Housing prices stabilise in Sydney, Melbourne ahead of possible rate pause

Property prices nationally have risen over the first quarter of the 2023 as low listings buoy the market ahead of the possible ending of the Reserve Bank’s rapid rate hikes.

Housing prices have recorded a modest rebound ahead of the Reserve Bank’s critical decision next week on whether to raise rates for an 11th consecutive month.

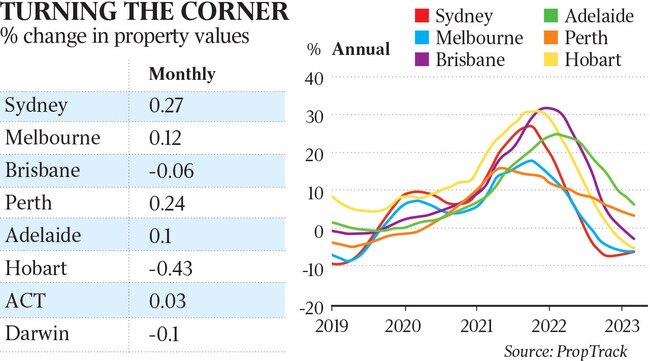

The first quarter of the year has seen residential prices claw back some losses. They finished up 0.49 per cent at the end of March despite negative consumer sentiment towards the housing market, according to PropTrack’s latest Home Price Index.

Sydney led the turnaround through March, up 0.27 per cent, with Melbourne (up 0.12 per cent) and Canberra (up 0.03 per cent) also holding ground. Adelaide and Perth remain at peak, achieving respective gains of 0.10 per cent and 0.24 per cent last month. Both are also up over the past year.

PropTrack senior economist Eleanor Creagh attributed the market’s stabilisation to the low number of homes on the market, giving buyers fewer choices and underpinning costs.

“While the significant reduction in borrowing capacities and deterioration in affordability caused by interest rate rises implies larger price falls, the impact of rate rises is being counterbalanced,” Ms Creagh said. “Positive demand drivers offsetting the downwards pressure include the strong rebound in immigration, tight rental markets and (slowly) increasing wages growth. The sustained softness in new listing volumes is also keeping a floor under prices.”

Sydney couple Kathryn Curley and Matthew Laycock hope the tights conditions will be good for them when they sell their Drummoyne home.

“The fact the market is stable is good,” Ms Curley said. “We are trying to go bigger and will need a bigger mortgage so rates are definitely playing on our mind.”

Not all markets are proving as robust. PropTrack found the largest falls last month were in Hobart, (down 0.43 per cent), Brisbane (down 0.06 per cent) and Darwin (0.1 per cent).

The RBA is to meet on Tuesday, with two-thirds of economists forecasting another 0.25 percentage-point increase in the cash rate to possibly round out the current tightening cycle. If so, repayments on a $600,000 mortgage would be up more than $12,500 since May.

HSBC chief economist Paul Bloxham is in the minority, arguing the RBA may pause because of data showing inflation has fallen.

“With this in mind, at its last board meeting, in early March, the RBA indicated that a pause in its hiking efforts could come soon as it seeks to find this narrow pathway to a soft landing,” he said.

“Our central view (held since late January) is that the RBA will pause at 3.6 per cent in April and hold this level for a number of quarters thereafter.”

PropTrack anticipates another rise to the cash rate before a prolonged pause. Several banks are now tipping homeowners may soon get payment relief, predicting cuts to interest rates will begin as soon as the end of the year.

Sydney real estate agent Mario Carbone isn’t convinced changes to rates at this stage will have a big impact on activity. The principal of Ray White-Drummoyne, who is marketing Ms Curley's home, said buyers were more informed about their borrowing capacity.

“There is a lot of confidence in our marker,” Mr Carbone said.

“People are used to the rate rises now and are budgeting accordingly.”

Ms Creagh warned price stabilisation may not last forever, with an uplift in listings having the potential of throwing the market off balance.

“Headwinds remain, with the full impact of recent rate rises yet to be felt,” she said.

“This means the decline in prices could still find a second wind, particularly if new listing volumes increase in the coming months.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout