Boral’s US-based stone business is likely to be the easiest part of its North American business to offload, according to industry analysts.

However, its windows, light building products and concrete block operations would be more challenging to divest.

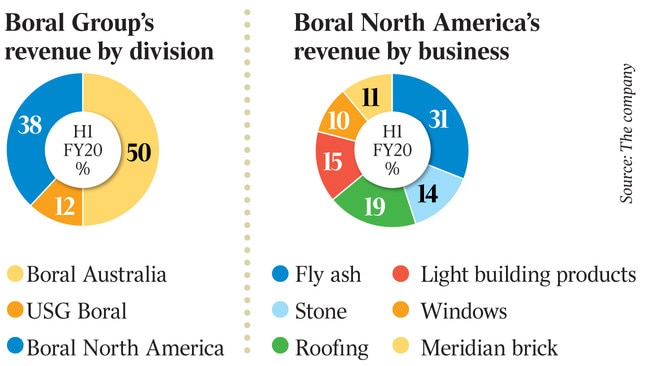

Asset sales by Boral remain a talking point as pressure mounts on the company to execute a break-up of the business, with many suggesting that its Australian operations and US-based fly ash operations should be retained and other components offloaded.

The US-based stone division is likely to be sought after by prospective acquirers, say sources in the market.

Real stone in the US market is considered the most expensive building material behind man-made stone, then bricks and lastly siding products sold by companies such as James Hardie.

But the windows operation, in particular, has faced challenges, with accounting irregularities last year emerging in the operations it inherited through its 2016 Headwaters acquisition.

Boral bought North America’s Headwaters for $3.5bn, which increased its fly ash operations, along with its stone and roofing businesses and brought new business to Boral, including light building products, windows and concrete blocks.

The opinion of many is that the acquisition has been less than successful, with various businesses disparate and now some say the challenge for Boral’s US business is that it has become too big to control.

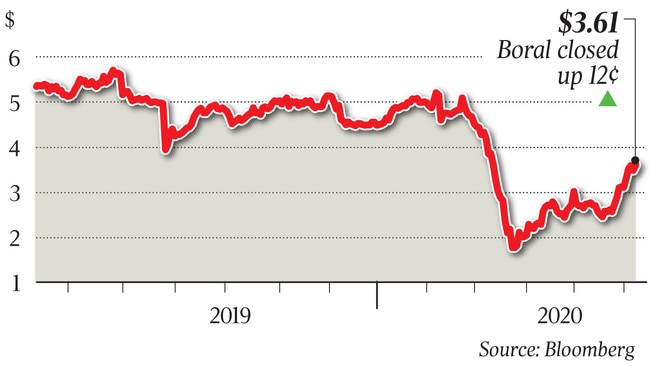

Boral has suffered from a lagging share price, and its interim profit fell 39 per cent in February amid a weak outlook for Australia.

Boral is now embarking on a strategic review with help from Macquarie Capital and Flagstaff Partners, and is carrying out a search for a candidate to replace current boss Mike Kane, who is due to leave around August.

The company has come under close focus in recent days after Seven Group Holdings emerged with a stake worth 10 per cent.

While Seven is thought to have little interest in embarking on a takeover, The Australian reported last week that it was likely to push for a board seat on the company and could lift its stake further.

DataRoom first revealed in September that activist investor John Wylie had been eager to raise funds for a break-up of Boral that would ultimately result in a private-equity buyout in parts.

Since that time, other investors are said to be eager for change due to concerns about the company’s underperformance and strategic direction, as earlier reported by The Australian.

Morgan Stanley analysts said Boral could unlock “meaningful value” from a business realignment, asset sales or a takeover, as reported by this column in December.

Asset sales could drive down debt and simplify the business.

By retaining Australian construction materials, the USG joint venture and the US fly ash businesses, the valuation would increase 17 per cent, the analysts predicted at the time.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout