ASX surges past 6000 as investors ride wave of optimism

The local sharemarket soared past 6000 points as investors ride a wave of liquidity and optimism over easing coronavirus restrictions.

The Australian sharemarket has soared past 6000 points as investors ride a wave of central bank liquidity and optimism over easing coronavirus restrictions and improving economic data, even as value becomes increasingly hard to find.

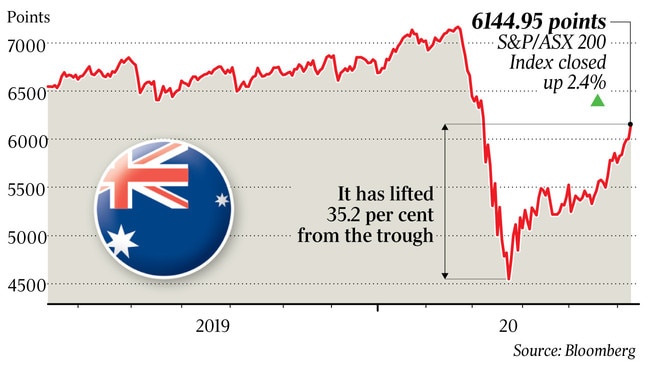

The benchmark S&P/ASX 200 Index added $45bn in value as it surged 2.4 per cent on Tuesday, extending its winning streak to six days as trade resumed following the long weekend.

At a fresh three-month high of 6144.9 points it has now shot up 35.2 per cent since its low point 11 weeks ago.

Meanwhile, the Australian dollar hit an 11-month high of US70.41c before falling sharply to just below US69.00c in early European trading.

The local sharemarket was led higher by big gains on Wall Street after better-than-expected US jobs data and a broadening of Federal Reserve lending.

Ahead of its monthly board meeting on Wednesday, the Fed expanded its Main Street Lending Program and adjusted the terms to allow more small and medium-sized businesses to receive support, suggesting its policy statement on Thursday will say the US economy needs continued support.

“That should mean that there will be no surprises to derail the buy everything post-COVID-19 rally that is still in full swing,” OANDA senior market analyst Asia Pacific Jeffery Halley said.

The rally in equities has “not been built on a V-shaped recovery by the world economy … it is built on the almost limitless amounts of unconventional easing by the world’s central banks in its myriad forms, and it appears in the Fed’s case, a determination to backstop any losses by investors,” he said.

Asian markets were mostly positive after further gains on Wall Street, with China’s Shanghai Composite up 0.6 per cent, Hong Kong’s Hang Seng index up 1.1 per cent, and South Korea’s KOSPI up 0.2 per cent.

But European equities fell sharply in early trading, with the Euro-Stoxx 50 down 1.7 per cent, the UK’s FTSE 100 down 1.8 per cent and Germany’s DAX index down 2.1 per cent.

NAB’s Monthly Business Survey showed Australian business conditions and confidence rebounded in May — albeit still at extremely depressed levels — but the Australian dollar later dived to US68.99c in early European trading as S&P 500 futures dived 1 per cent after the US benchmark rose 3.8 per cent in two days, having bounced 48 per cent from its recent bear market low 11 weeks ago.

The currency had soared a massive 28 per cent from an 18-year low of US55.05c three months ago.

Despite a broadbased improvement, NAB chief economist Alan Oster said business conditions “remain deeply negative” — at a level last seen after the global financial crisis — with the services sector weakest, while confidence was “remains weak” at levels last seen in the 1990s recession.

“Overall, this month’s results accord with what we have seen elsewhere, with restrictions having generally been eased, though to varying degrees across the states — there has seen some pick-up in activity,” he said.

“However, uncertainty remains high both globally and domestically and businesses likely remain concerned about how quickly they will return to full capacity.”

Mr Oster cautioned that very weak employment and capital expenditure indicators “point to ongoing restraint in the business sector with respect to hiring and expansion plans” and capacity utilisation “remains historically low and well below pre-COVID-19 levels.”

“Forward orders, also near record lows, suggest activity will remain weak in the near term.”

With the economy bouncing from depressed levels and the S&P/ASX 200 hitting a record-high 12-month forward price-to-earnings multiple near 20 times and a record low dividend yield near 3.3 per cent, investors gravitated to value and cyclical exposures over defensive and growth stocks.

Financials, Energy and Real Estate stocks led gains, with the banks index up 5.6 per cent after a massive 22 per cent rise in the past two week, Woodside Petroleum up 5.5 per cent and Scentre Group up 8.8 per cent.

But CSL fell 2.3 per cent and Xero and Evolution Mining both lost 6.4 per cent.

Bell Potter’s head of institutional sales and trading, Richard Coppleson said that with a “massive” $12.4bn of Australian shares changing hands Tuesday — adding to a pattern of volume on up days — shares were “very solid” with buying “across the board” rather than in a limited number of stocks.

Citi’s chief US equity strategist Tobias Levkovich noted that US equities in particular have stormed higher on hopes for economic recovery alongside improving US healthcare news, short covering, retail investor participation and Fed-induced liquidity.

He said clients were now concerned about such a risk appetite “generating a stock bubble” as asset allocators feel “the need to chase performance, or lose their jobs due to underperformance”.

“This happened in 1999 when sceptics got laid off when they pointed out nosebleed level valuations,” Mr Levkovich said.

He warned that euphoria readings in US equities have not reached similar highs since 2002, suggesting that the investor positions “could be very extended”.

“The prospect of a new speculative surge is always there though we can never predict one in advance,” he added. “But we are concerned that such thoughts have been sidelined by the pressure to partake or be left behind.”

In his view the best argument in favour of durable gains in the stockmarket was that companies are now “driving down costs structurally and earnings will be better than perceived”.

However, such efficiencies mean “permanent employment losses that restrain economic growth”.

Mr Levkovich noted that the market now was a mirror image of the March sell-off as fundamentals are being “overwhelmed by technical indicators with fund managers focusing on charts”.

But investors are ignoring joblessness, trade friction, social unrest and risks that loom including possible COVID-19 reinfections, the end of bonus supplemental unemployment checks and the upcoming elections,” he cautioned.

Still, central bank liquidity, via both credit and equity new issuance, was “providing a lifeline to many companies that now can get over the chasm of pandemic disruption”.

“Hence, it is plausible that this new underlying sustainability has invigorated Street animal spirits even if much of those newly raised funds are not used to generate growth,” he said.

“Yet, some of the Fed balance sheet build arguments leave more to the imagination than to reality.”