Shock reality as home buyers feel squeeze at both ends

Homeowners who bought at the top of the boom when changes to their repayments appeared years away are facing the harsh dual reality of rising rates and falling home prices.

Homeowners who bought at the top of the boom when changes to their repayments appeared years away are facing the harsh dual reality of rising rates and falling home prices that have effectively locked them into their loans.

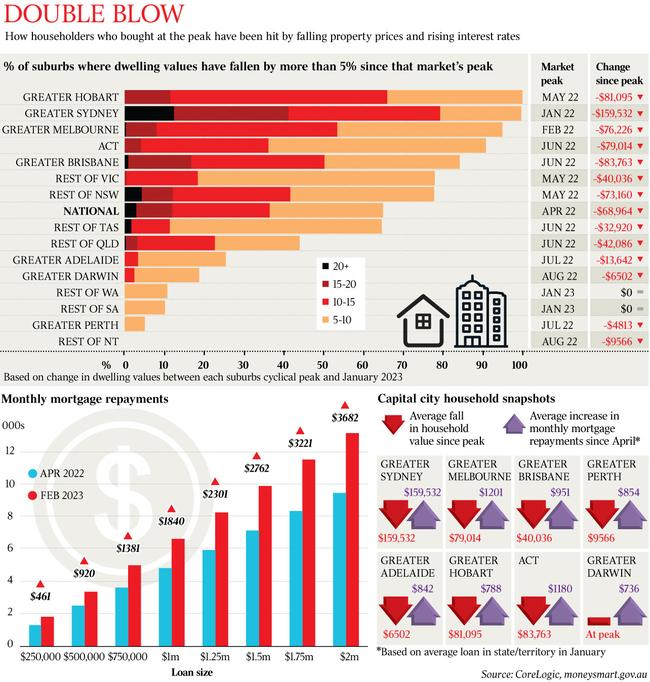

The rapidly tightening rates cycle has forced property prices lower at the fastest pace on record. New data from CoreLogic for The Weekend Australian shows the value in nearly half of all suburbs around the country has slipped more than 10 per cent.

It sparks huge concerns for recent borrowers who bought at the peak of the market in late 2021 and early 2022 in the affordable outer suburbs of capital cities with low to middle incomes on cheap credit, at the same time the Reserve Bank of Australia was providing guidance that “the cash rate is very likely to remain at its current level until at least 2024”.

A year later, interest rates have soared 3.25 per cent, adding almost $1000 to the monthly repayments on average $500,000 mortgage.

Further tightening is still expected, with the Reserve Bank flagging on Friday that another two 25-basis-point increases are likely in the current cycle to combat high inflation and continued consumer spending.

AMP chief economist Shane Oliver said there was more pain to come for stretched households, whether they were on fixed or variable loans.

“It’s that demographic of people in their late 20s into early 40s, who bought in the last few years and still have big mortgages,” Dr Oliver said.

“Some of them are people who probably got in knowing that they were somewhat stretched, but they met serviceability criteria that the banks were applying … and they probably allowed that interest rates could go up but that probably wouldn’t happen until 2024.”

When Belinda and Tyreece Banks, 37 and 38, sold their home in 2021, they thought time was on their side. They rented for a while and signed the contract on their “forever home” in the western Sydney suburb of St Clair last April as the market sat near its peak.

But the family of four’s monthly repayments have climbed about $1420 each month, while its $930,000 purchase has dropped in value to around $839,000 based on suburb trends.

The couple now tag-teams responsibilities, with Mr Banks working as a crane operator during the day while Ms Banks works a part-time retail job so they can save money on childcare.

“I had gone from a full-time job to a part-time job, so to hear that rates had gone up, it was quite scary,” Ms Banks said.

“We made all these changes for our family to learn that we might have made the wrong decisions.”

Tim Lawless of CoreLogic said those who rushed to buy in the boom had probably felt the market was running away from them.

“A lot of people felt a severe level of urgency to get into the market,” Mr Lawless said.

“They probably felt there was a safety net behind their decision-making, because no one really expects the interest rates to rise significantly … in many ways, the dialogue at the time was probably supportive of their decisions.”

As it stands, CoreLogic has found almost all suburbs in Greater Sydney and Hobart have fallen at least 5 per cent, and nine in 10 suburbs have similarly lowered in Canberra. Half of all Melbourne and Brisbane suburbs have fallen more than 10 per cent. A quarter of Adelaide postcodes have moved five or more per cent lower, with minimal movement in Perth.

Sydney broker Kim Horan said the average buyer has had about $220,000 wiped from their borrowing power.

“There are definitely people who can’t refinance because they don’t have borrowing capacity because their equity has fallen as the market dropped,” said the principal of Aussie Home Loans St Mary’s.

“Lenders are being pretty good and offering a discount if you ask for it.”

Dr Oliver said selling now would be the “worst option” for homeowners, who would effectively be “locking in their losses”.

ANZ expects property prices to come back significantly over the coming year, with the pandemic gains in Sydney likely to be completely eroded. The trajectory of rates is expected to determine the depth of home value falls.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout