut its planned interim dividend at the onset of the crisis in April.

Still, the special dividend is half of the 12c per share previously tipped to be dished out.

At the time, Harvey Norman said the cancelling of its interim payout would result in $149.5m of cash being retained in the business.

HVN last traded at $3.55.

Read more: Harvey Norman cans dividend, cuts board pay

9.26am: Shares to snap rally as optimism fades

The local market is set to snap a 6-day win streak after a slip on Wall Street overnight, as investors raise concerns that the recent lift in risk assets has overshot the economic outlook.

Futures relative to fair value suggest an early decline of 0.9 per cent after the S&P 500 gave up 0.8pc, even as the Nasdaq climbed higher by 0.3pc.

Even still, banks could soften the blow somewhat after a raft of upgrades for the majors from Goldmans yesterday, what was likely a key contributor to their outperformance.

Eyes are on the FOMC meeting, the outcome of which will be released early tomorrow morning though no change is expected.

The Aussie dollar is wavering after reports that China has warned its students against studying in Australia due to rising discrimination. AUDUSD last traded at US69.53c.

9.11am: Harvey Norman posts sales jump

Furniture and whitegoods retailer Harvey Norman has reported a 17.5 per cent sales jump for the second half to date, as consumers spend up during the lockdowns.

In an update to the market, Harvey Norman said Australian sales from the start of the year to May 31 were up by 17.5pc, helping sales for the financial year to date to edge up by 7.4pc.

The company detailed the closure of its local and international closures during the government imposed lockdowns, with overseas sales hit substantially harder.

In Australian dollars, sales in Singapore are now down 13.2pc year to date and Northern Ireland sales lower by 8.6pc while Ireland sales have jumped in the past half to notch year-to-date gains of 17.5pc.

Read more: Retail’s real test is to come

9.04am: What’s on the broker radar?

- ANZ cut to Neutral, target price raised 11pc to $20.02 – Goldman Sachs

- Australian Finance Group started at Outperform, $1.93 price target – Macquarie

- Bank of Queensland raised to Buy, price target lifted 30pc to $7.17 – Goldman Sachs

- Bendigo Bank raised to Overweight – JP Morgan

- Boral price target raised 20pc to $3.60 – Morgan Stanley

- Commonwealth Bank target price raised 11pc to $62.65 – Goldman Sachs

- Domino’s Pizza cut to Hold – Morgans

- Fortescue price target raised 26pc to $14.50 – UBS

- GPT Group cut to Hold – Jefferies

- Gold Road Resources rated new Overweight – JPMorgan

- Kogan.com price target raised 39pc to $12.10 – UBS

- NAB target price raised 22pc to $21.64 – Goldman Sachs

- Seven Group price target raised 32pc to $19 – UBS

- Sims Metal Management raised to Buy – UBS

- Vicinity Centres cut to Neutral – Macquarie

- Wesfarmers price target raised 15pc to $42.50 – Goldman Sachs

- Westpac target price raised 11pc to $20.13 – Goldman Sachs

8.57am: Kogan halted for raise

Shares in online retailer Kogan.com have been halted ahead of the open, pending detail on a proposed capital raising.

The stock has surged to record highs in recent weeks off the back of a shift to online retailing during the coronavirus lockdown.

Requesting the halt, Kogan said it was in connection with a proposed capital raising, comprising a placement to institutional, sophisticated and professional investors and a share purchase plan.

KGN last traded at $12.38 from a record high of $13.

Read more: Kogan sales jump amid online shopping boom

8.43am: CommBank faces class action for junk insurance

Commonwealth Bank is set to face a class action in the Federal Court for selling junk credit card and personal loan insurance, an allegation brought to light during the Royal Commission.

Law firm Slater and Gordon this morning announced the move against the nation’s largest bank, saying it would allow customers to hold the bank to account.

They say existing policies have been rolled over and that many customers continue to be charged for products they cannot claim on.

Practice group leader Andrew Paull said only a small portion of customers had been compensated in the wake of the royal commission, which he described as a “tokenistic effort”.

Read more: CBA chief told: ‘temper your sense of justice’

8.19am: ASX set for early falls

Investors appear set for early losses on the Australian share market after US markets turned cautious ahead of a Federal Reserve meeting.

The local SPI 200 futures contract was down by 86 points, or 1.39 per cent, to 6,098.0 at 0800 AEST on Tuesday, indicating losses in share values early. Overnight, the S&P 500 and Dow fell as the Federal Reserve began a two-day meeting.

While no major policy announcements are expected when the US central bank wraps up on Wednesday, investors will scrutinise remarks on the health of the economy, which has been reopening after coronavirus-related closures. The Dow Jones Industrial Average fell 1.09 per cent to 27,272.3, the S&P 500 lost 0.78 per cent to 3,207.18 while the Nasdaq Composite added 0.29 per cent to 9,953.75.

In Australia today, data for housing, personal and business loans from April will be published.

The share market on Tuesday climbed for the sixth consecutive day and the S&P/ASX200 benchmark index finished up 146.2 points, or 2.44 per cent, at 6,144.9 points, while the All Ordinaries index climbed 146.4 points, or 2.39 per cent, at 6,262.9.

The Australian dollar was buying 69.57 US cents at 0800 AEST. That was higher from 69.37 US cents at the close of trade on Tuesday.

AAP

8.06am: Gold jumps 1%

Gold jumped more than 1 per cent overnight as risk appetite took a back seat with cautious investors awaiting clarity on the state of the economy and further stimulus from the US Federal Reserve’s policy meeting.

Spot gold gained 1.2 per cent to $US1,714.78 per ounce by 1800 GMT. US gold futures settled up 1 per cent to $US1,721.90.

“The expectations of further Fed stimulus are in the forefront of what’s been supporting gold over the last couple of days. In addition, we’re also seeing global equities tick lower slightly across the board,” said David Meger, director of metals trading at High Ridge Futures.

“We’re seeing an unprecedented amount of global liquidity and that underlying fundamental environment is extremely supportive for gold.” Massive global stimulus to limit the economic damage from the coronavirus pandemic has supported gold, considered a hedge against inflation and currency debasement.

Major Wall Street indexes fell, while tech-heavy Nasdaq hit a record high for the third straight session ahead of the Fed meeting, which could offer views on recent signs of economic recovery.

Last week’s stronger-than-expected US employment report will most likely be discussed at the meeting ending Wednesday, while traders have stopped pricing in the possibility of negative interest rates.

Reuters

8.02am: Aluminium, zinc retreat

Aluminium and zinc prices retreated overnight after inventories climbed, reminding investors that weak demand because of the coronavirus pandemic is likely to result in large surpluses.

Some other industrial metals also slipped into the red along with oil and European stock markets as investors worried that rallies in riskier assets have moved too quickly to price in a recovery after lockdowns that froze many economies.

But copper extended its rally, touching its highest in more than three months on hopes of economic recovery in top consumer China.

“I think caution is warranted. We need to see some of the macro indicators confirm the recent recovery in prices,” said independent metals consultant Robin Bhar.

“We’re coming into the summer months, so I’d be surprised to see prices carry on rallying from here.” Benchmark aluminium on the London Metal Exchange (LME) retreated after making early gains and was almost flat at $US1,604.50 a tonne at 1600 GMT. It has rallied nearly 10 per cent over the past 3-1/2 weeks, touching its highest since March 20 on Monday.

Global aluminium inventories are expected to surge by 5 million tonnes by the end of the year to 16 million, much of it in hidden warehouses, according to consultancy CRU.

LME aluminium inventories hit a three-year high of 1.54 million tonnes and have surged by 52 per cent over the past three months, LME data showed. Before the LME stocks data was released, the most-traded July aluminium contract on the Shanghai Futures Exchange hit its highest in more than 4-1/2 months, closing with a 1.7 per cent gain at 13,555 yuan ($US1,915.31) a tonne. On-warrant LME zinc inventories jumped by 10,000 tonnes to 89,400 tonnes, data showed.

LME three-month zinc slipped 1.3 per cent to $US2,015.50 a tonne. LME nickel shed 1 per cent to $US12,935 a tonne but copper advanced 1.2 per cent to $US5,768.50, its highest since March 3.

Lead edged up 0.1 per cent to $US1,761 and tin climbed 1.4 per cent to its strongest since March 11 at $US16,895.

Reuters

7.56am: Amazon, eBay rally

The US market continues to bet heavily on e-commerce stocks. Amazon and eBay shares both rallied to record closing highs on Tuesday, even as physical retail stores have begun to reopen in some parts of the country.

Those two stocks in particular got a lift from bullish comments from Wells Fargo analyst Brian Fitzgerald. He raised his rating on eBay shares to Equal Weight from Underweight, with a new target price of $50, up from $32, while repeating his Overweight rating on Amazon and lifting his target price on the stock to $3,000 from $2,725.

On eBay, Fitzgerald writes that his review of the company’s recent guidance revision suggests “continued strength, if not acceleration, in digital commerce from March into April and May, despite bricks-and-mortar retailers beginning to reopen across much of the country.” He thinks it is too early to tell whether e-commerce will permanently ratchet higher, but he does think that “strong digital demand appears likely to persist over at least the near to midterm.” His view is that “accelerating growth and persistence of digital demand” likely outweigh enhanced digital and fulfilment capabilities of companies with physical stores. Fitzgerald says he remains cautious on eBay’s longer-range growth potential, and he thinks the market is potentially over-estimating the value creation associated with the potential sale of the company’s Classifieds business. But this is “simply the wrong time to be Underweight eBay shares, given what appear to be exceptionally strong sector tailwinds.” As for Amazon, he sees some of the same factors at work. “Amazon’s continued build-out of last-mile fulfilment capacity and a gradual return to more hectic work and school schedules among consumers will likely shift momentum back toward rapid delivery from competitors’ store-based fulfilment options,” he writes. Fitzgerald raised his revenue and profit estimates for the company’s current quarter, and for both 2020 and 2021.

eBay shares rose 2.1 per cent to $49.75, while Amazon climbed 3 per cent to $2,600.86. The Dow Jones Industrial Average fell 1.1 per cent.

Dow Jones Newswires